May 09, 2024

Magnetic Resources NL (ASX:MAU) (Magnetic or the Company) is pleased to announce that LJN4 continues to deliver with deepest intersection at 650m.

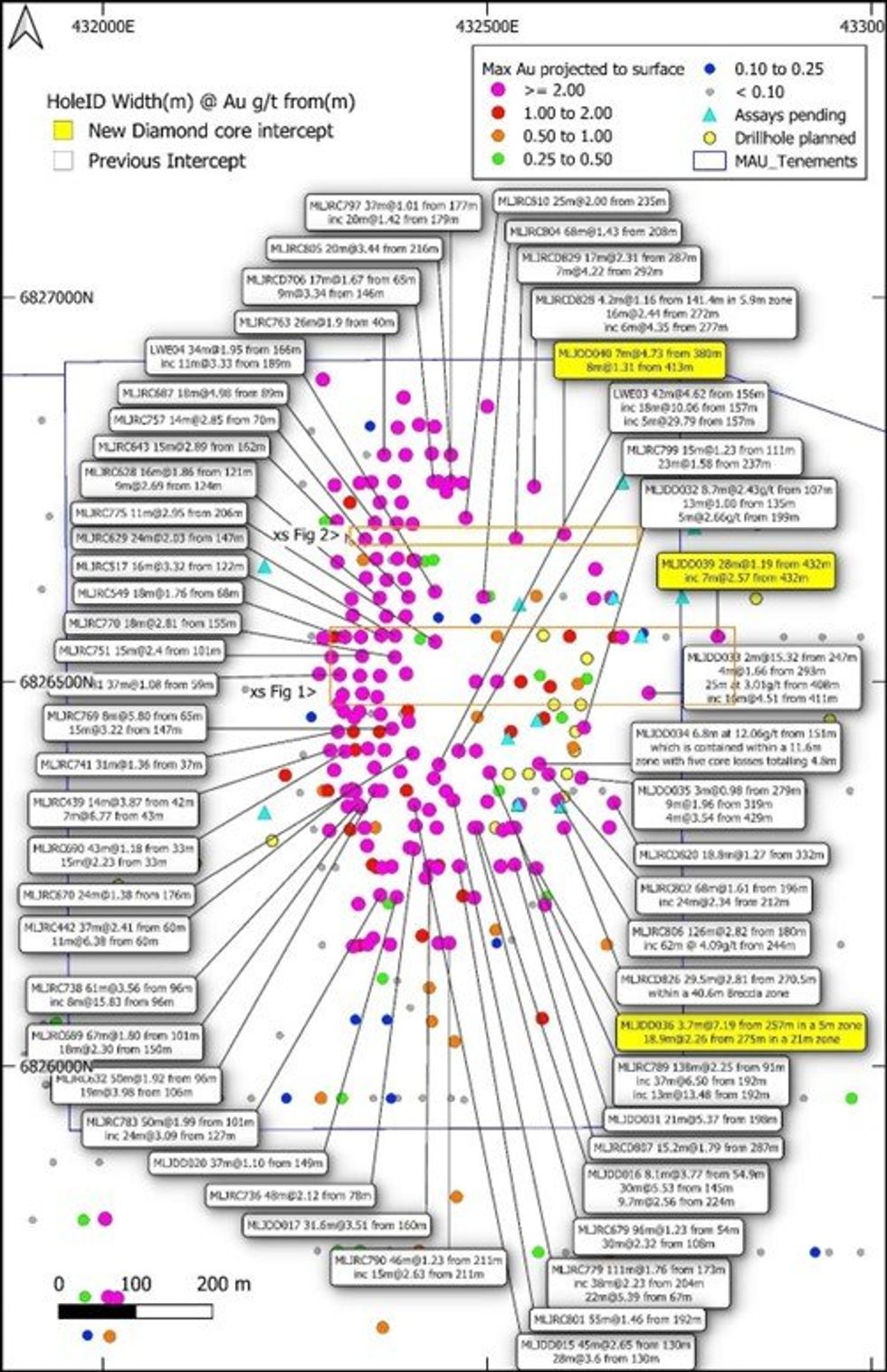

- After a significant intersection of 16m at 4.51g/t from 411m within MLJDD033, which was a very large 200m step out below the current resource (Figures 1 and 4) a further seven deeper diamond holes totalling 2,354m holes averaging 336m were drilled to ascertain the depth continuity in other parts of the LJN4 Deposit. Some compelling intersections are outlined below.

