Goldplay Mining Inc. (TSXV:AUC) (USOTCQB:AUCCF), (Frankfurt:9FY), (the "Company" or "Goldplay"),is pleased to announce results from the 2021 field program completed on the Scottie West Project, (located in the Golden Triangle of BC

HIGHLIGHTS

- Rock sample assaying: 5.90 grams per tonne ("gpt") Gold and 155 gpt Silver on the SE Exposure Nunatak.

- Rock sample assaying: 5.29 gpt Gold on the Leduc NE Ridge.

- Rock sample assaying: 2.19 gpt Gold and 119 gpt Silver on the Leduc East Central Ridge.

- Rock sample assaying: 0.95 gpt Gold, 91.87 gpt Silver, and 2.77% Zinc on the East Border Nunatak.

Catalin Kilofliski, Goldplay Mining President & CEO stated: "The Scottie West Project is located amongst some impressive neighbors including Pretium's Brucejack Mine, as well as the past producer Granduc and Silback Premier Mines. Recent success on the neighboring Scottie Gold Project bodes well for the potential of the area. Goldplay was the first company to complete a comprehensive exploration program on the Scottie West Project. For an initial first pass, the geological team has identified and discovered some encouraging Gold and Silver mineralization that the Company believes warrants further investigation and additional work."

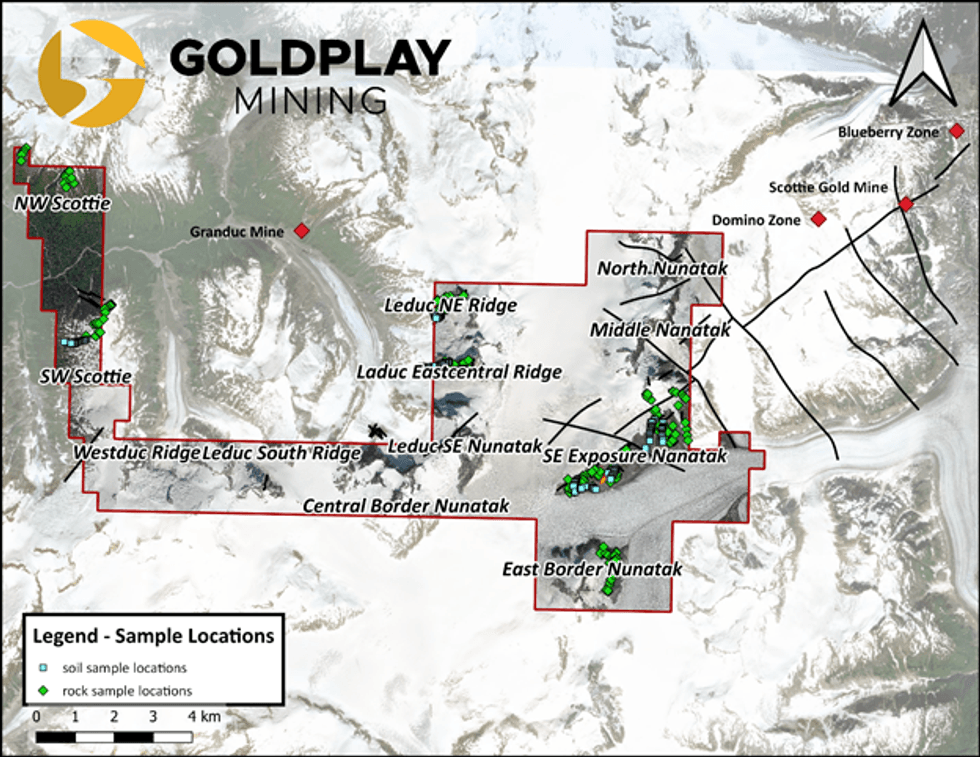

The 8,394-hectare Scottie West Project is located in the prospective Golden Triangle of British Columbia, 25 km north-northwest of the deep-water port of Stewart, BC and 7 km west of the Granduc Road. The Project is optioned from Coast Copper Corp. (formerly Roughrider Exploration (TSXV:COCO)).

Goldplay's initial exploration work has resulted in the discovery of several multi gram Gold assays in both grab samples and channel samples from the SE Exposure Nunatak, the Leduc NE Ridge and the Leduc East Central Ridge (figure 1).

