- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

April 21, 2022

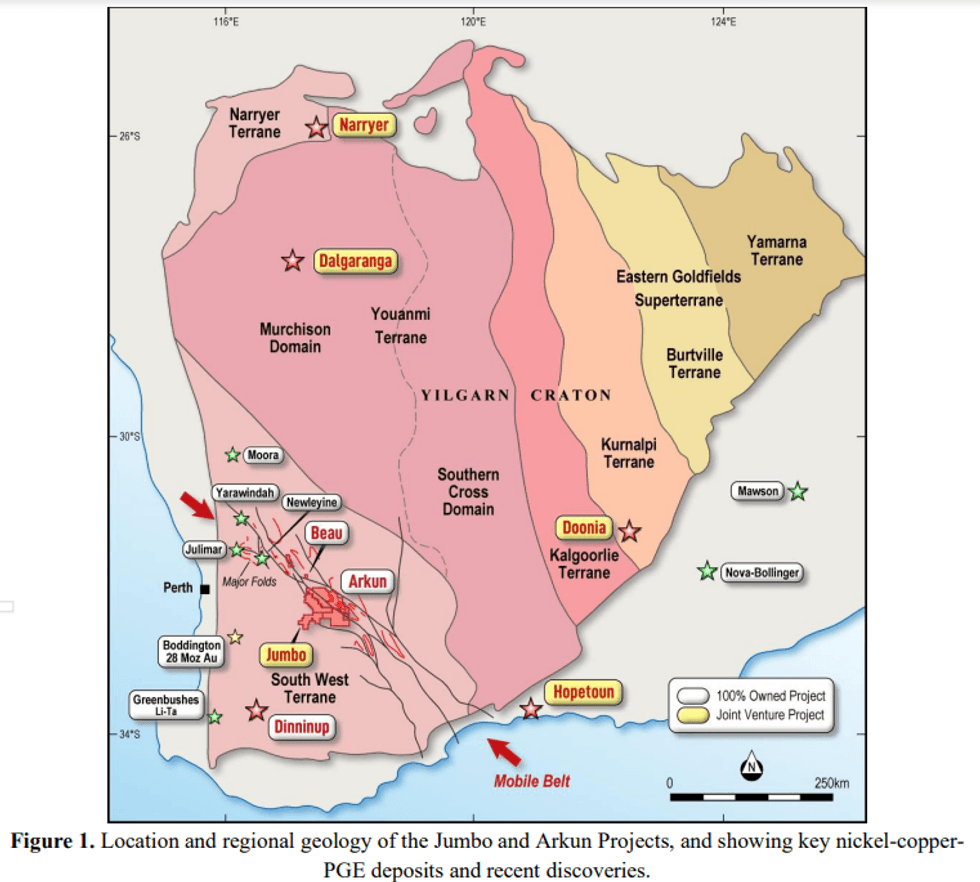

Impact Minerals Limited (ASX:IPT) is pleased to announce that it has acquired a new project prospective for a range of battery and strategic metals located 60 km east of the world-class Greenbushes lithium- tantalum mine (owned by Talison-Lithium Pty Ltd) in the emerging mineral province of south west Western Australia (Figure 1).

- The Dinninup project covers 485 sq km, is located 60 km east of the world-class Greenbushes lithium-tantalum mine and has had no previous exploration except for bauxite.

- Project acquired for $20,000 cash and 3 million options exercisable at 2.4 cents.

- High-priority targets for nickel-copper-Platinum Group Elements (PGM) (3), lithium- caesium-tantalum (LCT) pegmatites (2) and Rare Earth Elements (REE) (4) have been identified in a first-pass soil geochemistry survey that tested geophysical targets.

- Soil anomalies for all metal groups occur over significant areas of at least several hundred metres along the limited soil geochemistry traverse. Further anomalies are expected with more comprehensive coverage of the project area.

- Very high success rate of anomaly identification validates Impact’s targeting methodology.

- Dinninup, together with the flagship Arkun and Jumbo projects, forms the core of Impact’s battery and strategic metals portfolio in WA and the combined projects cover 2,720 sq km of the emerging mineral province of SW Western Australia.

- Follow-up work including field checking and rock chip sampling will commence this Quarter in concert with on-ground work at Arkun, where Land Access Negotiations are ongoing.

- First drill hole at the Silverstar copper-gold-silver prospect at the Hopetoun project intersects a 25 metre thick shear zone with high temperature alteration minerals and minor disseminate sulphides in places together with a 30 cm wide spodumene-bearing pegmatite.

- An extra hole to test the structure up dip will be commenced late next week.

Impact Minerals’ Managing Director Dr Mike Jones said “The Dinninup Project adds further significant value to our early project portfolio in south west Western Australia. Once again, our initial soil geochemistry results indicate untapped potential for a range of battery and strategic metals in this part of the state in an area where there has only been previous exploration for bauxite. The strong lithium anomalies are particularly exciting given our proximity to the world-class Greenbushes mine just 60 kilometres to the east and with similar geology. Together with our flagship Arkun-Jumbo project Impact has identified a significant number of areas for follow up work in the region and we are continuing to negotiate land access agreements to gain access to the priority targets.

“We are also encouraged by our initial drill hole at the Silverstar prospect at the Hopetoun joint venture project. The 25 metre thick shear zone contains significant high-temperature alteration minerals with minor sulphide and, although we were not looking for it, a narrow zone of quartz-tourmaline pegmatite with spodumene crystals. Following our recent announcement of spodumene-bearing veins at the Kalahari prospect the discovery of spodumene at Silverstar several kilometrs away attests to the prevalence of lithium in this area. A second hole will commence in about a week to test the structure closer to surface. In the meantime the core will be logged, cut and sent for assay with results expected in early June. It is a very busy time for Impact” Dr Jones said.

Click here for the full ASX Release

This article includes content from Impact Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

9h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

10h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

10h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

11h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

11h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

09 February

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00