September 12, 2024

– Lac Carheil’s strategic value also stands to be significantly enhanced by Canadian Government moves to potentially impose tariffs on Chinese critical mineral imports

Metals Australia Ltd (ASX: MLS) continues to make significant progress advancing its flagship Lac Carheil high-grade flake-graphite development project in the Tier 1 global mining province of Quebec, including:

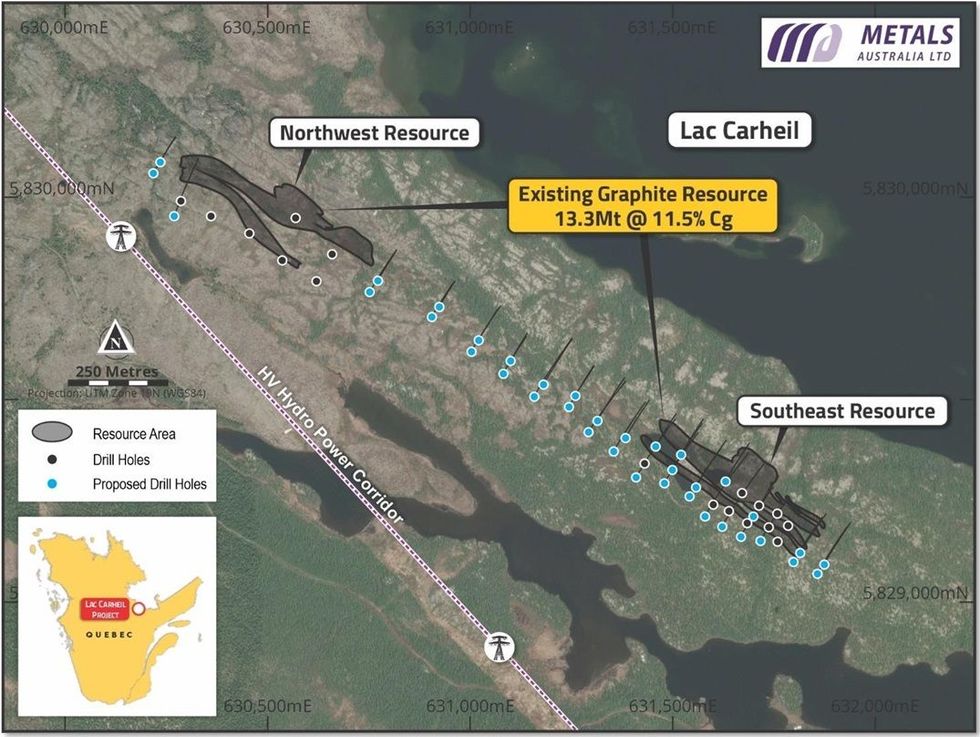

- Comprehensive metallurgical testwork1 confirming higher quantities of higher-value coarse flake graphite in the Northwest zone of the Mineral Resource2 (Figure 1 & Table 1), with average mass recoveries of 32.4% in the + 100# product fraction (+149 micron), compared to ~ 25.5% in the Southeast portion of the resource. This represents a 27% increase in the proportion of coarse flake graphite in this zone of the resource where coarse flake attracts premium pricing, as outlined in our scoping study3.

- Enhanced processing capability achieved in design updates to the flake graphite concentrator flowsheet4 to maximise recovery of coarse flake and optimise production efficiency - at an initial production rate of 100,000 tonnes per annum of concentrate (+95% Graphitic Carbon - Cg) (Figure 2).

- Land holding at Lac Carheil increased by 62% to 11,905 hectares through pegging of further claims covering potential southeast extensions of the existing resource and for placement of key infrastructure.

- Downstream design work4 set to commence to test and select the preferred graphite purification technology, conduct a plant site location study and develop a Project Economic Assessment (PEA) for the downstream Battery Anode Material (BAM) refinery, with a bulk concentrate sample being generated by SGS Canada for shipment to Dorfner Anzaplan facilities in Germany.

- Applications lodged with Government agencies to access grants under various funding programs, with further submissions planned, to advance Pre-Feasibility Study.

- Extensive local consultation and engagement with consultants, contractors, government and First Nations organisations, including the economic development arm of the Uashat Mak Mani-Utenam, in line with the Company’s commitment to establish a socially acceptable project for all stakeholders.