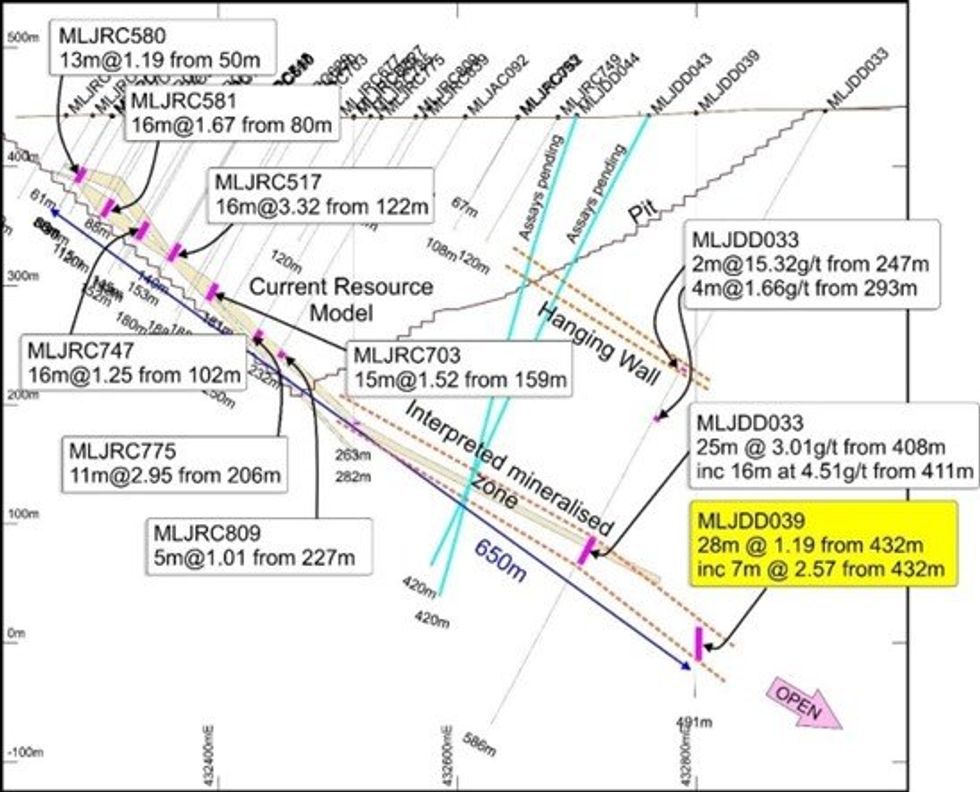

- MLJDD039 has the deepest intersection to date of 28m at 1.19g/t from 432m including 7m at 2.57g/t from 432m and is 100m down dip of MLJDD033 which intersected 25m at 3.01g/t from 408m and includes 16m at 4.51g/t from 411m. These intersections (Figure 1) are part of a 650m down dip, 45-degree mineralised zone, which is the longest so far within the 750m long LJN4 deposit.

