April 14, 2025

Invion (ASX:IVX) is a clinical-stage Australian life sciences company pioneering the next generation of photodynamic therapy (PDT) for the treatment of cancer and infectious diseases. Invion is advancing a transformative approach to disease treatment and diagnosis with a platform grounded in preclinical promise and growing clinical validation.

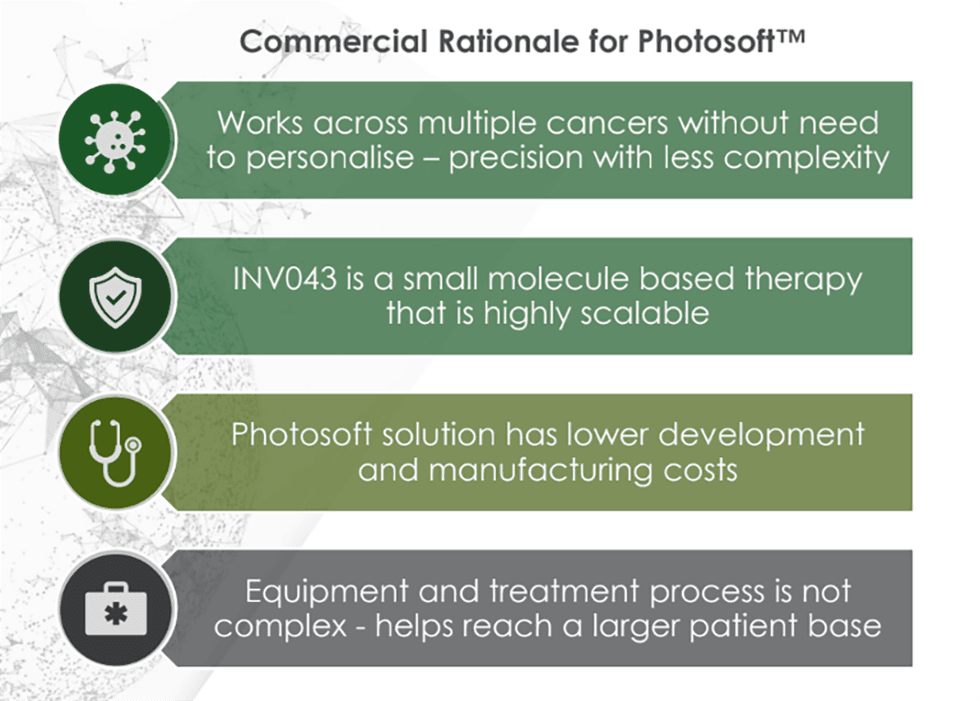

At the core of Invion’s platform is Photosoft, a proprietary suite of next-generation photosensitizers that selectively accumulate in diseased cells. Upon light activation, these compounds trigger a targeted oxidative stress response, leading to cell death with high precision. Unlike traditional PDT agents, Photosoft compounds are engineered to overcome the limitations of toxicity, off-target damage, and limited immune engagement. They are designed to deliver enhanced safety, selectivity, immune system activation, and theragnostic capabilities.

Invion is strategically expanding its clinical and commercial footprint through non-dilutive global partnerships that accelerate development while preserving shareholder value. In South Korea, Hanlim Pharm is fully funding the preclinical development of Photosoft for two high-need indications: glioblastoma multiforme (GBM) — one of the most aggressive and treatment-resistant brain cancers — and oesophageal cancer. Under the terms of the partnership, Hanlim covers all development costs, while Invion retains full ownership of the underlying intellectual property, positioning the company to benefit from future global opportunities.

Company Highlights

- Clinical-stage Pipeline in Multiple Indications: Successfully completed Phase II prostate cancer trial, ongoing Phase I/II skin cancer trial, and anogenital cancer trial initiating in 2025. Multiple cancer and infectious disease programs underway.

- Photosoft Platform Technology: Combines cancer selectivity, immune system activation, and minimal toxicity. Preclinical studies show INV043 can regress multiple cancers, deliver superior safety and efficacy and improve tumour control to 80 percent in combination therapy studies with blockbuster ICIs (vs 12 percent with ICIs alone).

