- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

July 22, 2024

Aggressive drilling at the flagship Never Never Deposit and the new Pepper discovery outlines 1.87Moz @ 8.65g/t within 2km of the plant

Spartan Resources Limited (“Spartan” or the “Company”) (ASX: Spartan) is pleased to announce the Updated Mineral Resource Estimate (“MRE”) for its 100%-owned Dalgaranga Gold Project “DGP”, located in the Murchison region of Western Australia.

HIGHLIGHTS

- Updated Mineral Resource Estimate (“MRE”) completed for the Dalgaranga Gold Project, located on granted Mining Leases and within 2km of the 2.5Mtpa processing plant:

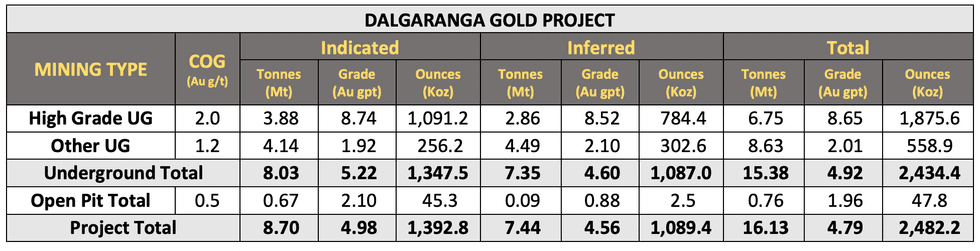

- 16.1Mt @ 4.79g/t gold for 2,482,200 ounces, comprising:

- 5.72Mt @ 8.07g/t gold for 1,485,200 ounces – Never Never Gold Deposit

- 1.78Mt @ 7.66g/t gold for 438,100 ounces – Pepper Gold Deposit

- 8.63Mt @ 2.01g/t gold for 558,900 ounces – “Other” Underground MRE

- 16.1Mt @ 4.79g/t gold for 2,482,200 ounces, comprising:

- Resource Classification breakdown for the updated Dalgaranga Gold Project MRE:

- 8.70Mt @ 4.98g/t gold for 1,392,800 ounces (56%) classified as Indicated;

- 7.44Mt @ 4.56g/t gold for 1,089,400 ounces (44%) classified as Inferred.

- Resource Classification breakdown for the Underground Never Never Gold Deposit MRE:

- 3.88Mt @ 8.74g/t gold for 1,091,200 ounces (76%) classified as Indicated;

- 1.08Mt @ 9.95g/t gold for 346,200 ounces (24%) classified as Inferred.

- Maiden Mineral Resource Estimate for the Underground Pepper Gold Deposit:

- 1.78Mt @ 7.66g/t gold for 438,100 ounces (100%) classified as Inferred.

- Combined high-grade underground MRE for the Never Never and Pepper Gold Deposits:

- 6.75Mt @ 8.65g/t gold for 1,875,600 ounces (58%) classified as Indicated.

- The ounces per vertical metre (“ozpvm”) for the updated high-grade underground MRE has increased 24% to 2,284ozpvm, from 1,690ozpvm. Between 450mbsl and 650mbsl, through both Never Never and Pepper, the ozpvm averages 3,796ozpm.

- A focus on delineating higher grade underground Mineral Resources for the Four Pillars and West Winds gold prospects, as well as the nearby Sly Fox and Plymouth gold deposits has underpinned the “Other” Underground MRE of:

- 8.63Mt @ 2.01g/t gold for 558,900 ounces:

- Updated Spartan Group Mineral Resources for the Dalgaranga and Yalgoo (“Murchison”) and Glenburgh and Egerton (“Gascoyne”) Projects now stand at:

- 39.15Mt @ 2.62g/t gold for 3,302,000 ounces (61% or 2.01Moz Indicated)

This latest MRE update is a pivot towards Dalgaranga as an emerging high-grade underground gold mining operation, and comprises Never Never, Pepper, Four Pillar, West Winds, Applewood, Plymouth and Sly Fox deposits. MRE details are shown in Tables 1 to 4:

Table 1. Dalgaranga Gold Project Combined Resources at 30 June 2024*

Click here for the full ASX Release

This article includes content from Spartan Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

22h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

23h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00