(TheNewswire)

-

- Three holes now outlining a series of productive fault splays at West Fault Complex

- Five holes completed to depth intersected breccia/fault/vein zone with siderite-galena-sphalerite mineralization

- West Fault target remains open along strike in both directions and down dip, only 150 metres of the 1,100 metre-long structure having been tested

Alianza Minerals Ltd. ( TSXV:ANZ ) ( OTC:TARSF ) (" Alianza" or the "Company" ) reports additional results from the 2021 drilling campaign at the Company's wholly-owned Haldane high-grade silver property located in the historic Keno Hill Mining District of Yukon Territory. Drilling has focused on the West Fault Complex target where a strong vein-fault system with high-grade silver mineralization is being defined. Following up on the initial success in hole HLD20-19, HLD21-25 has further extended the West Fault mineralization by 62 metres down dip with an intersection averaging 1,107 gt silver, 6.98% lead and 3.97% zinc (1,485 gt silver-equivalent (2) ) over 1.60 metres (estimated true width of 1.00 metres). This occurs within a wider zone of siderite veining and brecciation, fault gouge with lesser galena and sphalerite which averaged 363.4 gt silver, 1.73% lead and 2.80% zinc (534.2 gt silver-equivalent) over 6.83 metres (estimated true width 4.27 metres) . The 8,579 hectare Haldane Property is located in the western portion of the Keno Hill Silver District, 25 kilometres west of Keno City, YT. Exploration at Haldane is targeting extensions of historical high-grade silver production on the property as well as recently defined targets, such as the West Fault, in new areas of the property

"We continue to expand the West Fault Complex mineralization at Haldane, with our third high-grade silver intersection," stated Jason Weber, P.Geo, President and CEO of Alianza. "We have now extended the known mineralization 62 metres down dip in this hole and in our previously released HLD21-24, we have extended mineralization 75 metres down dip and approximately 50 metres along strike of HLD20-19. The additional holes at West Fault Complex are showing that it is a large structure with excellent potential for additional high grade silver mineralization."

Table 1 – West Fault Target Drill Intercepts

| Hole | From (m) | To (m) | Interval (m) | Est True Width (m) (1) | Silver (g/t) | Gold (g/t) | Lead (%) | Zinc (%) | Silver Eq. (2) (g/t) |

| HLD21-23 | 211.1 | 211.4 | 0.3 (3) | 0.18 | 145 | 0.53 | 0.30 | 19.3 | 925.6 |

| HLD21-24 (4) | 265.86 | 271.1 | 5.24 (3) | 3.14 | 1351 | 0.08 | 2.43 | 2.91 | 1542 |

| Including | 269.0 | 271.1 | 2.10 | 1.26 | 3267 | 0.11 | 5.80 | 7.02 | 3720 |

| HLD21-25 | 293.44 | 300.27 | 6.83 | 4.27 | 363.4 | 0.14 | 1.73 | 2.80 | 534.2 |

| Including | 295.80 | 297.40 | 1.60 | 1.00 | 1107 | 0.16 | 6.98 | 3.97 | 1485 |

-

(1) True width of the vein and breccia mineralization is estimated to be 50-70% of the core length intersection with the exception of HLD21-25 where precise measurements of vein contact angles yields 62.5% of the core length intersection. A value of 60% is used for the purposes of reporting HLD21-23, 24 and 62.5% for HLD21-25.

-

(2) Silver-equivalent values are calculated assuming 100% recovery using the formula: ((20 * silver (g/t) / 31.1035) + (1650 * gold (g/t) / 31.1035) + (0.90 * 2204 * lead %/100) + (1.10 * 2204 * zinc %/100)) *(31.1035 / 20). Metal price assumptions are US$20/oz silver, US$1650/oz gold, US$0.90/lb lead and US$1.10/lb zinc.

-

(3) Core recovery is estimated at 70-75% for HLD21-24 and 25, with the exception of a 0.80 metre section of HLD21-24 where recovery was zero. A value of zero was assigned to silver, gold, lead and zinc for the section of zero core recovery for the purposes of composite interval calculations. Core recovery is estimated at 46% for HLD21-23.

-

(4) Previously released July 12, 2021.

