September 24, 2024

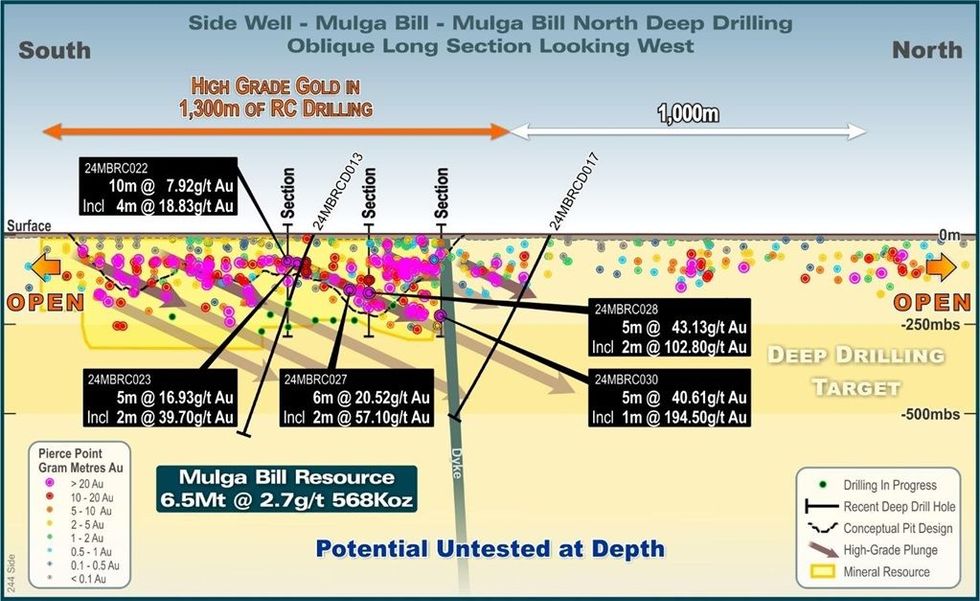

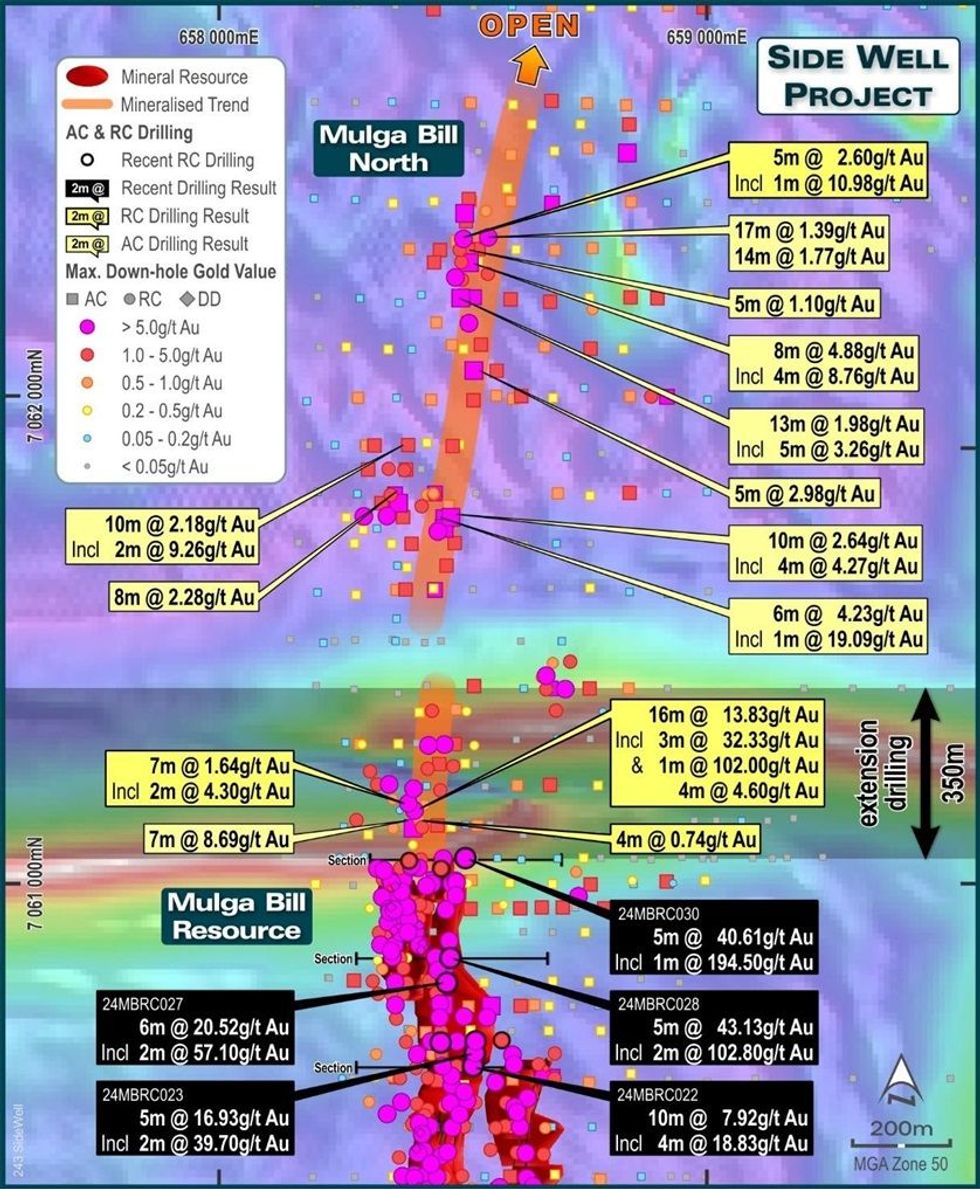

Multiple high-grade intersections with grades up to 194.50g/t Au from infill and extensional RC drilling at Mulga Bill

Great Boulder Resources (“Great Boulder” or the “Company”) (ASX: GBR) is pleased to provide an update on exploration at the Company’s flagship Side Well Gold Project (“Side Well”) near Meekatharra in Western Australia which hosts a Mineral Resource Estimate (“MRE”) of 668,000oz @ 2.8 g/t Au.

HIGHLIGHTS

- Reverse circulation (RC) at Mulga Bill has intersected more extremely high gold grades, extending the resource and adding thickness and grade to existing lodes

- Highlights include:

- 5m @ 43.13/t Au from 185m, including 2m @ 102.80/t Au from 186m in 24MBRC028

- 5m @ 40.61g/t Au from 256m, including 1m @ 194.50g/t Au from 258m in 24MBRC030

- 6m @ 20.52g/t Au from 179m, including 2m @ 57.10g/t Au from 179m in 24MBRC027

- 5m @ 16.93g/t Au from 91m, including 2m @ 39.70g/t Au from 92m in 24MBRC023

- Maiden AC drilling to commence imminently on the high priority Side Well South Prospect

Great Boulder’s Managing Director, Andrew Paterson commented:

“These are sensational new intersections at Mulga Bill. The holes were designed to add definition within areas of inferred resource and they have done so in emphatic style, with intersections that are both thicker and higher grade than previously estimated.”

“Equally impressive is the deep result in hole 24MBRC030 which is well outside the resource, down- dip and further north than previous drilling in that area.”

“After several rounds of drilling at Mulga Bill the high-grade lode positions fit our interpretation perfectly, which means we have very high confidence in the validity of this resource model. The drilling has added high-grade intersections up-dip from previous holes on several sections within the resource, which should add gold ounces closer to surface than the current estimate. This will be important for potential mine economics when we start scoping studies.”

