Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTCQB:TKRFF) is pleased to announce tin assays from the 7,600 metre, 21-hole, 2020-2021 drill program recently completed at the Ayawilca project in central Peru

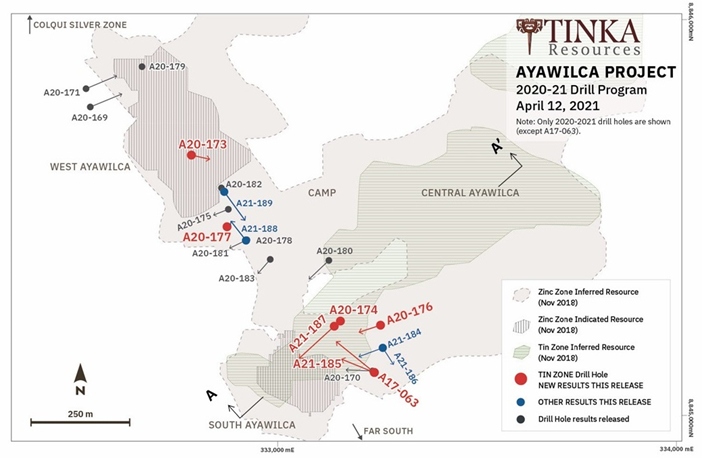

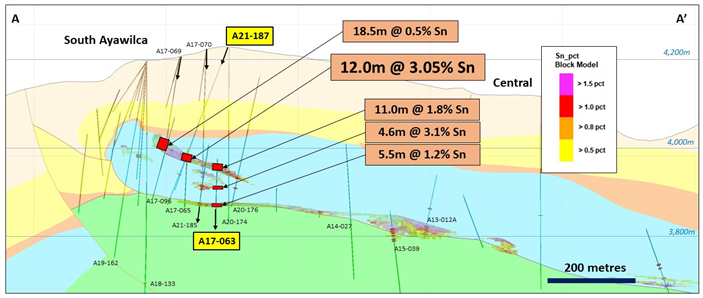

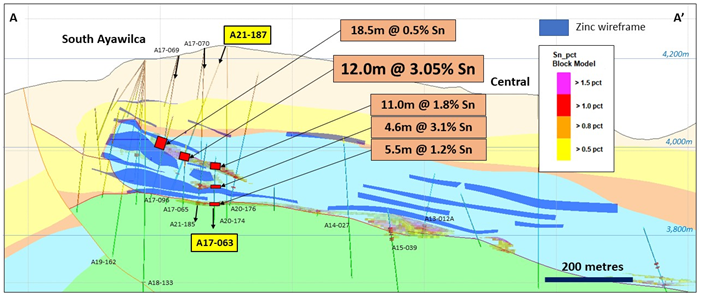

While the focus of the 2020-2021 drill program was on resource definition of zinc-silver mineralization, significant tin mineralization was also intercepted in several of the drill holes. Of note, Tinka has discovered a new zone of high-grade tin mineralization at South Ayawilca, immediately adjacent to the highest grade zinc resource. This is the first time that tin mineralization of such high grade has been discovered at South Ayawilca. Tin mineralization was intersected in eight adjacent drill holes, including seven of the recent holes, in zones that typically contain very minor or no zinc mineralization. The tin mineralization is believed to be hosted by multiple, flat-dipping lenses with each lens up to 12 metres in thickness and with horizontal dimensions of approximately 200 metres, remaining open to the north. Tin mineralization in hole A21-187 (12 metres grading 3.1% tin) occurs 40 metres above zinc mineralization in the same hole (4.1 metres grading 17.7% zinc) (link to news release). Tin occurs as cassiterite (SnO2), the most common ore-forming mineral of tin. Refer to maps in Figures 1 and 2 for the location of the tin mineralization.

Tin is traditionally used as a solder and for tin plating of other metals but it also is a key metal in new applications such as autonomous and electric vehicles, renewable energy, energy storage, and advanced computing. Tin has the highest value of the major base metals and is currently trading at around US$27,000 per tonne or 3 times the value of copper and 9 times the value of zinc (source).

Drill Highlights:

Tin results - South Area:

Hole A21-187

- 12.0 metres @ 3.05% tin from 262.0 metres depth, including

- 2.0 metres @ 5.43% tin from 266.0 metres depth.

