May 21, 2023

Ora Gold Limited (“Ora” or the “Company”, ASX: OAU) is pleased to announce further high-grade gold intercepts from reverse circulation (RC) drilling at the Crown Prince Gold Prospect (M51/886).

Highlights:

- Further assay results from the company’s RC drilling at the Garden Gully Gold Project have been received.

- High-grade gold results returned from South-Eastern Ore Body (SEB). These results come from the down dip parts of the SEB structure and Au-bearing quartz lode within fresh, sheared-dolerite (i.e. primary zone / fresh rock). Best intercepts include:

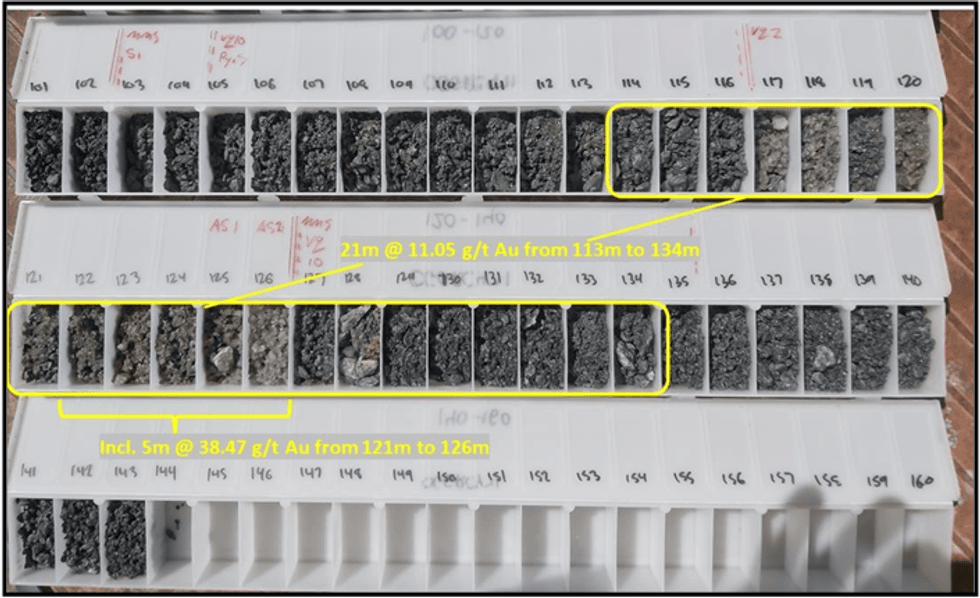

- 21m @ 11.05g/t Au from 113m in OGGRC471, incl. 9m @ 22.24g/t Au from 121m

- 24m @ 3.96g/t Au from 27m in OGGRC477 incl. 8m @ 7.27g/t Au from 35m

- 17m @ 1.85g/t Au from 101m in OGGRC480, incl. 7m @ 3.5g/t Au from 111m

- 5m @ 6.13g/t Au from 182m in OGGRC468, and 3m @ 3.45g/t Au from 195m

- These results include assays from hole OGGRC471 which is the deepest hole drilled at the newly delineated SEB ore body. This drill hole highlights good mineralisation continuity at depth. The mineralised zone is open below this hole.

- The high-grade CVX lode within SEB was intersected at 113m metres downhole well below the top of fresh rock and base of oxidation and down dip from previously reported high grade intersections (refer ASX release 8 May 2022).