Nine RC holes were drilled at Mulga Bill for a total of 1,587m. The program was designed to test poorly defined areas around the edges of the Mulga Bill high-grade vein positions as part of the process to upgrade less-drilled parts of the resource from inferred to indicated category. Highlights from the drilling include:

- 5m @ 43.13g/t Au from 185m, including 2m @ 102.80g/t Au from 186m in 24MBRC028.

- This sits within a Cervelo Lode vein, up-dip to the east from previous drilling.

- 5m @ 40.61g/t Au from 256m, including 1m @ 194.50g/t from 258m in 24MBRC030.

- This HGV lode was previously insufficiently drilled to be classified in the resource; it will now be added to the resource estimate and extends the Cervelo Lodes by approximately 30m to the north.

- 6m @ 20.52g/t Au from 179m, including 2m @ 57.10g/t Au from 179m in 24MBRC027.

- This sits within a Cervelo Lode vein, up-dip to the east from previous drilling.

- 5m @ 16.93g/t Au from 91m, including 2m @ 39.70g/t Au from 92m in 24MBRCD023.

- This sits within a Cervelo Lode vein, up-dip to the east from previous drilling. The intersection contains supergene mineralisation.

- 10m @ 7.92g/t Au from 82m, including 4m @ 18.83g/t Au from 85m in 24MBRC022.

- This sits within a Cervelo Lode vein, up-dip to the east from previous drilling. The intersection also contains supergene mineralisation.

- 2m @ 6.18g/t Au from 90m in 24MBRC025.

The mineralised wireframes at Mulga Bill will be updated and extended to incorporate the new intersections in preparation for a resource update which will be completed towards the end of the year.

Next Steps

The RC rig is currently drilling the final resource definition RC holes at Mulga Bill, after which reconnaissance AC drilling will commence on exciting new targets at Side Well South.

Click here for the full ASX Release

This article includes content from Great Boulder Resources licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GBR:AU

The Conversation (0)

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00