March 05, 2024

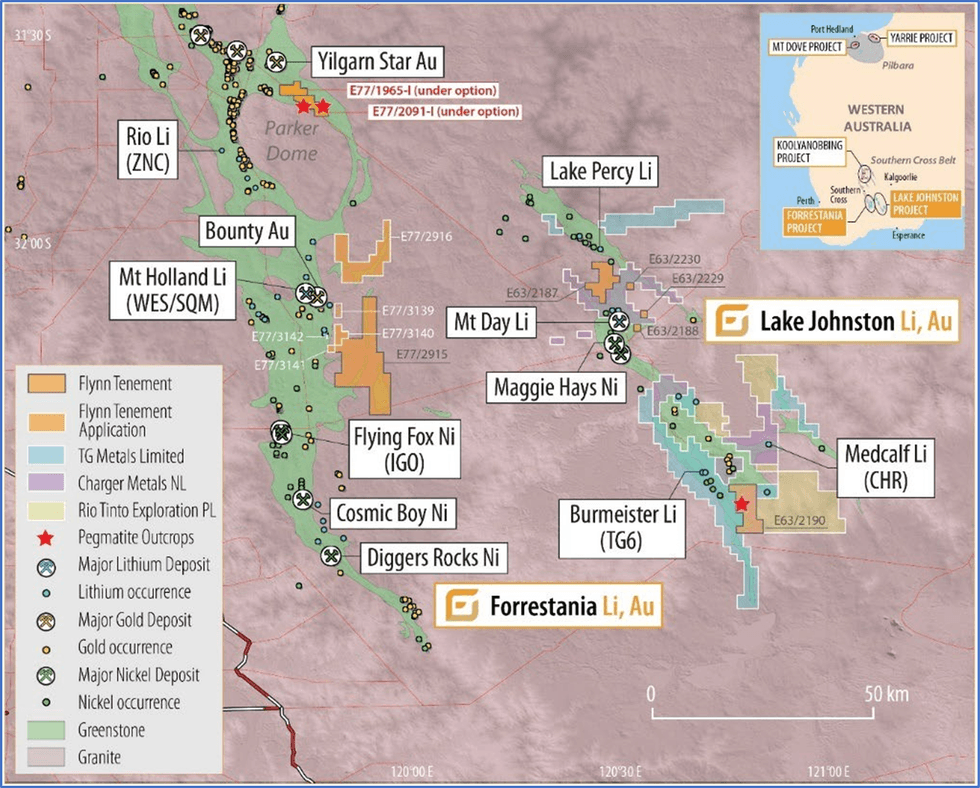

Flynn Gold Limited (“FG1” or “Flynn Gold”) (ASX: FG1) is pleased to announce results from its soil sampling program at its recently optioned2 Parker Dome lithium-gold project, situated in the highly prospective Forrestania Belt in Western Australia.

Highlights

- Soil sampling outlines multiple, large-scale lithium anomalies of up to 187ppm Li2O at the recently optioned Parker Dome project

- Lithium anomalies extend up to 2,300m length and 900m width

- Lithium-in-soil anomalies have corresponding and coincident anomalous values of caesium (Cs) and tantalum (Ta), considered key pathfinder elements for potential lithium mineralisation

- Anomalies overlie the Western and Eastern Pegmatite Trends defined by historic RAB drilling1 where historic drill holes contain logged pegmatite with no assays for lithium

- Planning underway for a first-pass RC drilling program to test targets

The licences are located 50km north of the world class Mount Holland lithium project and 20km north-east of the Rio lithium deposit held by Zenith Minerals Limited (ASX: ZNC)3 (see Figure 1).

The soil sampling program was designed to provide first-pass geochemical coverage over the Western and Eastern pegmatite trends, delivering the first systematic lithium and associated pathfinder assays for the project.

Managing Director and CEO, Neil Marston commented,

“We are very pleased with the results of the first soil program at Parker Dome, which delineated a series of strong kilometre-long lithium soil anomalies in areas not yet drill tested for lithium, highlighting the exciting lithium potential of the project.”

“The consistency and coherency of the lithium values within these large-scale anomalies is impressive. The coincident pathfinder elements like tantalum and caesium as well as the identification of logged pegmatite in historic drill holes make these areas compelling targets which have been cheaply delineated”.

Parker Dome Project - Soil Sampling Program

The results from an auger soil geochemistry program at the Parker Dome project have been received and have outlined six new, large-scale, high priority lithium anomalies4 with associated pathfinder geochemistry (Figures 2 - 10).

The soil program was designed to provide first-pass coverage over the Western and Eastern pegmatite trends. The pegmatite trends were outlined by historic, shallow RAB drilling which intersected multiple pegmatite intersections logged over a wide area5, with most holes ending in pegmatite up to 12m thick. The historic drill holes with pegmatite were not assayed for lithium. Flynn believes the soil sampling results announced in this release represent the first significant systematic exploration for lithium at the Parker Dome project.

The auger soil survey was completed on a spacing which varied between 200m x 100m and 400m x 100m, with a total of 679 soil samples collected. Samples were sieved to -80 mesh (180um) and assayed at SGS Australia Pty Ltd, for lithium and associated pathfinder elements by four-acid digest with an ICP-MS finish and gold by 30g fire assay (refer Appendix 1 for further details). The auger soil program has outlined six, large, coherent lithium anomalies with coincident and zoned pathfinder element support (Figures 2 – 10). Three targets (Targets 3, 5 and 6) require further follow-up infill and extensional auger soil sampling. The six targets present as compelling, high order drill targets.

Click here for the full ASX Release

This article includes content from Flynn Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FG1:AU

The Conversation (0)

12 August 2024

Flynn Gold

Advancing three high-grade gold projects in Tasmania

Advancing three high-grade gold projects in Tasmania Keep Reading...

20 February 2025

Exploration Update - Golden Ridge Project, NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Update - Golden Ridge Project, NE TasmaniaDownload the PDF here. Keep Reading...

18 February 2025

High-Grade Silver-Lead at Henty Project, Western Tasmania

Flynn Gold (FG1:AU) has announced High-Grade Silver-Lead at Henty Project, Western TasmaniaDownload the PDF here. Keep Reading...

30 January 2025

December 2024 Quarterly Activities Report and Appendix 5B

Flynn Gold (FG1:AU) has announced December 2024 Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

12 January 2025

Flynn Expands Key Gold Targets at Golden Ridge, NE Tasmania

Flynn Gold (FG1:AU) has announced Flynn Expands Key Gold Targets at Golden Ridge, NE TasmaniaDownload the PDF here. Keep Reading...

08 December 2024

Exploration Licence Granted at Beaconsfield in NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Licence Granted at Beaconsfield in NE TasmaniaDownload the PDF here. Keep Reading...

3h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

21h

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

31 January

Chris Vermeulen: Gold, Silver to Go "Dramatically Higher," This is When

Speaking ahead of this week's gold and silver price correction, Chris Vermeulen, chief market strategist at TheTechnicalTraders.com, said the metals were due for a "significant pullback." After that, they'll be positioned for a new leg up."There will be a time definitely to get back into metals,... Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00