- Our initial drill program has intersected mineralization in 15 of 15 holes drilled across 930 metres within a 3 kilometre soil anomaly

- Partial assay results received for 5 holes, include:

- J-21-006: 3.96 g/t gold over 7.05 metre interval from 41.2 metres downhole

- J-21-007: 4.10 g/t gold over 4.00 metre interval from 9.00 metres downhole

- Subsequent holes J-21-008, 009, 010 and 011 have intercepted broader zones of arsenopyrite mineralization and quartz veining, with additional assays pending

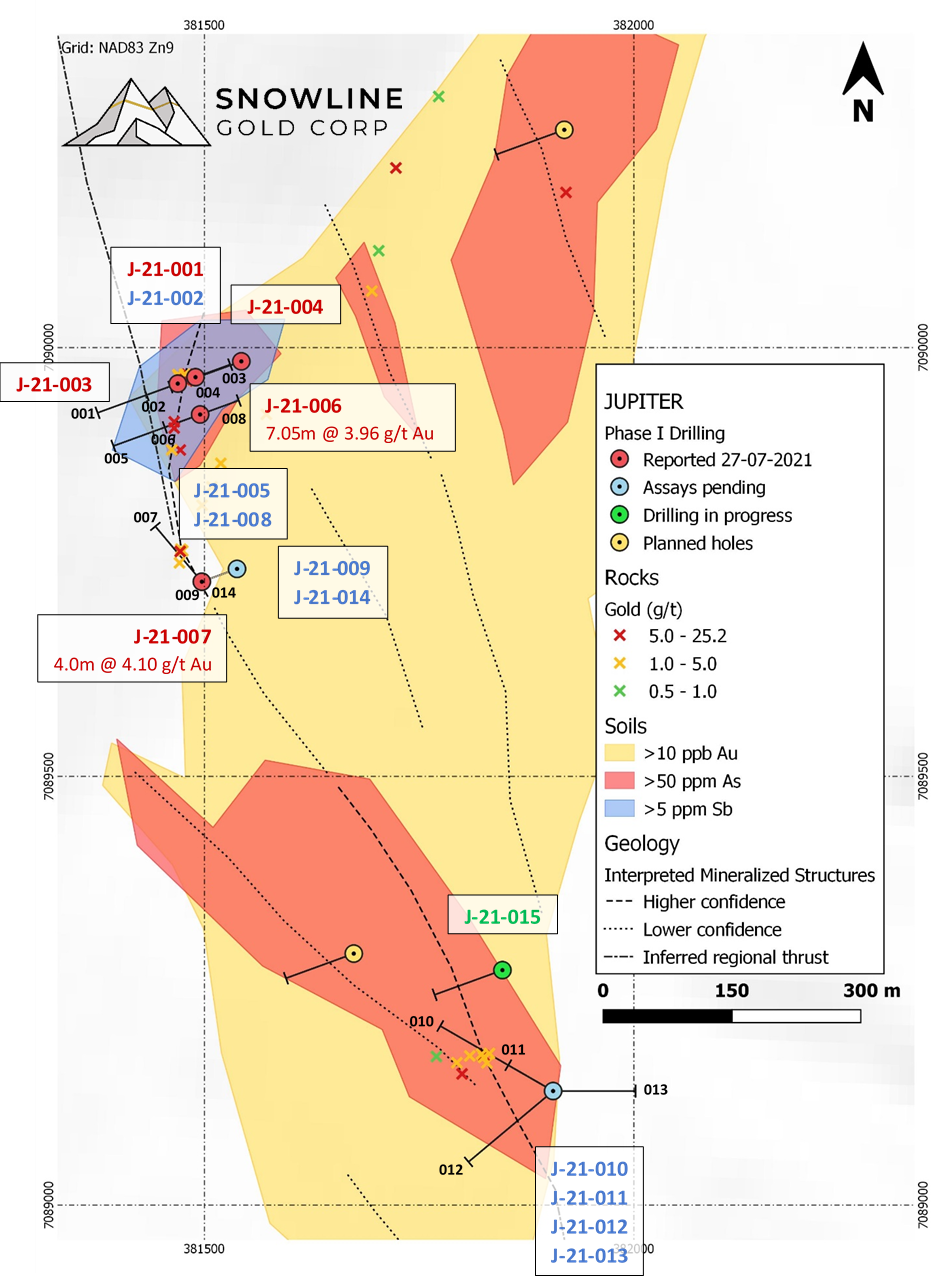

Snowline Gold Corp. (CSE:SGD) (OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce it has intersected 7.05 metres at 3.96 gt Au, including 0.7 metres at 10.65 gt Au, and 4.00 metres at 4.10 gt Au, including 0.5 metres at 17.95 gt Au in initial drill program at the Jupiter Zone on its Einarson project in the Yukon Territory, Canada. Assays from hole J-21-006 & 007 confirm the presence of near-surface gold mineralization along a covered, regional scale structure. The Company has intersected mineralization associated with this structure in all 15 holes drilled to date. Step-out drill holes up to 930 metres along the trend continue to hit mineralization, with even wider mineralized intervals than those reported here for J-21-006 & 007 (Figure 1). Assay results are pending

"This blind discovery at the Jupiter Zone in our first-ever drill campaign is a remarkable achievement for the Snowline geology team", said Nikolas Matysek, Director and CEO. "We have consistently intersected mineralization in all 15 holes drilled to date and these initial assay results are a strong indication of the high-grade gold potential at Jupiter. The programme will now focus on extending the yet unknown limits of this structure with immediate follow up drilling."

In hole J-21-006, a significant mineralized zone was intercepted between 41.2 - 48.3 metres within a 15-metre highly deformed and fractured fault zone (Figure 2). This zone is characterized by disseminated to locally massive arsenopyrite & pyrite within siltstone overlying a mineralized faulted vein. Holes J-21-005 and J-21-008 were drilled from the same pad, with assay results pending (Table 1).

