August 29, 2022

Substantial scope for further growth with mineralisation open in all directions and resource constrained only by drilling; 20,000m drilling program set for Dec quarter

Kairos Minerals (ASX: KAI) is a diversified West Australian-based exploration company focused on the exploration and development of its 100%-owned, high-quality gold and lithium projects centred around the advanced Mt York Gold Project.

Highlights

- Mt York emerges as a top-shelf WA gold project with genuine scale and ongoing growth potential

- The 26% increase in the resource stems from recent highly successful drilling campaign; ~15,000m of drilling completed in 2021

- 1,104,000 ozs Au resource increases to 1,329,000 ozs Au at 0.5 g/t Au lower cutoff

- Resource growth also reflects extension of assumed pit depth to take into account significant mineralisation excluded from previous inventory

- 20,000m drilling contract signed with Orlando Drilling; Drilling set to start within days targeting further significant resource growth

- Drilling will take place in parallel with geotechnical assessment and metallurgical test work

Kairos Managing Director, Dr Peter Turner said: “This substantial resource increase is a game-changer for Kairos on several levels.

“Mt York now has genuine scale at 1.1Moz in a tier-one location. And the results demonstrate the huge potential for further increases, with the mineralisation open in all directions and constrained only by drilling.

“Our resource optimisation work on the Main Trend outlines a single 3km-long pit constrained only by drilling at depth.

“A major 20,000m drilling program has started with the aim of continuing to grow the inventory along strike and at depth and between the current optimal pit shells.

“We will also undertake important geotechnical and metallurgical work in preparation for a pre-feasibility study”.

Mt York Resource Estimate Update

The current resource estimate was completed by Christopher Speedy of Encompass Mining Consultants using wireframes built by Kairos’s technical team and based on a 0.3 g/t Au envelope of mineralisation. The resource includes an additional 14,988m of drilling at all prospects in late 2021 by the company. The resource includes the continuous and contiguous deposits of Main Hill, The Gap, Breccia Hill and Gossan Hill that form an arcuate form with mineralisation dipping moderately to steeply to the south to south-west, herein referred to as The Main Trend (see Figure 1).

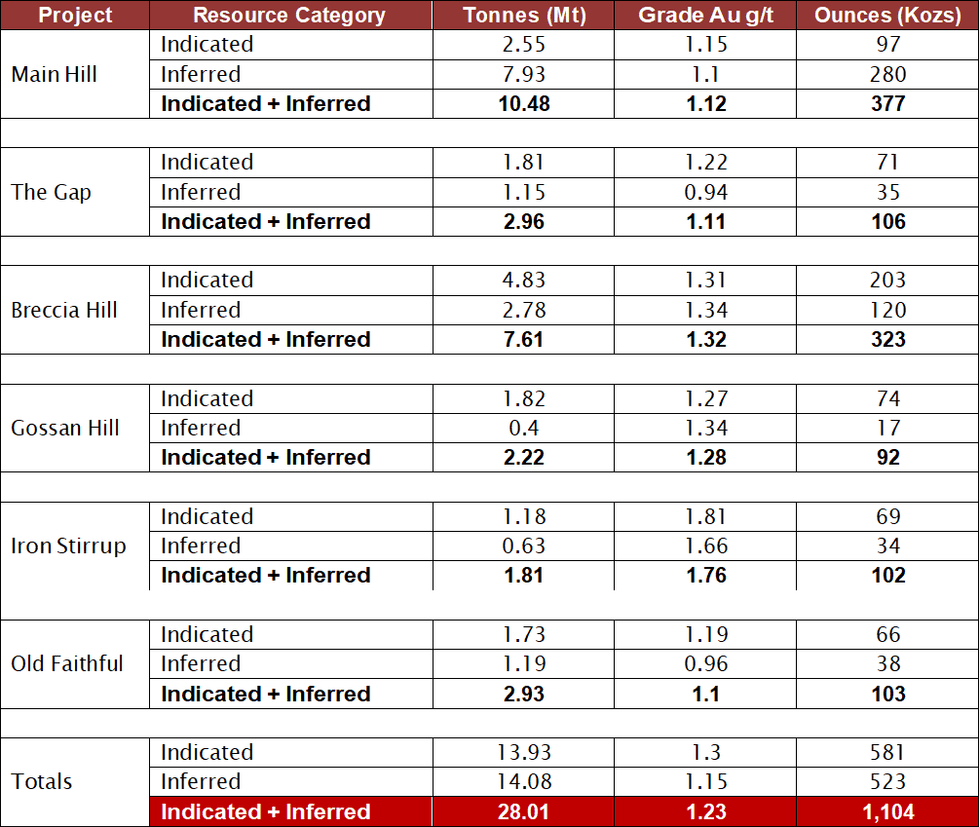

Table 1. Mineral Resource Estimate for the Mt York Gold Project using a 0.7 g/t lower cutoff. The deposits of Main Hill, The Gap, Breccia Hill and Gossan Hill are contiguous orebodies with Iron Stirrup and Old Faithful being satellite deposits 4.5km and 6.5km to the north respectively (see Figure 1).

Click here for the full ASX Release

This article includes content from Kairos Minerals , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

KAI:AU

The Conversation (0)

14 February 2022

Kairos Minerals

Developing Highly Prospective Gold Projects in a World-Class Gold District

Developing Highly Prospective Gold Projects in a World-Class Gold District Keep Reading...

3h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

9h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00