April 15, 2024

Exciting High Grade Gold & Base metals on Granted Mining Lease. Up to 12.64 Cu (%) & 4.12g/t Au

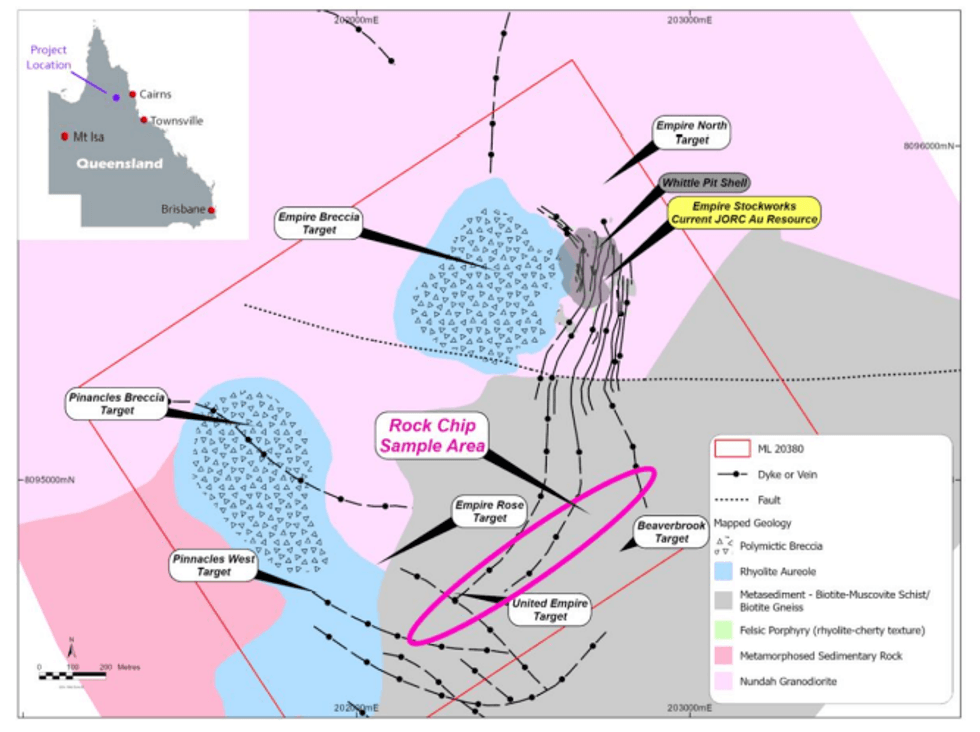

Far Northern Resources Limited (ASX: FNR, “Far Northern Resources”, “the Company”) is pleased to provide an update on exploration activities at the Empire Project, located 34km west of Chillagoe in North Queensland Australia. The Empire Mining Lease (Empire) covers an area of 252 (ha). It has a JORC 2012 Resource and will be subject to 5000m of drilling over the next two years.

HIGHLIGHTS

- Empire has a current Mineral Resource Estimate of (22,505 AuOz), refer to prospectus page 14.

- New reconnaissance (undertaken just prior to Christmas 2023 and for which assay results have now been received) away from this known resource has commenced with high grade copper and gold rock chip samples on mineralized outcrops and old prospector scratching extending the strike of known mineralization by a further 750m.

- High Grade Copper and Gold rock chips have returned assays of up to 12.64% Cu (FNRRCS24001) and 4.12 g/t gold (FNRRCS24002) (see Table 1)

- Other individual surface samples have returned copper grades of 11.59% Cu, 11.89% Cu, 9.60% Cu, 6.53% Cu and 2.61% Cu (%) (see Table 1)

- Other individual samples have returned gold grades of 0.78g/t, 0.92g/t, 1.19g/t, 2.16g/t, 0.75g/t, 1.68g/t and 0.70g/t (see Table 1)

The Managing Director of Far Northern Resources , Cameron Woodrow said:

“Far Northern Resources has been exploring this area for some time and it is pleasing to release some very exciting new copper and gold results which clearly show there is a much bigger picture at play at our Empire Project.

We are excited to now have the funding to get on the ground and drill out the potential for what is shaping as a nice copper-gold project in a proven copper-gold mining area”.

Enquires:

Cameron Woodrow

cwoodrow@farnorthernresources.com

Roderick Corps.

rcorps@farnorthernresources.com

Empire Copper Gold Project Previous exploration activity at Empire including drilling and soil geochemistry prove a very strong geochemical signature in the associate elements of Au-Ag-Bi-Cu-Mo-Sb-W typical of copper-gold porphyry systems. So far drilling has focussed only on the stockworks where an open pit mineable resource has been defined. Our latest rock chips show these stockworks extend for at least another 750m and our geologist believes these could be the part of a bigger porphyry style target.

Click here for the full ASX Release

This article includes content from Far Northern Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FNR:AU

The Conversation (0)

23 June 2025

Bridge Creek Phase 1 Assays

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 AssaysDownload the PDF here. Keep Reading...

21 May 2025

Bridge Creek Phase 1 Assay Composites Received

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 Assay Composites ReceivedDownload the PDF here. Keep Reading...

29 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Far Northern Resources (FNR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

08 April 2025

Drilling to Commence on Bridge Creek Mining Lease

Far Northern Resources (FNR:AU) has announced Drilling to Commence on Bridge Creek Mining LeaseDownload the PDF here. Keep Reading...

17 February 2025

Amended Appendix 5B

Far Northern Resources (FNR:AU) has announced Amended Appendix 5BDownload the PDF here. Keep Reading...

14h

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

31 January

Chris Vermeulen: Gold, Silver to Go "Dramatically Higher," This is When

Speaking ahead of this week's gold and silver price correction, Chris Vermeulen, chief market strategist at TheTechnicalTraders.com, said the metals were due for a "significant pullback." After that, they'll be positioned for a new leg up."There will be a time definitely to get back into metals,... Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00