- Cutting for drill core sampling revealed two instances of visible gold in drill core, the first visible gold found on Snowline's Einarson project

- Additional visible gold encountered in third and fourth holes at Valley, Rogue project

- Extensive electromagnetic survey completed across Ursa project to examine base metal and gold fertility

Snowline Gold Corp. (CSE:SGD) (OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to provide an update on its exploration activities on its Einarson, Rogue and Ursa projects in the Yukon Territory, Canada. Core cutting for drill core sampling in Hole J-21-020 revealed two instances of visible gold, the first visible gold observed in the Jupiter zone. It is Snowline's second discovery of visible gold in drill core on a previously untested target in two weeks. At Rogue, additional visible gold has been observed in drill holes V-21-003 and 004, complementing previously observed trace visible gold mineralization in V-21-001 and 002. At Ursa, an extensive aerial versatile time domain electromagnetic (VTEM) survey has been completed across 439 km, covering most of the claim block at 200 m line spacings in preparation for possible drilling

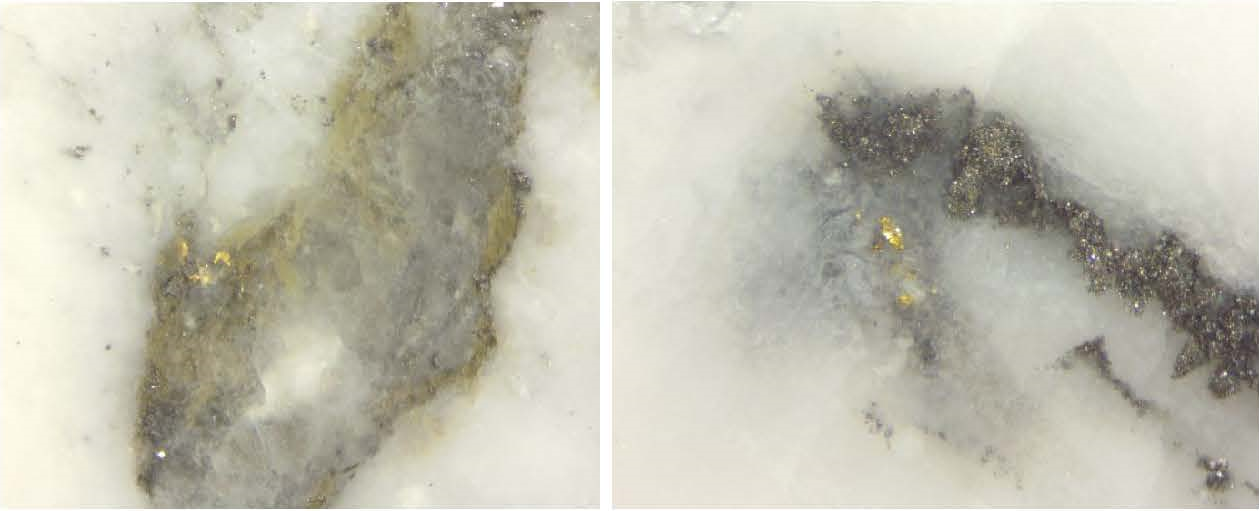

Figure 1 - Visible gold in J-21-020, at 109.6 m and 109.8 m downhole. Pictures are not consistently scaled. Observed native gold grains are up to 0.3 mm across. Note that these are the only two instances of native gold observed in J-21-020 and are not representative of mineralization throughout the hole. Assays for this drill hole are pending.

"This is icing on the cake for our successful Phase I drill program at Jupiter," said Scott Berdahl, CEO and Director of Snowline Gold. "On September 3, we released a photo from this drill hole given the potential significance of intersecting mineralized quartz in such a large, blind step-out. I said then it was ‘almost as good as we could hope for.' With this visible gold, that ‘almost' can be removed. Hole 20 joins a majority of the 21 holes drilled at Jupiter for which we eagerly await assay results. Apart from our Hole 11 ‘discovery hole,' which we rushed, we have yet to receive assays back from any of the largest quartz-arsenopyrite intervals we have seen in holes 10 and higher. We expect a steady stream of assays back from these holes and from our drilling at Valley on the Rogue project over the coming weeks and months."

