October 03, 2024

Operating in Kazakhstan since 2008, Jupiter Energy (ASX:JPR) is an established oil exploration and production company producing approximately 600 to 700 barrels of oil per day. The company's operations are fully compliant, with its three commercial production licenses secured until 2045/46/49. Jupiter Energy’s reserve base has been independently confirmed by a Sproule International competent person’s report (CPR), effective 31 December 2023, detailing significant recoverable reserves.

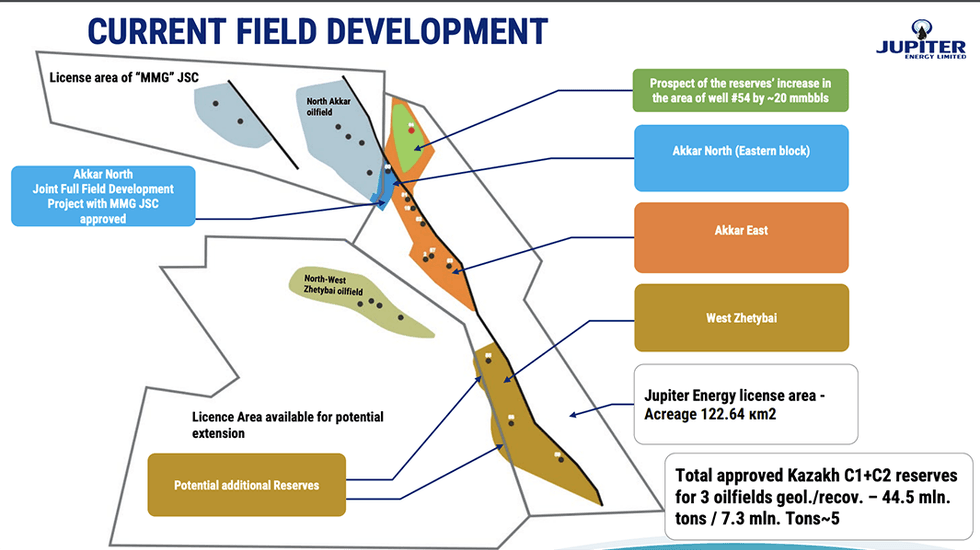

Jupiter has successfully transitioned its oilfields through the various regulatory phases required to reach full commercial production. Its three oilfields – Akkar East, Akkar North (East Block) and West Zhetybai – all operate under their respective 25-year full commercial licences. The company’s established compliance and operational framework underline its commitment to long-term sustainable production in Kazakhstan.

Block 31 is Jupiter Energy’s flagship project located in the Mangistau Basin of West Kazakhstan. Covering an area of approximately 123 sq km, it lies in a highly prospective region with proven oil reserves. The company acquired extensive 3D seismic data over the entire block and surrounding areas, totaling 235 sq km, which then enabled the identification of multiple drilling targets.

Company Highlights

- Operating in Kazakhstan since 2008, with three oilfields under licence.

- Holds commercial production licenses for all three oilfields, valid until 2045/2046/2049.

- Current production is approximately 640 barrels per day from four wells, with plans to increase to approximately 1,000 barrels per day by the end of 2024.

- After-tax NPS (20 percent discount) of US$180 million, with an EV of approximately AU$54 million (~US$36 million) – based on a share price of AU$0.025 per share.

- Operates in West Kazakhstan in the Mangistau region, a proven area for Kazakhstan’s oil reserves.

- The company is cash flow positive at the operational level.

- Key shareholders include Waterford (60.5 percent) and Blackbird Trust (21 percent), aligning interests and providing stability.

- Jupiter’s strategic investment in gas utilisation infrastructure, signifies its commitment to sustainable operations and its contribution to the welfare of the local community.

This Jupiter Energy profile is part of a paid investor education campaign.*

Click here to connect with Jupiter Energy (ASX:JPR) to receive an Investor Presentation

JPR:AU

The Conversation (0)

21 October 2025

Sep25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Sep25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

21 October 2025

Sep25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Sep25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Jun25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Jun25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

22 May 2025

Variation to Noteholder Agreements

Jupiter Energy (JPR:AU) has announced Variation to Noteholder AgreementsDownload the PDF here. Keep Reading...

18h

Syntholene Energy Selects Dynelectro, Developer of "World's Most Efficient Electrolyzer" as Vendor for Synthetic Fuel Demonstration Facility

Relationship Represents Potential Long Term Scalability of High Efficiency Supply Chain from Demonstration to Commercial ScaleSyntholene Energy CORP (TSXV: ESAF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene" or the "Company") announces that it has selected Dynelectro ApS (Denmark) as the electrolyzer... Keep Reading...

18h

Syntholene Energy Selects Dynelectro, Developer of "World's Most Efficient Electrolyzer" as Vendor for Synthetic Fuel Demonstration Facility

Relationship Represents Potential Long Term Scalability of High Efficiency Supply Chain from Demonstration to Commercial ScaleSyntholene Energy CORP (TSXV: ESAF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene" or the "Company") announces that it has selected Dynelectro ApS (Denmark) as the electrolyzer... Keep Reading...

09 February

Syntholene Energy Corp. Announces Upsize to Previously Announced Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it will be increasing the size of its previously announced... Keep Reading...

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00