- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

August 12, 2024

Leeuwin Metals Ltd (Leeuwin or the Company) (ASX: LM1) is pleased to announce that results have been received from first pass rock chip sampling program conducted at its West Pilbara Iron Ore Project in Western Australia.

HIGHLIGHTS

- Highly encouraging iron ore rock chips from first pass exploration at the West Pilbara Project, Western Australia.

- Significant rock chip results include:

- 55.27% Fe, 62.4% Ca Fe, 2.27% Al2O3, 6.74% SiO2, 0.02% P, 11.42% LOI

- 54.94% Fe, 62.22% Ca Fe, 2.1% Al2O3, 7.1% SiO2, 0.015% P, 11.7% LOI

- 53.73% Fe, 60.27% Ca Fe, 2.65% Al2O3, 8.88% SiO2, 0.002% P, 10.85% LOI

- 52.08% Fe, 58.35% Ca Fe, 2.82% Al2O3, 10.02% SiO2, 0.470% P, 10.75% LOI

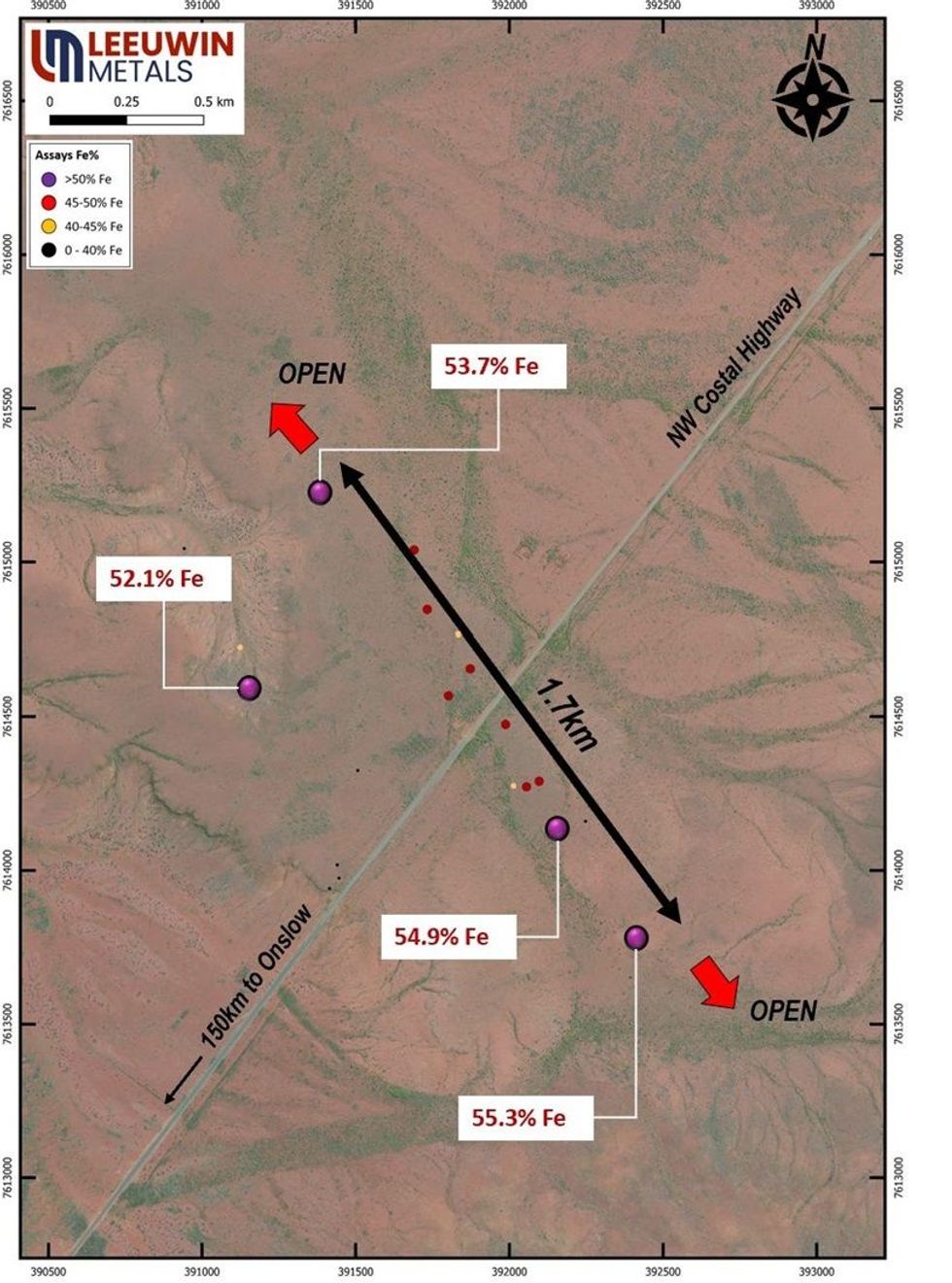

- Large scale mineralisation evident over 1.7km of strike and remains open.