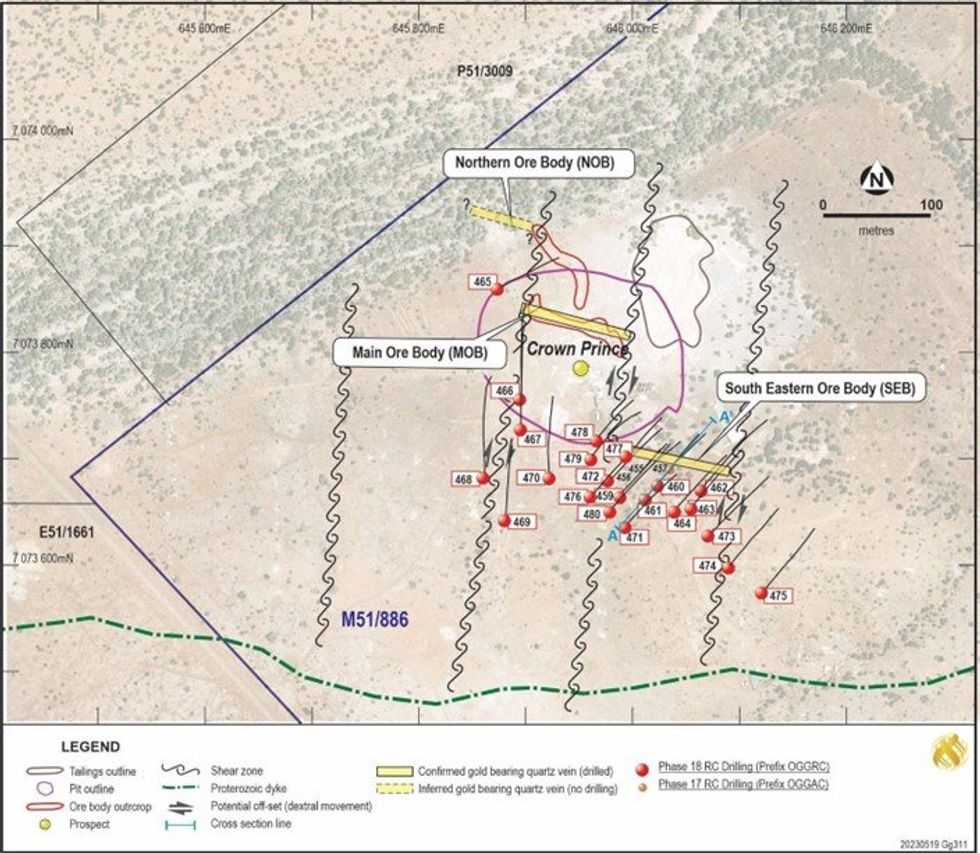

Drill holes in the current program have successfully delineated extensions to mineralized zones along strike of known mineralisation (to the north-west and south-east) and also in down-dip positions. In several areas new zones of gold mineralisation are indicated to be present in the footwall to previously drilled lodes.

The Crown Prince south-east extension (SEB) continues to develop as a key growth area for gold resources at the prospect.

Ora Gold’s CEO Alex Passmore commented: “We are pleased to report further high-grade gold intercepts from Crown Prince Prospect. These results will be used in an upcoming resource estimation. The drilling discussed in this release indicates that the SEB ore body is strongly mineralised in the primary zone i.e. well below the top of fresh rock and we look forward to further drilling in this area. Diamond drilling to target deeper zones is set to commence shortly with shallower up-dip positions being better defined by air-core and slimline RC drilling currently. All data received so far suggests the SEB zone mineralisation commences at shallow depths, is high-grade over good widths and hence is likely to show robust economic outcomes in any conceptual mining scenario.”

