iMetal Resources, Inc. (TSXV:IMR)(OTC PINK:ADTFF)(FRANKFURT:A7V2) ("iMetal" or the "Company") is pleased to announce results from the 2021 trenching program at its Gowganda West property in the Shining Tree District of the Abitibi Greenstone Gold Belt in Northern Ontario. The Company excavated a total of 5 trenches following up on spring 2021 prospecting results. Three of these trenches were located at Zone 1 near the area of 2019 drilling. Highlights from Trench 1 include

- 3.29 g/t gold over 1.8m

- 10.85 g/t gold over 0.35m

- 2.93 g/t gold over 2m

- 1.61 g/t gold over 1m

"The mechanical trenching met our key objective, locating +1 g/t gold in two of the five trenches," commented iMetal President & CEO Saf Dhillon. "We are working with the Riverside technical team, in finalizing the compilation of the trenching data, surface sampling results, magnetics and IP geophysics to work up drill targets," he concluded.

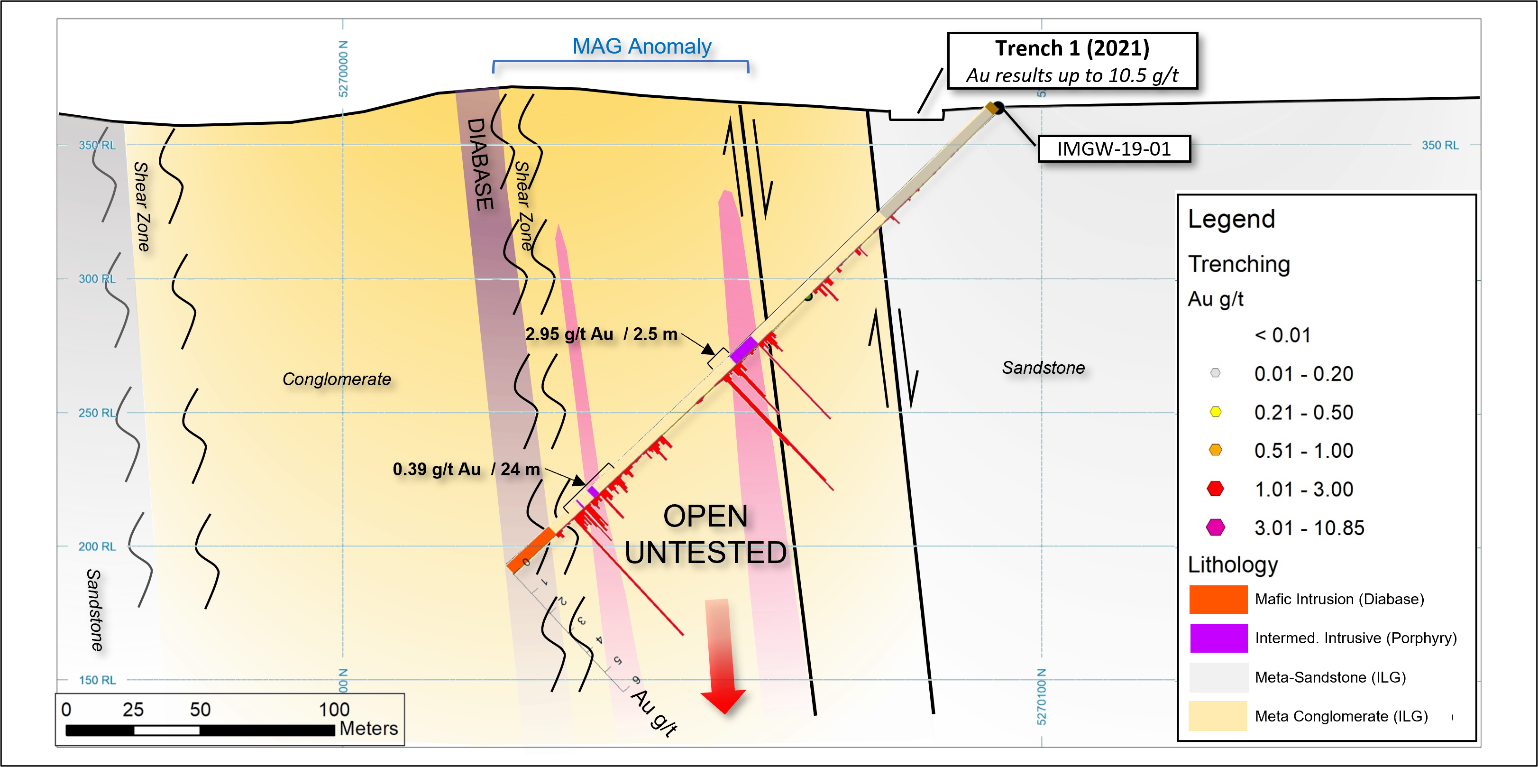

Zone 1 Section

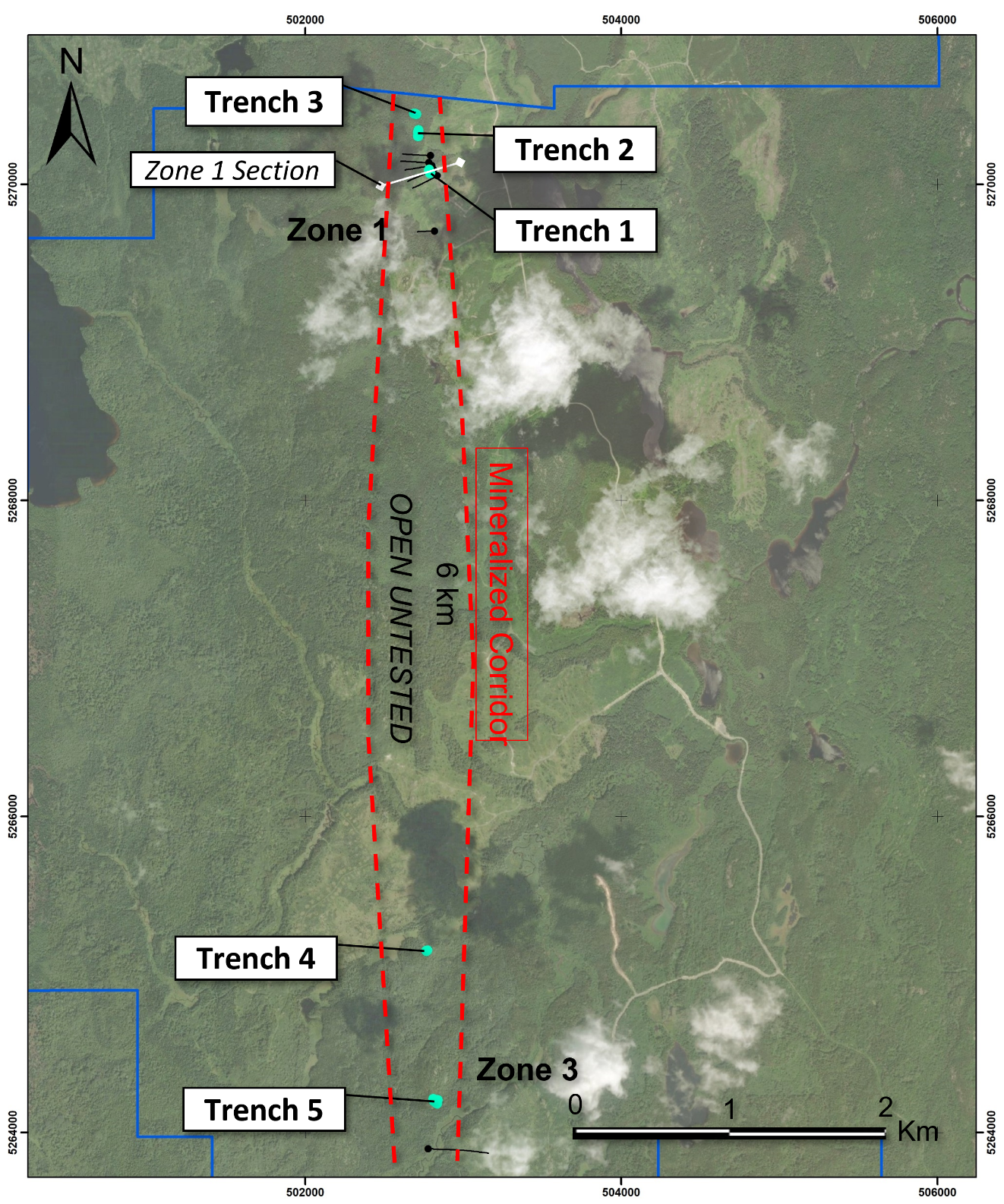

Exploration to date has defined a 6km long, north-south trending zone of anomalous gold mineralization and alteration associated with the contact zone between finer and coarser meta-clastic units of the Archean aged Indian Lake Group (ILG), mudstone, arenite and