March 10, 2024

Australian Vanadium Limited (ASX: AVL, “the Company” or “AVL”) is pleased to announce progress on the work being undertaken by the Company to integrate the two adjoining projects located across one orebody, following the successful completion of its merger with Technology Metals Australia (TMT).1

KEY POINTS

- Following the recent merger, metallurgical testwork confirms the trend of higher vanadium and iron concentrate grades towards the south of the combined project and supports further investigation of a commercial scale ilmenite product.

- Vanadium concentrate grades for Block 70 average up to 1.6% V2O5, consistent with the results from the Yarrabubba deposit (Block 80).

- Higher iron grade in concentrate averages greater than 60% for Block 70.

- Results suggest a high-grade project can be optimised across an unconstrained southern strike extent, with potential for increased economic benefits.

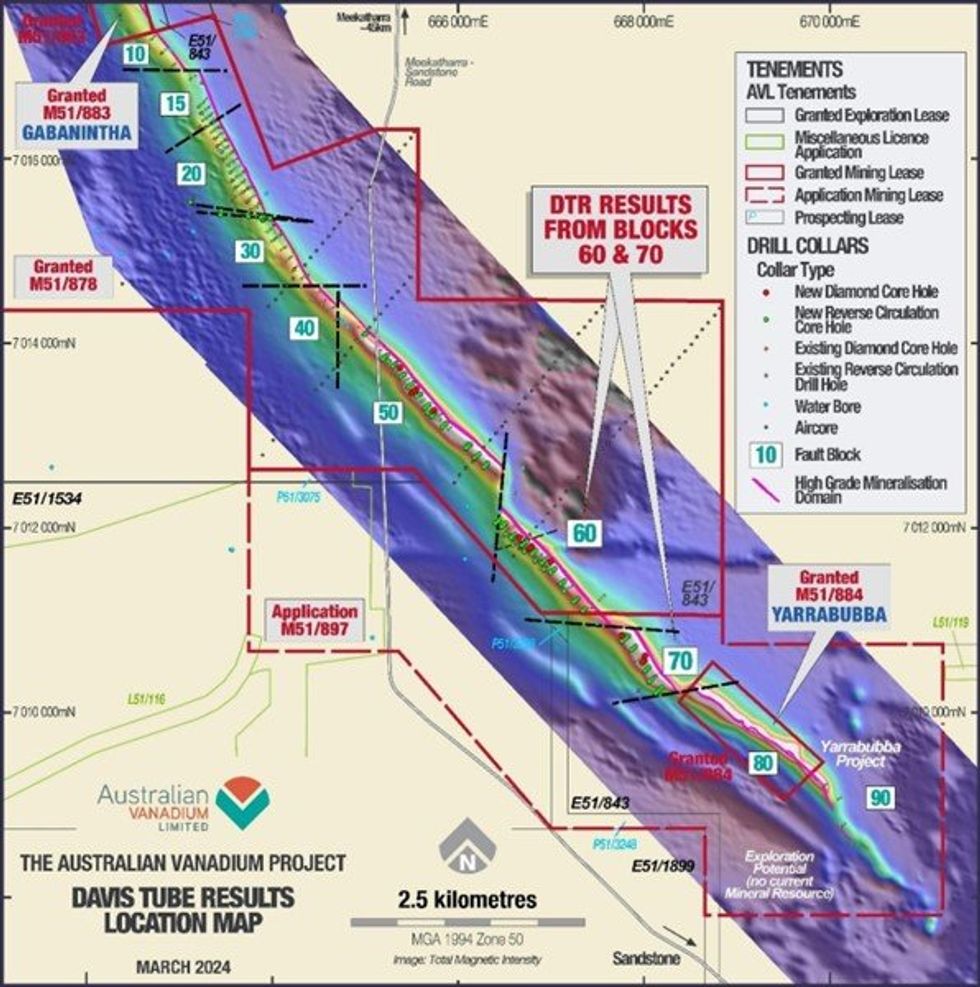

Prior to the merger, TMT owned tenements at the northern end of the orebody and a small block at the southern end of the orebody, known as the Yarrabubba deposit. The Yarrabubba deposit was entirely surrounded by AVL’s tenements, significantly constraining development by TMT (see Figure 1 below).2

As part of the Optimised Feasibility Study (OFS) being conducted by AVL to inform the preferred project development pathway for the integrated project,1 work has progressed to maximise the possible economic return through access to the high-grade southern area of the orebody, which previously straddled the two projects. This work has included metallurgical testwork on parts of the orebody adjoining the Yarrabubba deposit.

CEO, Graham Arvidson comments, “This testwork bolsters our view that a long-life, high-grade integrated project at the southern areas of the combined project can be defined quickly based on historical work by removing the constraints from TMT’s previously landlocked Yarrabubba deposit and adding to it similar mineralisation within the historical AVL deposit. The team will use this testwork within the broader integration studies, with the aim of improving the economics of the project via reduced capital and operating costs. This has the potential to deliver a material increase in value for our shareholders.”

The combined project on one orebody is broken by several regional scale faults which split the deposit into a series of blocks. The Yarrabubba deposit has now become Block 80 of AVL’s combined deposit and abuts AVL’s Block 70 deposit (see Figure 1 above).

Click here for the full ASX Release

This article includes content from Australian Vanadium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AVL:AU

The Conversation (0)

29 April 2024

Australian Vanadium

An Australian vanadium leader

An Australian vanadium leader Keep Reading...

09 February

Western Australia Implements 2.5 Percent Vanadium Royalty Rate

A royalty rate of 2.5 percent has been applied to all vanadium products in Western Australia as of February 4, 2026.In a joint announcement by Minister for Mines and Petroleum David Michael and Minister for Energy and Decarbonisation Amber-Jade Sanderson, the government said that the new rate... Keep Reading...

21 January

Vanadium Market Forecast: Top Trends for Vanadium in 2026

The vanadium market remained subdued in H1 2025, weighed down by persistent oversupply and weak usage from the steelmaking sector, even as new demand avenues like energy storage gained attention.Price data shows that vanadium pentoxide in major regions such as the US, China and Europe traded in... Keep Reading...

20 January

Carbon Black Substitute Memorandum of Understanding

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer and developer of the large Balasausqandiq vanadium deposit in Southern Kazakhstan, is pleased to announce that it has entered into a non-binding, non-exclusive, memorandum of understanding ("MOU") for the supply of up to 360,000... Keep Reading...

25 July 2025

Top 5 Australian Mining Stocks This Week: Vanadium Resources Soars on DSO Offtake Deal

Welcome to the Investing News Network's weekly round-up of Australia’s top-performing mining stocks on the ASX, starting with news in Australia's resource sector.This week, gold companies continued to shine in Australia, joined by battery and base metals explorers and developers. In corporate... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00