Historical Grab Samples Essayed Up To 126 G/T Gold, And 1% Copper And 2 Metres Channel Sample Averaged 85 G/T Gold, 51 G/T Silver And Over 1% Copper

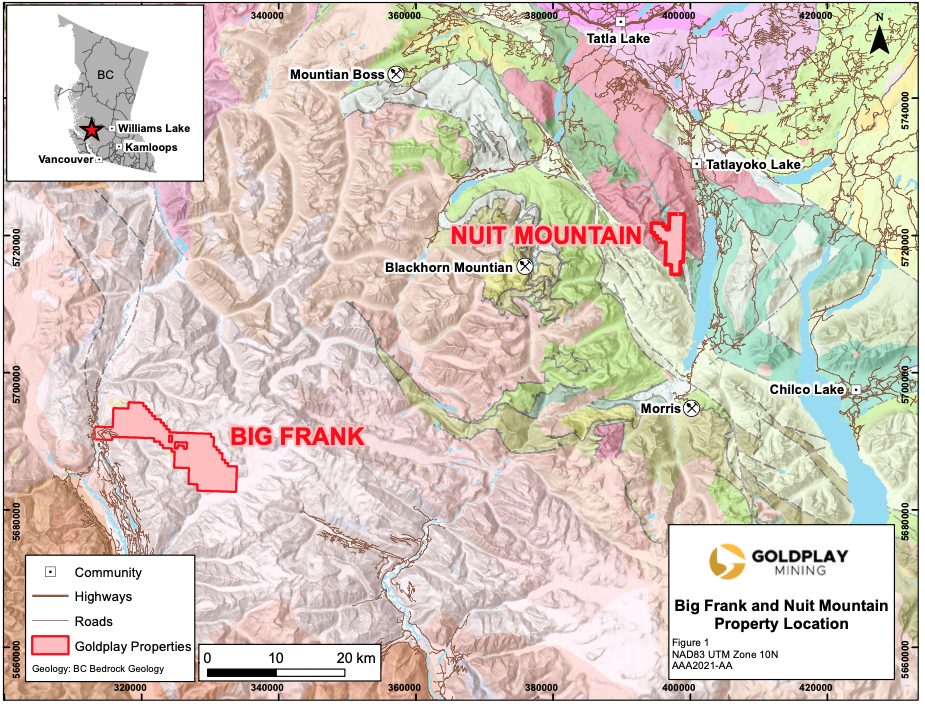

TSXV:AUC), (Frankfurt:9FY), (the "Company" or "Goldplay"), is pleased to announce that it has signed an option agreement (the "Agreement") with Cazador Resources Ltd. ("Cazador") to earn a 100 % interest in two properties known as "Big Frank" and "Nuit Mountain" (together, the "Properties"). The projects are located in the western Chilcotin District of southwestern British Columbia (see Figure 1) and have district scale potential for both high-grade epithermal gold and copper-gold porphyry deposits. Further information on the transaction is detailed under "Terms of the Agreement" below

Historic Highlights

- grab samples assaying up to 126 grams per tonne gold and over 1% copper.

- Historic channel samples with up to 85 grams per tonne gold, 51 grams per tonne silver and over 1% copper over 2 metres.

Catalin Kilofliski, Goldplay Mining President & CEO stated: "We are very excited about today's announcement. Through this transaction, Goldplay has a unique opportunity to capitalize on the earlier work completed on the Properties and the potential to develop and control district scale projects and become a significant gold and copper-gold explorer in B.C. Given the encouraging historical results, an exploration crew has already been mobilized and intends to begin the initial work program on September 1st."

THE PROPERTIES

The Big Frank Property (9,470.8 hectares) covers a 20-kilometre-long favourable geological trend and is located approximately 285 kilometres northwest of Vancouver or alternatively about 30 kilometres north of the head of Knight Inlet with logging roads occurring in the western portions of the property. Five principal target areas include:

