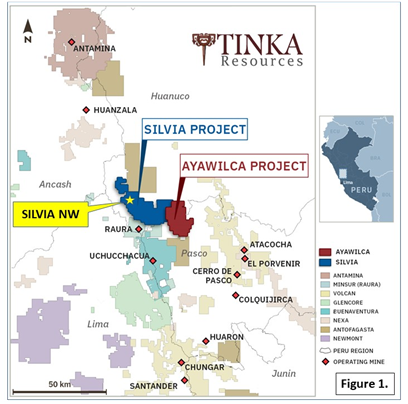

Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTCQB:TKRFF) is pleased to announce initial high grade copper-gold surface sampling results from the Silvia NW target, one of several prospective areas within the Company's 100%-owned Silvia Project which was recently acquired (see news release dated July 12, 2021). Silvia NW is located in the Huanuco region of central Peru, 30 km from the Company's flagship Ayawilca project and 90 km along strike south of the Antamina copper mine (see Figure 1

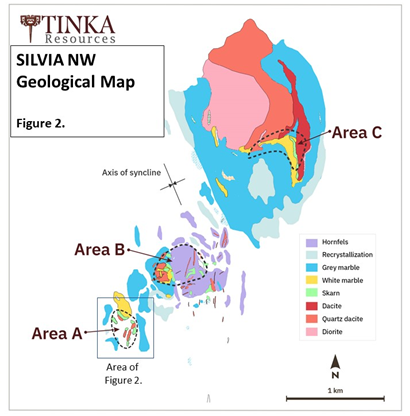

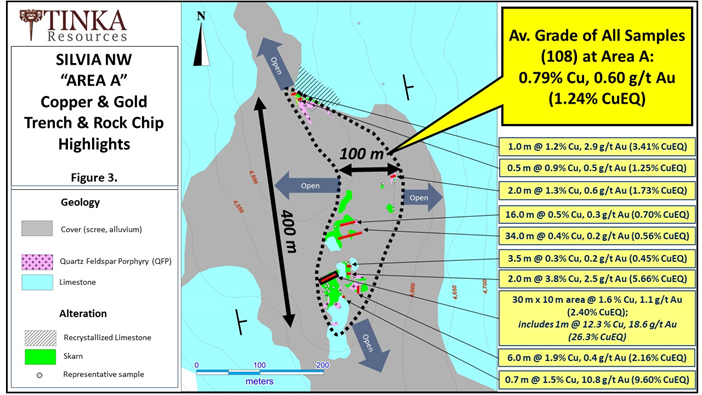

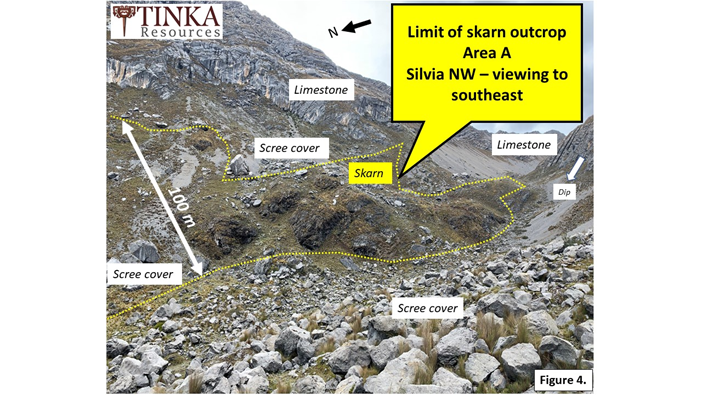

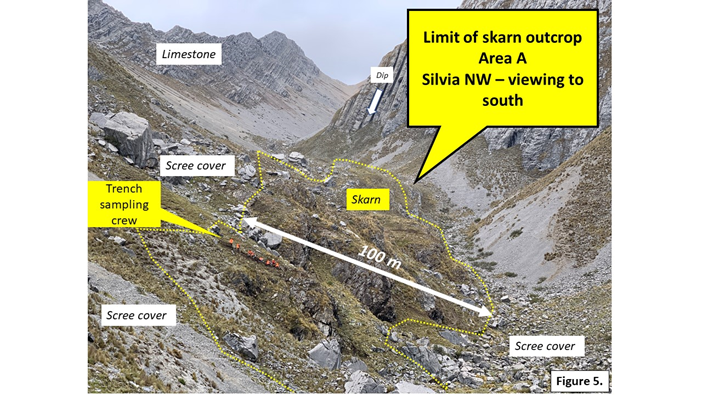

Silvia NW is prospective for copper-gold skarn mineralization along a 3 km x 1 km trend that has seen minimal exploration and no drilling. Tinka's detailed sampling at "Area A", one of three mineralized zones at Silvia NW (see Figure 2), has discovered high-grade copper-gold mineralization associated with apparently continuous outcrops of skarn covering an area of approximately 400 metres by 100 metres, open in all directions. Widespread scree intermittently covers the outcrops and has limited the lateral extent of this early sampling (see Figures 3, 4 & 5).

