August 29, 2022

Substantial scope for further growth with mineralisation open in all directions and resource constrained only by drilling; 20,000m drilling program set for Dec quarter

Kairos Minerals (ASX: KAI) is a diversified West Australian-based exploration company focused on the exploration and development of its 100%-owned, high-quality gold and lithium projects centred around the advanced Mt York Gold Project.

Highlights

- Mt York emerges as a top-shelf WA gold project with genuine scale and ongoing growth potential

- The 26% increase in the resource stems from recent highly successful drilling campaign; ~15,000m of drilling completed in 2021

- 1,104,000 ozs Au resource increases to 1,329,000 ozs Au at 0.5 g/t Au lower cutoff

- Resource growth also reflects extension of assumed pit depth to take into account significant mineralisation excluded from previous inventory

- 20,000m drilling contract signed with Orlando Drilling; Drilling set to start within days targeting further significant resource growth

- Drilling will take place in parallel with geotechnical assessment and metallurgical test work

Kairos Managing Director, Dr Peter Turner said: “This substantial resource increase is a game-changer for Kairos on several levels.

“Mt York now has genuine scale at 1.1Moz in a tier-one location. And the results demonstrate the huge potential for further increases, with the mineralisation open in all directions and constrained only by drilling.

“Our resource optimisation work on the Main Trend outlines a single 3km-long pit constrained only by drilling at depth.

“A major 20,000m drilling program has started with the aim of continuing to grow the inventory along strike and at depth and between the current optimal pit shells.

“We will also undertake important geotechnical and metallurgical work in preparation for a pre-feasibility study”.

Mt York Resource Estimate Update

The current resource estimate was completed by Christopher Speedy of Encompass Mining Consultants using wireframes built by Kairos’s technical team and based on a 0.3 g/t Au envelope of mineralisation. The resource includes an additional 14,988m of drilling at all prospects in late 2021 by the company. The resource includes the continuous and contiguous deposits of Main Hill, The Gap, Breccia Hill and Gossan Hill that form an arcuate form with mineralisation dipping moderately to steeply to the south to south-west, herein referred to as The Main Trend (see Figure 1).

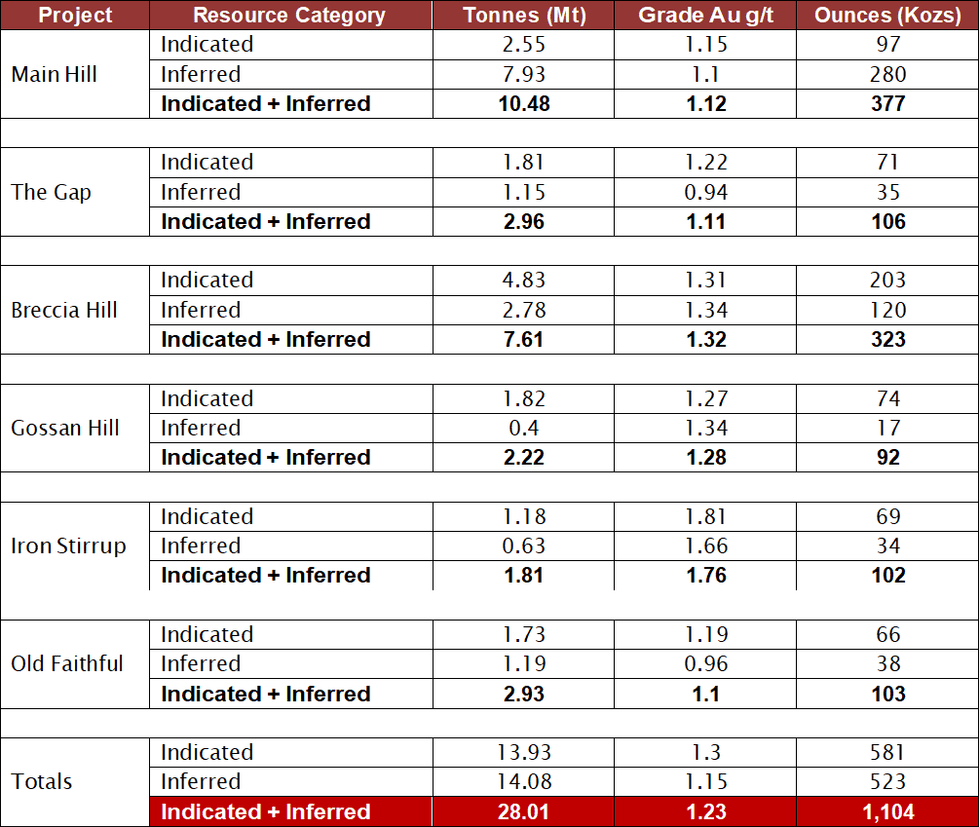

Table 1. Mineral Resource Estimate for the Mt York Gold Project using a 0.7 g/t lower cutoff. The deposits of Main Hill, The Gap, Breccia Hill and Gossan Hill are contiguous orebodies with Iron Stirrup and Old Faithful being satellite deposits 4.5km and 6.5km to the north respectively (see Figure 1).

Click here for the full ASX Release

This article includes content from Kairos Minerals , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

KAI:AU

The Conversation (0)

14 February 2022

Kairos Minerals

Developing Highly Prospective Gold Projects in a World-Class Gold District

Developing Highly Prospective Gold Projects in a World-Class Gold District Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00