January 15, 2025

Magnetic Resources NL (ASX:MAU) (Magnetic or the Company) has announced Increased Lady Julie Gold Project Resource and Project Update.

HIGHLIGHTS

- Magnetic Resources is pleased to provide an update to its flagship Lady Julie Gold Project (LJGP), an exciting new gold development currently in an advanced Feasibility stage. The project is located near Laverton in WA and will comprise three open pits, a CIL processing plant and all associated infrastructure.

- Recent deeper infill drilling at Lady Julie North 4 (LJN4) has significantly increased resource confidence and continuity of mineralisation, whilst also expanding gold inventory (relative to the July 2024 ASX update). This will assist in building a substantial future mining reserve.

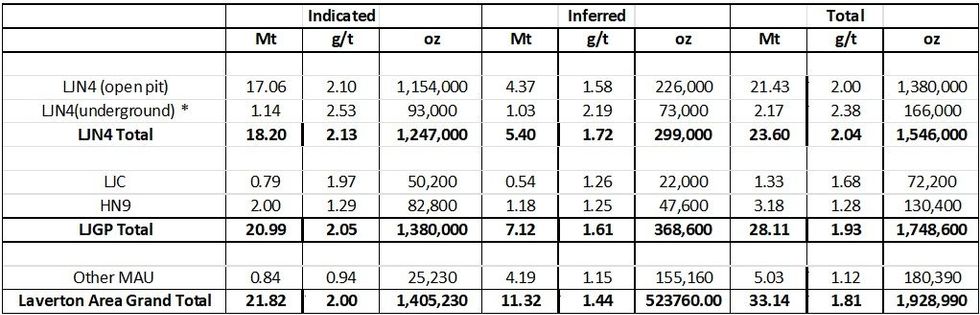

- The updated Combined Mineral Resources Estimate (Table 1) for LJGP:

- 28.11 Mt at 1.93g/t Au containing 1.75Moz of gold at 0.5/1.5g/t cutoffs1.

- 75% of the combined resource is now in Indicated category (previously 68%).

- The updated Combined Laverton Region Mineral Resource Estimate (Table 1):

- 33.14 Mt at 1.81g/t Au containing 1.93Moz of gold at 0.5/1.5g/t cutoffs1.

- On the basis of the strong resource development below the planned open pit, a scoping exercise has been completed to study the potential for operating an underground mine concurrently with the open pit. The study found that a concurrent underground operation producing 550,000tpa of higher-grade ore would add significantly to project value, with total output of 150,000oz pa over an 8-year project life. Commencement of underground access development would be scheduled for year two to minimize the potential for disruption of the main part of the project. More detailed design of access, stoping and fill systems will commence in late January 2025.

- As a result of this scoping exercise, the processing plant design capacity is being boosted to 2.75Mtpa to treat a combined open pit/underground feed. A key change with the scale increase will be in comminution where a ball/SAG mill circuit is now proposed in place of multistage crushing/ball mill. The plant design and costing will be completed in early February.

- Metallurgical testwork is continuing to optimize the treatment process with differing lithology units.

- A Mining Proposal has been submitted to DEMIRS for approval. The proposal is in support of the application for two new Mining leases and a new Miscellaneous lease covering the remainder of the project footprint (see Figure 1). The combined project area of 1,424Ha is now under application.

- With some late changes to the Feasibility Study, the aim remains to complete the Study by the end Q1 2025.

Note 1:

The cutoff grade is considered appropriate for a large-scale open pit operation and in the case of LJN4, is applied to a depth of 400m below surface. It should be noted that the pit resource does not consider any restraining factors which may influence the final pit design in the feasibility study.

The mineralisation deeper than 400m below surface shows strong continuity and therefore is amenable to underground mining. On the basis of a gold price of A$3600/oz and economic modelling of an underground operation, a cutoff grade of 1.5g/t Au is considered appropriate and has been applied to this portion of the model. As above, constraints applied to a pit design at Feasibility may lead to an increase in the resource available for underground extraction.

The verification and reporting of Mineral Resources on behalf of the Company was completed by its JORC Competent Person, Mr. M Edwards of Blue Cap Mining. The Mineral Resources Estimate has been prepared and reported in accordance with the 2012 Edition of the JORC Code.

Managing Director George Sakalidis commented:

“The LJN4 resource has been the Company’s primary drilling focus over recent months with the completion of infill drilling and some extension drilling at depth in the northern part of LJN4, which consists of thick strongly altered zones mainly associated with intensely fuchsite altered ultramafic rock types.

Two deeper holes are being planned testing for deeper extensions of the main ultramafic-hosted lodes, which are still open at depth and one deeper hole beneath the southern breccia- silica-pyrite lode. The LJN4 deposit sits within a regional structure called the Chatterbox Shear Zone that extends over 12km in length within the Magnetic tenements and remains as a prospective target zone where RC drilling has been recently completed.

The Lady Julie Gold Project Pre-Feasibility Study was released to the ASX on 7 March 2024. The project now envisaged and advanced planning is at a scale to provide more credibility to the wider industry and offer more substantial value to shareholders.

Most of the background work has now been completed to take this to feasibility study level of accuracy. The submission of a Mining Proposal and application for Mining Leases are key steps in the regulatory approval process.”

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

1h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

6h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

8h

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

8h

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

9h

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

18h

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00