Figure 1 - Scottie West Property in Relation to the Scottie Gold Mine and the Granduc Mine

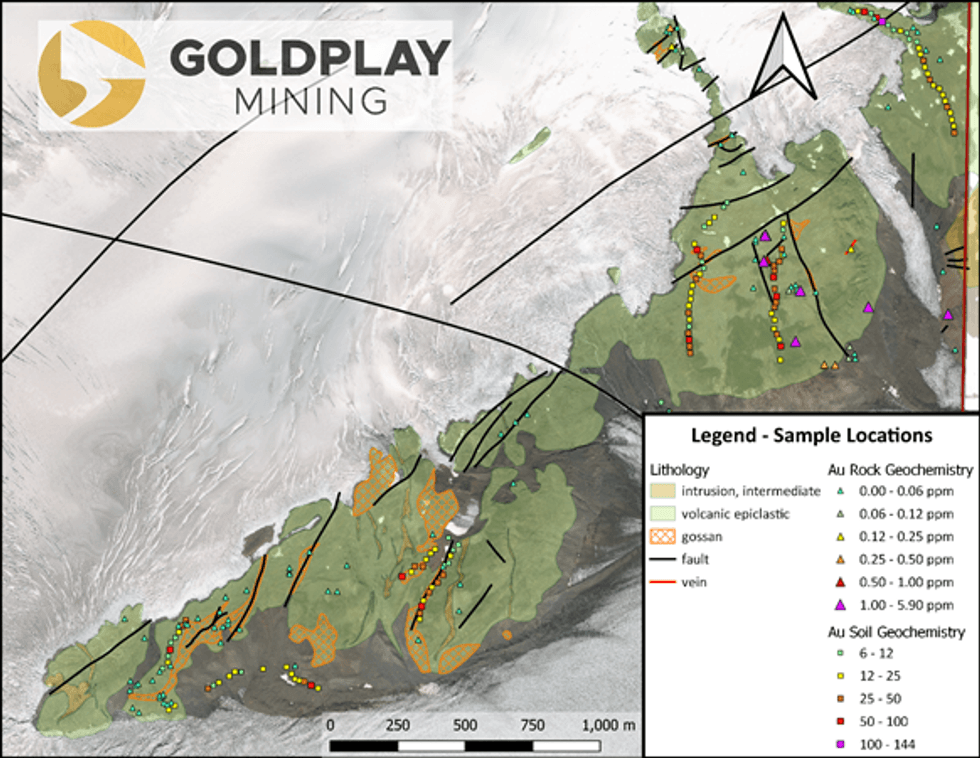

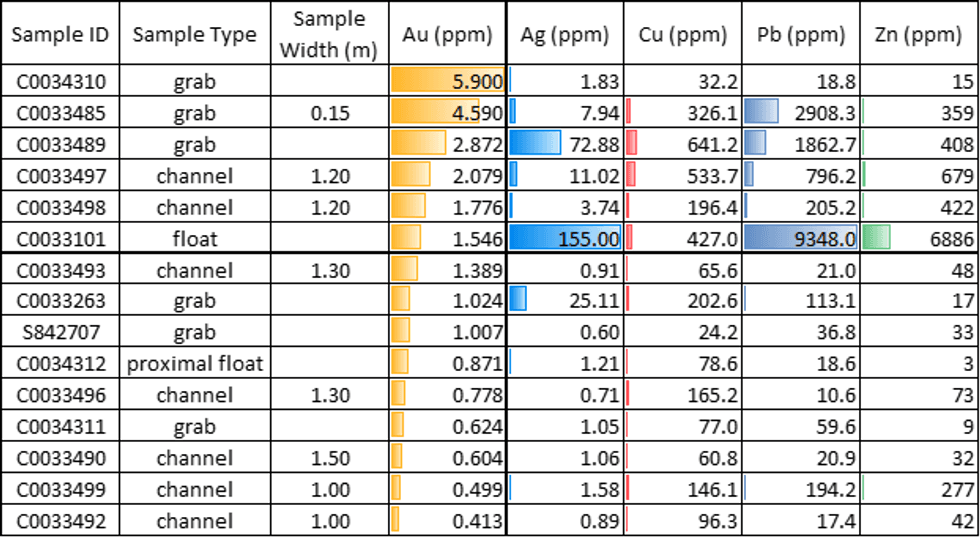

The SE Exposure Nunatak (figure 2,below) has the highest Gold assay with a grab sample assaying 5.9 gpt Gold, occurring within quartz-carbonate veins with pyrite and arsenopyrite. Follow up channel sampling of the original discovery has yielded 1.39 gpt Gold over 1.3 metres ("m"). A second zone was also discovered 95 m to the north with a grab sample of 4.59 gpt Gold and channel samples of 2.08 gpt Gold over 1.2 m and 1.78 gpt Gold over 1.2 m. Table 1 highlights some of the results. East-northeast and north-south trending structures appear to be important features controlling mineralization. The Nunatak consists of mostly bedded volcaniclastic and epiclastic rocks consisting of siltstone, ash and lapilli tuff. Also noted was mudstone, agglomerate and mafic coherent volcanic flows. The stratigraphy is cut by numerous intermediate dykes. Gossanous biotite-pyrrhotite hornfelsing occurs around the dykes and is especially evident in the mudstone units. Talus fines sampling has identified numerous targets on the Nunatak which also coincide with gossanous alteration zones identified in both satellite imagery and on the ground.

Figure 2 - SE Exposure Nunatak

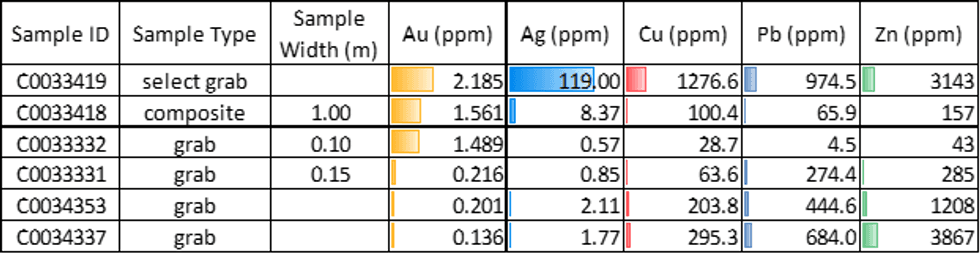

Table 1 - Highlights from SE Exposure Nunatak