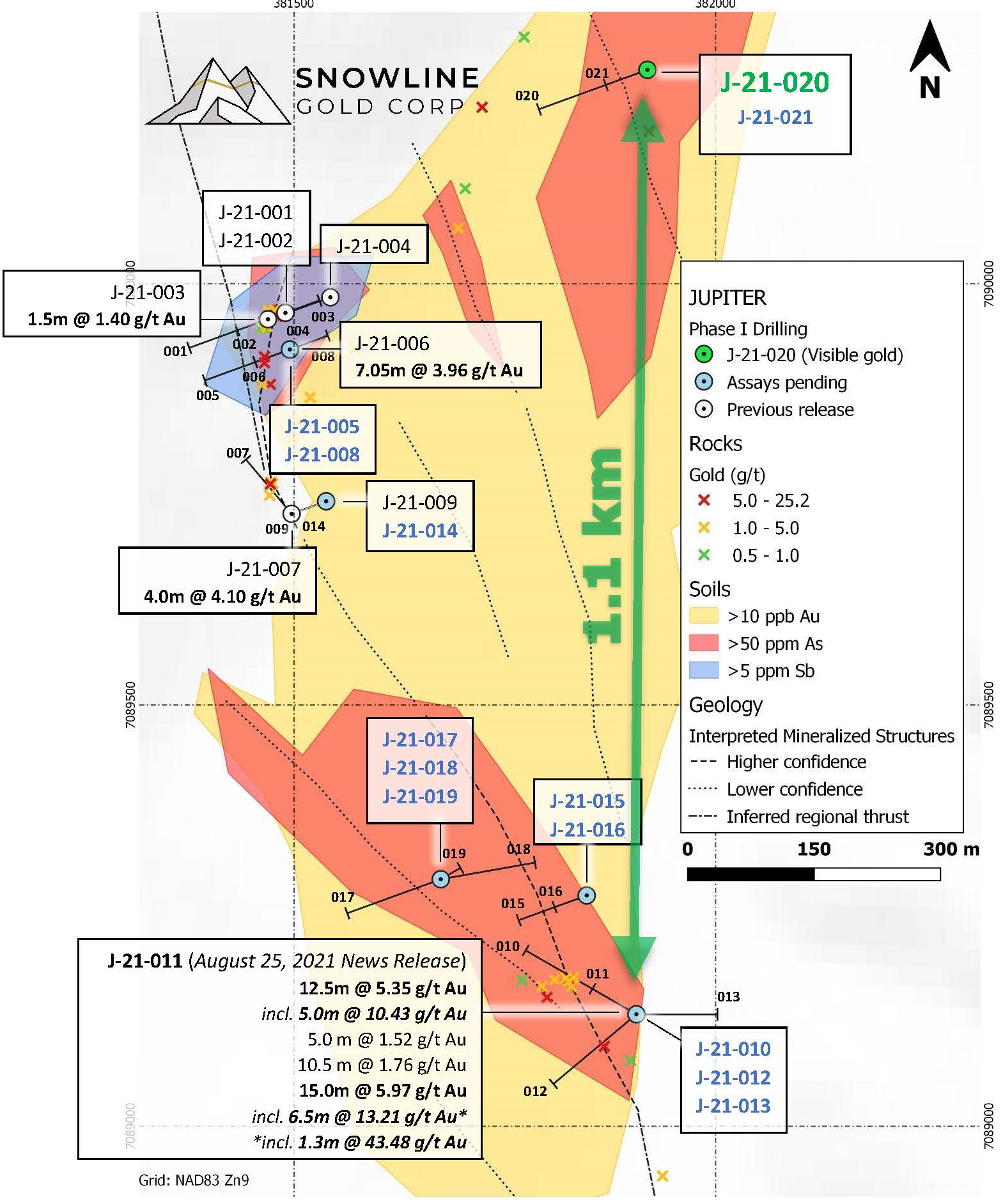

Lengthwise core cutting of J-21-020 for geochemical sampling revealed instances of visible gold (Figure 1) that weren't apparent during geological logging of the intact core. The visible gold was found in a roughly 1 m wide quartz vein previously flagged for its potential by the company (Figure 2), at the base of a 9 m wide zone of alteration and variable amounts of arsenopyrite mineralization. True widths of these zones are not known but are expected to be roughly 90% of intersected widths based on the high angles to drill core. While the observed gold confirms that the quartz veins carry gold in this area, the actual concentrations and distribution of gold in the core remains unknown until assays are returned. Hole J-21-020 was drilled roughly 1.1 km north of hole J-21-011 which returned multiple high-grade intervals of up to 13.2 g/t Au over 6.5 m (see Snowline's August 25, 2021 news release) and some 460 m from any previous hole at Jupiter, highlighting the potential scale of the system (Figure 3).