conglomerate that have been intruded by felsic and quartz porphyry dikes. Early Proterozoic narrow Matachewan diabase dikes with finely disseminated magnetite exhibiting a moderate to strong magnetic signature cut the meta-sedimentary lithological sequence locally.

2021 Trench Locations

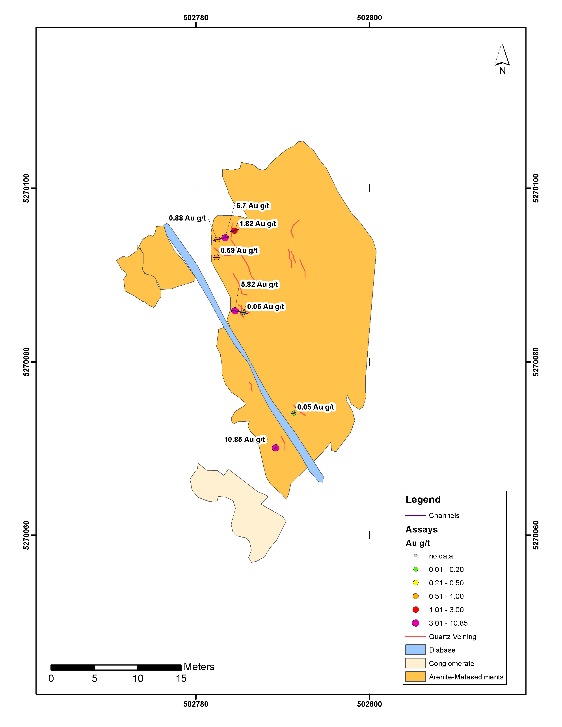

At Trench 1 in Zone 1, gold mineralization lies at or near the contact between ILG conglomerates and sandstones that have been subject to regional faulting and shearing. The mineralization largely consists of pyrite associated with beige or fuchsite-bearing green quartz carbonate veins. These north-south striking veins show carbonate (ankerite) and sericitic alteration extending tens of meters outward from the veins. Peripheral to these alteration zones, distal weaker alteration consists predominantly of calcite stringers and veinlets, locally pervasive to patchy interstitial calcite and local minor epidote patches and occasional stringers. Drill logs show the mineralized zones are also associated with intrusive rocks and silica flooding. This pyrite-gold bearing mineralizing system is characterized by extensive hydrothermal alteration believed to be caused by quartz feldspar porphyry dikes linked to a deeper larger intrusion.

The pyritized conglomerate shows up strongly as a large linear conductive body in the 2018 IP survey over this area. At Zone 1, closer to the shear zones, a 50m wide diabase dike intrudes the conglomerate. This dike shows as a strong north-south trending, linear magnetic high. Inversion work completed by iMetal prior to the trenching indicated the diabase dike marks the western boundary of the gold mineralization suggesting the mineralizing fluids moved along the shear zone prior to the dike intruding into the conglomerate.

At Trench 1 (TR-21-01) the mineralization and alteration sequence are repeated with the dike marking the western extend of mineralization providing a hard boundary for exploration. Gold in Trench 1 is also associated with silica flooding and pyritization. XRF work performed in the field showed higher gold values to be associated with high potassium and iron with a possible path finder being arsenic. However, assays from the trench sampling indicate copper to be the best path finder in this area which agrees with other projects in the district. Due to the nature of the terrain saw cut channel samples where limited to about 3m on the uneven surface. The best interval from this first phase of trenching returned 3.29g/t gold over 1.8m with one sample returning 10.85g/t gold over 0.35m.

