November 17, 2024

Norfolk Metals (ASX:NFL) (Norfolk or the Company) is pleased to present the following Orroroo Project update.

- Norfolk engaged Pacific Consultants to build a data base providing for a more model driven approach to further exploration in the expanded tenement package.

- Previously identified gamma anomalies at around 120m depth confirmed reduced sediments (redox environment) developed around this target horizon.

- Structural reinterpretation of the gravity data and phreatic uranium flow model generates new targets.

- Norfolk progressing exploration towards regional approach with focus on broad spaced drilling over possible controlling structures.

Commenting on Norfolk Metals, Executive Chairman, Ben Phillips, states:

“Norfolk is extremely pleased with the outcomes of Pacific Consultants and our technical team increasing our understanding on the regional prospectivity of the Orroroo Project. The Company expects to conduct a subsequent drilling campaign which must consider all the structurally hosted contributions along with any low cost pre-drilling targeting techniques to be completed prior. We now have additional information to proceed forward with stakeholder engagements and required contractors”

Drill core and drill chips Investigation

Drill core, drill cuttings and muds from holes drilled in the Walloway Basin to the north of Orroroo were recently reviewed at the South Australian (SA) Government core facility in Adelaide.

Pacific Consulting was engaged to build a data base providing for a more model driven approach to further exploration across the tenement package. Data incudes drill data from Linc Energy drilling as well as numerous water bores in the district.

A digital data base has been built in Micromine using open file data from the SA Government. A number of water bores and coal exploration holes are located within the Norfolk tenement package. Radiometric logs show a wide spread anomaly in the upper Tertiary at ~ 120m below current surface. The Walloway Coal (lignite) Seam occurs in the lower Tertiary stratigraphy of the basin and is associated with low radiometric anomalism marginal to the lignite.

In borehole Orroroo 2A (Figure 2), the carbonaceous silty clay at ~ 112-114m has an elevated radiometric reading on the margin with oxidized sediments above and below. A clear demonstration that, at least locally, reduced sediments were developed at this target sedimentary horizon and that uranium was deposited on the redox margin. The drill core generally shows large intervals of silt / clayey silt with medium to coarse sand bands now silted up. The current drainage shows a similar and expected pattern in cross section with narrow cobble strewn high energy channels and silty alluvial fans with sandy beds.

The Walloway Basin contains sediment at the base which includes fine-grained sands, clayey sands and clays with minor lignite, of middle to late Eocene age. The overlying sediments include up to 70m of clays with coarse gravel beds, often lenticular. These overlying sediments range in age from mid-Tertiary to Quaternary. Obscuring the Quaternary are older deposits of recent alluvium and outwash material, derived from the surrounding Pre- Cambrian rocks.

While the paleoenvironment has not been reconstructed it can be expected that oxidized groundwater has percolated down gradient into the Walloway Basin carrying uranium which has interacted with either reduced sediments or sediments bearing reduced fluids. The source of the uranium remains uncertain (possibly from the west/northwest), but the coarse (sandy) beds at the target horizon are the clear exploration targets.

