August 06, 2024

Neptune GBX, a trusted partner for wealth management solutions, is a full-service precious metals dealer, and exchange operator in Wilmington, Delaware. Founded in 2002, the company has been building its reputation in the precious metals industry consistently expanding its services and expertise to meet the evolving needs of its diverse clientele. Neptune GBX focuses on first-class cost-efficient solutions, establishing itself as a knowledgeable and reliable partner in this specialized market.

Neptune GBX's combination of expertise, innovative products, and client-centric approach positions it as a distinctive and valuable partner in the precious metals investment sector.

$100,000 investment with 10% ROI compounded

$100,000 investment with 10% ROI compoundedNeptune GBX's value proposition centers on empowering clients through education and insightful market analysis. The company places a strong emphasis on client education. By providing clients with essential knowledge and tools, Neptune GBX enables them to navigate the precious metals investment landscape with confidence.

Company Highlights

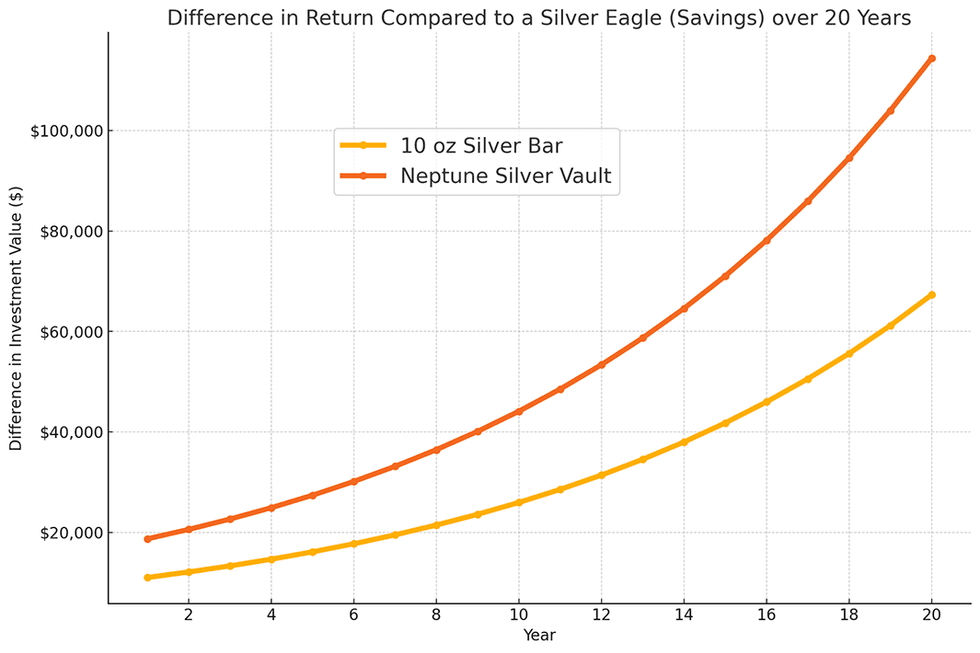

- Neptune Vault offers significantly lower premiums—up to 25 percent less than competitors. This reduction in premium costs translates to potential gains of more than twice over the long run. Minimizing spreads is crucial, and Neptune Vault excels in providing cost-effective options for investors.

- Neptune-GBX has teamed up with Franklin Templeton’s Fiduciary Trust International to provide precious metals investors with institutional-quality custodian, cash management and reporting services. This means products and services are tailored for various client types, from individual investors to wealth management professionals.

- Neptune Vault accounts offer storage fees as low as 0.30 percent per annum, ensuring substantial savings over time. For comparison, the PSLV Silver Fund has a management expense ratio of 0.60 percent. With Neptune Vault at 0.40 percent, investors gain an extra 1 percent every 5 years, totaling a 5 percent gain over 25 years.

- Neptune Vault accounts provide instant liquidity with better spreads than coins and small bars. With live pricing available five days a week, there is no need for shipping or assaying. A simple phone call or email can liquidate your investment promptly, ensuring access to funds in times of urgent need.

- Every ounce in a Neptune Vault account is directly allocated to the client's name, ensuring no over-allocation. The vault provides an asset custody letter to affirm true ownership, giving you peace of mind that you own the metal outright.

- Neptune Vault makes redemptions straightforward and quick. With just a phone call or email, your bullion can be transferred, shipped, or converted within days. The segregated and allocated nature of the product ensures that it is always ready for you, providing essential quick access to your physical investment.

- The PMC Ounce® offers diversified exposure to multiple precious metals.

This Neptune GBX profile is part of a paid investor education campaign.*

Click here to connect with Neptune GBX to receive an Investor Presentation

Sign up to get your FREE

Flow Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 February

Flow Metals

Advancing gold and copper projects in the Yukon and BC, Canada

Advancing gold and copper projects in the Yukon and BC, Canada Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Flow Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00