Highlights of sampling from Area A at Silvia NW:

- A total of 108 trench and rock chip samples were collected over a 400 m x 100 m area of semi-continuous skarn:

- Average grade of all samples is 0.79% copper & 0.60 g/t gold (1.24% CuEQ*);

- Copper ranges between 0.01% to 12.31% Cu, and gold ranges between 0.01 g/t to 18.60 g/t Au;

- There is a strong positive correlation between copper and gold;

- Copper occurs as chalcopyrite with chalcocite and covellite (and minor copper oxides) in green garnet-magnetite skarn associated with quartz feldspar porphyry (QFP) dikes - mineralization occurs in both limestone ("exoskarn") and QFP ("endoskarn");

- Skarn mineralization is open in all directions under shallow scree cover;

- Rock samples are representative, non-selective, trench or continuous rock chip samples (1-2m wide) covering various rock types including skarn, QFP and limestone;

- Exploration is continuing at Area A, B and C along the 3 km northeast-southwest trend.

Dr. Graham Carman, Tinka's President and CEO, stated: "We are very excited to announce the discovery of high grade copper-gold mineralization in our initial sampling at Silvia NW, located in an underexplored Andean region of central Peru close to our flagship Ayawilca project. We believe that these initial sampling results, covering a surface area of approximately 400 m x 100 m, show the outstanding potential for a large and high-grade skarn deposit that has previously not been recognized. The high levels of gold associated with the copper mineralization is a big positive, as gold significantly increases the potential value of the mineralization. The skarn remains open in all directions."

"We believe that we could be seeing the early indications of a high potential, high quality copper-gold prospect at Silvia NW. Exploration is continuing at target Areas B and C with mapping and detailed sampling along the 3 km trend, where additional skarn bodies have been reported in both areas."

"In addition to our current exploration activities, Tinka continues to advance its outstanding Ayawilca zinc-silver project which we believe is one of the best undeveloped zinc projects in the Americas. A Mineral Resource estimation update was recently released (see news release dated September 27, 2021). A Preliminary Economic Assessment (PEA) for the Ayawilca deposit will be disclosed within weeks."

* Copper Equivalent (CuEQ) is calculated assuming 100% recovery of copper and gold using a Gold Conversion Factor of 0.751, calculated from a nominal copper price of US$3.30/lb and a gold price of US$1,700/oz.

Geology and Sampling Results at Area A

Tinka's exploration activities at Silvia NW have concentrated to date on detailed mapping and sampling of skarns at Area A, located at the southwestern end of the target area (Figure 2). The skarns are hosted by the Cretaceous Jumasha Formation, a thick (> 2km) sequence of limestones that form a major part of the fold and thrust belt in central Peru and host to several major skarn deposits in Peru (including Antamina). The limestone at Area A has been intruded by quartz feldspar porphyry dikes and sills (QFP) which appear to control the copper-gold skarn mineralization.

Skarn occurs both in the limestone (as exoskarn) and in QFP (as endoskarn) over an apparently continuous area of approximately 400 metres x 100 metres (see Figure 3). There is widespread scree cover in-between outcrops of skarn limiting outcrop (Figures 4 & 5). Tinka geologists believe that the skarn mineralization could continue over a larger area beneath the scree on the lower slopes and floor of the valley. On the edges of the outcropping skarn zones, limestones show minor to weak skarn development and are weakly mineralized or unmineralized. Limestone outside of the skarn zones have developed localised hornfels and minor skarn veining.

The skarns are dominated by green garnets with or without magnetite and other calc-silicates (Figure 6). Sulphides in the outcrops are common (typically partially oxidised) and dominated by chalcopyrite and pyrite with minor covellite, chalcocite, and malachite.

Table 1 below highlights the copper-gold trench sampling results presented in this release (also highlighted in Figure 3) along with selected other metals. Table 2 is a summary of the surface samples by rock type. Zinc, along with silver, is anomalous in many of the samples while arsenic is not significant.

Table 1. Highlights of surface sampling at Area A presented in this release

| Sample type | No. Samples | Length m | Cu % | Au g/t | Ag g/t | Zn % | As ppm | CuEQ %* |

| Trench & Chip | 21 | 30 X 10 m area | 1.56 | 1.12 | 14.20 | 0.50 | 189.0 | 2.40 |

