October 15, 2023

Titan Minerals Limited (Titan or the Company) (ASX:TTM) is pleased to announce the results of a recently completed 3-dimensional Induced Polarisation (3D IP) geophysical survey at the Company’s 100% held Linderos Project (Linderos) in southern Ecuador.

Key Highlights

- 2-kilometre diameter IP chargeability anomaly indicates that the Copper Ridge porphyry and Meseta epithermal gold prospects are part of the same system, and that additional porphyry mineralisation potentially sits just below Meseta

- Potential for much larger porphyry system unveiled, with IP chargeability mapping phyllic alteration well beyond currently defined Copper Ridge porphyry mineralisation

- Next phase of drilling being planned to test lateral and depth extensions at Copper Ridge Porphyry and the potential for porphyry mineralisation below Meseta

- Regional generative exploration continues across broader project with other prospect areas being advanced with detailed mapping and surface geochemistry programs

Titan’s CEO Melanie Leighton commented:

“Results of the Linderos Project IP survey have confirmed our hypothesis that the Copper Ridge porphyry and Meseta epithermal gold mineral systems are intimately associated.

“A 2-kilometre chargeability anomaly has highlighted phyllic alteration/ sulphide mineralisation associated with a porphyry system to extend from Copper Ridge, all the way to the Meseta epithermal gold system in the north.

“This is a very exciting development for Titan, implying a much larger porphyry system than previously recognised by surface mapping, geochemistry, and drilling to date.

“The Company looks forward to drill testing the newly defined larger porphyry system in early 2024.”

IP Survey Unveils Large-Scale Porphyry Mineralisation Footprint

The 3D IP survey was completed by Zissou Peru (Zissou) and was designed to map the distribution of subsurface sulphide mineralisation and phyllic (pyrite) alteration associated with porphyry systems. The 3DIP survey covered an area of approximately nine square kilometres and included the Copper Ridge Porphyry (Copper Ridge), Meseta Gold (Meseta), Capa Rosa and Nueva Esperanza prospects.

Importantly, the 3D IP survey was successful in unveiling a much larger porphyry system than previously recognised in surface mapping, geochemistry, and limited drilling. It is evident from the IP survey that the Copper Ridge Porphyry system continues to the north and manifests beneath the Meseta Gold prospect (refer to figure 1). This is an exciting revelation and confirms the Company’s view that Linderos has the potential to host a much larger porphyry system.

A strong north-northwest trending chargeability anomaly was also identified on the eastern side of Copper Ridge at approximately 350 metres depth. This chargeability anomaly coincides with the end of drillholes CRDD22-003 (Figure 2) and CRDD22-006 (Figure 3), which both ended in strong copper mineralisation.

Copper mineralisation in these holes is observed to be associated with disseminated chalcopyrite (0.8%), pyrrhotite (2.5%), pyrite (0.4%) in CRDD23-003 and chalcopyrite (0.7%), pyrite (0.4%) in CRDD23-006.

The interpretation at the time of drilling these holes in late 2022, was that a larger porphyry copper intrusion could potentially be sitting just below these drillholes, with this now being verified by the 3DIP results.

This additional layer of geophysical information has further endorsed the Company’s view that we have only just begun to scratch the surface of the porphyry potential at the Linderos Project. This view is further reinforced by the presence of phyllic alteration and green-grey sericite overprinting potassic alteration.

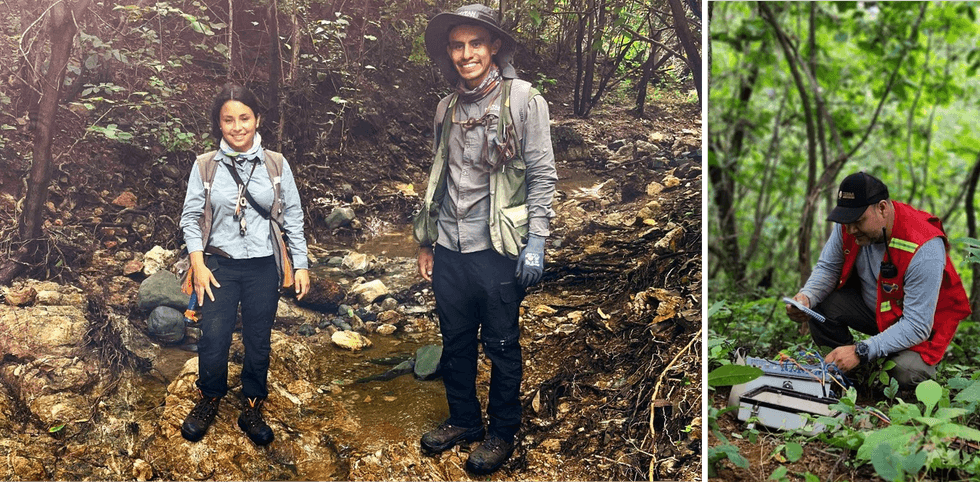

Titan’s geology team continue to expand their understanding of the porphyry system with further detailed mapping and surface geochemistry being collected and the phase 2 drill design being refined to accommodate this new information.

The Linderos Project also has several other areas of interest which have been identified from historical data and subsequently confirmed by geological data collected by Titan. These areas of significance require follow up work, with the geology team currently conducting mapping and surface geochemical sampling over a number of other high priority targets at the project.

The Company looks forward to providing further updates as results are received.

Click here for the full ASX Release

This article includes content from Titan Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TTM:AU

The Conversation (0)

31 March 2022

Titan Minerals

Developing Ecuador’s Underexplored High-Grade Mineral Deposits

Developing Ecuador’s Underexplored High-Grade Mineral Deposits Keep Reading...

23h

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

23h

Gold and Silver Stocks Dominate TSX Venture 50 List

This year's TSX Venture 50 list showcases a major shift in sentiment toward the mining sector. The TSX Venture 50 ranks the top 50 companies on the TSX Venture Exchange based on annual performance using three criteria: one year share price appreciation, market cap growth and Canadian... Keep Reading...

19 February

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

19 February

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

19 February

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00