(TheNewswire)

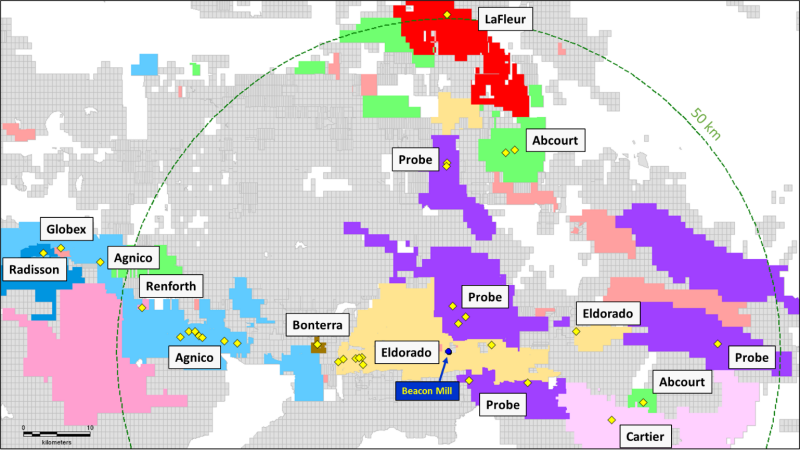

VANCOUVER, B.C. TheNewswire - January 27, 2025 - LaFleur Minerals Inc. ( CSE: LFLR, OTCQB: LFLRF ) (" LaFleur Minerals " or the " Company ") is pleased to provide an update on its 2025 exploration and development plans for its 100%-owned Swanson Gold Deposit (" Swanson ") and Beacon Gold Mill (" Beacon ") located near Val-d'Or, Québec in the Abitibi Gold Belt ( Figure 1 ).

SWANSON GOLD DEPOSIT AND FULLY PERMITTED BEACON GOLD MILL, VAL-D'OR, QUEBEC, CANADA

The 100% Company owned Swanson Gold Deposit hosts an Indicated Mineral Resource of 2,113,000 t with an average grade of 1.8 g/t gold for 123,400 oz of contained gold and Inferred Mineral Resource Estimate of 872,000 t with an average grade of 2.3 g/t gold for 64,500 oz of contained gold ( source: NI 43-101 technical report with an effective date of September 17, 2024 and filed on the Company's SEDAR+ profile ).

Swanson Gold Deposit is located within 50 km of the Company's Beacon Gold Mill, which is fully permitted and underwent approximately $20,000,000 in upgrades from 2021-2022 by its previous owner. The Beacon Mill is currently being evaluated for processing mineralized material from the Swanson Gold Deposit as part of a high-level preliminary mining and economic study.

The Company recently completed a very high-resolution airborne magnetics and VLF-EM geophysics program over the entire Swanson Gold Deposit and the final processed results from Novatem Inc. are currently being interpreted. The airborne geophysics results will be disclosed once final interpretations are complete. An oriented soil geochemistry and prospecting program was also completed by IOS Géosciences (IOS) with final assay results still pending from the laboratory.

An Induced Polarization (IP) - Resistivity ground geophysics survey totalling 166 line-km will be completed from January to February 2025 at approximately 200 m line spacings and cover the Swanson, Bartec, and Jolin deposits, which are all advanced gold targets with current and historical mineral resources.

OVER $3M IN FINANCINGS RECENTLY COMPLETED

The Company recently closed a $2,832,000 flow-through (FT) financing and the first tranche of a non-FT financing with gross proceeds of $175,019.70 and these funds will be spent on exploration and drilling programs at its Swanson and Beacon Deposits. The Company plans to complete the following exploration and development programs in the coming weeks:

-

Results from the recent very high-resolution airborne magnetics and VLF-EM geophysics program, soil geochemistry and prospecting program, and upcoming IP ground geophysics survey will be used to define multiple drilling targets along interpreted major structural breaks at Swanson with the goal to increase mineral resources to well over 1M contained gold ounces.

