February 07, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) advises that it has identified multiple very large uranium targets within the Company’s 100%-owned Bangemall Projects, in the Gascoyne region of Western Australia.

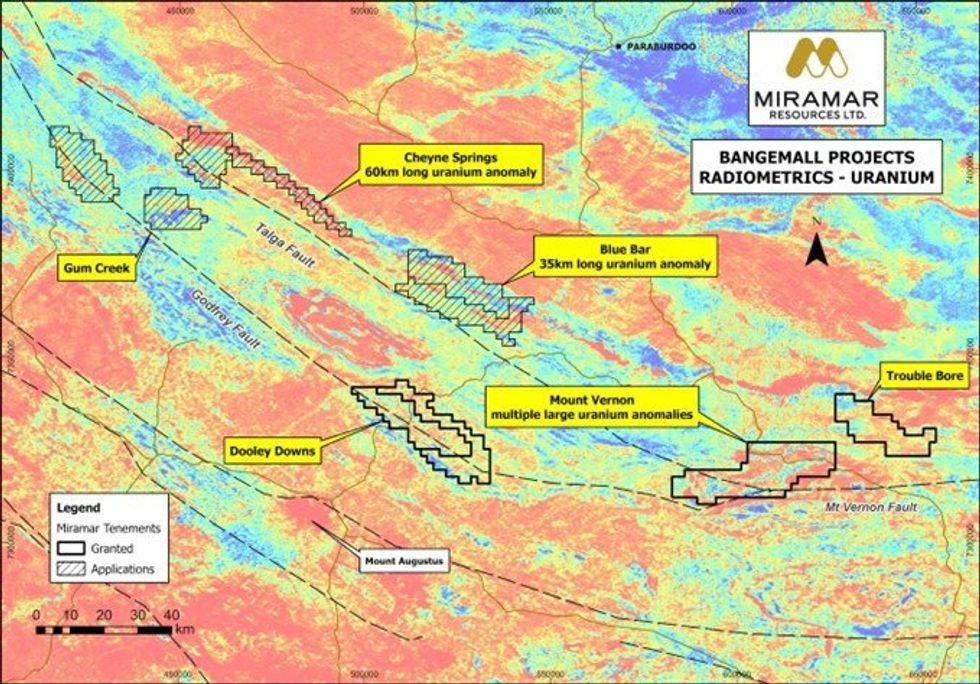

Regional radiometric data shows multiple very large and high-amplitude uranium anomalies that stretch over at least 100km of strike and across several of Miramar’s tenements (Figure 1).

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company’s strategic Bangemall landholding has potential for multiple commodities and deposit types.

“Proterozoic orogens throughout Australia and worldwide host many large base and precious metal deposits, and we believe the Capricorn Orogen should be no exception,” Mr Kelly said.

“Whilst our current focus is on exploring for Norilsk-style nickel, copper and platinum group elements at our Mount Vernon and Trouble Bore Projects, we have a very long list of attractive exploration targets we aim to systematically explore,” he added.

Cheyne Springs Target

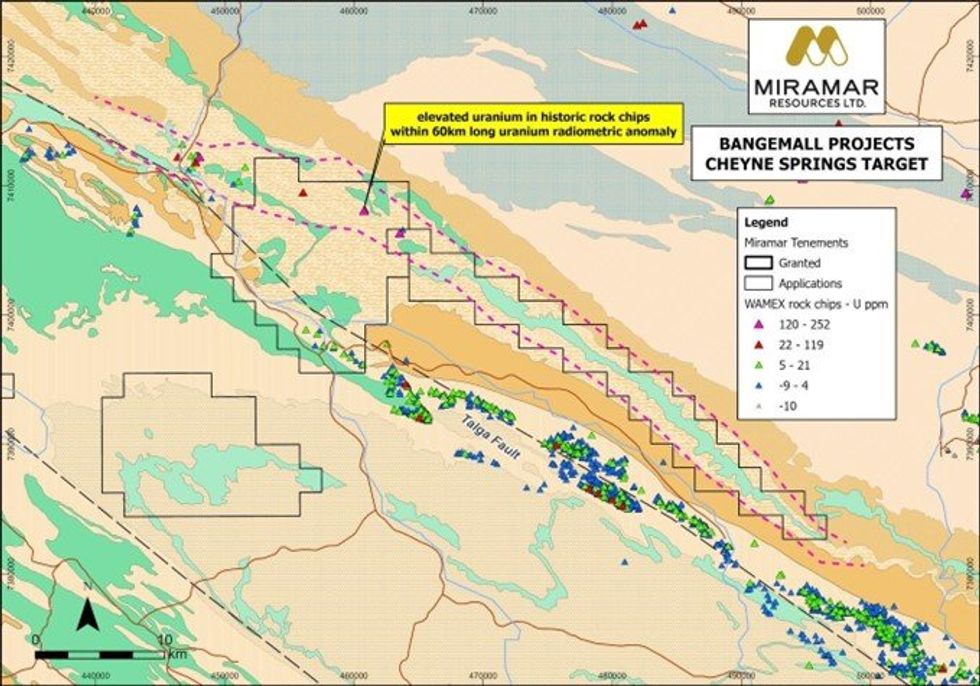

A well-defined, 60-kilometre-long uranium anomaly is located within the Cheyne Springs Target towards the northern edge of the Edmund Basin, at the contact with the older Ashburton Basin rocks (Figure 2).

The very large radiometric anomaly has been virtually unexplored except for a few wide-spaced rock chip samples that returned results up to 246ppm U (i.e. 290ppm U3O8) (WAMEX Reports a78053, a81036, a91967 and a92435) (Figure 3).

The Company is working towards grant of the tenement applications at Cheyne Springs, and the adjacent Blue Bar Target.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

21h

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00