A 710 metre along-strike step-out to the south for holes J-21-010, 011, 012 and 013 brings the total tested strike length to 930 metres and demonstrates the potential scale of the mineralized system at Jupiter (Figures 1, 3 & 4). Holes J-21-010 and J-21-011 encountered localized zones of disseminated and vein-hosted arsenopyrite mineralization along 121.2 metres and 133.9 metres of core length, respectively. Hole J-21-013 was drilled from the same pad but oriented away from the main target area at 090 azimuth degrees, and nonetheless also encountered zones of arsenopyrite mineralization thought to be associated with gold. True widths and the relationships of these broader intervals to any potential mineralized body or bodies is not yet known, nor is the continuity of the mineral system between northern holes and the southern drilling step-out. The Company believes these results to be highly encouraging evidence of a large, robust mineralizing system, but it cautions that their true significance awaits assay results.

Figure 1- Schematic geochemistry and structural map showing drill hole locations for Phase I drilling at Jupiter. The scope of this initial phase has been expanded based on positive results.

Figure 2 A) Quartz-carbonate vein material from drill hole J-21-006 (47.98 to 48.23 m downhole), as shown in previous SGD exploration release dated July 14, 2021. This quartz vein and the preceding fault zone returned 10.65 g/t Au across 0.7 m, at the base of a mineralized interval.

B) Above quartz-carbonate vein material in context of preceeding mineralized interval. View shows 41.54 m to 48.30 m core depth in hole J-21-006. Assay samples from 41.20 m to 48.25 m returned a weighted average of 3.96 g/t Au, ranging from 1.24 g/t over 1.05 m to 10.65 g/t over 0.7 m. Note the varying core angles to bedding and structures, making a precise estimate of true width difficult until more is known about the mineralizing system, its controls and its geometry.

The Jupiter property is thought to host a shallow epizonal orogenic gold system. It is one of eight target zones prospective for orogenic and/or Carlin-style gold mineralization currently recognized on Snowline Gold's 70%-owned Einarson project.