The Leduc NE Ridge yielded assays of up to 5.29 gpt Gold. A composite sample taken across 5 m of pervasive silicification and quartz veining within a major NE structure also assayed 1.00 gpt Gold. Channel samples, 1 metre across, taken from what was described as a "silicified cap" within lapilli tuff fragmental volcanic are all strongly anomalous in Gold as well. These "silicified cap" rocks occur proximal to the major NE structure identified above. The structure is a compelling target due to the size and degree of silica alteration with coincident anomalous Gold within the structure and surrounding silicified volcanic. The structure appears to mark the contact between mafic and intermediate volcanic fragmental to the northwest and conglomerates to the southeast. Table 2 highlights results from the Leduc NE Ridge.

Table 2 - Highlights from Leduc NE Ridge

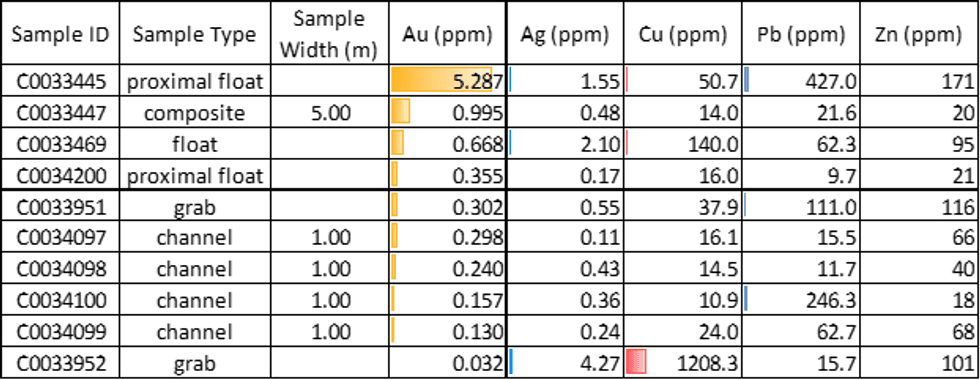

The Leduc East-central Ridge also yielded assays of up to 2.19 gpt Gold and 119 gpt Silver within NE trending fault zones containing quartz, sericite and pyrite alteration, and chalcopyrite and sphalerite mineralization. Table 3 highlights results from the Leduc East-central Ridge. The Ridge is immediately south of the Leduc NE Ridge and consists of predominantly epiclastic conglomerate. Pillow basalt occurs on the west end of the ridge. It is speculated that the conglomerates and pillow basalts might be related to the Eskay Rift however there is not enough evidence to confirm such a speculation. Intrusive rocks believed to be part of the Eocene Boundary Stock occur at the south end of the ridge.