- Renowned Partners & Global Pharma-funded Collaborations: Working with distinguished research institutions like Peter MacCallum Cancer Centre and Hudson Institute of Medical Research. Further, Hanlim Pharm (GBM, oesophageal cancer) and Dr.inB (HPV) are funding multiple programs without requiring Invion to contribute capital or give up IP.

- Theragnostic Capability: Photosoft compounds enable both treatment and imaging, allowing for highly precise cancer targeting and enhanced surgical decision-making.

- Strong Clinical and IP Foundation: GMP-grade INV043 manufactured and patented in Australia, with global IP protection extending to at least 2041.

- Compelling Upside: Following a share consolidation and reduced overhangs, IVX offers significant re-rating potential with multiple clinical readouts expected over the next six to 12 months.

This Invion profile is part of a paid investor education campaign.*

Click here to connect with Invion (ASX:IVX) to receive an Investor Presentation

IVX:AU

The Conversation (0)

22 December 2025

Hanlim & Korean Government Fund Pathway to Clinical Trial

Invion Limited (IVX:AU) has announced Hanlim & Korean Government Fund Pathway to Clinical TrialDownload the PDF here. Keep Reading...

02 December 2025

Invion Secures Expanded Photosoft Global Exclusive License

Invion Limited (IVX:AU) has announced Invion Secures Expanded Photosoft Global Exclusive LicenseDownload the PDF here. Keep Reading...

30 October 2025

Appendix 4C and Quarterly Activities Report - September 2025

Invion Limited (IVX:AU) has announced Appendix 4C and Quarterly Activities Report - September 2025Download the PDF here. Keep Reading...

20 October 2025

Funded Collaboration Agreement with Protect Animal Health

Invion Limited (IVX:AU) has announced Funded Collaboration Agreement with Protect Animal HealthDownload the PDF here. Keep Reading...

09 October 2025

Repayment of Lind Facility with Successful Capital Raise

Invion Limited (IVX:AU) has announced Repayment of Lind Facility with Successful Capital RaiseDownload the PDF here. Keep Reading...

13 January

DCVC, NVIDIA Back Proxima’s US$80 Million Bet on AI Drug Discovery

Artificial intelligence (AI) biotech startup Proxima has raised US$80 million in seed funding to accelerate the development of drugs that modulate protein-to-protein interactions.The financing round was led by Data Collective Venture Capital (DCVC), with participation from NVIDIA's (NASDAQ:NVDA)... Keep Reading...

05 January

Top 5 Small-cap Pharma Stocks (Updated January 2026)

Today's pharmaceutical stocks are facing the challenges of government-imposed drug price caps, waning demand for COVID-19 vaccines and global stock market upheaval. However, the industry's major underlying drivers — higher rates of cancer and chronic disease — are still at play and not expected... Keep Reading...

05 January

5 Best-performing Canadian Pharma Stocks (Updated January 2026)

From established players to up-and-coming firms, Canada's pharmaceutical landscape is diverse and dynamic.Canadian drug companies are working to discover and develop major innovations amidst an increasingly competitive global landscape. Rising technologies such as artificial intelligence are... Keep Reading...

31 December 2025

Pharma Market Forecast: Top Trends for Pharma in 2026

The pharmaceutical sector is entering 2026 at a critical juncture. While recent initial public offering (IPO) performance has been stellar, with pharma firms claiming five of the top 10 IPO returns this year, the outlook next year is dominated by significant investment headwinds. Large,... Keep Reading...

17 December 2025

InMed Announces Results of 2025 Annual General and Special Meeting

InMed Pharmaceuticals Inc. (NASDAQ: INM) ("InMed" or the "Company"), a pharmaceutical company focused on developing a pipeline of proprietary small molecule drug candidates for diseases with high unmet medical needs, today confirmed that, at its annual general and special meeting of shareholders... Keep Reading...

12 December 2025

InMed Provides Update on BayMedica Commercial Business

InMed Pharmaceuticals Inc. (NASDAQ: INM) ("InMed" or the "Company"), a pharmaceutical company focused on developing a pipeline of proprietary small molecule drug candidates for diseases with high unmet medical needs, today released the following statement.Recently, H.R. 5371, the "Continuing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00