- Contract award readiness for additional work scopes integral to the broader PFS study following approval of a drilling permit, including Mineral Resource Estimation, mining design and scheduling and Environmental and Social Impact Assessment (ESIA) studies.

In addition to the advancements being made by the Company, the strategic value of the Lac Carheil high- grade flake-graphite project stands to be significantly enhanced from the outcome of a 30-day consultation period announced by the Canadian Government on August 26th 2024 (September 10 to October 10, 2024) seeking inputs on the potential application of a surtax on a range of Chinese imports related to critical manufacturing sectors, including critical minerals.

This follows the imposition of a 100% surtax on Chinese-made EVs due to come into effect on October 1, 2024, and a 25% surtax on imports of steel and aluminium from China, effective October 15, 2024. Lac Carheil’s strategic significance is also linked directly to, and referenced in, Quebec’s Plan for The Development of Strategic Minerals5 (2020-2025).

Based on its reviews of the projects outlined in the above plan, Metals Australia is unaware of any graphite projects actively progressing in Canada that have both the resource grade and upside potential that Lac Carheil exhibits.

Metals Australia CEO Paul Ferguson commented:

“We are delighted to report progress on multiple fronts at Lac Carheil as we continue to advance our flagship high- grade flake-graphite project in Quebec to Pre-Feasibility Study status.

This progress comes as we wrap up our phase one field exploration program at our Corvette River project in Canada, where we expect to receive assay results later this month, and the recent launch of aggressive exploration programs across our three Australian gold and critical minerals projects – Warrambie, Big Bell North and Warrego East.

Over the last couple of weeks, I have had the pleasure of engaging in person with a broad range of stakeholders on country in Ontario and Quebec regarding the development of Lac Carheil. The very clear message from those discussions is that our project is rapidly developing a profile as one of the best graphite projects advancing in North America today.

Earlier this week, the Lac Carheil project received a further potential tailwind when Canada’s Department of Finance launched a 30-day consultation process on a range of potential new surtaxes, including on critical minerals, in response to what it claimed were unfair Chinese trade practices. The Government has already shown its teeth on this issue by imposing a 100% surtax on all Chinese-made EVs, effective October 1, 2024, and a 25% surtax on imports of steel and aluminium, effective October 15, 2024.

Our project can contribute to forecasted shortfalls of graphite required to meet national and homeland security requirements across North America. This future stands in stark contrast to the state of domestic market supply for graphite in North America today. There is extremely limited onshore production of graphite in North America. Nearly all graphite used in the growing North American battery industry is sourced from offshore jurisdictions. This places Lac Carheil as a project of strategic importance for a domestic supply of high-quality graphite. This is essential for securing the supply chain certainty required for the clean energy transition.

The work we committed to completing as part of our planned PFS is rapidly advancing. Comprehensive metallurgical test work for the PFS level flowsheet design of the planned 100,000 tonnes per annum concentrate plant is well progressed – as are the plant designs for the concentrate plant. We are very close to dispatching the bulk concentrate sample to Germany that will launch the downstream design phase of the project, on schedule.

The design work to date has also given rise to a prioritised list of follow-up projects that we intend to further refine and progress as we move from PFS level studies and into the Feasibility Study design. We have held discussions related to grant funding avenues in Canada, including in Quebec, and in the USA, with funding applications made and more to follow. The work we are proposing is innovative and the solutions to be generated match well with the criteria set by governments for grant funding.

While our recent endeavours have focused heavily on the engineering and scientific elements of design, we are cognizant of our need to engage broadly with stakeholders and communities to ensure we understand their concerns, identify solutions as we look to establish enduring partnerships with those communities and stakeholders.

In that regard, a large focus of my recent trip was spent engaging with government at the provincial and local levels and speaking with stakeholders, including existing and prospective service providers, First Nations economic development groups and to seek further meetings with governments and First Nations communities. I was appreciative of the many groups we were able to speak with face to face and to those who have committed to follow up discussions.

As a board and management team, we remain dedicated to collaborating with all stakeholders to develop this strategically significant project for the betterment of all.”

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

17 February

High Grade Assays Verify the Emerging Manindi VTM Project

Metals Australia (MLS:AU) has announced High Grade Assays Verify the Emerging Manindi VTM ProjectDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00