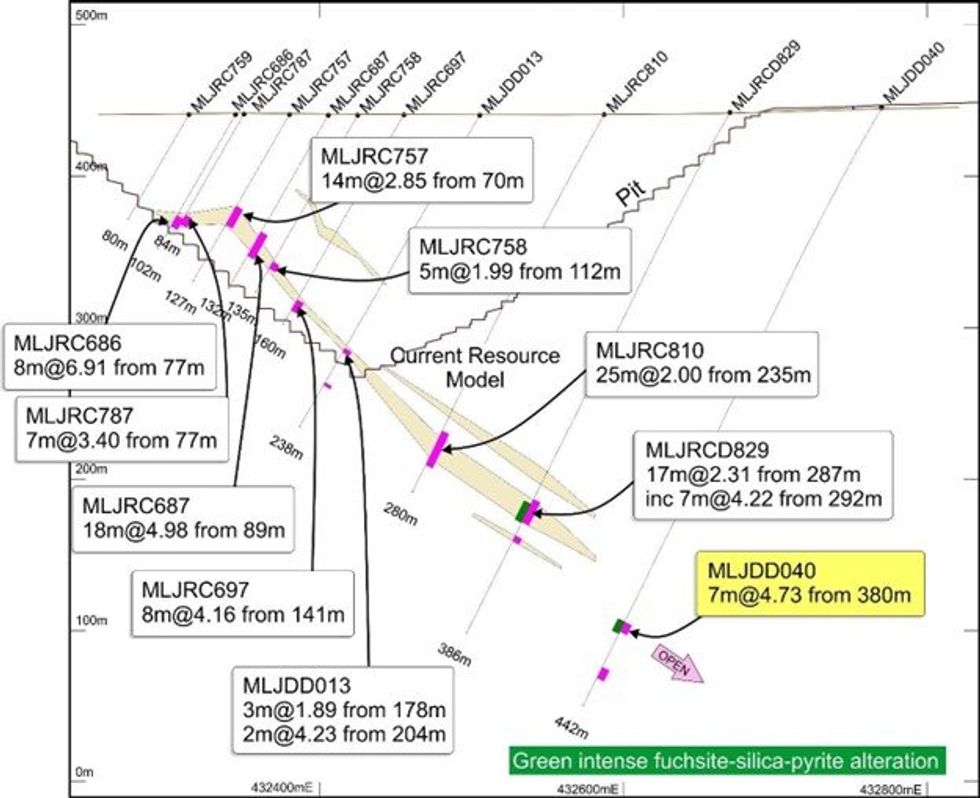

- In the northern part of LJN4 there is a strong green fuchsite-silica-pyrite alteration within the ultramafic. Drill holes MLJDD040 intersected 7m at 4.73g/t from 380m (Figure 2 ) and contained silicified ultramafic with fuchsite and quartz veins. This intersection is 100m down dip of MLJRCD829 which intersected 17m at 2.31g/t from 287m which includes 7m at 4.22g/t from 292m (which is also intensely fuchsite altered with quartz veins). The extend of this down dip zone is 450m and is still open at depth.