- Redbreast/Sawyers Grid/Hannah/Big Frank/Discovery - the area has been variously named and at times only partially held and explored by respective parties. Significant ice retreat continues to expose the westward expansion of alteration over the Redbreast area with numerous copper and molybdenum talus fine samples (up to 1000 ppm copper and 1000 ppm molybdenum) and sporadic rock gold anomalies up to 11.2 g/t Au. Further to the east at the Hannah/Saffron/Big Frank, epithermal style veins are noted. A select grab sample assayed 126 grams per tonne gold and over 1 per cent copper. A channel sample averaged 85 grams per tonne gold, 51 grams per tonne silver and over 1 per cent copper over 2 metres. Drilling in 1988 (9 drillholes totalling 984 m) returned sporadic results of up to 0.53 ounce per ton gold and 4.3 % copper over narrow intervals. Numerous untested EM anomalies were noted and obvious propylitic (chlorite) alteration is noted in the satellite imagery to the NE. (Source: BC Minfile 092N 028: Hannah 8 and B.C Assessment Report 18,202: Geology and Gold Potential of the Hannah 1- 11 Claims for United Pacific Gold Ltd by M.P Twyman & F.D Fergeron, 1988).

- Confederation Glacier- a 1-kilometre-wide alteration zone is noted on the northern edge of the Confederation Glacier with the collection of 22 talus fines collected at 50 m intervals returning up to 1,550 ppb Au, 318 ppm Cu and 11.2 ppm Ag (Source: B.C Assessment Report 31228: Preparatory Geological & GIS Compilation Studies on the LR Project for United Exploration Management by Carl Von Einsiedel, 2009).

- Hoodoo Creek North - a 1 km 2 open-ended historical soil anomaly (> 100 ppb Au, >500 ppm Cu, > 8 ppm Ag and > 25 ppm Mo) is noted in reports by Amax Corp. in 1978 and was later drilled by Utah Mines in 1979 & 1980 along the southern portion of the anomaly targeting potential for a deep molybdenum porphyry. Exploration efforts did not test the better portions of the copper and gold anomaly as much as 600 metres uphill from this drilling. Alteration viewed in satellite imagery appears to show room to grow this geochemical anomaly particularly to the north towards the Darlene Minfile occurrence and along other structures mapped to the northeast. (Source: B.C Minfile: 092N029: Hoodoo North). Hoodoo South: between 1977-1982 Amax outlined molybdenite and copper mineralization over an area of 500 m x 500 m (Source B.C Minfile 092N 034: Hoodoo South).

- Breccia - extensive alteration is observed in satellite imagery between the Redbreast and Lancer Mountain areas and appears to have seen little to no exploration perhaps because the area is just recently free of snow and ice. Further to the south and west of the Redbreast Area the GR 16-18 series rock samples have returned up to 0.16 g/t Au and 0.17 % Cu. (Source: B.C Assessment Report 31,228: Preparatory Geological & GIS Compilation Studies on the LR Project for United Exploration Management by Carl Von Einsiedel, 2009).

The Nuit Mountain Property (2,448.8 hectares) covers an 8-kilometre-long alteration trend and is located 170 km southwest of Williams Lake or alternatively 75 kilometres east of the Big Frank Property (see Figures 1 & 2) and has road access to within four kilometers of the property. Exploration in the vicinity of the Nuit Mountain Property was prompted in the 1960's by the sighting of large rusty gossans and at least seven documented copper and gold mineral showings (Niut Mountain, Down's Showing, Fly, Harvey Gold, Fly Creek, Rusty and Anthony). Examples of know mineralization include a composite sample of well mineralized rocks collected in 1972 along the length of the Fly showing which averaged 0.677% copper over 200 m.

At Harvey Gold located 1,200 metres northeast of the Fly Showing, several historical samples were taken with the two best samples yielding 0.159 and 0.746 g/t gold with subdued copper. At an unnamed occurrence, quartz vein float, was found in 2006 within the main south-flowing creek on the property and returned 4.96 g/t gold. Much of the historical work at Nuit focused on the well exposed gossans along ridges but recent programs (>2007) obtained strong copper and gold geochemical results from heavily vegetated, and overburden covered slopes at lower elevations. The last field program completed in 2016 recommended additional work to follow up geophysical and geochemical targets, many of which received little or no systematic evaluation.(Sources: B.C Minfile and B.C Assessment Report 35815: Geochemical Sampling and Prospecting at the Buzz Property for Strategic Metals by A. Mitchell and H. Burrell, 2016).