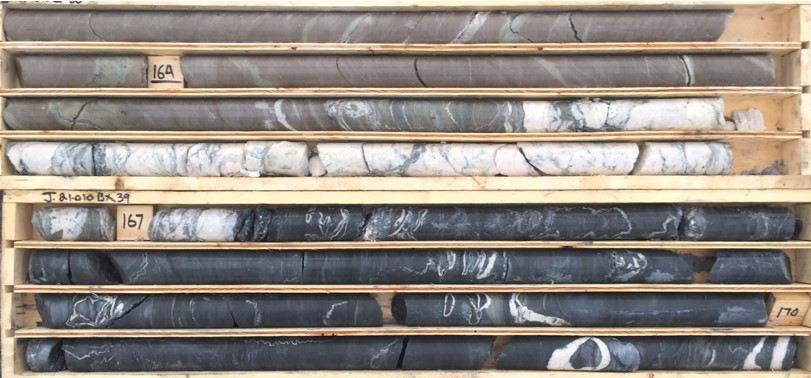

Figure 3 - 1.5 metre arsenopyrite-bearing quartz vein along a fault contact within Narchilla formation mudstones, from 165.6 to 167.1 m downhole in J-21-010. Overlying units contain quartz veinlets to 2 cm wide with abundant pyrite +/- arsenopyrite, extending some 26.6 metres up hole. Darker underlying units contain similar veinlets, along with zones of disseminated acicular arsenopyrite crystrals in the groundmass extending a further 11.1 metres down hole. Assay results are pending.

Figure 4 - Quartz flooding with abundant arsenopyrite in patches, veinlets and stylolites, from roughly 56 m to 62 m downhole in J-21-011. Assays for this and other mineralized zones in J-21-011 are pending.

Drillhole ID | Coordinates (NAD83 Zn9) | Orientation (True) | Intercept (metres) | Grade (Au g/t) | ||||

| Easting | Northing | Azimuth | Dip | From | To | Width | ||

| J-21-001 | 381489 | 7089966 | 250 | -45 | 50.45 | 51.00 | 0.55 | 0.33 |

| J-21-002 | 381489 | 7089966 | 250 | -70 | awaiting results | |||

| J-21-003 | 381469 | 7089958 | 70 | -75 | 78.50 | 80.00 | 1.50 | 1.41 |

| J-21-004 | 381543 | 7089984 | 250 | -65 | 80.00 | 83.00 | 3.00 | 0.54 |

| J-21-005 | 381495 | 7089922 | 250 | -50 | awaiting results | |||

| J-21-006 | 381495 | 7089922 | 250 | -80 | 41.20 | 48.25 | 7.05 | 3.96 |

including | 47.55 | 48.25 | 0.70 | 10.65 | ||||

remainder | 6.35 | 3.23 | ||||||

J-21-007 | 381497 | 7089727 | 320 | -50 | 9.00 | 13.00 | 4.00 | 4.10 |

including | 11.00 | 11.50 | 0.50 | 17.95 | ||||

remainder | 3.50 | 2.13 | ||||||

Table 1 - Drill assay results received to date from the Jupiter zone at Einarson. Select zones were sent for rushed assay based on arsenopyrite and quartz content observed in core. True widths are not known, but based on angles to core axis they are generally believed to represent a substantial portion (>75%) of downhole intervals. The company awaits complete assay results for sampled portions of these holes. All assay results from holes 008 through 014, which appear to have intersected more substantial zones of mineralization than holes 001 through 007, are still pending.

Qualified Person

Information in this release has been reviewed and approved by Scott Berdahl, P. Geo., Chief Operating Officer of Snowline and a Qualified Person for the purposes of National Instrument 43-101. The Einarson property is an early-stage exploration prospects that do not presently contain any mineral resources as defined by National Instrument 43-101.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a 7-project portfolio covering over 90,000 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the prospective yet underexplored Selwyn Basin. Snowline's projects all lie in the prolific Tintina Gold Province that hosts multiple million-ounce-plus gold mines and deposits, from Kinross' Fort Knox mine to Newmont's Coffee deposit. Snowline's first mover claim position represents a unique opportunity to explore and expand a new greenfield, district-scale gold system.

ON BEHALF OF THE BOARD

Nikolas Matysek, B.Sc. (Geol)

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1-778-228-3020

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/657121/Snowline-Gold-Intersects-396-GT-Gold-Over-705-Metres-and-410-GT-Gold-Over-400-Metres-in-Initial-Drill-Results-From-Its-Jupiter-Zone