including | 1 | 1.00 | 12.31 | 18.60 | 82.00 | 0.16 | 870.0 | 26.28 |

including | 1 | 1.00 | 1.87 | 1.24 | 12.20 | 0.34 | 621.0 | 2.80 |

| Trench | 1 | 2.00 | 3.79 | 2.49 | 31.50 | 3.97 | 69.6 | 5.66 |

| Trench | 3.50 | 0.31 | 0.19 | 2.35 | 3.67 | 60.6 | 0.45 | |

| Trench | 3 | 6.00 | 1.88 | 0.38 | 7.13 | 0.07 | 30.6 | 2.16 |

| Trench | 1 | 1.00 | 0.55 | 0.78 | 2.90 | 0.70 | 95.8 | 1.14 |

| Trench | 17 | 34.00 | 0.42 | 0.19 | 2.44 | 0.20 | 23.2 | 0.56 |

including | 2 | 4.00 | 1.04 | 0.48 | 2.55 | 0.03 | 36.8 | 1.40 |

| Trench | 8 | 16.00 | 0.50 | 0.28 | 6.76 | 0.27 | 50.4 | 0.70 |

including | 1 | 2.00 | 0.90 | 1.43 | 22.20 | 0.25 | 50.6 | 1.98 |

| Trench | 1 | 0.60 | 1.25 | 0.45 | 6.90 | 2.98 | 73.0 | 1.59 |

| Trench | 1 | 1.00 | 1.21 | 2.93 | 8.50 | 3.73 | 31.0 | 3.41 |

| Chip | 1 | 0.50 | 0.88 | 0.49 | 5.30 | 0.16 | 1.5 | 1.25 |

| Trench | 1 | 2.00 | 1.30 | 0.57 | 7.50 | 5.85 | 37.0 | 1.73 |

| Chip | 1 | 0.70 | 1.49 | 10.80 | 11.00 | 5.31 | 60.8 | 9.60 |

* Copper Equivalent (CuEQ) is calculated assuming 100% recovery of copper and gold using a Gold Conversion Factor of 0.751, calculated from a nominal copper price of US$3.30/lb and a gold price of US$1,700/oz.

Table 2. Summary of sampling at Area A by rock type

| Average by Rock Type | |||||||

No. Samples | Cu % | Au g/t | Ag g/t | Zn % | As ppm | CuEQ % | |

| Area A | |||||||

| Endo Skarn | 66 | 1.09 | 0.83 | 8.73 | 0.79 | 83.18 | 1.71 |

| Exo Skarn | 16 | 0.81 | 0.59 | 5.50 | 1.31 | 78.48 | 1.25 |

| Limestone | 7 | 0.01 | 0.01 | 0.20 | 0.07 | 19.74 | 0.02 |

| QFP | 19 | 0.03 | 0.02 | 0.40 | 0.02 | 13.07 | 0.05 |

| TOTAL Area A | 108 | 0.79 | 0.60 | 6.20 | 0.69 | 66.00 | 1.24 |

* Copper Equivalent (CuEQ) is calculated assuming 100% recovery of copper and gold using a Gold Conversion Factor of 0.751, calculated from a nominal copper price of US$3.30/lb and a gold price of US$1,700/oz.

Notes on sampling and assaying

Trenches were dug up to a depth of 1 metre, where possible, across areas of outcrop (partially weathered) to test the grade of skarn and adjacent limestones and intrusions. Trench samples are continuous samples collected with hammer and chisel over 1 to 2 metre intervals. In areas of sporadic outcrop, samples are taken as semi-continuous rock chips. Tinka believes that the samples are representative of the outcrop and non-selective. Samples were bagged and labelled in the field. Samples were sent to Certimin laboratory in Lima where samples were dried, crushed to 90% passing 2mm, then 1 kg pulverized to 85% passing 75 microns. Gold was analysed by fire assay on 30 g (method G0108) and multi-element analysis by ICP using multi-acid digestion (method G0176). Gold assays above 10 g/t Au were re-assayed by a high-grade fire assay method and a gravimetric finish (method G0014). Copper assays over 1% Cu were re-assayed by atomic absorption (method G0039). Standards and blanks were not inserted by Tinka but were inserted at the laboratory.

Figure 1 - Location of Silvia NW target area with selected mining claims in central Peru

Figure 2 - Simplified geological map of Silvia NW highlighting Areas A, B & C

Figure 3 - Highlights of copper-gold trenching and rock chip results at Area A

Figure 4 - Photo of Area A highlighting copper-gold skarn outcrops (darker shade) and scree, viewing SE

Figure 5 - Photo of Area A highlighting copper-gold skarn outcrops (darker shade) and scree, viewing South

Figure 6 - Photograph of Exoskarn from Area A. Green garnets are pervasive throughout the rock, while copper is observed as turquoise-coloured malachite replacing chalcopyrite

The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

On behalf of the Board,

"Graham Carman"

Dr. Graham Carman, President & CEO

Further Information:

www.tinkaresources.com

Mariana Bermudez

1.604.685.9316

info@tinkaresources.com

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver-tin project in central Peru. The Ayawilca Zinc Zone deposit has an estimated Indicated Mineral Resource of 19.0 Mt grading 7.15% Zn, 16.8 g/t Ag & 0.2% Pb and an Inferred mineral resource of 47.9 Mt grading 5.4% Zn, 20.0 g/t Ag & 0.4% Pb (dated August 30, 2021 - see news release dated September 27, 2021). The Ayawilca Tin Zone has an estimated Inferred Mineral Resource of 8.4 Mt grading 1.02% Sn (also dated August 30, 2021). An NI 43-101 report will be released in November 2021.

Tinka holds 46,000 hectares of mining claims in central Peru, one of the largest holders of mining claims in the belt. Tinka is actively exploring for copper-gold skarn mineral deposits at its 100%-owned Silvia project.

Forward-Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; the Company's expectations regarding the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/667120/Tinka-Discovers-High-Grade-Copper-and-Gold-at-Silvia-Project--Surface-Samples-Up-to-123-Copper-and-186-GT-Gold