TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that the Board of Directors have approved the spinout of the Ball Creek copper-gold porphyry target located in the Golden Triangle, British Columbia (the "Ball Creek Project"), into a new company ("SpinCo") by way of a Plan of Arrangement under the British Columbia Business Corporation Act (the "Arrangement

Upon completion of the Arrangement, the Company's shareholders will: (i) maintain their existing ownership of common shares in Orogen Royalties, that will continue to operate as an organic royalty and prospect generator in North America with its flagship Ermitaño and Silicon royalties, and (ii) gain new shares in SpinCo on a ratio to be determined, that will focus on the exploration and advancement of the 100% owned Ball Creek copper-gold porphyry project. Orogen will also retain a minority shareholding interest in SpinCo and a royalty in the Ball Creek Project.

The Company expects that the Arrangement will increase shareholder value by allowing capital markets to ascribe full value to the Ball Creek Project independently of the Company's royalty assets, joint ventures, and other mineral properties. The spinout also enables SpinCo to operate under a different business model, with significant exploration and drilling programs planned to advance the Ball Creek Project.

The completion of the Arrangement, distribution of SpinCo common shares to the Company's shareholders, and listing of SpinCo's common shares on a recognized Canadian stock exchange are subject to several conditions including the completion of corporate, legal and tax structuring, completion of SpinCo financing, and appointment of a Board of Directors and management team for SpinCo. The Arrangement must also receive Orogen shareholder and regulatory approval. There is no certainty that the spinout transaction will be completed on the terms proposed or at all. The Company will provide additional updates when further details of the Arrangement are determined.

Orogen acknowledges that the Ball Creek Project is situated in the traditional territory of the Tahltan Nation with whom the Company has maintained a positive relationship since the project was acquired in 2015. The Company is committed to maintaining that relationship and look forward to dialogue based on respect and transparency.

"The approval from the Company's Board aligns with Orogen Royalties' goal to create value for its shareholders. SpinCo will be a stand-alone company that controls the exploration of the Ball Creek Project," said Paddy Nicol, President and CEO of Orogen Royalties. "Shareholders will participate in SpinCo directly as well as through their ownership in Orogen Royalties, providing exposure to exploration on an underexplored copper-gold project in British Columbia's Golden Triangle."

About the Ball Creek project.

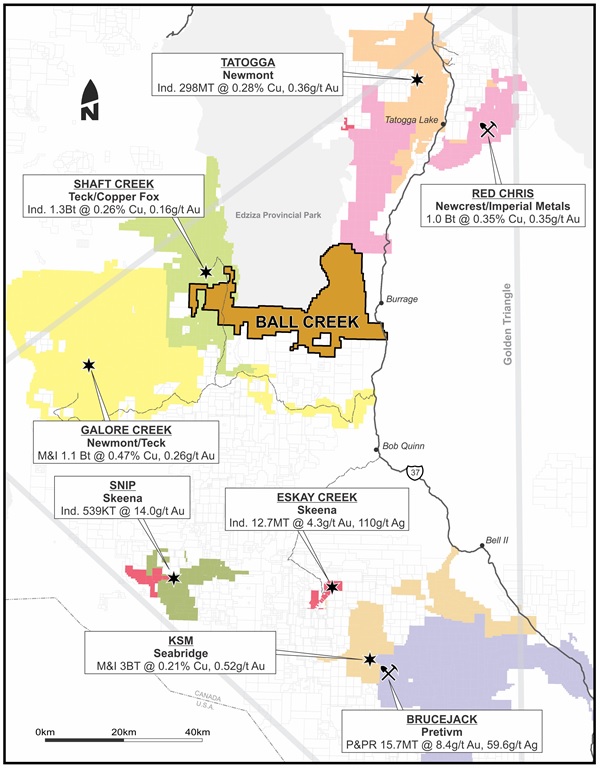

The Ball Creek copper-gold porphyry project consists of over 500 square-kilometres of mineral tenure in the heart of British Columbia's prolific Golden Triangle (Figure 1), a region that has seen significant infrastructure development for access and power, and major mining company investments. Recent transactions include Newmont Mining's acquisition of 50% of the Galore Creek project for US$275 million in July 20181, Newcrest Mining's acquisition of 70% of the Red Chris Mine for US$804 million in August 20192, Newmont Mining's acquisition of GT Gold (Tatogga Project) in May 2021 for C$393 million3, and Royal Gold's acquisition of a 1% net smelter return ("NSR") royalty on the Red Chris Mine for US$165 million in August 20214.