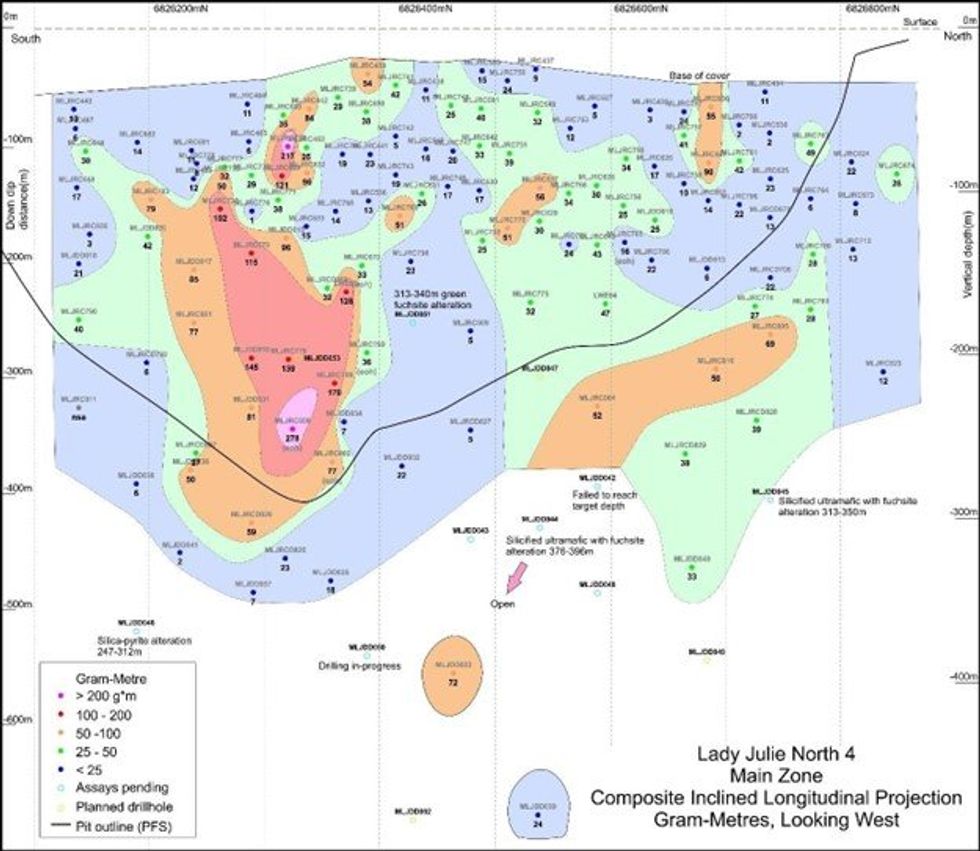

- This ultramafic alteration is much more prevalent and occurs within the 350m long northern part of LJN4 (Figure 3) and is also present in holes MLJDD044 (from 376-396m), MLJDD045 (from 313-350m) and MLDD051 (from 313-340m), which have assays pending. The central and northern parts of LJN4 are still open at depth and there is a suggestion that the zones plunge to the SE (Figure 3).

- These intersections in MLJDD039 and 40 are far below the open pit from our PFS study (ASX release 7 March 2024) and are also not included in our current resource, this augers well for the enlargement of the resource, increasing both the potential size of the open pit and the accompanying positive economic studies.

- MLRDD036 intersected 18.9m at 2.26 g/t from 275M within a 21m zone, which is a 40m step out down dip from MLJRCD807 which intersected 15.2m at 1.79g/t from 287m (Figure 4).

- As described in the 5 March 2024 ASX release there was a 7.7% increase in overall resource in the Laverton Project to 24.9Mt @1.66g/t totalling 1.33moz of gold at 0.5g/t cut off and LJN4 has increased 11% to 948,200 oz (Table 1).

- It is particularly interesting that we have 8 stacked lodes in the central part of LJN4 and we have one planned 600m hole that will be testing for stacked lodes beneath the current mineralised stacked lodes.

- A number of deeper step out holes have now been carried out to see whether the LJN4 resource appears to extend further at depth and there are assays pending for 7 diamond drillholes totalling 1980m averaging 396m and include MLJDD042-46, 48, 50, 51) and 14 RC drillholes totalling 946m (MLJRC839-859). In addition, there are 6 holes being drilled in this current programme totalling 2800m and averaging 466m and are expected to be completed by the end of May 2024 with three diamond rigs operating.

The central and northern part of the 750m long LJN4 deposit has been drilled with very promising results. Highlights of this drilling are shown in Table 4, Figures 1-4.

The follow up deeper diamond holes have tested and are looking to extend up to two and in some cases eight, stacked lodes mainly found in the central parts of LJN4. Hole MLJDD053 is a 600m deep hole and is designed to investigate for further stacked lodes below the current bottom stacked lode. Many of these are outside the existing resource and have potential for the enlargement of the LJN4 (Indicated and Inferred) of 15.4mt at 1.92g/t for 948,200oz at a 0.5g/t cutoff (Table 1).

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

14h

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

15h

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

16h

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16h

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

20 February

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

20 February

Editor's Picks: Gold, Silver End Week Higher, Experts Share Next Price Targets

Gold and silver prices experienced declines early in the week, but ended higher. The yellow metal closed the week at US$5,111.88 per ounce, while silver finished at US$84.65 per ounce, buoyed by reignited tariff uncertainty out of the US. On Friday (February 20), the US Supreme Court stuck down... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00