THE OPPORTUNITY

Both the Nuit Mountain and Big Frank Properties exhibit widespread alteration, high-grade gold and copper-gold mineralization, and favorable geology trending over 8-20 km. They are both relatively underexplored and have seen no systematic or modern exploration within the last few decades whilst glacial retreat continues to make new exposures in the case of Big Frank. Previous exploration programs have discovered significant copper and gold values and recommended further work. The Company and Cazador recognize the potential for district scale mineralization in the area. Under the terms of the Agreement, Goldplay has agreed to incur $25,000 in expenditures on Nuit and $50,000 of expenditures on Big Frank on or before December 31, 2021 with the intention of preparing NI 43-101 technical reports on both Properties.

TERMS OF THE AGREEMENT

Under the terms of the Agreement, Goldplay may acquire a 100% interest in the Properties by completing the following work commitments on the Properties and by making the following cash and share payments:

BIG FRANK PROPERTY

Timing | Work | Goldplay Shares | Cash |

| Upon Signing/ TSX Approval | $50K | 60K | $10K |

Within 1 Year | $350K | 140K | $40K |

Within 2 Years | $600K | 600K | $100K |

Within 3 Years | $2.0 M | 1.2M | $150K |

Within 4 Years | $4.0 M | 2.0M | $400K |

Totals | $7.0 m | 4 .0M | $700 k |

NUIT MOUNTAIN PROPERTY

Timing | Work | Goldplay Shares | Cash |

| Upon Signing/ TSX Approval | $25K | 30K | $5K |

Within 1 Year | $175K | 170K | $20K |

Within 2 Years | $300K | 300K | $50K |

Within 3 Years | $1.0 M | 600K | $75K |

Within 4 Years | $2.0 M | 1.0M | $200K |

Totals | $3.5 m | 2.0 M | $350 k |

Upon completion of all commitments Goldplay will own 100% of the Properties. Goldplay has the option to acquire either Big Frank or Nuit or to acquire both Properties concurrently or successively. Cazador Resources Ltd. will retain a 2 % NSR on each Property half buyable for $5M each. Advance royalty payments of $25K a year for Nuit Mountain and $50K a year for Big Frank will become due starting in Year 5. The Agreement is subject to acceptance by the TSX Venture Exchange.

Figure 1: Regional Geology, Mineral Claims and Properties, West Chilcotin, Southwest British Columbia

Figure 2: Nuit Mountain Property, Google Earth Image Showing Impressive Gossanous Alteration > 8 km trends

Qualified Person

The scientific and technical information has been reviewed and approved by Mr. Andrew Wilkins, Goldplay's BC Exploration Manager and Qualified Person within the context of Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects. The information in this news release contains historical results and is speculative in nature as very little recent ground work has been done to date on the Properties.

About Goldplay Mining

Goldplay Mining is a newly listed Canadian public company which is focused on exploring and advancing gold-copper projects located in top mining jurisdictions with potential for world class mineral discovery.

On behalf of the Board of Directors

"Catalin Kilofliski"

Catalin Kilofliski

President, CEO & Director

For further information please contact:

Goldplay Mining Inc.

Mr. Catalin Kilofliski, President & CEO

Suite 650 - 1021 West Hastings Street

Vancouver, BC V6E 0C3

T: (604) 655-1420

E: catalin@goldplaymining.ca

www.goldplaymining.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws relating to the exploration potential of the Properties. Generally forward-looking statements can be identified by the use of terminology such as "anticipate", "will", "expect", "may", "continue", "could", "estimate", "forecast", "plan", "potential" and similar expressions. These forward-looking statements involve risks and uncertainties relating to, among other things, the lack of recent exploration work on the Properties, results of future exploration and development activities, uninsured risks, regulatory changes, defects in title, availability of materials and equipment, timeliness of government approvals, changes in commodity prices and unanticipated environmental impacts on operations. Although the Company believes current conditions and expected future developments and other factors that have been considered are appropriate and that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct or enduring. Readers are cautioned to not place undue reliance on forward-looking information. The statements in this press release are made as of the date of this release. Except as required by law, the Company does not undertake any obligation to update publicly or to revise any forward-looking statements that are contained or incorporated in this press release. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

SOURCE: Goldplay Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/662020/Goldplay-Signs-Option-Agreement-To-Acquire-100-Interest-In-Two-Large-BC-Properties-With-District-Scale-Potential-For-High-Grade-Epithermal-Gold-And-Copper--Gold-Porphyry-Deposits