Hole A21-185

- 2.0 metres @ 1.25% tin from 332.0 metres depth; and

- 7.0 metres @ 0.78% tin from 373.0 metres depth;

Hole A21-184

- 4.5 metres @ 0.54% tin from 286.4 metres depth;

Hole A20-177

- 2.2 metres @ 0.63% tin from 317.0 metres depth;

Hole A20-176

- 4.0 metres @ 0.66% tin from 300.0 metres depth;

Hole A20-174

- 4.0 metres @ 1.03% tin from 348.0 metres depth;

Hole A20-173

- 3.9 metres @ 0.96% tin from 253.1 metres depth;

Hole A17-063*

- 11.0 metres @ 1.81% tin from 275.0 metres depth.

Zinc results - South Area:

Hole A21-184

- 16.6 metres @ 5.0% zinc & 12 g/t silver from 281.8 metres depth.

True thicknesses of the tin and zinc intersections above are estimated to be at least 90% of the downhole thicknesses. Tin intervals are calculated at a 0.5% Sn cut-off. *Result was partially announced in an earlier drill program.

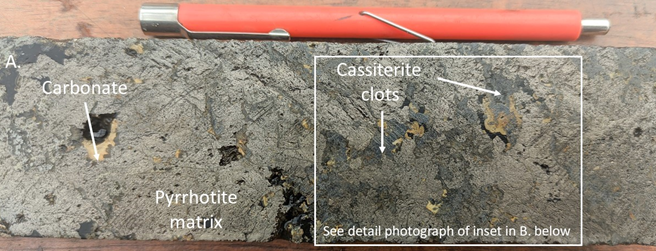

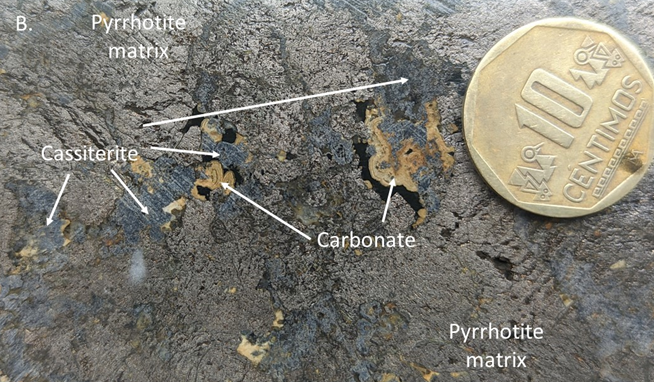

President and CEO of Tinka, Dr. Graham Carman, stated: "While Ayawilca is best known for its large and high-grade Zinc Zone resource, the property also hosts a Tin Zone resource which is mostly located at deeper levels along a northeastern trend away from the highest grade zinc deposit at South Ayawilca. The new discovery of tin at South Ayawilca is potentially very important as a complement to the zinc deposit, as it is the first time we have encountered such high grades of tin immediately adjacent to one of the best zones of zinc at the property, an area which would likely be prioritized in the early years of a future mining operation. This new style of tin mineralization appears to be different to that observed previously in the deeper part of the Tin Zone at Central Ayawilca - the new style contains what appears to be ‘clots' of coarse-grained cassiterite mineral grains (see photographs of the tin mineralization in Figure 3). The Company is immediately prioritizing mineralogical test work of this exciting new discovery, including gravitational separation of the cassiterite which has a very high density compared with most other minerals including sulphides."

"All significant intersections of zinc-silver and tin in the 2020-2021 program have now been reported. Two holes followed up on a high-grade shallow zinc-silver intersection at 100 metres depth in A20-177 (holes A21-188 and 189) hosted by sandstone overlying the main carbonate host rock. Only narrow mineralized structures were encountered. Tinka geologists interpret that the high-grade zinc-silver veins hosted in the sandstone have variable thicknesses and may have different orientations which require tighter drill spacing to be adequately tested."

"Now that the drill results are fully reported, the Company is advancing Ayawilca towards a resource update and an updated Preliminary Economic Assessment by early Q3 2021."

Tin Mineralization in Drill hole A21-187

Tin mineralization in hole A21-187 is 12 metres in downhole thickness (which approximates true width) and hosted by massive sulphides consisting of pyrrhotite (magnetic iron sulphide) and lesser pyrite with minor quartz, carbonates and other silicates. Tin minerals occur as clots and disseminations of cassiterite (SnO2) within the pyrrhotite matrix and are commonly associated with carbonate infillings. See photos of the tin mineralized drill core in Figure 3.

