July 08, 2022

Gran Tierra Energy (TSX:GTE,NYSE:GTE,LSE:GTE) produces assets and exploration prospects in Colombia and Ecuador. The company operates the production from the vast majority of its assets, which gives it control over where and when to drill. Gran Tierra is focusing on enhancing recovery by utilizing the waterflooding process that results in higher oil recovery rates and modest future development costs. The company has plans to conduct additional exploration and development operations throughout 2022 and 2023.

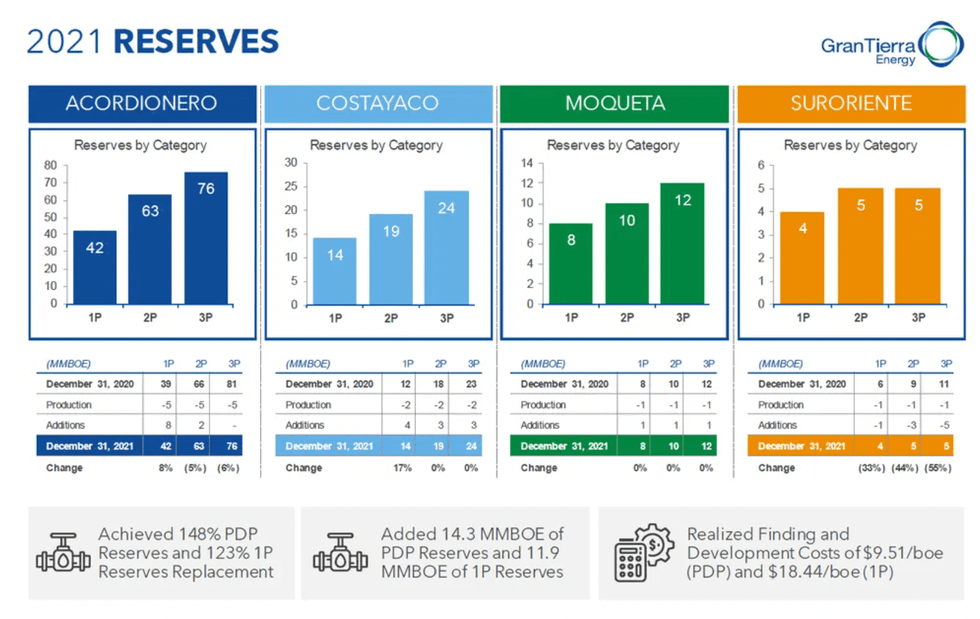

The company is currently increasing its production at its flagship project, Acordionero, by drilling 14-16 new development wells throughout 2022. Since the project’s acquisition in 2016, it has produced roughly 28 million barrels of oil (MMbbl) and generated approximately US$1.3 billion in oil and gas sales. In addition, drilling and completion costs have steadily decreased by over 50 percent during the past four years. The drilling of new developemtn wells is also slated for this year at two of Gran Tierra’s other major fields, Costayaco and Moqueta. All the company’s oil fields have access to robust transportation infrastructure and benefit from a stable economic environment.

Company Highlights

- Gran Tierra is an international oil and gas company focused on exploration and production in Colombia and Ecuador.

- The company leverages waterflooding to improve oil recovery at each of its assets, which are world-class candidates for this enhanced recovery technique.

- Gran Tierra plans to drill several new wells throughout 2022 in addition to conducting exploration programs at its other assets.

- Acordionero, the company’s flagship project, has already produced over US$1.3 billion in oil and gas sales since 2016. Additionally, 14-16 new wells are scheduled to be drilled in this oil field this year.

- The company focuses on enhancing oil recovery at each producing asset to maximize the value of all its reservoirs.

- ESG ratings are essential for Gran Tierra, and the company has already planted 1.2 million trees in Colombia, alongside other environmental initiatives.

- A strong management team with directly relevant experience leads the company towards its goals.

This Gran Tierra Energy company profile is part of a paid investor education campaign.*

GTE:CA

The Conversation (0)

07 July 2022

Gran Tierra Energy

Top Tier Conventional Oil Assets Under Waterflood

Top Tier Conventional Oil Assets Under Waterflood Keep Reading...

06 February

Syntholene Energy Corp. Announces $2.0 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") announces that it intends to complete a non-brokered private placement of... Keep Reading...

05 February

Angkor Resources Celebrates Indigenous Community Land Titles and Advances Social Programs, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 5, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") is pleased to announce that nine Indigenous community land titles have been formally granted to Indigenous communities in Ratanakiri Province, Cambodia, following a... Keep Reading...

05 February

Syntholene Energy Corp Strengthens Advisory Board with Former COO of Icelandair Jens Thordarson

Mr. Thordarson brings two decades of expertise in operations, infrastructure development, and large-scale business transformation in the aviation industrySyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces the nomination of Jens... Keep Reading...

04 February

The Future of Aviation is Synthetic: Syntholene CEO Highlights Growing Demand for E-Fuel

The global aviation industry is entering a period of rapid transition as airlines seek low-carbon fuel alternatives that meet both performance and regulatory demands. It’s a market Syntholene Energy (TSXV:ESAF,OTCQB:SYNTF) is aiming to supply through its breakthrough synthetic fuel, or... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00