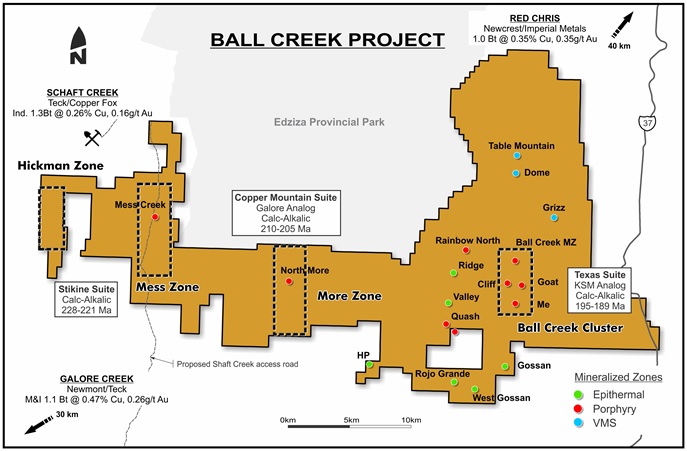

The Ball Creek Project has had CA$5.3 million invested by the Company and its exploration partners since 2015, which identified at least three intrusive suites associated with mineral deposits in the region:

- Stikine Suite, a Schaft Creek analog (indicated 1.3 billion tonnes at 0.26% copper and 0.16 grams per tonne ("g/t") gold5);

- Copper Mountain Suite, a Galore Creek analog (measured and indicated 1.1 billion tonnes at 0.47% copper and 0.26g/t gold6); and

- Texas Suite. a KSM analog (measured and indicated resources of 3 billion tonnes at 0.52g/t gold and 0.21% copper7).

Porphyry style mineralization has been identified in all the suites across the property (Figure 2) but more importantly, the Ball Creek Project is underexplored relative to the rest of the Golden Triangle. Furthermore, the project is fully permitted for exploration and drilling.

The Ball Creek Main zone ("MZ") is a 1,200 by 400 metre porphyry system that has returned drill intersects including 455 metres grading 0.28 g/t gold and 0.11% copper in drill hole BC12-47, and 231 metres grading 0.54g/t gold and 0.21% copper in drill hole BC07-12. The MZ remains open with anomalous intercepts at the extremities of the drilled area, untested internal areas, and open at depth.

Outside of the MZ, the 12 square-kilometre Ball Creek Cluster is defined by highly anomalous copper, gold and molybdenum soil and rock geochemistry with multiple exposures of porphyry-style alteration. This region is largely unexplored.

Other porphyry targets on the property, including More, Mess and Hickman, have seen limited exploration:

- The More zone consists of an undrilled Galore Creek style megacrystic syenite porphyry occurrence partially hidden by Quaternary basalts with a potassically altered outcrop returning 6.8% copper, 0.20g/t gold and 10.3g/t silver;

- The Mess zone consists of copper mineralization associated with the eastern contact of a monzonitic stock defining a fifteen-kilometre-long anomalous zone of mineralization at surface. There are greater than 500 metre internal gaps between drill holes and multiple strong soil anomalies remain untested; and

- The Hickman target, discovered in 2019, represents an undrilled porphyry target with copper-gold mineralization at surface in a potassically altered diorite just eight kilometres from Schaft Creek.

Multiple underexplored epithermal and volcanic-hosted-massive sulphide prospects exist outside these defined porphyry targets.

Figure 1: Location of the Ball Creek project

Figure 2: Overview of the Ball Creek Project

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Exploration Manager for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño West gold deposit in Sonora, Mexico (2% NSR royalty) being developed by First Majestic Silver Corp. and the Silicon gold project (1% NSR royalty) in Nevada, USA, being advanced by AngloGold Ashanti N.A. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Liliana Wong, Manager of Marketing and Investor Relations at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1201 - 510 West Hastings Street

Vancouver, BC

Canada V6B 1L8

info@orogenroyalties.com

2. https://www.newcrest.com/sites/default/files/2019-10/190816_Market%20Release_Newcrest%20complete%27s%2070%25%20acquisition% 20of% 20Red%20 Chris_0.pdf

3. https://www.mining.com/newmont-buys-canadas-gt-gold-for-325-million/

5. https://copperfoxmetals.com/projects/schaft-creek-project/overview/

6. https://www.gcmc.ca/wp-content/uploads/2021/02/2014-09-30-Galore-Creek-Reserves-and-Resources.pdf

Forward-Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Forward-looking information relates to statements concerning the Company's future outlook and anticipated events or results, as well as the Company's management expectations with respect to the proposed business combination (the "Transaction"). This document also contains forward-looking statements regarding the anticipated completion of the Transaction and timing thereof. Forward-looking statements in this document are based on certain key expectations and assumptions made by the Company, including expectations and assumptions concerning the receipt, in a timely manner, of regulatory and stock exchange approvals in respect of the Transaction.

Although the Company believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/660180/Orogen-Announces-Spin-Out-of-the-Ball-Creek-Property