Tables 1 and 2 highlight the details of the recent drill results for tin, and zinc-silver-lead intersections, respectively.

Table 3 presents a summary of all drill hole collars in the 2020-2021 program.

About Ayawilca: The Zinc Zone contains an estimated 1.8 billion pounds of zinc and 5.8 million ounces silver in Indicated Mineral Resources, and 5.6 billion pounds zinc and 25.2 million ounces silver in Inferred Mineral Resources, while the Tin Zone contains an estimated 200 million pounds of tin in Inferred Mineral Resources (see news release dated November 26, 2018). The Colquipucro Silver Zone contains an estimated 14.3 million ounces silver in the Indicated category and 13.2 million ounces silver in the Inferred category as potentially open-pittable resources (see Technical Report dated July 2, 2019).

| On behalf of the Board, "Graham Carman" | Investor Information: |

Figure 1. Drill hole plan showing all 2020-2021 holes

Table 1 - Summary of significant tin results from the 2020-2021 drill program at Ayawilca

Drill Hole | From m | To m | Interval m | Sn % | Cu % | Ag ppm | Zn % |

A20-173 | 252.10 | 256.00 | 3.90 | 0.96 | 0.03 | 12 | 4.10 |

A20-174 | 288.00 | 290.00 | 2.00 | 1.00 | 0.06 | 3 | 0.10 |

and | 348.00 | 352.00 | 4.00 | 1.03 | 0.20 | 17 | 0.23 |

A20-176 | 300.00 | 304.00 | 4.00 | 0.66 | 0.05 | 8 | |

A20-177 | 317.00 | 319.20 | 2.20 | 0.63 | 0.06 | 6 | 2.10 |

A21-184 | 286.40 | 290.90 | 4.50 | 0.54 | 0.04 | 15 | 8.39 |

A21-185 | 332.00 | 334.00 | 2.00 | 1.25 | 0.05 | 7 | 0.56 |

and | 373.00 | 380.00 | 7.00 | 0.78 | 0.25 | 31 | 0.33 |

A21-187 | 262.00 | 274.00 | 12.00 | 3.05 | 0.05 | 5 | 0.05 |

incl | 266.00 | 268.00 | 2.00 | 5.43 | 0.04 | 7 | 0.02 |

A17-063* | 275.00 | 286.00 | 11.00 | 1.81 | 0.04 | 6 | 0.01 |

and | 327.40 | 332.00 | 4.60 | 3.08 | 0.52 | 53 | 19.08 |

and | 369.00 | 374.50 | 5.50 | 1.22 | 0.22 | 16 | 0.05 |

* Drill hole results were partially released November 3rd, 2017.

All intersections are ‘manto' style and true thicknesses are estimated to be at least 90% of downhole thicknesses.

Table 2 - Summary of significant new zinc results from the 2020-2021 drill program at Ayawilca

Drill Hole | From m | To (m) | Interval m | Zn % | Pb % | Ag ppm | In ppm |

A21-184 | 174.10 | 174.40 | 0.30 | 48.45 | 0.16 | 49 | 422 |

and | 178.00 | 182.70 | 4.70 | 7.36 | 0.20 | 32 | 64 |

and | 281.80 | 298.40 | 16.60 | 5.03 | 0.02 | 12 | 96 |

A21-186 | 132.70 | 133.90 | 1.20 | 33.62 | 0.50 | 938 | 35 |

A21-188 | 118.20 | 119.50 | 1.30 | 4.51 | 0.07 | 17 | 15 |

A21-189 | NSR |

NSR = no significant result

Figure 2. Cross section of Ayawilca (looking northwest) with geological interpretation of the Tin Zone

- Geological model of the tin mineralization (zinc mineralization not shown) coloured by tin grade.

- Geological model of the same cross section as A. showing tin grade and zinc wireframes (blue polygons).

Figure 3. Drill core photographs of tin mineralization in drill hole A21-187

A. Drill core from 271.6 metres depth showing clots of cassiterite (steely grey colour) and carbonate (cream colour with bands) in a matrix of massive pyrrhotite (bright bronze colour).

B. Detailed photograph highlighting the cassiterite (grey) and carbonate (cream) minerals within a matrix of pyrrhotite. For scale, the coin has a diameter of 20 mm.

