September 08, 2021

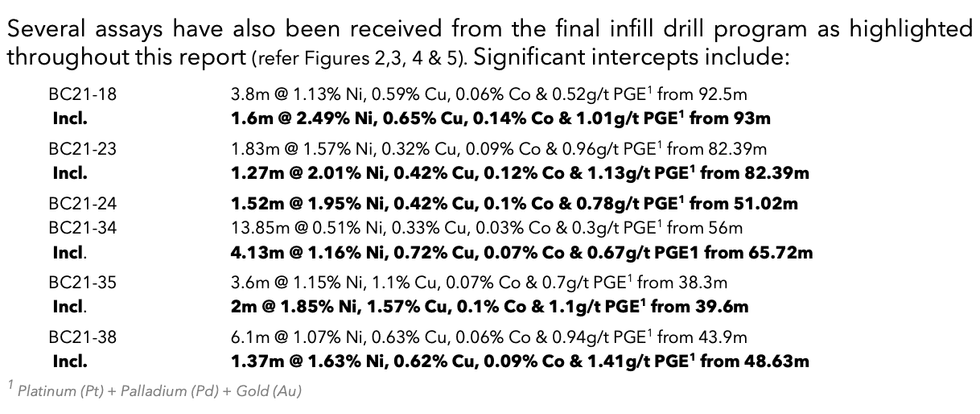

Blackstone Minerals Limited ("Blackstone" or the "Company") is pleased to provide an update on infill drilling at Ban Chang, the most advanced massive sulfide vein (MSV) target at the Ta Khoa Nickel – Copper- PGE Project in Northern Vietnam (refer Table 3, Table 4 & Appendix 1). Highlights include 5.35m of massive sulfide nickel intersected in drill hole BC21-66 (refer Image 1, Table 1 & Figure 6).

Blackstone Minerals' Managing Director Scott Williamson commented: "We look forward to presenting a maiden resource at Ban Chang and incorporating the successful outcomes of infill drilling into a mine plan as part of our Upstream Business Unit PFS. Drilling at Ban Chang is tightly spaced and has consistently intersected massive sulfide mineralisation, providing a high level of confidence as we progress through the next phases of mine development."

Ban Chang MSV Project

Ban Chang is located 2.5km south-east of the existing processing facility and the Ban Phuc DSS deposit adjacent to the Chim Van – Co Muong fault system. The prospect geology consists of massive and disseminated sulfides (DSS) hosted within a tremolitic dyke swarm which intruded into phyllites, sericite schists and quartzites of the Devonian Ban Cai Formation (refer Figure 1).

The known dyke swarm is approximately 900m long and varies between 5 and 60 meters wide. The dykes and massive sulfide are interpreted to be hosted within a splay (and subsidiary structures) off the major regional Chim Van – Co Muong fault system.

Drilling at Ban Chang has identified multiple massive sulfide lenses, which are often associated with broader disseminated sulfide zones. Preliminary mining studies suggest that Ban Chang is amenable to a modern mechanised underground mining.

As part of the ongoing work for the Upstream Business Unit (UBU) Pre-feasibility Study (PFS), Ban Chang is being assessed as an ore source for the existing 450ktpa concentrator and/or as a feedstock that complements processing of disseminated sulfide ore (i.e., from Ban Phuc) for the larger proposed concentrator.

Click here for the full ASX release.

BSX:AU

The Conversation (0)

25 February

Blackstone Minerals

Advancing the Mankayan copper-gold project, a world-class copper-gold project in the Philippines

Advancing the Mankayan copper-gold project, a world-class copper-gold project in the Philippines Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00