Figure 2 - Quartz-arsenopyrite mineralization in J-21-020, before (A) and after (B) cutting. The upper part of this figure was shown as part of Figure 1 in Snowline's September 3, 2021 news release. Orange flagging tape in B denotes the locations of visible gold on cut faces below. The "missing" half of the core in B has been shipped for geochemical analysis, while the half shown here will be kept by the company as a record for analytical purposes. Both images show core returned from 106.0 m to 110.3 m downhole. Assays for this zone are pending.

Jupiter is thought to represent an epizonal orogenic gold system. It is one of ten target zones prospective for orogenic and/or Carlin-style gold mineralization currently recognized on Snowline Gold's 70%-owned, district-scale Einarson project. Adjacent projects Rogue and Ursa are prospective for intrusion-related gold, and sediment-hosted gold and base metal deposits. No resources nor reserves have been calculated on any of these targets, and while current results are encouraging, they do not guarantee that economically viable ore bodies will be encountered at Jupiter or elsewhere. Readers are cautioned that without assay results, the true significance of the intersections reported herein is uncertain.

Figure 3 - Location of J-21-020, which hosts visible gold mineralization, plotted on Jupiter area soil and rock geochemical results. Holes are labelled with significant assay results received to date, though most results are still pending. Collar sites are shown as circles with drill traces shown as black lines labelled by hole number. Snowline's 2021 drill campaign is the first ever drill testing of the recently identified Jupiter zone on the district-scale Einarson gold project.

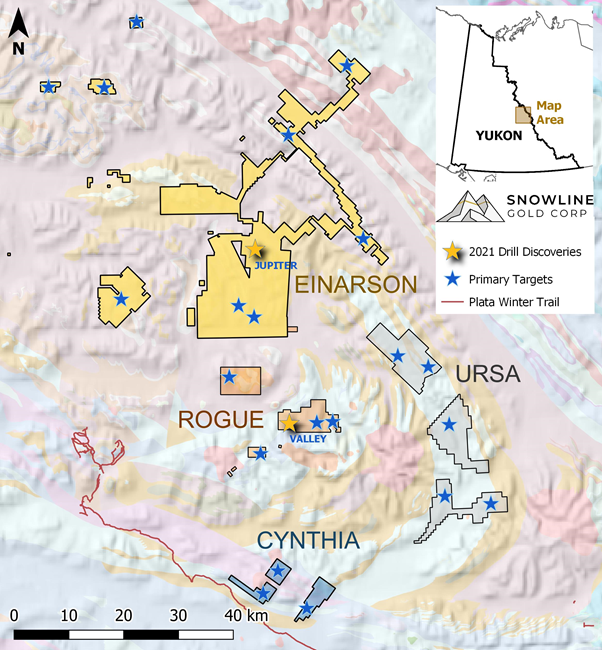

Figure 4 - Jupiter & Valley zone location map in relation to surrounding Snowline Gold Corp. projects. The discovery of visible gold at Jupiter makes for Snowline's second 2021 drill discovery of native gold in drill core in first-ever drill testing of a recently-identified target. Most targets in Snowline's district-scale Selwyn Basin portfolio remain to be tested.

ROGUE PROJECT UPDATE

Trace amounts of visible gold have been observed in holes V-21-003 and V-21-004, the third and fourth holes drilled on Snowline's Rogue project, in the Valley zone. This news follows the Company's September 7, 2021 report of visible gold in its first two drill holes at Valley. Subsequent analysis of V-21-001 and V-21-002 has revealed additional details.

In V-21-001, thirty-one quartz veins containing trace visible gold have been observed across 152 m of drill core, with up to five grains of visible gold (0.1 mm to 0.5 mm in size) within a single vein. Quartz veins themselves are usually on the order of 1 cm in thickness, with anywhere from 1 - 8 veins per metre of core. The first instance of visible gold in V-21-001 occurs at 7.5 m from surface, while the final occurrence is at 159.55 m, just 1.45 m from the end of the 161 m hole. Thirty-one of 169 samples submitted for assay, or nearly 1 in 5 samples across the length of the hole, contain trace levels of visible gold.

In V-21-002, sixteen instances of trace visible gold were observed in cm-scale quartz veins across 162 m, with similar characteristics to V-21-001. The first instance occurs at 49.5 m downhole, while the last observed instance was at 217.5 m depth in a 242 m hole.

