Marvel Discovery Corp. (TSXV:MARV)(Frankfurt:O4T1)(OTC PINK:IMTFF) (the "Company") is pleased announce that it has entered into a purchase agreement for two claim groups, located approximately 85 km northeast of Prince George, British Columbia

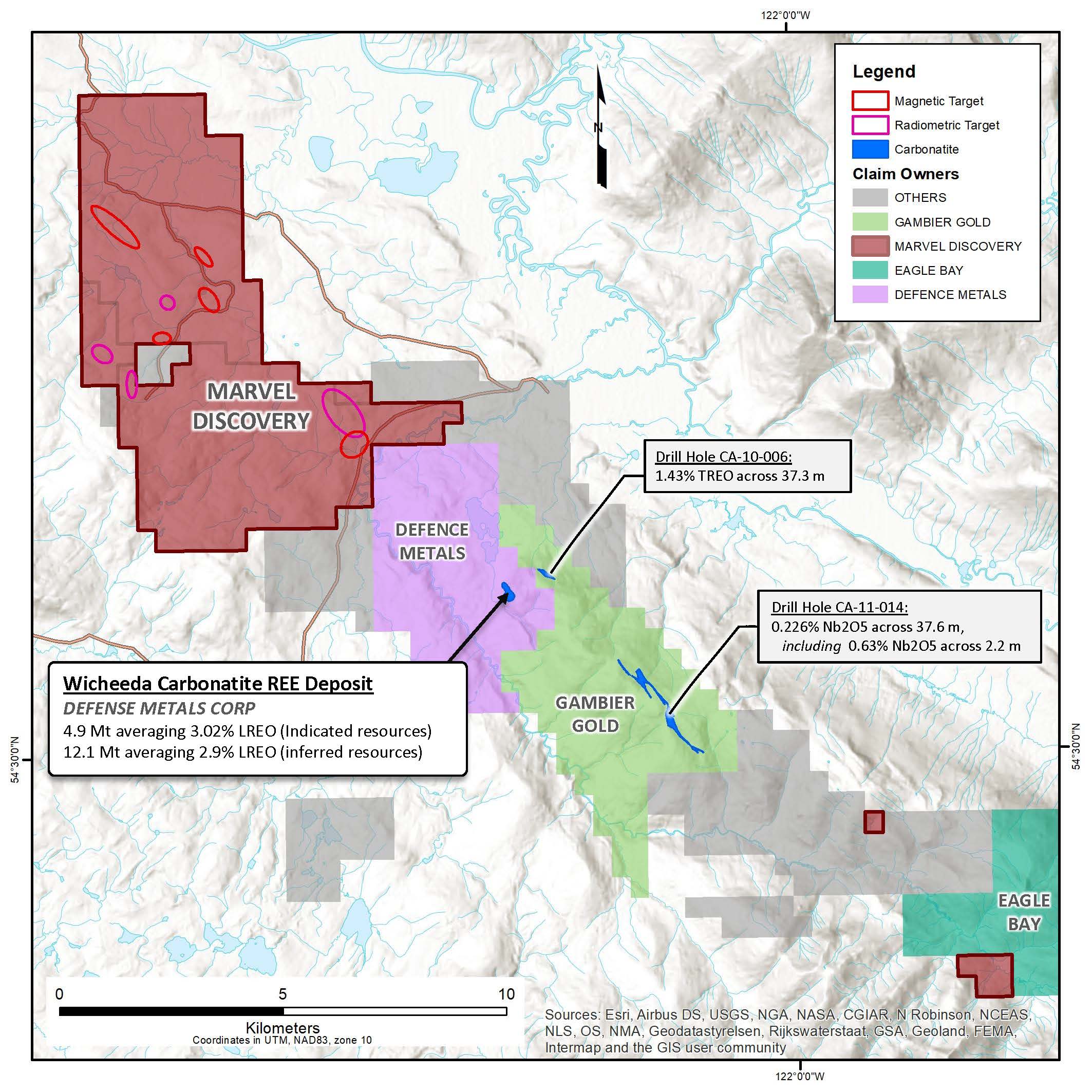

The properties are located within an approximately 40 km long belt of carbonatite and related rocks, including the Wicheeda Carbonatite - Rare Earth Element (REE) Project at the northwest end and the Cap Carbonatite - Rare Metal (RM) Project near the southeast end. The Wicheeda Rare Metal Belt (WRMB) covers a multitude of REE and RM bearing carbonatites and syenites that form as either elongate to elliptical or sub-circular bodies intruding Proterozoic and/or Paleozoic sedimentary rocks. No carbonatite occurrences have been documented on the Company's properties to date; however, the geology is considered favourable to host such mineralization styles associated with carbonatites.

