October 28, 2024

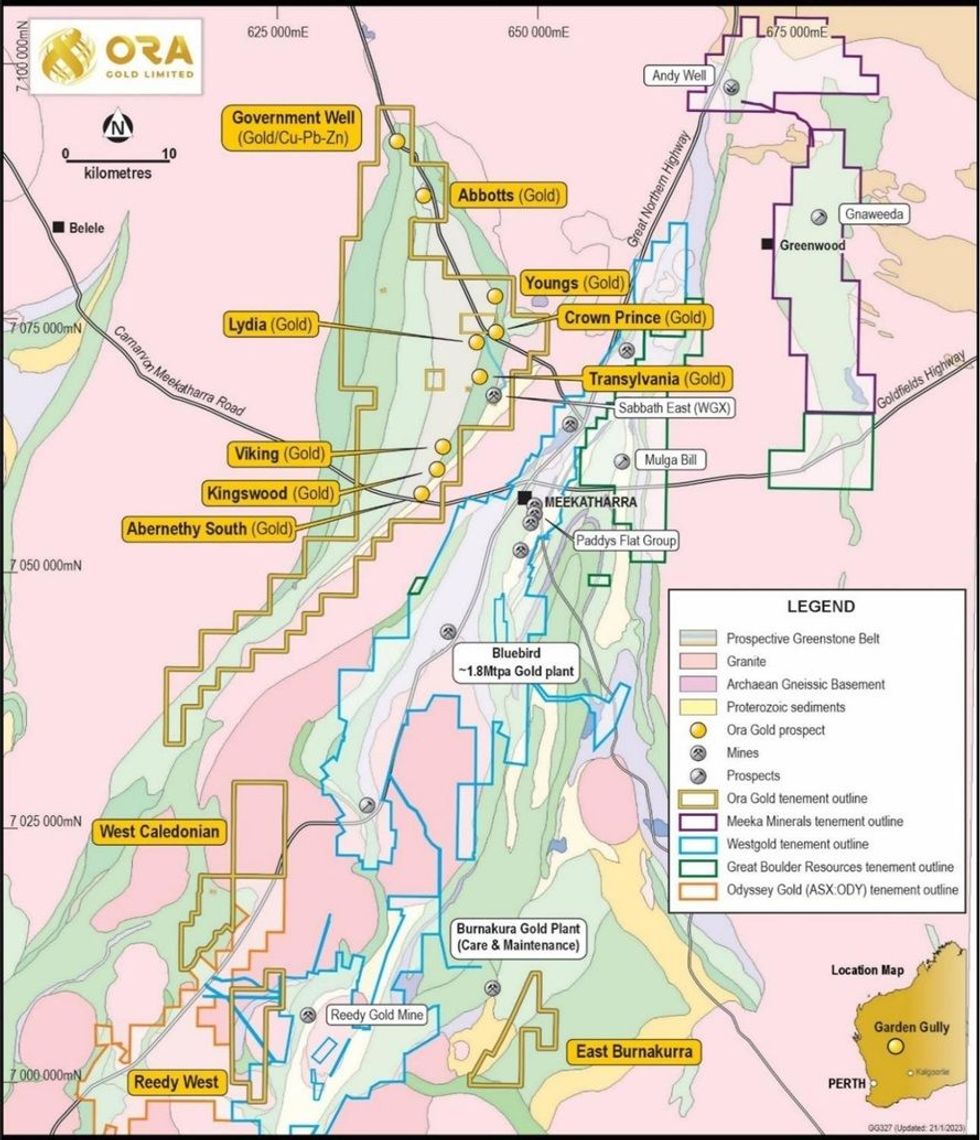

Ora Gold Limited (ASX: OAU, “Ora” or the “Company”) is pleased to report assay results from infill RC drilling at the Crown Prince Project (M51/886) part of Ora’s broader Garden Gully tenure (Figure 1).