In V-21-003 and V-21-004, visible gold is less common, with only four and two instances observed respectively. Nonetheless, the trace occurrences of visible gold in V-21-003 also span a considerable length of core, from the first instance at 12.5 m to the final at 173.5 m.

Some 804 m of drilling has been completed across the four holes in the Valley zone. While encouraged by the trace amounts of visible gold in each hole, the Company cautions that no assays have been received for these holes. The true significance of the discovery at Valley awaits these results.

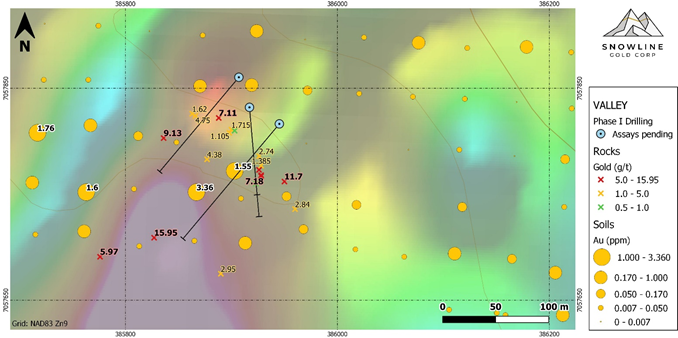

Figure 5 - Drill hole locations at Valley atop soil, rock and magnetic surveying results. Anomalous gold in soils defines a WNW-ESE trend some 900 m in length and open to the southwest, roughly parallel to sheeted quartz veins that span the edge of an unmapped intrusion. Soils assaying >1 g/t Au are labeled with white haloes. High-resolution magnetic data captured by drone surveying shows a magnetic high (pink) likely related to hornfels alteration on the edge of the intrusion. Holes V-21-001 & 002 targeted local structures in what may be a hornfels roof pendant, whereas holes V-21-003 and 004 were drilled to crosscut larger intervals of sheeted veins farther from the intrusion. Trace amounts of visible gold were observed in all four holes. Assays are pending for all holes drilled at Valley.

URSA PROJECT UPDATE

At Ursa, a 439 line-kilometre VTEM survey was conducted in early September by Geotech Inc. across most of the northernmost Ursa claim block (Figure 4) at a line spacing of 200 m. The survey covers an area of roughly 7,750 ha. It will provide the Company with information on the conductivity and chargeability of rock units underlying the trend of anomalous geochemistry, allowing for better understanding of the underlying geology and potentially mapping out anomalous geophysical targets directly related to base metal or gold mineralization.

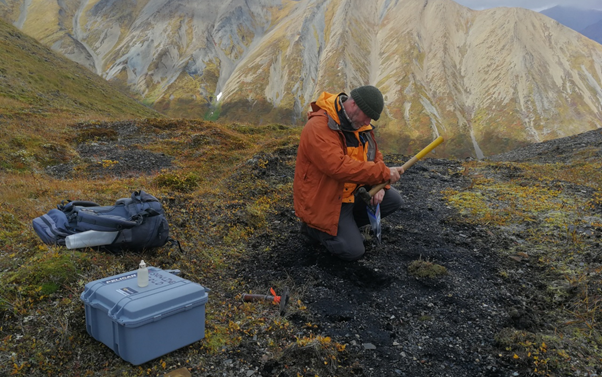

A small program of additional surface sampling was completed by the Company in a prospective part of the Ursa base metals trend to gain further insight on the origin of the anomalous zinc, nickel, copper, vanadium and silver values in soil and stream geochemical sampling encountered in historical sampling across a wide area, and to provide context for results of the geophysical surveying.

Figure 6 - Snowline's Chair, Dr. Craig Hart, samples recessive black shale units at Ursa in late August, 2021. This hands-on approach from a senior board member underscores Snowline's commitment to rigorous exploration. Dr. Hart was a founding member of the Yukon Geological Survey, where he worked for 14 years. While head of the YGS mineral services branch, he kept abreast of and helped to catalogue all significant exploration activities across the Yukon Territory.

QUALIFIED PERSON

Information in this release has been prepared and approved by Scott Berdahl, P. Geo., Chief Executive Officer of Snowline and a Qualified Person for the purposes of National Instrument 43-101.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seven-project portfolio covering >106,000 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. Snowline's first-mover land position provides a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

ON BEHALF OF THE BOARD

Scott Berdahl, MSc, MBA, PGeo

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/664338/Snowline-Gold-Encounters-Visible-Gold-in-Jupiter-Drill-Core-Completes-439-Kilometre-Electromagnetic-Survey-At-URSA