April 04, 2022

Australasian Metals Limited (ASX: A8G, Australasian or the Company) is pleased to advise that the Company has received confirmation that Exploration License (EL) 32830, representing the Mt Peake Lithium Project in the prospective Northern Arunta pegmatite province, Northern Territory, has been successfully granted by the Northern Territory Mines Department.

Highlights

- Exploration Licence (EL 32830), located in the central part of the Arunta Pegmatite province, has been successfully granted for an initial period of 6 years

- Preliminary results from the soil geochemical sampling program have identified northwest striking trends of anomalous Li, Rb, Cs, Nb and Ta, consistent with our regional geological interpretation and DGPR geophysics work

- Follow up work including infill soil sampling and field checking to commence shortly

- Further soil geochemical lines are planned to extend this program approximately 2km to the south-east

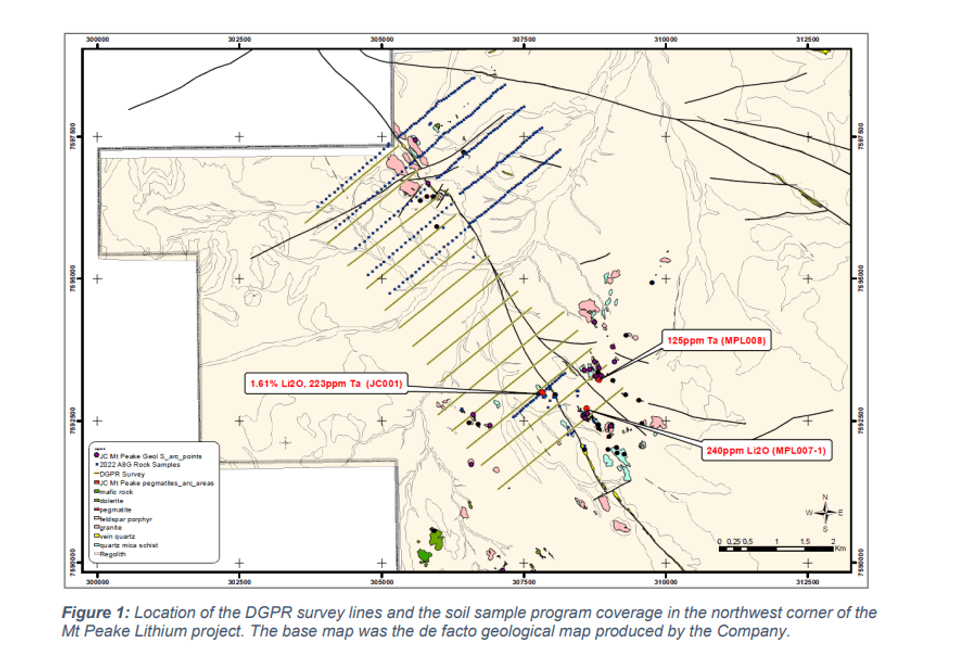

The Company has also completed a soil geochemical sampling program focussed on the northwest corner of EL32830, with six sample lines, 400m apart. Sampling was completed at 100m and 50m along lines (Figure 1). The size of the program is such that clear anomalous values can be established over a relative background. The transects were designed to cover sub-cropping or shallowly buried pegmatite dykes or swarms of pegmatites outcropping along the northwest striking into Core Lithium Ltd’s (ASX:CXO) tenement to the northwest.

A8G Managing Director Dr Qingtao Zeng commented:

“The granting of the Mt Peake exploration license allows us to be more aggressive with our on-ground exploration. The soil sampling program successfully identified the northwest striking structures which are consistent with the DGPR interpretation. This gives us added confidence in our exploration strategy in identifying potentially mineralised pegmatites, and helps to firm up our future drilling targets”.

About the Soil Geochemistry Survey

The soil samples were submitted to ALS in Perth for analysis by the ionic leach method. This method is a “partial digest” technique that uses very dilute chemical solutions to only extract weakly bound ions from the sample for analysis. Many case studies have shown that partial digests tend to give better discrimination of soil geochemical anomalies over background values. However, the weak nature of the chemical solutions used means that the absolute values of metals returned in the analysis are much lower than those returned from more aggressive digestion techniques such as aqua regia and four acid digests. It is the background-to-anomaly ratio that is the critical factor to consider.

Click here for the full ASX Release

This article includes content from Australasian Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

A8G:AU

The Conversation (0)

21h

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00