Highlights

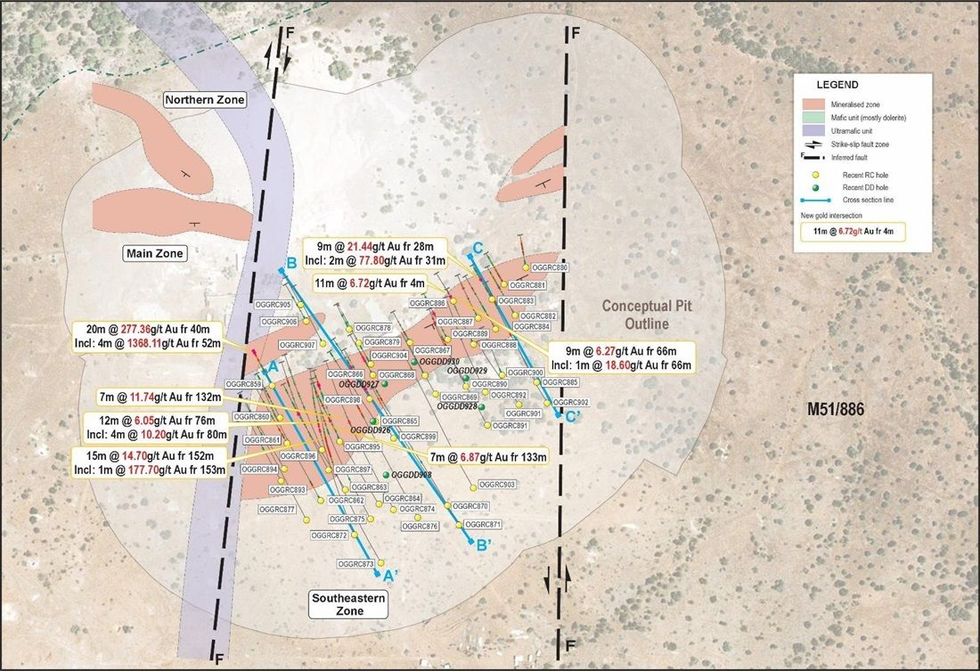

- Ora has received assays for a 7,500m, 66-hole infill RC drilling program at Crown Prince. This drilling was undertaken to better define mineralised lodes within the south eastern zone (SEZ) deposit to upgrade resource categories within a future conceptual open pit area.

- This drilling has returned some exceptional grades and intercepts including:

- 20m at 277g/t Au from 40m including 4m at 1,368g/t Au from 52m (OGGRC859)

- 15m at 14.7g/t Au from 152m (OGGRC872)

- 9m at 21.44g/t Au from 28m including 2m at 77.8g/t Au from 31m (OGGRC883)

- 7m at 11.74g/t Au from 132m (OGGRC874)

- 11m at 6.72g/t Au from 4m (OGGRC886)

- 12m at 6.05g/t Au from 76m including 4m at 10.2g/t Au from 80m (OGGRC895)

- 9m at 6.27g/ t Au from 66m including 1m at 18.6g/t Au from 66m (OGGRC888)

- 7m at 6.87g/ t Au from 133m (OGGRC864)

- New very high-grade zones have been encountered in the footwall of SEZ lodes which will likely improve grade and tonnage estimates in this area.

- This infill drilling has generally confirmed gold mineralisation modelling and has upgraded the quality in many areas.

Ora is continuing to progress Crown Prince towards development, targeting production commencement mid calendar year 2025. Among the several workstreams underway, including regulatory approvals, the Company has completed infill drilling ahead of releasing an ore reserve.

The program was designed to target zones of mineralisation within a conceptual pit design at Crown Prince that are currently in the inferred category of mineral resource (refer ASX release 20 February 2024). This drilling successfully confirmed mineralised zones and improved gold grades in some key areas.

Other improvements from this infill drilling include delineation of new near surface high grade zones and parallel lodes in new positions in the footwall and hanging wall of the south eastern zone (SEZ) mineralisation.

These zones are within the conceptual open pit for the Crown Prince deposit and are expected to add to the mineral resource and future mining inventory. Importantly, the grades returned in this infill drilling support existing published grades and may provide a foundation for an uplift in the average grade overall for the resource.

Assay results discussed in this announcement are shown in Appendix 1 & Figures 2-5. RC hole details are included in Table 1.

Alex Passmore Ora Gold’s CEO commented:

“We are very pleased to report these exceptionally high-grade results returned from recent infill drilling. The infill drilling was carried out successfully and has confirmed or improved the mineralisation model we have for Crown Prince.

Such high-grade headline results demonstrate the high quality nature of the Crown Prince Project and point to its likely strong economics during development and production.

We look forward to providing further information on the updated resource estimate in coming weeks and then to follow up with an ore reserve as work progresses.”