Table 3 - Drill Collar Information for 2020-2021 holes (coordinates are in UTM Zone 18S WGS84 datum)

Drill hole | Easting | Northing | RL m | Azimuth | Dip | Total Depth m |

A20-169 | 332,532 | 8,845,783 | 4,285 | 68 | -74 | 383.8 |

A20-170 | 333,242 | 8,845,117 | 4,223 | 273 | -78 | 373.2 |

A20-171 | 332,523 | 8,845,826 | 4,283 | 70 | -78 | 402.3 |

A20-172 | 333,243 | 8,845,118 | 4,223 | 325 | -82 | 332.3 |

A20-173 | 332,786 | 8,845,662 | 4,234 | 100 | -83 | 306.9 |

A20-174 | 333,143 | 8,845,234 | 4,227 | 0 | -90 | 395.9 |

A20-175 | 332,880 | 8,845,526 | 4,230 | 256 | -82 | 339.7 |

A20-176 | 333,259 | 8,845,234 | 4,227 | 255 | -75 | 368.6 |

A20-177 | 332,874 | 8,845,482 | 4,236 | 200 | -88 | 383.0 |

A20-178 | 332,924 | 8,845,448 | 4,233 | 0 | -90 | 371.7 |

A20-179 | 332,660 | 8,845,883 | 4,256 | 0 | -90 | 320.0 |

A20-180 | 333,129 | 8,845,397 | 4,215 | 220 | -75 | 358.9 |

A20-181 | 332,923 | 8,845,448 | 4,233 | 245 | -82 | 371.3 |

A20-182 | 332,861 | 8,845,578 | 4,228 | 0 | -90 | 317.4 |

A20-183 | 332,983 | 8,845,399 | 4,236 | 220 | -82 | 380.2 |

A21-184 | 333,271 | 8,845,184 | 4,222 | 253 | -78 | 325.2 |

A21-185 | 333,241 | 8,845,118 | 4,223 | 290 | -68 | 382.4 |

A21-186 | 333,269 | 8,845,182 | 4,222 | 140 | -82 | 397.5 |

A21-187 | 333,143 | 8,845,234 | 4,227 | 222 | -68 | 382.9 |

A21-188 | 332,920 | 8,845,450 | 4,233 | 320 | -63 | 200.0 |

A21-189 | 332,861 | 8,845,578 | 4,228 | 140 | -50 | 214.0 |

A17-063 | 333,241 | 8,845,118 | 4,223 | 310 | -70 | 416.6 |

Notes on sampling and assaying

Drill holes are diamond HQ or NQ size core holes with recoveries generally above 80% and often close to 100%. The drill core is marked up, logged, and photographed on site. The cores are cut in half at the Company's core storage facility, with half-cores stored as a future reference. Half-core is bagged on average over 1 to 2 metre composite intervals and sent to ALS laboratories in Lima for assay in batches. Standards and blanks are inserted by Tinka into each batch prior to departure from the core storage facilities. At the laboratory samples are dried, crushed to 100% passing 2mm, then 500 grams pulverized for multi-element analysis by ICP using multi-acid digestion. Samples assaying over 1% zinc, lead, or copper and over 100 g/t silver are re-assayed using precise ore-grade AAS techniques.

Qualified Person

Dr. Graham Carman, Tinka's President and CEO, reviewed, verified and compiled the technical contents of this release. Dr Carman is a Fellow of the Australasian Institute of Mining and Metallurgy, and is a qualified person as defined by National Instrument 43-101.

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver project in central Peru. The Ayawilca Zinc Zone has an estimated Indicated resource of 11.7 Mt grading 6.9% zinc, 15 g/t silver & 0.2% lead and an Inferred resource of 45.0 Mt grading 5.6% zinc, 17 g/t silver & 0.2% lead (dated November 26, 2018). The Colqui Silver Zone (oxide) has an estimated Indicated resource of 7.4 Mt grading 60 g/t silver, and an Inferred resource of 8.5 Mt grading 48 g/t silver occurring from surface (dated May 25, 2016). A Preliminary Economic Assessment for the Zinc Zone was released on July 2, 2019 (see release).

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned drill programs and results varying from expectations; delay in obtaining results; expectations regarding the Ayawilca Project PEA; the potential impact of epidemics, pandemics or other public health crises, including the current coronavirus pandemic known as COVID-19 on the Company's business, operations and financial condition; changes in world metal markets; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: Tinka Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/640338/Tinka-Discovers-High-Grade-Tin-Mineralization-at-South-Ayawilca