Table 3- Highlights from Leduc East-central Ridge

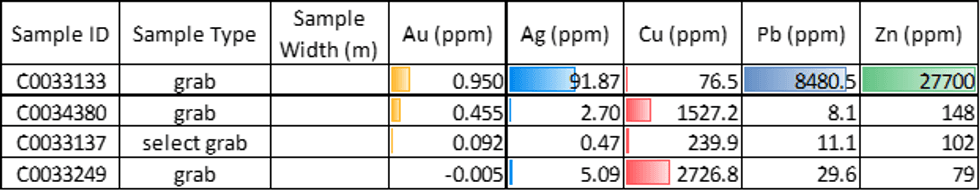

The East Border Nunatak consists of a mixed package of coherent andesitic and dacitic volcanic and associated volcaniclastic, believed to be part of the Lower Jurassic Hazelton Group. The Eocene Boundary Stock occurs at the southern end of the Nunatak and as dykes within the Hazelton Group rocks. Malachite and hydrozincite were noted in numerous locations and are hosted within both volcanic and intrusive rocks and associated fractures and faults. One grab sample assayed of up to 0.95 gpt Gold, 91.9 gpt Silver, 2.77% Zinc and 0.85% Lead. Another sample assayed 0.27% zcopper. Table 4 highlights the East Border Nunatak samples.

Table 4 - Highlights from East Border Nunatak

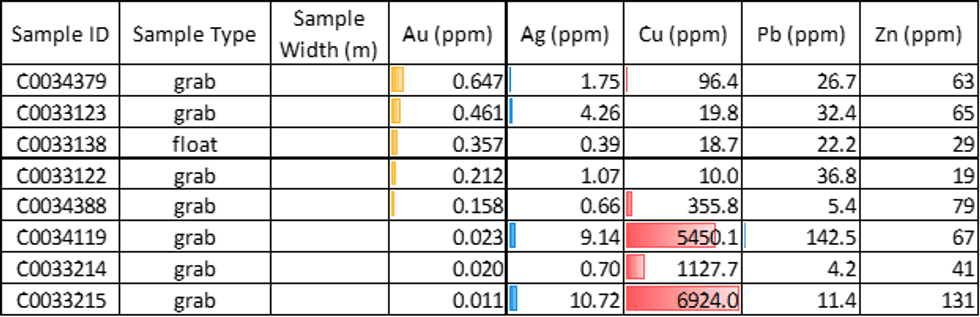

In the NW and SW Scottie areas, the geology consists of bedded, schistose to weakly gneissic epiclastic sandstone and argillite as well as mafic pyroxene phyric coherent volcanic flows believed to be part of the Late Triassic Stuhini Group. These rocks have been intruded by tonalite of the Eocene Boundary Stock. Pyrrhotite with minor chalcopyrite and malachite was noted on SW Scottie. Table 5 highlights some of the samples from NW and SW Scottie with samples of up to 0.69% Copper and 10.72 gpt Silver.

Table 5 - Highlights from NW and SW Scottie

Goldplay had planned to spend approximately $400,000 on the Scottie West 2021 exploration program. Given most of the claims are above 1300 m, the best time for surface exploration work is in the later part of the summer and early fall, with only about 6 weeks of prime weather conditions. Due to extreme work-loads and staff shortages at the laboratories, the processing time for complete assay results is currently 2-3 months. Given these significant delays and short prime weather window, management felt it was prudent to wait for assay results before planning and completing additional work. As a result, Goldplay was able to spend a total of about $200,000 on the Scottie West 2021 exploration program. Much of the discovered mineralization is associated with altered rocks that are poorly exposed as they occur in recessive outcrop. These areas are often the last areas to be exposed from the melting seasonal snowpack.