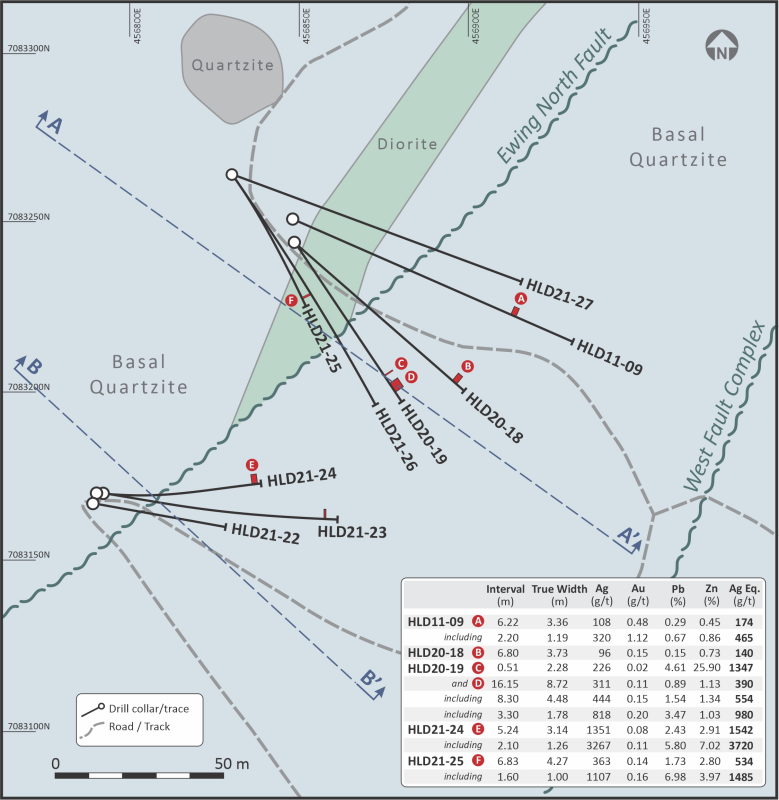

Figure 1. Plan map of West Fault Complex drilling.

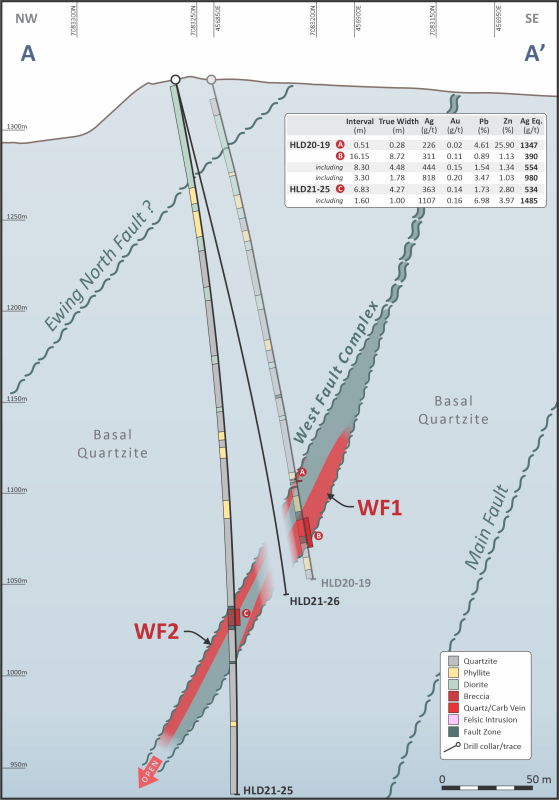

Figure 2. Cross section – West Fault drill holes HLD20-19 and HLD21-25.

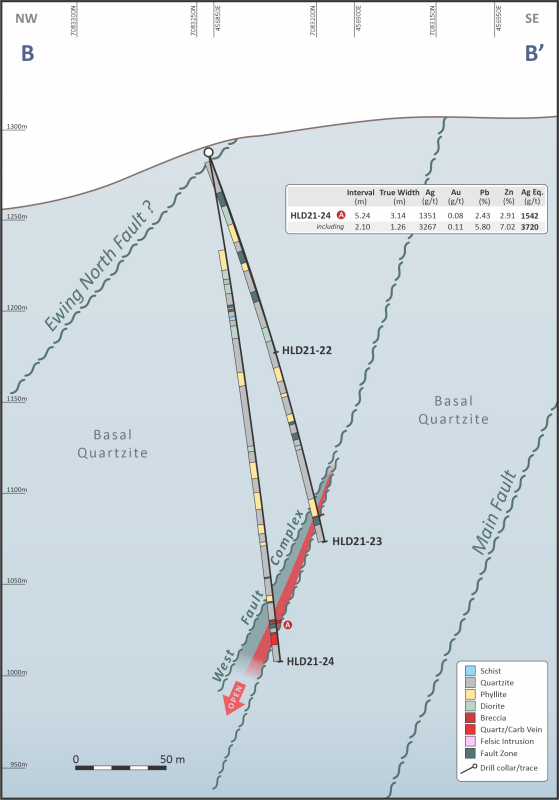

Figure 3. Cross section – West Fault drill holes HLD21-22,-23 and -24.

