January 21, 2024

Flynn Gold Limited (ASX: FG1, “Flynn Gold” or “the Company”) is pleased to provide the first drilling results from its 100%-owned Firetower Project located in northwest Tasmania.

Highlights

- First assay results from recent diamond drilling have confirmed potential for significant polymetallic gold and critical minerals mineralisation at the Firetower Project in northwest Tasmania

- High-grade gold-cobalt-tungsten-copper mineralisation intersected, including:

- 2019FTD007E:

- 17.0m @ 2.31g/t Au, 0.16% Co, 0.38% WO3, 0.16% Cu from 121.0-138.0m, including:

- 1.7m @ 6.64g/t Au, 0.12% Co, 0.87% WO3, 0.14% Cu from 121.0m, and

- 5.5m @ 3.27g/t Au, 0.24% Co, 0.53% WO3, 0.33% Cu from 132.5m.

- 17.0m @ 2.31g/t Au, 0.16% Co, 0.38% WO3, 0.16% Cu from 121.0-138.0m, including:

- 2019FTD007E:

- Diamond drilling program comprised one new drillhole and three diamond tail extensions to holes previously drilled in 2019, for a total of 496.0m

- All drill core has been cut and submitted for multi-element analysis with 164.6m of assays reported here and assays pending for 331.4m

- Drilling permits in place to extend additional shallow historic drill holes and test for depth and strike extensions to the high-grade polymetallic mineralised zone

- Prospective strike length of 6km remains lightly drilled.

The initial drilling results confirm coherent zones of high-grade polymetallic gold, cobalt, tungsten and copper (Au-Co-W-Cu) mineralisation at the project, with laboratory assays for most of the program still pending.

Commenting on the drilling, Managing Director and CEO Neil Marston said

“High-grade gold-cobalt-tungsten has been recorded in the first results from drilling at the Company’s Firetower Project in northwest Tasmania. Our drilling has been successful in testing for depth extensions of the main mineralised zone.

“The 4-hole drill program completed in December 2023 tested depth extension targets generated from our recent review of the project.

“Previous drilling at Firetower has been generally shallow and across a limited strike length, with very few holes extending beyond 150m from the surface. Several previous drill holes ended in mineralisation.

“These early results demonstrate the depth continuity of mineralisation and highlight the significant potential for high-grade mineralisation to continue at depth and along strike.

“Importantly Flynn already has permits in place to undertake a follow-up drilling program to test for further mineralisation.”

Firetower Polymetallic (Au-Co-W-Cu) Mineralisation

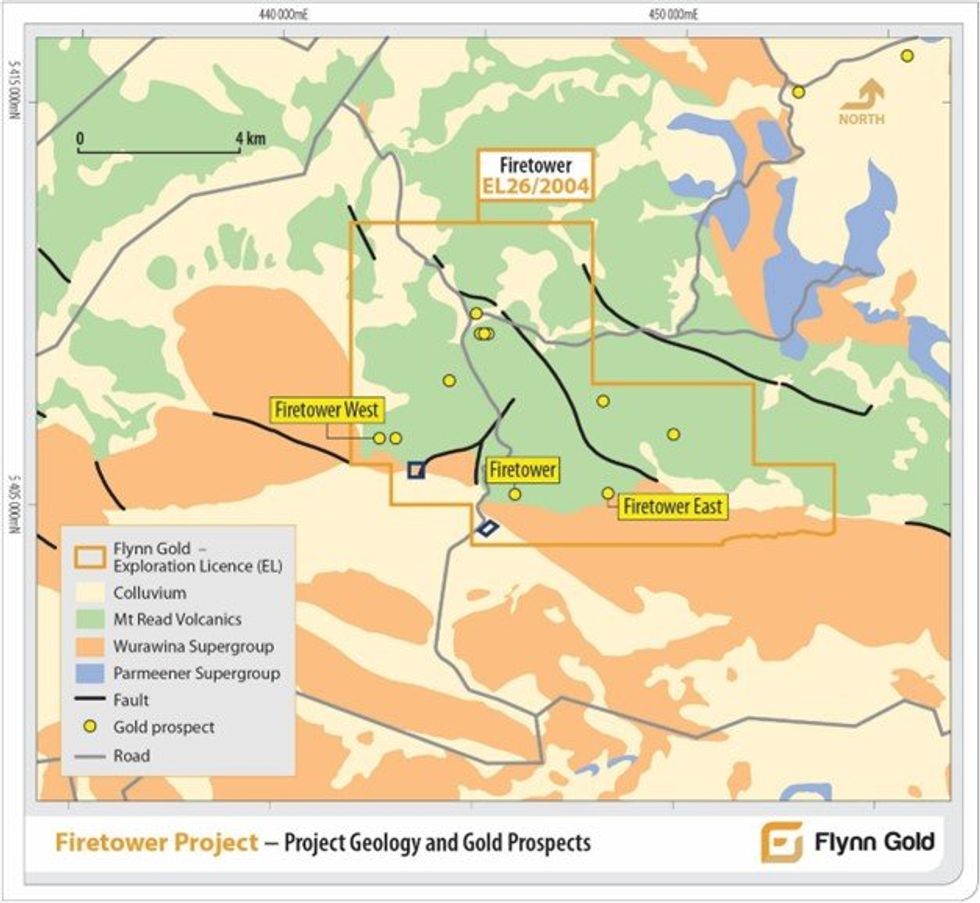

The polymetallic Au-Co-W-Cu mineralisation at Firetower is currently defined by historic drilling over a strike length of 200m and remains open along a highly prospective 6km-long trend between the Firetower West and Firetower East prospects (Figure 1). The mineralisation, which partly outcrops, is currently drill-tested to approximately 150m depth and remains open down-dip.

Latest Firetower Drilling

One diamond drill hole and three diamond extension tails on existing holes were drilled at the Firetower Prospect for a total of 496.0m. The location of these 4 drill holes is shown in Figure 2. Table 1 contains full details of these drillholes.

Click here for the full ASX Release

This article includes content from Flynn Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FG1:AU

The Conversation (0)

12 August 2024

Flynn Gold

Advancing three high-grade gold projects in Tasmania

Advancing three high-grade gold projects in Tasmania Keep Reading...

20 February 2025

Exploration Update - Golden Ridge Project, NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Update - Golden Ridge Project, NE TasmaniaDownload the PDF here. Keep Reading...

18 February 2025

High-Grade Silver-Lead at Henty Project, Western Tasmania

Flynn Gold (FG1:AU) has announced High-Grade Silver-Lead at Henty Project, Western TasmaniaDownload the PDF here. Keep Reading...

30 January 2025

December 2024 Quarterly Activities Report and Appendix 5B

Flynn Gold (FG1:AU) has announced December 2024 Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

12 January 2025

Flynn Expands Key Gold Targets at Golden Ridge, NE Tasmania

Flynn Gold (FG1:AU) has announced Flynn Expands Key Gold Targets at Golden Ridge, NE TasmaniaDownload the PDF here. Keep Reading...

08 December 2024

Exploration Licence Granted at Beaconsfield in NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Licence Granted at Beaconsfield in NE TasmaniaDownload the PDF here. Keep Reading...

5h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

22h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00