Mr. Karim Rayani, President & Chief Executive Officer commented, "We are very excited to have acquired two separate property groups, each with potential to host rare metal mineralization, at a time when the world's need for green energy metals is growing at an ever-increasing rate. Coupled with our existing holdings, Marvel is now one of the largest landholders in the Wicheeda Rare Metal Belt."

Carbonatite-related rocks are exceptionally rare, with less than 700 complexes know worldwide. They are a major host for rare metals, such as niobium and tantalum, and rare earth elements (REE's), and are also known to host economic concentrations of copper, gold and other base metals. The world's largest niobium mine, Araxa in Brazil, and several of the world's largest rare earth element deposits, including Lynas Corporation's Mt. Weld deposit in Australia and MP Material's Mountain Pass Deposit in the United States, are all hosted by carbonatites.

Wicheeda North Property

The Wicheeda North Property, the main property of interest, consists of six mineral claims, which encompass 2135.6 ha, immediately northwest of the Wicheeda Property, which hosts the Wicheeda Carbonatite, currently being explored by Defense Metals Corp. This brings the company's total land holdings within the WRMB to just over 4,423.8 ha across a total of 18 claims.

The Wicheeda Carbonatite Deposit, held by Defense Metals Corp., is host to an indicated resource of 4.89 million tonnes (Mt) at 3.02% light rare earth oxide (LREO) and an inferred resource of 12.1 Mt at 2.90% LREO, using a cut-off grade of 1.5% total metal (see "Technical Report on the Wicheeda Property, British Columbia, Canada" with an Effective Date of June 27th, 2020). Management cautions that past results or discoveries on proximal properties (i.e. the Wicheeda Carbonatite Deposit) may not necessarily be indicative to the presence of mineralization on the Company's properties (i.e. Wicheeda North).

The property was originally acquired to cover a distinct, oval, aeromagnetic feature. The magnetic feature is flanked by two areas of above-background magnetics, indicating a complex magnetic environment, similar to that observed at Wicheeda.

Two additional claims totaling about 113 ha, are located within the south-central parts of the WRMB.

The projects were acquired from Zimtu Capital Corp. and prospecting associates for a one-time cash payment of $22,500 for a 100% interest.

Green Infrastructure

Within the USA, the recent announcement of $2 Trillion USD of green infrastructure spending and jobs plan will focus on modernizing and electrifying the US energy grid to handle modern electric vehicles that will result in a carbon-neutral economy by 2035. In order to facilitate this transition, a dramatic surge in demand for green energy metals and minerals will take place. These include light rare earth elements such as neodymium and praseodymium (used in the creation of permanent magnets), niobium, and copper. Marvel Discovery Corp. is actively positioning itself to ensure it is well placed to capitalize on this growing market.

Qualified person

Jody Dahrouge, P.Geo., of Dahrouge Geological Consulting Ltd. and a qualified person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

About Marvel Discovery Corp.

Marvel, listed on the TSX Venture Exchange for over 25 years, is a Canadian based emerging resource company. The Company is systematically exploring its extensive property positions in:

- Exploits Zone, Newfoundland (Slip and Victoria Lake - Au Prospects)

- Atikokan, Ontario (BlackFly - Au prospect)

- Red Lake, Ontario (Camping Lake - Au prospect)

- Elliot Lake, Ontario (Serpent River/Pecors -Ni-Cu-PGE discovery) & (Uranium- REE's)

- Quebec (Duhamel -Ni-Cu-Co prospect & Titanium, Vanadium, and Chromium prospect)

- Prince George, British Columbia (Wicheeda North - Rare Earth Elements prospect)

The Company's website is: https://montororesources.com/

ON BEHALF OF THE BOARD

Marvel Discovery Corp.

"Karim Rayani"

Karim Rayani

President/Chief Executive Officer, Director

Tel: 604 716 0551 email: k@r7.capital

Disclaimer for Forward-Looking Information:

Certain statements in this release are forward-looking statements which reflect the expectations of management. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. These forward-looking statements reflect management's current views and are based on certain expectations, estimates and assumptions which may prove to be incorrect.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Marvel Discovery Corp.

View source version on accesswire.com:

https://www.accesswire.com/641293/Marvel-Discovery-Corp-Acquires-Rare-Metal-Project-Northeast-British-Columbia