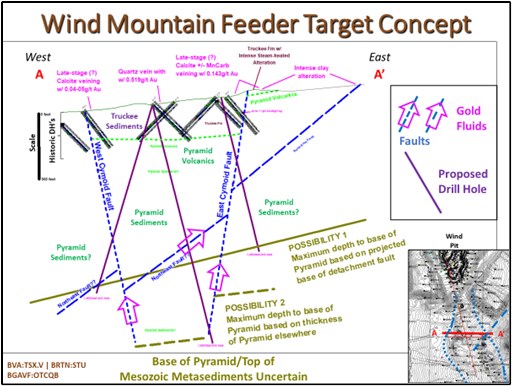

Bravada Gold Corporation (TSXV: BVA) (FSE: BRTN) (OTCQB: BGAVF) (the "Company" or "Bravada") announces that a drill rig is expected to mobilize to the Company's 100% owned Wind Mountain goldsilver project in northwestern Nevada after the US Thanksgiving holiday. Three or four reverse-circulate drill holes are planned to depths ranging from 360m to 580m as the first relatively deep test of the interpreted feeder zone of this large hydrothermal system.

The Feeder target is interpreted as the deeper source area for gold/silver-bearing hydrothermal fluids that resulted in the shallower disseminated gold/silver open-pit deposit previously mined by Amax Gold and the remaining Resources defined by Bravada. Evidence for the target concept is from Amax's shallow condemnation drill holes and Bravada's geological mapping, geochemical sampling, magnetic geophysics, and nearby 2017/18 deep drill holes. Disseminated gold and silver mineralization on the Wind Mountain property is exposed over a strike length of +6km, indicating a robust gold system that spread laterally over a large area within permeable host sediments; however, a high-grade "feeder" zone has not been discovered to date and that is the objective of this campaign.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5343/67940_ae8c4d99f472a88c_001full.jpg

In other project news, assays for diamond drilling completed at Bravada's Highland gold/silver project are still pending as assay labs continue to be backed up due to Covid-19 issues and delayed drilling programs that are now underway, which have overwhelmed assay labs. Assays now are expected in December.

Field work was initiated in late October at the Company's 100% owned SF/HC gold project. Initial work included geologic mapping, rock-chip sampling, and claim staking. SF is a Carlin-type gold property located along the Battle Mountain-Eureka Gold trend, approximately 6 kilometers east of Barrick's Goldrush/Red Hill development-stage gold mine in the prolific Cortez district.

About Wind Mountain

The Wind Mountain Property is in northwestern Nevada approximately 160km northeast of Reno in a sparsely populated region with excellent logistics, including county-maintained road access and a power line to the property. It is an historic past-producing, bulk-tonnage gold-silver mine. An independent resource estimate and Preliminary Economic Evaluation for Wind Mountain commissioned by Bravada in 2012 reported:

- 570,000 ounces of gold and 14.7 million ounces of silver in the Indicated category, and

- 354,000 ounces of gold and 10.1 million ounces of silver in the Inferred category.

See the table below and news release NR-06-12 dated April 11, 2012 for details of the resource update. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be classified as mineral reserves. There is no assurance that any part of the resources will ultimately be converted to mineral reserves.

Mine Development Associates compiled the Technical Report and PEA. Thomas Dyer, P.E. is a Senior Engineer for MDA and is responsible for sections of the Technical Report involving mine designs and the economic evaluation, and Steven Ristorcelli, C.P.G., is a Principal Geologist for MDA and is responsible for the sections involving the Mineral Resource estimate. These are the Qualified Persons of the technical report for the purpose of Canadian NI 43-101, Standards of Disclosure for Economic Analyses of Mineral Projects. Details of the PEA produced by Mine Development Associates (MDA) of Reno can be found on SEDAR, as previously reported (see NR-07-12 dated May 1, 2012). Note that although the PEA was encouraging, it is preliminary in nature, it includes Inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized.

| Tons | oz Au/T | oz Ag/T | Tonnes | gms Au/T | gms Ag/T | oz Au | oz Ag | |

| Indicated resource | ||||||||

| Oxide at 0.005 oz Au/ton cut off | ||||||||

| 58,816,000 | 0.010 | 0.25 | 53,372,051 | 0.343 | 8.6 | 564,600 | 14,539,000 | |

| Mixed/Sulfide at 0.01 oz Au/ton cut off | ||||||||

| 498,000 | 0.012 | 0.40 | 451,906 | 0.411 | 13.7 | 5,900 | 197,000 | |

| Total | 59,314,000 | 53,823,956 | 570,500 | 14,736,000 | ||||

| | ||||||||

| Inferred resource | ||||||||

| Oxide at 0.005 oz Au/ton cut off | ||||||||

| 19,866,000 | 0.006 | 0.17 | 18,027,223 | 0.206 | 5.8 | 125,200 | 3,443,000 | |

| Mixed/Sulfide at 0.01 oz Au/ton cut off | ||||||||

| 14,595,000 | 0.016 | 0.46 | 13,244,102 | 0.549 | 15.8 | 229,100 | 6,672,000 | |

| Total | 34,461,000 | 31,271,325 | 354,300 | 10,115,000 | ||||

About Bravada

Bravada is an exploration company with a portfolio of high-quality properties in Nevada, one of the best mining jurisdictions in the world. Bravada has successfully identified and advanced properties with the potential to host high-margin deposits while successfully attracting partners to fund later stages of project development. Three of Bravada's ten Nevada properties are being funded by partners. Bravada's value is underpinned by a substantial gold and silver resource with a positive PEA at Wind Mountain, and the Company has significant upside potential from possible new discoveries at its exploration properties.

Since 2005, the Company signed 32 earn-in joint-venture agreements for its properties with 19 publicly traded companies, as well as a similar number of property-acquisition agreements with private individuals. Bravada currently has 10 projects in its portfolio, consisting of 764 claims for approximately 6,100 ha in two of Nevada's most prolific gold trends. Most of the projects host encouraging drill intercepts of gold and already have drill targets developed. Several videos are available on the Company's website that describe Bravada's major properties, answering commonly asked investor questions. Simply click on this link https://www.bravadagold.com/en/management-videos.php.

Joseph Anthony Kizis, Jr. (AIPG CPG-11513, Wyoming PG-2576) is the qualified person responsible for reviewing and preparing the technical data presented in this release and has approved its disclosure.

-30-

On behalf of the Board of Directors of Bravada Gold Corporation

"Joseph A. Kizis, Jr."

Joseph A. Kizis, Jr., Director, President, Bravada Gold Corporation

For further information, please visit Bravada Gold Corporation's website at bravadagold.com or contact the Company at 604.684.9384 or 775.746.3780.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. These statements are based on a number of assumptions, including, but not limited to, assumptions regarding general economic conditions, interest rates, commodity markets, regulatory and governmental approvals for the company's projects, and the availability of financing for the company's development projects on reasonable terms. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Bravada Gold Corporation does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/67940