November 15, 2021

Nano One Materials Corp. (Nano One) (TSX:NANO,FWB:LBMB,OTC: Nasdaq Int'l Designation:NNOMF) aims to establish its technology as the leading platform for the global production of green battery materials through licensing and joint venture agreements. The company is led by a highly experienced management team with decades of experience in financing, capital growth, technology management metals and mining and the sciences.

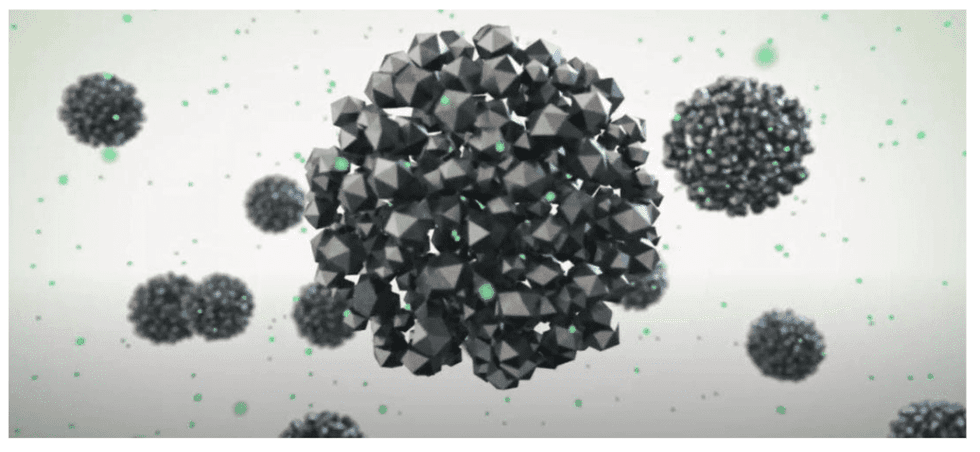

Nano One's patented "One-Pot Process" is a proven, efficient and scalable manufacturing technology for producing cathode materials used in advanced lithium-ion batteries. The One-Pot Process streamlines the production process which significantly reduces costs and increases battery performance and durability compared to the standard manufacturing process.

Nano One's Company Highlights

- Nano One's patented One-Pot Process is a proven, efficient and scalable manufacturing technology for producing cathode materials used in advanced lithium-ion batteries.

- Nano One's M2CAM (Metal direct to Cathode Active Material) technology addresses fundamental performance needs and supply chain constraints while reducing costs and carbon footprint. Enabling a cleaner more sustainable supply chain.

- The company has over 20+ strategic partnerships and collaborations with multiple global leaders to advance its cathode technology for e-mobility and energy storage system applications, including:

- Saint-Gobain S.A. (EPA:SGO)

- Volkswagen AG (ETR:VOW3)

- Companhia Brasileira de Metalurgia e Mineração (CBMM)

- Johnson Matthey PLC (LON:JMAT)

- Euro Manganese Inc. (TSX-V:EMN)

- An Asian cathode material producer

- An American automobile manufacturer

- The company is led by a highly experienced management team with expertise in financing, capital growth, technology management, intellectual and the sciences.

NANO:CA

The Conversation (0)

04 February

Charbone Announces its First Hydrogen Supply Hub in the Ontario Market

(TheNewswire) Brossard, Quebec, February 4, 2026 TheNewswire Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

04 February

Charbone annonce l'etablissement de son premier pole d'approvisionnement en hydrogene sur le marche Ontarien

(TheNewswire) Brossard, Quebec, le 4 février 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

02 February

10 Biggest EV Stocks to Watch in 2026

The energy revolution is here to stay, and electric vehicles (EVs) have become part of the mainstream narrative. The shift toward green energy is gathering momentum, with governments adding more incentives to accelerate this transition. Increasing EV sales are good news for battery metals... Keep Reading...

01 February

MOU with Yinson and Himile to Advance LCO2 Tank Production

Provaris Energy (PV1:AU) has announced MOU with Yinson and Himile to Advance LCO2 Tank ProductionDownload the PDF here. Keep Reading...

22 January

RZOLV Technologies Signs Operating Agreement with Environmental Research and Development to Advance Agitated Tank Leach Demonstration Facility in Arizona

RZOLV Technologies Inc. (TSXV: RZL) (FSE: S711), ("RZOLV" or the "Company"), a clean-technology company developing non-cyanide hydrometallurgical solutions for gold recovery, today announced that it has entered into an operating agreement with Environmental Research and Development ("ERD") to... Keep Reading...

22 January

RZOLV Technologies Signs Operating Agreement with Environmental Research and Development to Advance Agitated Tank Leach Demonstration Facility in Arizona

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711), ("RZOLV" or the "Company"), a clean-technology company developing non-cyanide hydrometallurgical solutions for gold recovery, today announced that it has entered into an operating agreement with Environmental Research and Development... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00