HLD21-25 intersected the West Fault structure at 291.5 m over a core length of 13.38 m (estimated true width of 8.36 m), averaging 220.5 g/t Ag (325.0 g/t silver-equivalent). Strong siderite/sulphide breccia and veining was intersected at 293.44 m returning a 6.83 m (4.27 m estimated true width) intersection of 363.4 g/t silver (534.2 g/t silver-equivalent). The highest grade interval of 1.6 m (1.00 m estimated true width) of 1,107 g/t silver, 3.97% lead and 3.97% zinc (1,485 g/t silver-equivalent) consisted of very strong siderite-galena-sphalerite with trace tetrahedrite in veins and breccia. Siderite/sulphide veining is bounded on both sides by zones of clay-gouge with elevated silver content. The West Fault intersection in HLD21-25 occurs approximately 25 metres uphole from where the target was modelled to occur and it is now believed that the West Fault is a complex of faults and splays rather than a single discreet fault structure. Narrow structures hosting siderite-galena-sphalerite veins have been intersected above the West Fault mineralization in previous holes (HLD20-19, HLD21-24) and are now thought to represent the upper splay of the West Fault, now referred to as WF2. The WF1 structure, host to the high grade silver mineralization previously released in hole HLD20-19 and HLD21-24, looks to weaken to down dip to the northwest, perhaps stepping over to the WF2 splay in this direction.

HLD21-22 and -23 were drilled to test mineralization 50 metres on strike of HLD20-19 to the southwest. HLD21-22 was lost in a fault at 116.70 metres depth. HLD21-23 successfully intersected the West Fault Vein (WF1); however, recent remobilization of the fault is interpreted to have cut the vein mineralization off, yielding a 30 cm intersection of 145 g/t silver, 0.529 g/t gold, 0.30% lead and 19.3 % Zn (925.6 g/t Ag-equivalent). It appears that some of the intersection may have been lost as the footwall contact consists of rubble and gouge. Samples from the remaining two drill holes targeting the West Fault Complex are in process at the laboratory. It is expected that the next set of results will be released in late September. An updated drill plan and long section with the completed drilling can by found on the Company's website https://www.alianzaminerals.com under the Haldane Project section.

The West Fault Complex is traced for over 650 metres and can be interpreted to extend to 1.1 kilometres in length before merging with the 2.2 kilometre-long Main Zone structure. Drill testing to date covers only a fraction of the West Fault Complex target. The current program systematically tested the structure in approximate 50 metre step-outs along strike and down dip. High grade silver mineralization has now been intersected in three holes that pierce the WF1 and WF2 veins over 90 metres of dip direction and 50 metres of strike direction. The West Fault Complex is one of four high-priority silver-lead-zinc-bearing vein drill targets at Haldane.

Quality Assurance / Quality Control

All samples were analyzed by 33 element four acid digestion ICP-MS methods at ALS Canada Ltd. Sample preparation was completed in Whitehorse, Yukon and geochemical analyses were performed in Vancouver, British Columbia. Samples with over limit silver and gold were re-analyzed using a 30-gram fire assay fusion with a gravimetric finish. Over-limit lead and zinc samples were analyzed by four acid digestion and atomic absorption spectrometry. All results have passed the QA/QC screening by the lab Equity Exploration Consultants Ltd, of Vancouver BC is executing and managing the Haldane Project. Equity utilized a quality control and quality assurance protocol for the drill core sampling, including blank, duplicate, and standard reference samples.

About Alianza Minerals Ltd.

Alianza employs a hybrid business model of joint venture funding and self-funded projects to maximize opportunity for exploration success. The Company currently has gold, silver and base metal projects in Yukon Territory, British Columbia, Colorado, Nevada and Peru. Alianza currently has one project (Tim, Yukon Territory) optioned out to Coeur Mining, Inc. and a copper exploration alliance in the southwestern United States with Cloudbreak Discovery PLC. Alianza is also seeking partners on other projects. .

The Company is listed on the TSX Venture Exchange under the symbol "ANZ" and trades on the OTCQB market in the US under the symbol "TARSF".

Mr. Jason Weber, P.Geo., President and CEO of Alianza Minerals Ltd. is a Qualified Person as defined by National Instrument 43-101. Mr. Weber supervised the preparation of the technical information contained in this release.

For further information, contact:

Jason Weber, President and CEO

Sandrine Lam, Shareholder Communications

Tel: (604) 807-7217

Fax: (888) 889-4874

Renmark Financial Communications Inc.

Scott Logan

slogan@renmarkfinancial.com

Tel: (416) 644-2020 or (212) 812-7680

To learn more visit: www.alianzaminerals.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. STATEMENTS IN THIS NEWS RELEASE, OTHER THAN PURELY HISTORICAL INFORMATION, INCLUDING STATEMENTS RELATING TO THE COMPANY'S FUTURE PLANS AND OBJECTIVES OR EXPECTED RESULTS, MAY INCLUDE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS ARE BASED ON NUMEROUS ASSUMPTIONS AND ARE SUBJECT TO ALL OF THE RISKS AND UNCERTAINTIES INHERENT IN RESOURCE EXPLORATION AND DEVELOPMENT. AS A RESULT, ACTUAL RESULTS MAY VARY MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS.

Copyright (c) 2021 TheNewswire - All rights reserved.