- Evidence of Channel Iron Deposit (CID) mineralisation 13 km north of Rio Tinto’s Mesa A mine.

- Follow-up fieldwork planned for the coming weeks to expand the footprint of mineralisation.

- The project added to Leeuwin’s portfolio is a result of internal project generation.

Managing Director, Christopher Piggott, commented:

“The assay results received from West Pilbara Iron Ore Project provide an exciting start to revealing the extent of a potential CID deposits in a world class region in Western Australia. With these first pass results there is potential for a project of scale, with encouraging grades and low impurities. The Pilbara is home to World Class Iron Ore mines with the region well supported by excellent infrastructure within access to Leeuwin’s tenure.

With exploration ongoing by Leeuwin’s dedicated staff at the Cross Lake Lithium Project in Manitoba, Canada and work programs running in parallel by the Western Australia team, we look forward to providing strong news to market in the second half of 2024.”

West Pilbara Iron Ore Project

The West Pilbara Iron Ore Project (the Project) has identified compelling iron ore targets, returning highly encouraging iron ore values of over 50% Fe along a 1.7 km strike. This target area was identified through satellite imagery and regional mapping. Mineralisation remains open along strike with follow up field work to commence in the coming weeks.

Overview

The Project area is prospective for Channel Iron Deposit (CID) with multiple target areas present within the Project. The target areas are located close to the North-West Costal Highway, with excellent infrastructure being 150km southwest of Ashburton Port (Onslow) and Port of Port Headland 380km northeast accessed via sealed highway. Situated in close proximity to Rio Tinto’s Mesa A mine, CZR Resources' Robe Mesa project, and Macro Metals' Deepdale project refer Figure 2.

Today’s results (refer Appendix B for full details) are located just 13 km north of Rio Tinto’s Mesa A mine, which is a substantial Channel Iron Deposit (CID) mineralisation. This strategic location not only aligns us with significant industry players but also enhances our prospects to advance any discovery within the project.

Click here for the full ASX Release

This article includes content from Leeuwin Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11 November 2025

BHP Invests AU$944 Million in Western Australia Communities

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has released its 2025 Community Development Report for Western Australia, demonstrating a record-breaking investment of AU$944 million. According to the report, a majority of this year’s investment went to local suppliers, with AU$737 million spent. Of this, AU$529... Keep Reading...

02 April 2025

Fortescue's Forrest Hones in on Renewable Energy, Aims to Go Green by 2030

Andrew Forrest, founder and executive chair of major mining company Fortescue (ASX:FMG,OTCQX:FSUMF), has been making headlines following his bold statements on renewable energy.Toward the end of February, the mining tycoon was quoted as saying that Fortescue is quitting fossil fuels. According... Keep Reading...

10 March 2025

Rio Tinto Plans US$1.8 Billion Investment in BS1 Extension, Completes Arcadium Acquisition

Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) made headlines after two announcements on March 6. The mining giant said it will invest US$1.8 billion to develop the Brockman Syncline 1 mine project (BS1), a move that will extend the life of the Brockman region in West Pilbara, Western Australia.BS1 now... Keep Reading...

13 August 2024

Australia's Mining Dilemma: Can ESG Goals and Competitive Production Coexist?

With investors placing increasing value on environmental, social and governance (ESG) issues, mining companies are having to choose between maintaining competitive production and promoting ESG principles. That's the topic explored in an August 8 report from Callum Perry, Solomon Cefai, Alice Li... Keep Reading...

27 February 2020

Rio Tinto to Invest US$1 Billion to Reach Zero Emissions Goal by 2050

Mining giant Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO) is set to invest US$1 billion in the next five years to reach its new climate change targets. The company is aiming to reduce emissions intensity by 30 percent and absolute emissions by a further 15 percent from 2018 levels by 2030. “Climate... Keep Reading...

02 January 2020

Iron Outlook 2020: Prices to Stabilize Following Supply Shock

Click here to read the latest iron outlook. Iron ore prices have come off their highest level of 2019, but are still ending on a high note. The year was marked once again by a disaster in the space, with Vale’s (NYSE:VALE) news of a dam collapse in January remaining in the spotlight throughout... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00