(TheNewswire)

August 24, 2021 TheNewswire - Vancouver, British Columbia Volcanic Gold Mines Inc. (TSXV:VG) (OTC:VLMZF) is pleased to report further high grade drill results from La Peña vein at the Holly Project in Guatemala.

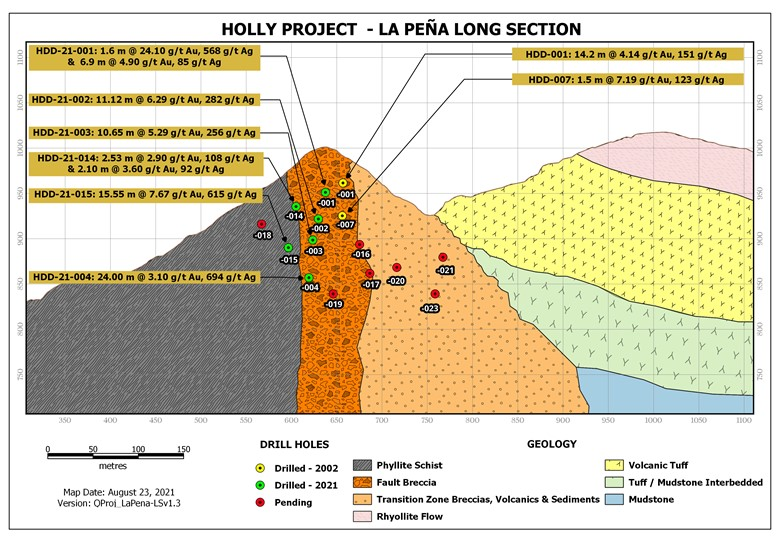

The last hole reported from La Peña zone was hole HDD21-004, which intersected an impressive 14.8m at 3.86 g/t Au and 1,097 g/t Ag (press release July 16, 2021 ). Core adjacent to the reported intercept that was not sampled in the original program has recently been sampled and assayed. This extended the intercept in hole HDD21-004 to 24.0m @ 3.1 g/t Au and 694 g/t Ag.

Hole HDD21-014, the next hole to target La Peña structure, cut the vein zone approximately 50m below surface, 70m higher that hole 004. The hole cut broad silver intercept of 28.3m @ 42 g/t Ag with strongly anomalous mercury and antimony with two narrow gold intervals including 2.53m @ 2.90 g/t Au and 108g/t Ag, and 2.1m @ 3.60 g/t Au and 92 g/t Ag. The interpretation is that this hole cut La Peña structure above the main ore shoot.

Hole HDD21-015 targeted La Peña structure at an elevation of 875m, 50m down dip from 014 and 40m north of hole HDD21-004, within the Paleozoic phyllites. Hole HDD21-015 returned 15.55m @ 7.67 g/t Au and 615 g/t Ag, including 7.25m @ 16.20 g/t Au and 848 g/t Ag.

As with the results in previous holes, gold / silver ratios from 1 to 50 to 1 to 1000 indicate multiple mineralizing events.

For example: interval 108.65m to 109.65m returned 39 g/t Au and 2,400 g/t Ag

interval 117.42m to 118.95m returned 240ppb Au and 1,200 g/t Ag

Results to date indicate the La Peña system is improving at depth with wider intervals and better grades than compared with the near surface intercepts.

Holes HDD21-016 to HDD21-025 have tested the La Peña structure over a strike length of over 300m and to depths of 200m, and the system remains open in all directions. Results from these holes are expected in the next two weeks.

Figure 1. La Peña Zone; Long Section:

Steep terrain at Holly Ridge requires a large local work force to manage portable rig moves on the steep slopes. With the first rains of the planting season, the local workers requested and the Company agreed that they will take time to sow their crops. As well, the drill rig will undergo needed maintenance. The break will allow management time to receive results for the ten holes pending and to plan targeting the deeper more complex intersections of the Jocotan Fault breccia and the La Peña vein system.

