July 23, 2024

C29 Metals expands Ulytau Uranium Project with new licence applications (252km²), strong local support, and a Social Support Agreement signed. Drilling Approvals Advancing.

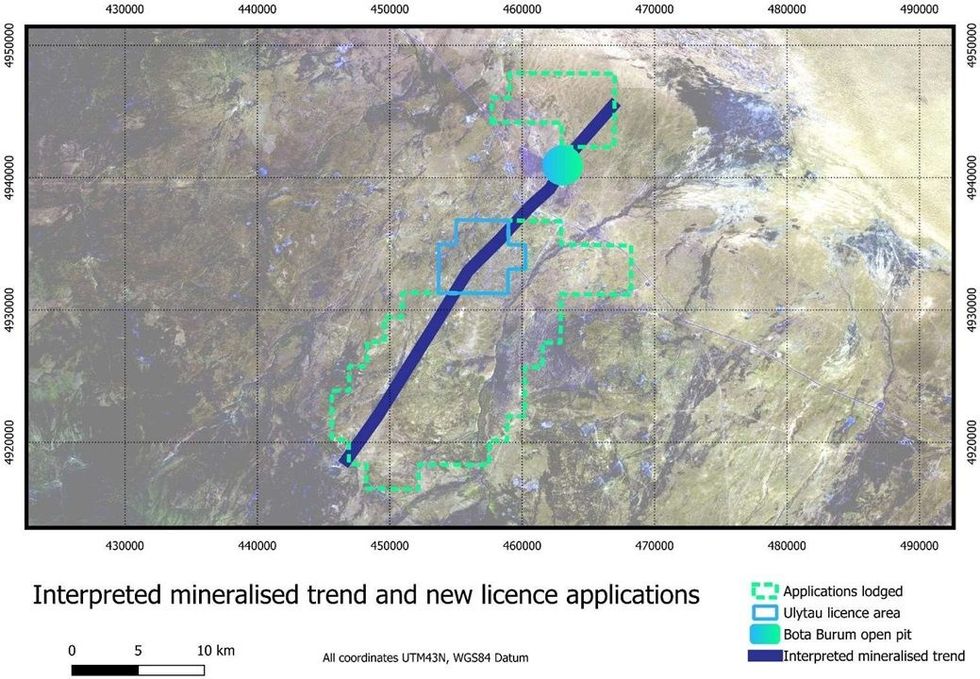

C29 Metals Limited (ASX:C29) (C29, or the Company) is pleased to announce that it has lodged two (2) new licence applications with the Kazakhstan ministry of Natural Resources. The licenses are designed to cover ~18km of additional prospective strike that the C29 geologists have interpreted as potentially being in the same mineralised trend that hosts the high grade Ulytau Uranium Project and may contain further high-grade uranium mineralisation.

HIGHLIGHTS

- C29 Metals has lodged two (2) new licence applications around the high grade Ulytau Uranium project. The combined size of the applications is ~252km2.

- The Company has held two (2) community consultation days at the local community of Aksuyek. The local community of Aksuyek have shown their strong support for the Company’s planned exploration programs.

- A Social Support Agreement has been signed with the district government, providing the framework for the Company to assist the village of Aksuyek with projects aligned to the social development of the community.

- The approval process for the Company’s planned exploration programs is at an advanced stage & on track.

- The Ulytau Uranium Project contains a Non-JORC foreign estimate of 9.85M/lbs Uranium @ 2,790ppm. *

- Multiple non-JORC foreign drill intersects >6,000ppm U308 from surface have been recorded. *

*Cautionary statement: The foreign estimates and foreign exploration results in this announcement are not reported in accordance with the JORC code 2012. A competent person has not done sufficient work to classify the foreign estimate as a Mineral Resource, or disclose the foreign exploration results, in accordance with the JORC Code 2012. It is uncertain that following evaluation and/or further exploration work the foreign estimate will be able to be reported in accordance with the JORC Code 2012, and it is possible that following further evaluation and/or exploration work that the confidence in the prior reported foreign exploration results may be reduced when reported under the JORC Code 2012. Nothing has come to the attention of the Company that causes it to question the accuracy or reliability of the foreign exploration results, but the Company has not independently validated the foreign exploration results and therefore is not to be regarded as reporting, adopting or endorsing the foreign exploration results.

C29 Metals Managing Director, Mr Shannon Green, commented:

“It is very exciting to have these highly prospective applications lodged as the Company has been moving very quickly in accordance with its stated strategic plan to rapidly grow our prospective footprint in Kazakhstan. The fact that these applications are interpreted as potentially being in the same mineralised trend that hosts the high grade Ulytau Uranium Project is extremely exciting for the Company’s growth aspirations and our exploration programs moving into 2025. It is also very pleasing to be receiving such positive support from our local community and key stakeholders”.

Figure 1 below shows the interpreted mineralised uranium trend with the new licence applications.

Application Information

The Southern application (application number 1905-EA, lodged 17/07/2024) is contiguous with the Ulytau licence area, and sits immediately to the South and East of the Ulytau Uranium project tenement boundaries. The Southern application area is ~213 km2.

The Northern application (application number application number 1913-EA, lodged 17/07/24) sits to the north of the Ulytau Uranium project tenement and immediately North of the historic Bota Burum Uranium mine. The Northern licence application area is ~39 km2.

Click here for the full ASX Release

This article includes content from C29 Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

C29:AU

The Conversation (0)

21 October 2025

C29 Metals to drill Sampsons Tank Copper Project

C29 Metals (C29:AU) has announced C29 Metals to drill Sampsons Tank Copper ProjectDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

C29 Metals (C29:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

01 July 2025

C29 Metals shifts focus to Mayfield Copper Project

C29 Metals (C29:AU) has announced C29 Metals shifts focus to Mayfield Copper ProjectDownload the PDF here. Keep Reading...

11 May 2025

Multiple New Multi-Commodity Targets

C29 Metals (C29:AU) has announced Multiple New Multi-Commodity TargetsDownload the PDF here. Keep Reading...

04 May 2025

C29 Signs Binding HOA to Drive Growth

C29 Metals (C29:AU) has announced C29 Signs Binding HOA to Drive GrowthDownload the PDF here. Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00