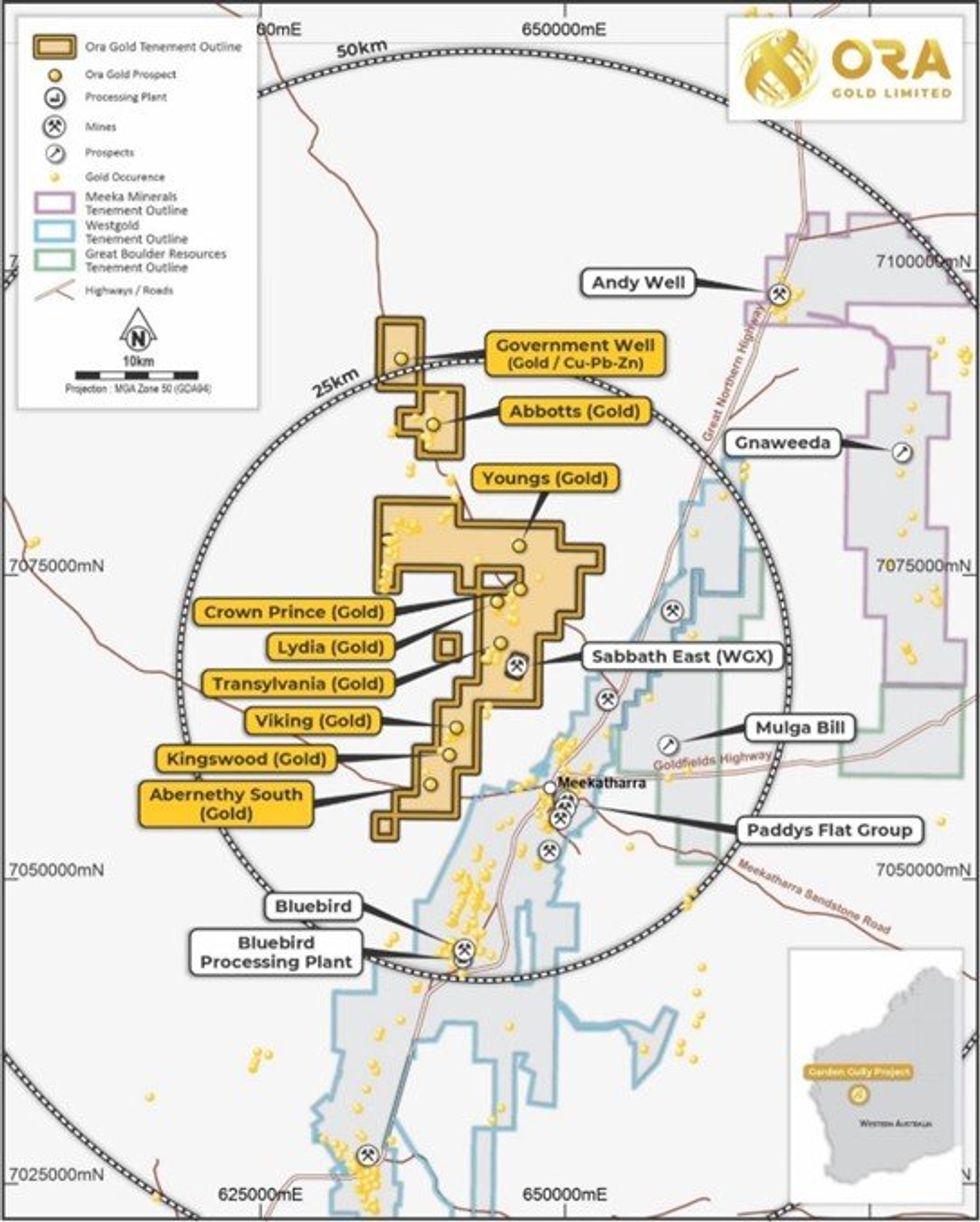

The Crown Prince Prospect is a high-grade gold deposit within Ora Gold’s Garden Gully Project. Crown Prince is located 22 kilometers north-west of Meekatharra in Western Australia via the Great Northern Highway and the Mt Clere Road (Figure 1).

The majority of assay results from an RC drill program undertaken in March and April targeting the Main Ore Body (MOB) and the South East Ore Body (SEB) have been received (Figure 2). Air core and slimline RC drilling is currently underway with diamond drilling set to commence in early June 2023.

The results in this release include a new high-grade extension to the South Eastern Ore Body (SEB) importantly this is the deepest intersection at this ore body thus far (Figures 2,3 and 4). Mineralisation is open at depth.

All hole details and sampling information are included in Table 1. Assay results with more than 0.1ppm Au are included in Appendix 1.

South-Eastern Ore Body (SEB)

Additional high-grade gold intercepts have been returned and are reported in this release. The best intersections are located down-dip from the previously reported mineralized zone at SEB. Primary high- grade gold mineralisation has been confirmed showing the down-dip continuity of the CVX Lode (OGGRC471: 21m @ 11.05g/t Au from 113m in OGGRC471, incl. 9m @ 22.24g/t Au from 121m, refer Figures 3 and 4, AA’ cross section). This intercept is well below the TOFR and will be further tested at depth by diamond drilling (Figure 4).

Click here for the full ASX Release

This article includes content from Ora Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00