Seismic Data

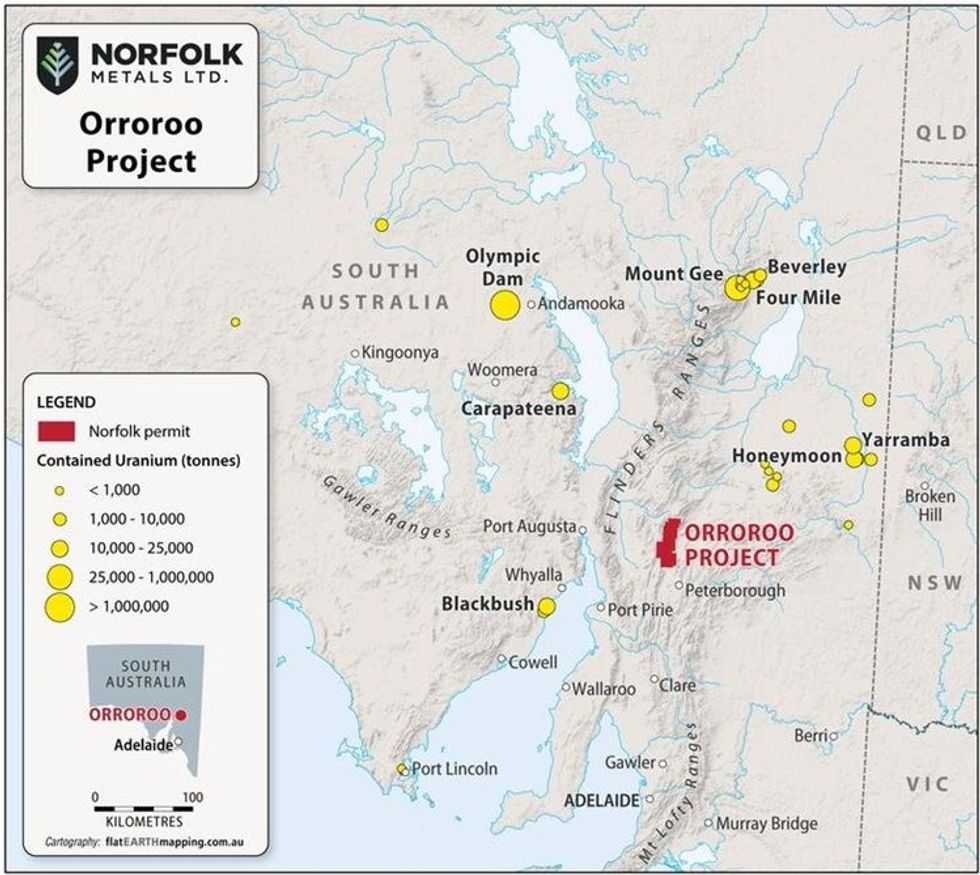

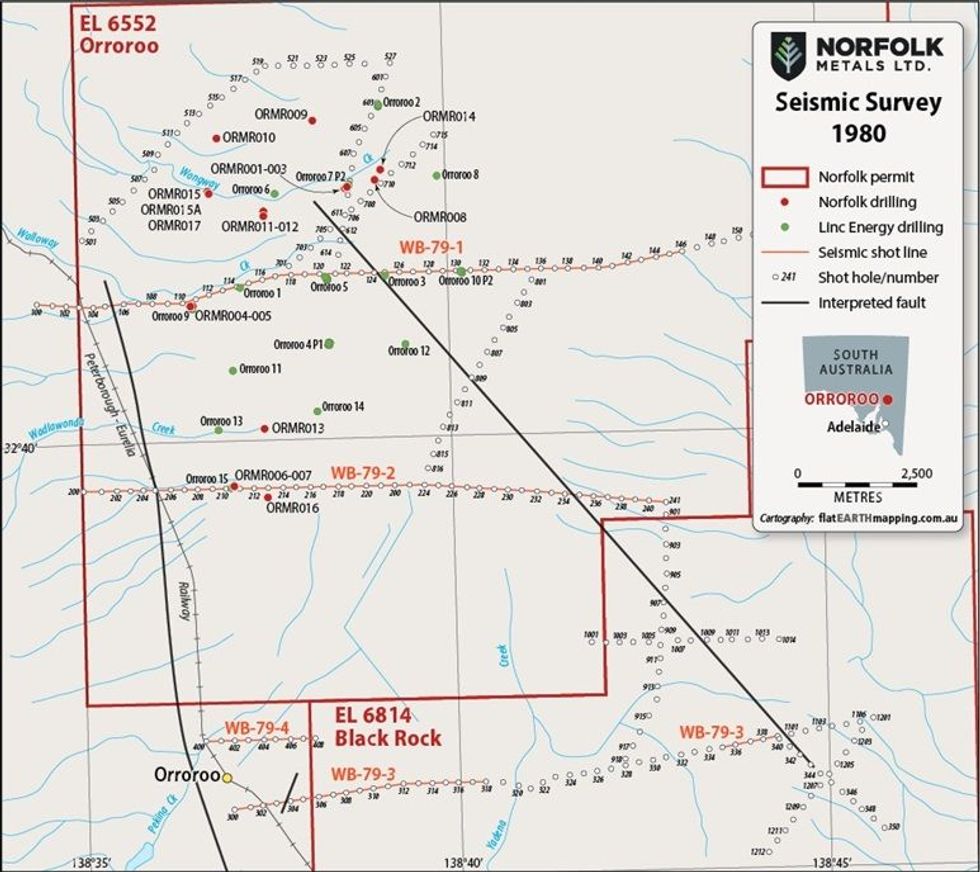

In March 1980, the Department of Mines and Energy South Australia (DME SA) conducted several seismic lines over the Walloway Basin, in particular around the central portion of EL 6552 (Orroroo Project) and the northern portion of EL 6814 (Black Rock Project) (Figure 3).

The purpose of the study was to identify the depth and lithological layers of the Walloway Basin and identify possible structural features that may influence the water intake/flow of the basin.

The results of the seismic survey showed that the Walloway Basin can be divided into different layers based on the different seismic velocities. The layers were then correlated with the lithological units identified in the NFL and Linc Energy drill holes (Figure 4): -

- Quaternary to Recent – Layers 2, 2A and 3

- Upper Tertiary – Layer 3

- Lower Tertiary – Layer 4

- Basement – Layer 5

As confirmed in the drill core and drill chips investigation, Layer 4 (Lower Tertiary unit) consists of interbedded sand, silt and clay which is overlain by Layer 3 (Upper Tertiary), generally thick clay unit. The Lower Tertiary unit predominates and thickens along the deeper troughs of the basin and its sandy nature suggest deposition in a fluviatile environment. The overlying Upper Tertiary unit is a more extensive and continuous unit of grey, brown and black clay, with kaolinite bands indicating deposition in a lacustrine environment.

The general shape of the valley is asymmetrical with western margins steeper than east and bedrock depth up to 350m deep at the observed deepest point on line WB-79-1.

Several sections were constructed from the seismic survey but the two main seismic section lines WB-79-1 and WB-79-2 coincides with the drilling conducted by NFL along the Walloway Creek and Rankin Rd Targets respectively (see ASX announcement: 7 February 2024).

It was also noted from the seismic study that structurally, the Walloway Basin is fault controlled to the west and the major northwest-southeast fault identified to the east may be a zone of diapiric activity. These faults have also been observed in the interpretation of the regional gravity data.