-

Up to 10,000 m of diamond drilling is expected to commence at Swanson in early to mid-2025 once drill hole targeting exercises are completed by the Company's technical team and drilling permits have been obtained from the Québec government;

-

High-level preliminary mining and economic study results for Swanson and Beacon are expected in Q1-2025 from independent mining consultants and will drive the Company's plans to quickly advance these Deposits to a Pre-Feasibility Study in 2025 to commence production at Swanson as soon as possible. The Company is also evaluating other gold Deposits and mineral resources located within a 50 to 100 km radius of the Beacon Mill as potential mill feed in addition to the Swanson and Beacon deposits; and

-

Planning work has commenced to restart the Beacon Gold Mill, which has been under full care and maintenance since early 2023 and is currently capable of processing 750 tonnes per day. The Company is working with local mining services contractor ABF Mines to develop a restart plan, which includes ongoing maintenance and repairs, potential upgrades to the mill to increase production, and staffing considerations.

Paul Ténière, CEO of LaFleur Minerals Commented, " We are excited about our 2025 strategic plans that include aggressive exploration and drilling programs at the Swanson and Beacon deposits now that we have completed just over $3M in recent financings. Our immediate plan is to continue to increase gold resources through diamond drilling at Swanson, Bartec, Jolin, and other gold deposits and simultaneously restarting the Beacon Mill to eventually process mineralized material from the Swanson Gold Deposit and other deposits in the Abitibi Gold Belt as soon as possible. 2025 is expected to be a transformational year for LaFleur Minerals as we embark on an aggressive path to production. In addition, to expanding our gold resource at our Swanson Gold Deposit, we are looking to consolidate other "gold ounces" within vicinity of our fully-permitted Beacon Gold Mill."

Figure 1: Gold deposits and mines within a 50 km radius of Beacon Mill including Swanson Gold Deposit (in red)

Qualified Person Statement

All scientific and technical information in this news release has been prepared and approved by Louis Martin, P.Geo., Technical Advisor to the Company and considered a Qualified Person for the purposes of NI 43-101.

About LaFleur Minerals Inc.

LaFleur Minerals Inc. (CSE: LFLR, OTCQB: LFLRF ) is focused on the development of district-scale gold Deposits in the Abitibi Gold Belt near Val-d'Or, Québec. Our mission is to advance mining Deposits with a laser focus on our resource-stage Swanson Gold Deposit and the Beacon Gold Mill and Property, which have significant potential to deliver long-term value. The Swanson Gold Deposit is over 15,000 hectares (150 km 2 ) in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. LaFleur has recently consolidated a large land package along a major structural break that hosts the Swanson, Bartec, and Jolin gold deposits and several other showings which make up the Swanson Gold Deposit. The Swanson Gold Deposit is easily accessible by road with a rail line running through the property allowing direct access to several nearby gold mills, further enhancing its development potential. Lafleur Minerals' fully-refurbished and permitted Beacon Gold Mill is capable of processing over 750 tonnes per day and is being considered for processing mineralized material at Swanson and for custom milling operations for other nearby gold Deposits.

ON BEHALF OF LAFLEUR MINERALS INC.

Paul Ténière, P.Geo.

Chief Executive Officer

E: info@lafleurminerals.com

LaFleur Minerals Inc.

1500-1055 West Georgia Street

Vancouver, BC V6E 4N7

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this news release.

1. Cautionary Statement Regarding "Forward-Looking" Information

2. This news release includes certain statements that may be deemed "forward-looking statements". Forward-looking statements in this news release include, but are not limited to, statements about the Offering and the Company's expectations with respect to the foregoing. Factors that could cause future results to differ materially from those anticipated in forward-looking statements in this news release include the tax treatment of the FT Shares. All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "Deposits", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, political and regulatory risks associated with mining and exploration, risks related to environmental regulation and liability. the potential for delays in exploration or development activities or the completion of feasibility studies, risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits, risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, results of prefeasibility and feasibility studies, the possibility that future exploration, development or mining results will not be consistent with the Company's expectations, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those Deposited in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Copyright (c) 2025 TheNewswire - All rights reserved.