In reviewing the assays from the rock samples collected in 2021, there appears to be a strong correlation between Gold and the pathfinder element arsenic. There also appears to be a strong correlation between Silver, Lead, Zinc, Antimony and Cadmium.

For the 2022 field program, a follow up program of detailed prospecting, mapping and talus fines sampling in the vicinity of the discovered showings on the SE Exposure Nunatak and the Leduc NE Ridge is proposed. This would be followed by targeted channel sampling and ground Induced Polarization Geophysics. The program would not start until mid-August 2022 when much of the winter snowpack has melted.

The property borders Scottie Resources' Scottie Gold property and is 7 kilometres southwest of the past-producing Scottie Gold Mine, which operated from October 1981 to February 1985 and produced a total 2,984 kilograms (95,940 ounces) of Gold and 1,625 kilograms (52,250 ounces) Silver from 160,264 tonnes of milled ore, for an average recovered grade of 18.62 gpt (0.543 ounces per ton) Gold and 10.14 gpt (0.296 ounces per ton) Silver (MINFILE 104B 034). The Scottie West property occurs along the southwest extension of a mineralized belt that includes Scottie Resources' Blueberry Zone, the Scottie Gold Mine and the recently discovered Domino Zone (Figure 1). The Domino Zone is 3 kilometres northeast of the Scottie West property and drilling in 2020 included the following results.

- 12.4 gpt Gold and 8.7 gpt Silver over 2.69 m

- 2.48 gpt Gold and 8.63 gpt Silver over 15.46 m including 19.9 gpt Gold and 71.6 gpt Silver over 0.94 m

- 13.4 gpt Gold and 8.11 gpt Silver over 1.07 m.

*Scottie Resources News Release, January 21, 2021

QAQC

Sample station locations, descriptions and photographs were recorded using a Samsung Active Pro Tablet and QField software. Rock material was collected in poly bags and stored in a secure location under the supervision of Lithos Geological personnel and then transported to the MSALABS sample preparation facility located in Terrace, BC. Samples were crushed and then pulps were sent to the MSALABS in Vancouver. Four acid digestion and Ultratrace ICP-AES/MS analysis for 48 elements and fire assay for Gold was performed on all samples.

Qualified Person

The scientific and technical information has been reviewed and approved by Mr. Andrew Wilkins, Goldplay's BC Exploration Manager and Qualified Person within the context of Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Goldplay Mining

Goldplay Mining is a Canadian public company listed on TSXV and in US on OTCQB. Goldplay holds large district scale Gold, and copper-Gold projects located in BC's Golden Triangle and southwestern BC with potential for world class mineral discoveries. The Company also holds several brownfield Gold, and copper-Gold projects located in Portugal with near term mining potential.

On behalf of the Board of Directors

"Catalin Kilofliski"

Catalin Kilofliski

President, CEO & Director

For further information please contact:

Goldplay Mining Inc.

Mr. Catalin Kilofliski, President & CEO

Suite 650 - 1021 West Hastings Street

Vancouver, BC V6E 0C3

T: (604) 655-1420

E: catalin@Goldplaymining.ca

www.Goldplaymining.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws relating to the exploration potential of the Scottie West Project, including planned future exploration programs. Generally forward-looking statements can be identified by the use of terminology such as "anticipate", "will", "expect", "may", "continue", "could", "estimate", "forecast", "plan", "potential" and similar expressions. These forward-looking statements involve risks and uncertainties relating to, among other things, results of exploration and development activities, management's discretion to revise proposed exploration programs, uninsured risks, regulatory changes, defects in title, availability of materials and equipment, timeliness of government approvals, changes in commodity prices and unanticipated environmental impacts on operations. Although the Company believes current conditions and expected future developments and other factors that have been considered are appropriate and that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct or enduring. Readers are cautioned to not place undue reliance on forward-looking information. The statements in this press release are made as of the date of this release. Except as required by law, the Company does not undertake any obligation to update publicly or to revise any forward-looking statements that are contained or incorporated in this press release. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

SOURCE: Goldplay Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/676211/Goldplay-Anounces-Encouraging-Results-of-up-to-590gpt-Gold-and-155gpt-Silver-from-the-First-Exploration-Program-Completed-on-the-Scottie-West-Project