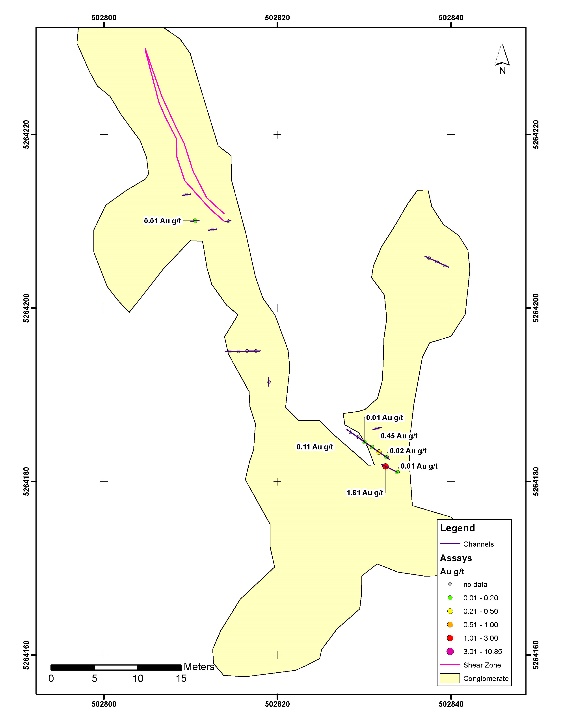

Zone 3 Trenching | Zone 1 Trenching |

|  |

The trenching results at Zone 3 were not as high as the prospecting samples from the spring program where values as high as 56 g/t gold were found in outcrop. The steep terrain in the area of the spring sampling was not conducive to mechanical trenching; more work is required in this area before a drill target can be established.

The Company's technical team is now reviewing all historic exploration data in combination with the new trenching data to develop a model for the Gowganda mineralization. The model will assist in identifying drill targets for the upcoming drill program.

The current interpretation for mineralization is the permeable nature of the ILG meta-sedimentary rocks provide a favorable environment for gold bearing hydrothermal systems and fluids to penetrate and precipitate. The porous nature of the conglomerate manifests as larger lower grade zones of gold mineralization. The 2019 drilling showed geochemically anomalous to low grade gold mineralization throughout the Zone 1 (South) Area. DDH IMGW-19-01 returned weighted averages with 0.29 g/t Au over 9.0 m at 175.0-184.0 m and 0.37 g/t Au over 29.4 m at 191.0-220.4 m. Some higher-grade intercepts from Zone 1 included 2.95 g/t Au over 2.5m (IMGW-19-01), 1.55 g/t Au over 0.9m (IMGW-19-03), 1.43 g/t Au over 4.6m (IMGW-19-05) and 1.07 g/t Au over 6.65m (IMGW-19-04); see press release dated April 20, 2020.

Quality Assurance and Quality Control

All trench samples were delivered by the geological contractor to ALS Minerals in Thunder Bay, an ISO/IEC 17025:2017 accredited facility. All samples were analyzed with ALS's AuME-TL43 procedure, a 25-gram aqua regia digestion with an ICP-MS finish with a 1-gram upper limit for gold. All overlimit gold values were fire assayed with a 30-gram sample and a gravimetric finish, ALS's Au-GRA21 procedure. iMetal completed a quality control program with about 10% of the samples assayed being control samples. Standards and blanks were inserted within the assay stream for each trench about every 15 to 20 samples. The scientific and technical information contained in this news release has been reviewed and approved by R. Tim Henneberry, P.Geo. (British Columbia), a director of iMetal, and a "qualified person" as defined in National Instrument 43-101.