Drill holes HDD21-005 through HDD21 -013 tested El Pino and the Alpha structures. Narrow intercepts of medium and anomalous grade gold/silver were intersected. These holes tested historic surface anomalies. Drilling at El Pino cut the vein zone significantly higher than intercepts at La Peña and that may account for the narrow results. At the Alpha zone, the system was not targeted within the 200m wide Jocotan fault breccia, which drilling at La Peña indicates may be a key control on the mineralizing system.

Drilling will re-commence once results of holes HDD21-016 to HDD21-025 have been received and the planting season is complete, likely mid-September.

Technical Information

Bruce Smith, M.Sc. (Geology), a member of the Australian Institute of Geoscientists, is Volcanics's Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Smith has 27 years of mineral exploration experience and has prepared and approved the technical information contained in this news release.

Quality Assurance and Quality Control

Volcanic Gold follows industry standard procedures for diamond core drilling and analysis. Drilling is carried out using NQ and HQ size tooling. Drill core is cut in half using a rock saw with one-half of the core then taken as a sample for analysis. Sample intervals are generally 1m intervals, producing samples of between 2 to 9 kg. Half-core samples are delivered to the internationally certified Bureau Veritas Mineral laboratory facilities in Nicaragua where the samples are prepared. Assays are completed by Bureua Veritas in Canada. The samples are fire assayed for Au and are analysed for Ag and multi-elements using method code ICP following a four-acid digestion. Overlimits are analysed using an appropriate method. Multi-element geochemical standards and blanks are routenely entered into the drill core sample stream to monitor laboratory performance. Quality control samples submitted were returned within acceptable limits.

Terms of Guatemala Radius Gold and Volcanic Gold Mines option

Pursuant to an option agreement signed in May 2020 with Radius Gold Inc. (TSXV:RDU), Volcanic can earn a 60% interest in the Holly and Banderas projects by spending the cumulative amount of US$7.0 million on exploration of the properties within 48 months from the date of the agreement. An initial US$1M must be spent on exploration within the 12 months of receiving the required drill permits, which expenditure will include a minimum 3,000m of drilling on the properties.

Following the exercise of the Option, Volcanic will enter into a standard 60/40 Joint Venture in order to further develop the Properties. Volcanic has also been granted an exclusive right to evaluate all other property interests of Radius in Guatemala with a right to acquire an interest in any or all other such properties on reasonable terms.

About Volcanic

Volcanic brings together an experienced and successful mining, exploration and capital markets team focused on building multi-million -ounce gold and silver resources in underexplored countries. Through the strategic acquisition of mineral properties with demonstrated potential for hosting gold and silver resources, and by undertaking effective exploration and drill programs, Volcanic intends to become a leading gold-silver company.

For further information, visit our website at www.volgold.com .

Volcanic Gold Mines Inc.

Simon Ridgway, President and CEO

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements

Certain statements contained in this news release constitute forward-looking statements within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward- looking statements and include, without limitation, statements about the Company's plans for exploration work in Guatemala. Often, but not always, these forward looking statements can be identified by the use of words such as "estimate", "estimates", "estimated", "potential", "open", "future", "assumed", "projected", "used", "detailed", "has been", "gain", "upgraded", "offset", "limited", "contained", "reflecting", "containing", "remaining", "to be", "periodically", or statements that events, "could" or "should" occur or be achieved and similar expressions, including negative variations.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by forward-looking statements. Such uncertainties and factors include, among others, whether the Company's planned exploration work will be proceed as intended; changes in general economic conditions and financial markets; the Company or any joint venture partner not having the financial ability to meet its exploration and development goals; risks associated with the results of exploration and development activities, estimation of mineral resources and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; and such other risks detailed from time to time in the Company's quarterly and annual filings with securities regulators and available under the Company's profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to: that the Company's stated goals and planned exploration and development activities will be achieved; that there will be no material adverse change affecting the Company or its properties; and such other assumptions as set out herein. Forward-looking statements are made as of the date hereof and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

Copyright (c) 2021 TheNewswire - All rights reserved.