It is important to note that historical water well drill holes have been included in the seismic sections but no data has been sighted on the public domain database of the DME SA.

Click here for the full ASX Release

This article includes content from Norfolk Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NFL:AU

The Conversation (0)

03 August 2021

Norfolk Metals

ASX-listed uranium explorer

ASX-listed uranium explorer Keep Reading...

30 March 2025

Norfolk to earn-into Chilean Copper Project

Norfolk Metals (NFL:AU) has announced Norfolk to earn-into Chilean Copper ProjectDownload the PDF here. Keep Reading...

26 March 2025

Trading Halt

Norfolk Metals (NFL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Norfolk Metals (NFL:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

1h

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

12h

Canadian Investment Regulatory Organization Trade Resumption - IMR

Trading resumes in: Company: iMetal Resources Inc. TSX-Venture Symbol: IMR All Issues: Yes Resumption (ET): 10:30 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

12h

iMetal Resources Intersects 16.65 Metres at 1.24 g/t Gold Within 62.25 Metres at 0.61 g/t Gold at Gowganda West

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company") has intersected 16.65 metres at 1.25 gt gold within 62.25 metres at 0.61 gt gold at its Gowganda West Gold Project, southwest of Timmins, Ontario. Drilling in the West Zone intersected broad levels... Keep Reading...

25 February

Precious Metals Price Update: Gold, Silver, PGMs Boosted by Geopolitical and Trade Tensions

Precious metals are recovering their safe-haven demand appeal this week.Gold, silver and platinum are up this week, all still down from the all-time highs recorded in January. Escalating geopolitical tensions and US trade policy shifts are once again at center stage in this sector of the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00