About Gowganda West

The Gowganda West property covers approximately 147 sq km in the Shining Tree volcano-sedimentary succession of the southwestern Abitibi Greenstone Gold Belt contiguous to the north and west of Aris Gold Corp.'s (ARIS) (formerly Caldas Gold Corp.) Juby Gold deposit, a series of four mineralized alteration zones along the Tyrrell Shear Zone. Gold mineralization at Juby is associated with narrow quartz-carbonate-pyrite veins hosted within 20- to 330-metre-wide zones of ankerite-albite-silica-sericite alteration and variable amounts of fine-grained, disseminated. The Juby Deposits host indicated resources of 774,000 ounces at 1.13 g/t Au and inferred resources of 1,488,000 ounces at 0.98 g/t Au. iMetal cautions investors mineralization at Juby is not necessarily indicative of similar mineralization at Gowganda West. Source: Technical Report on the Updated Mineral Resource Estimate for the Juby Gold Deposit for Caldas Gold Corp. (named currently changed to Aris Gold Corp.) Dated 2020-Oct-05 By: J. Campbell, A. Sexton, D. Studd, and A. Armitage.

iMetal acquired Gowganda West in 2016, discovering Zone 1 and Zone 3 through focused exploration proximal to the Aris property border, and subsequently completing programs of prospecting, channel sampling, airborne VTEM, ground IP and limited diamond drilling. Zone 1 has excellent access and is located 500m south from the Juby deposit. Two distinct outcrop areas approximately 300m apart have been sampled, Zone 1 that returned: 6.47 g/t Au and 39.3 g/t Au, and 16.9 g/t Au. Five holes were subsequently drilled in 2019. The best drill intersections included: 2.95 g/t Au over 2.5 metres, 1.43 g/t Au over 4.6 metres and longer intervals of 0.37 g/t au over 29.4 metres and 0.32 g/t au over 30.25 metres (see press release dated, April 20, 2020). Zone 3 consists of two distinct areas separated by 225 metres, 6 kilometres due south of Zone 1. Highlights from Zone 3A grab sample results include 56.59 g/t Au and 34.81 g/t Au, while highlight Zone 3B grab sample results include 14.74 g/t Au and 12.7 g/t Au. Zone 3A and Zone 3B remain undrilled.

About iMetal Resources Inc.

A Canadian based junior exploration company focused on the exploration and development of its portfolio of resource properties in Ontario and Quebec. iMetal is focused on advancing its Gowganda West Project that borders the Juby Project, an advanced exploration-stage gold project located within the Shining Tree area in the southern part of the Abitibi greenstone belt about 100 km south-southeast of the Timmins gold camp.

The Company is also focused on the Oakes Gold Project which forms part of a portfolio of projects it is in the process of acquiring from Riverside Resources Inc. (TSXV: RRI) who is now a strategic investor/partner. The Oakes Gold Project is located in the Oakes Township just north of Canadian National Highway 11 and about 2km north of the town of Long Lac, Ontario. The Oakes Township is part of the well-endowed Beardmore-Geraldton Greenstone Belt region, located northeast of Thunder Bay, Ontario and the region has a long and rich mining history that has produced 4.1 million ounces of gold over the past 100 years including the combined MacLeod-Cockshutt Mine, which produced 1.5 million ounces of gold. More recently, the Hardrock Project held 50% by Equinox Gold Corp. (EQX) has elevated attention to the area by announcing their intention to mine their gold resource near Geraldton, Ontario.

ON BEHALF OF THE BOARD OF DIRECTORS,

Saf Dhillon

President & CEO

iMetal Resources Inc.

saf@imetalresources.ca

Tel. (604-484-3031)

Suite 510, 580 Hornby Street, Vancouver, British Columbia, V6C 3B6.

https://imetalresources.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Forward-looking statements in this news release include but, are not limited to: statements with respect to future exploration and drilling of the Company; statements with respect to the release of assays and exploration results; and statements with respect to the Company's geological understanding of its mineral properties. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include results of exploration, variations in results of mineralization, relationships with local communities, market prices, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

SOURCE: iMetal Resources, Inc.

View source version on accesswire.com:

https://www.accesswire.com/670695/iMetal-Resources-Trenches-1085-gt-gold-over-035m-at-Gowganda-West-Project-Ontario-Canada