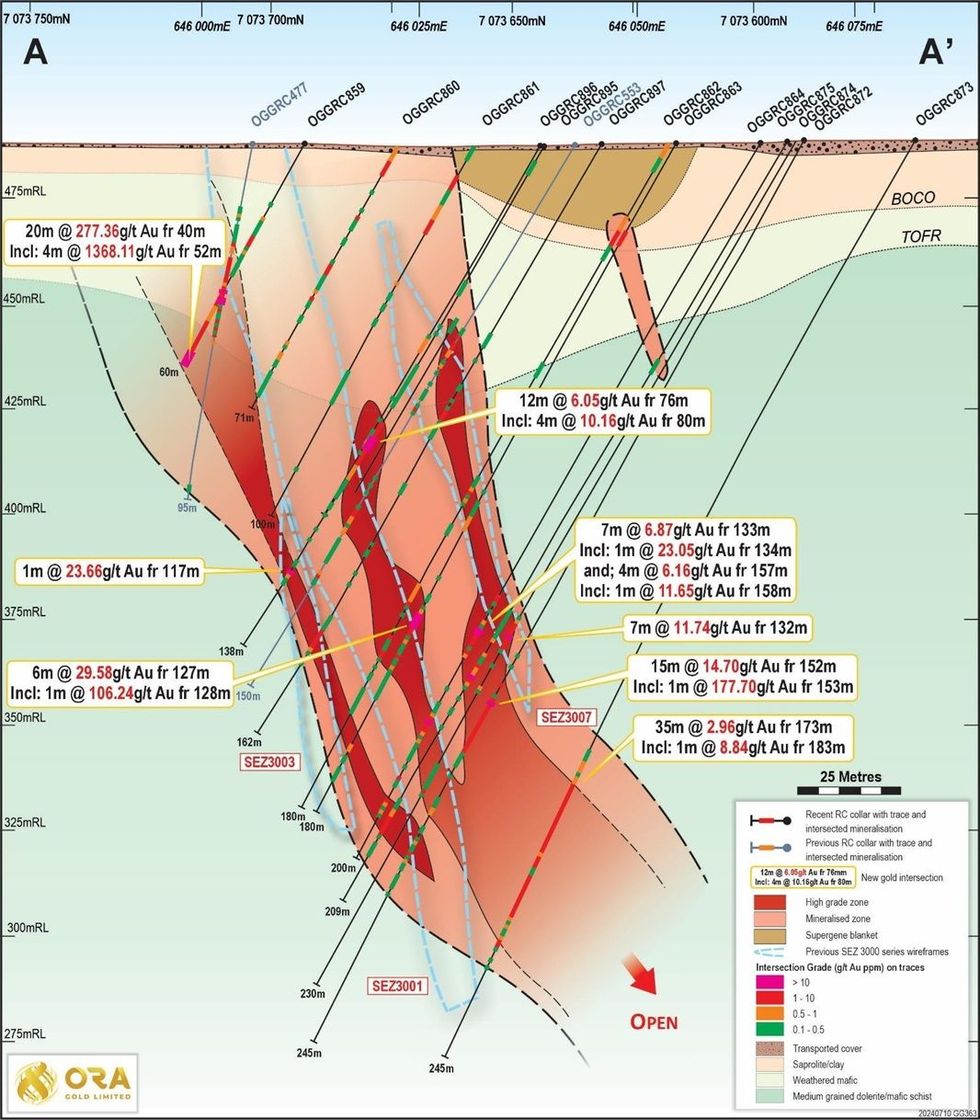

Cross Section A-A’

Infill drilling at SEZ has confirmed new FW and HW lodes outside the current mineralisation wireframes, with outstanding high-grade intercepts Including: 20m @ 277.36g/t Au from 40m (incl: 4m @1368.11 g/t Au from 52m) in OGGRC859 and 35m @ 2.96 g/t Au from 173m In OGGRC873.

Extensions to the current mineralisation model along section A-A have been confirmed by intercepts in OGGRC862, 875 and 872 which include 7m @ 6.87 g/t Au from 133m in OGGRC864 and 15m @ 14.7 g/t Au from 152m (incl: 1m @ 177 Au from 153m).

New high-grade intercepts in OGGRC859, along with previous intercepts in OGGRC477 have highlighted additional mineralised zones close to surface in the footwall, which fall outside existing mineralisation wireframes.

OGGRC873 has strengthened the current interpretation that the high-grade shoots at the southwestern end remain wide and continuous at depth.

The SEZ host geology consists of a series of coarse-grained amphibole dolerites and minor high Mg basalts which grade into an intensely sheared unit proximal to mineralisation. Gold is associated with classic, extensional mesothermal style quartz lodes with characteristic Fe carbonate +/- fuchsite alteration, with high grade zones occurring with sulphide laminations and microstructures that crosscut the early-stage white buck veins.

Recent infill drilling has confirmed that the mineralisation system remains high grade down dip, highlighting potential for future underground mining.

Click here for the full ASX Release

This article includes content from Ora Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

OAU:AU

The Conversation (0)

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00