June 14, 2023

Forrestania Resources Limited (ASX:FRS) (Forrestania or the Company), is pleased to announce that it has executed a drilling contract for a lithium-focussed RC drilling programme at its flagship Forrestania Project. The RC drill rig has arrived on site and drilling is due to commence imminently.

Highlights

- RC drill rig on site with lithium-focussed drilling to commence at Forrestania.

- RC drill programme for an initial 3000 - 4000m at three high priority targets, including a maiden drilling programme at the highly promising Calypso prospect.

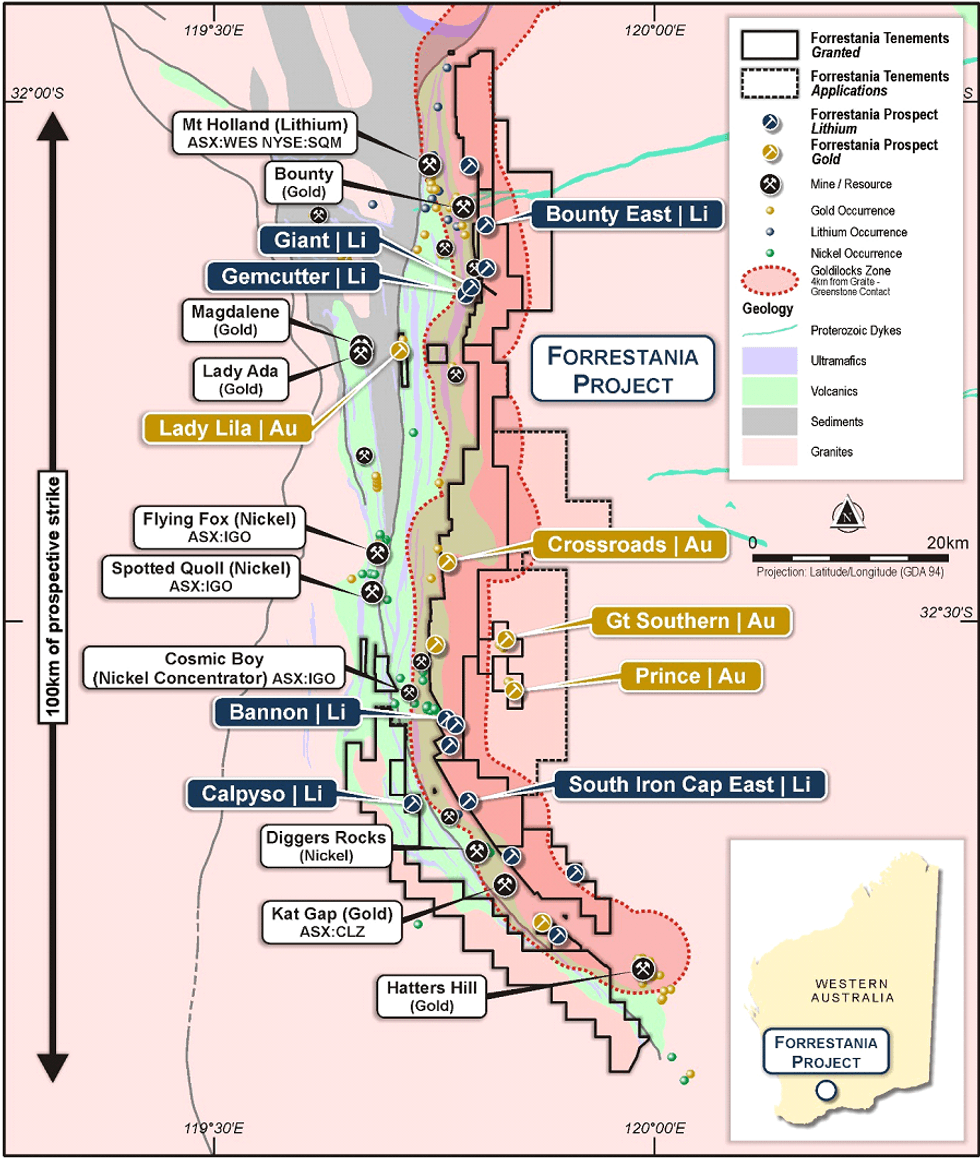

The RC drilling programme for up to 4,000m will test targets at three of the company’s high priority lithium targets:

Calypso – maiden drilling programme to define the extents of and investigate whether pegmatites identified from mapping and historic drilling1 host lithium mineralisation.

South Iron Cap East – following up on the highly encouraging geochemistry returned from pegmatites intersected in the company’s previous drilling campaign2.

Giant - testing the down-dip extent of high-grade lithium mineralisation (10m @ 1.49% Li2O) which was intersected in the company’s previous drilling campaign2. Additionally, the strike continuation of the Giant pegmatite body will be tested to the south.

Forrestania Resources MD Michael Anderson commented:

“We are extremely excited to see what this latest drilling programme will uncover across three of our highest priority targets. The drilling represents a carefully refined and targeted programme – a testament to our exploration strategy which is continually being optimised through results analysis, investigation into historic data and observations in the field. We remain confident that the Forrestania project remains highly prospective for a significant lithium discovery”.

Discussion

The company is eagerly anticipating its maiden drilling programme at Calypso, as it holds the belief that the project possesses all the right criteria for a potentially significant lithium discovery. This includes the following which was detailed in the company’s announcement ‘Pegmatite identified at new Calypso prospect’ dated 29th November 2022:

- Favourable geological setting – the prospect is located in the Forrestania greenstone belt and overlies ultramafic and mafic rocks which are interpreted to be the preferential host for pegmatite intrusions. Additionally, Calypso occurs within 4.5km of South Ironcap (Figure 2) where Western Areas (now IGO) previously reported a significant intercept of 50m @ 0.95% Li2O.3

- Promising soil geochemistry – the area shows well-defined anomalism for key lithium pathfinder elements: beryllium (see Figure 3) and rubidium. The anomaly trends in a north-west, south-east orientation over a length of ~1.4km and a width of ~440m1 and is consistent with an underlying ultramafic unit1.

- Outcropping pegmatite - pegmatite rock chips1 (FR001306 and FR001307 – see figure 3) were identified during mapping and soil sampling. The samples exhibit a mineral assemblage of quartz, feldspar, tourmaline and muscovite; considered a typical mineral assemblage of fractionated pegmatites.

- Pegmatite intercepts in historic drilling (untested for lithium) – there is a line of historic air core drilling which crosscuts the Calypso prospect1 (Figures 2 - 3). The historical aircore drill holes were drilled in 2005 by LionOre Australia Pty Ltd to test the source of aeromagnetic highs. Historic logs report the intersection of numerous pegmatites and granitoids within the regolith profile. The nature of the intercepts appear somewhat flat lying in cross-section (Figure 4) with some intercepts not closed out.

The upcoming drilling will aim to validate and extend the historic pegmatite intercepts with deeper RC drill holes along the same drill line. Additionally, the extent of the pegmatite body will be fully tested along strike of the anomalous soil trend.

Click here for the full ASX Release

This article includes content from Forrestania Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

17h

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00