- High-priority uranium targets to be drilled to unlock further scale and enhance project economics

- Step-out and in-fill exploration follows identification of extensive zones of uranium mineralization

GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) ("GoviEx" or "the Company") today announces the launch of the 2025 field season at the Muntanga uranium project in Zambia ("Muntanga"). Following four years of work that culminated in a positive feasibility study with a post-tax NPV8% of USD243 million[1], the Company is expanding its exploration program to assess and advance new opportunities aimed at improving the project's overall economics by increasing resource size, extending mine life and identifying new deposits that could enhance the scale and long-term stakeholder value of the project.

The 2025 campaign will consist of 35 drill holes for approximately 3500 metres and will test four high priority areas, ranging from near-mine targets that could extend Muntanga itself to a potential larger-scale opportunity at Kariba Valley, situated on strike and on trend 70 kilometres to the south-east of Muntanga. GoviEx's geological team reassessed three of the priority areas, identifying encouraging signs of potential success based on historical drilling with their updated geological model presented to senior executives during their most recent site visit.

Commenting on the new campaign, Govind Friedland, Executive Chairman said: "After years of detailed feasibility and engineering work, we are super excited to refocus our geologic team on exploration and discovery. The Muntanga project already stands on a solid resource foundation, but what really inspires us is the opportunity to grow it - both near the existing deposits and through Kariba Valley, which we believe could be a true game-changer. This is one of Africa's most underexplored uranium belts, and we're only just beginning to understand its true scale."

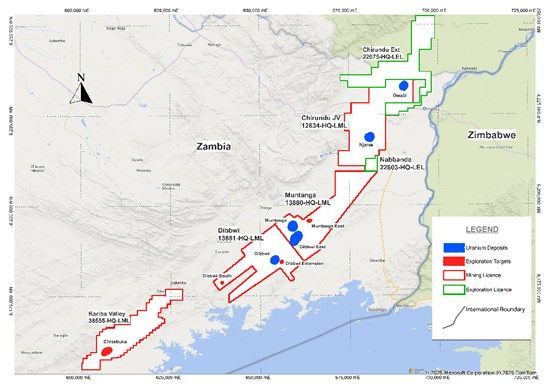

Figure 1- Location of the four priority targets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5017/256603_fe8d3374a4b2aa74_001full.jpg

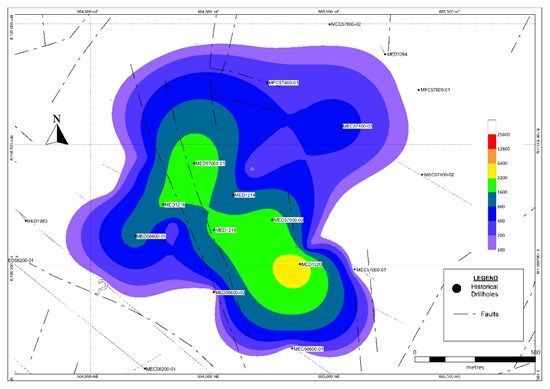

Priority drilling will commence at the Muntanga East target, where ten shallow holes (to a maximum depth of 60 metres) will follow up historical intercepts over a radiometric anomaly located five kilometres from the planned Muntanga open pit, in the same Escarpment Grit Formation host rocks that contain the current resource. Geological interpretation of existing data suggests a conceptual shallow exploration target ranging from two to four million pounds of U₃O₈ at grades between 150 and 350 ppm. [2]

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5017/256603_fe8d3374a4b2aa74_003full.jpg

Figure 2a & b: (R) Muntanga East prospect with GT contours showing extension potential to the NE and SE and (L) Cross section showing the shallow depth encountered in historical drill holes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5017/256603_fe8d3374a4b2aa74_004full.jpg

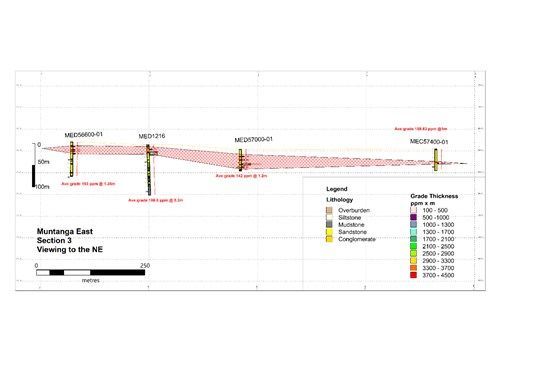

The targeted exploration programme also includes further focus around the Dibbwi deposit, where remodeling interpretation suggests strong potential to significantly extend mineralisation. Five drill holes are planned just East of the existing Dibbwi pit shell, targeting a well-defined radon anomaly that has never been drill-tested. This anomaly lies along the projected mineralised trend and presents a compelling case for potential resource expansion. Notably, this anomaly was not drilled previously as the historic radiometric survey that identified it was conducted only after earlier drilling activities had taken place.

Figure 3: Untested Radon anomaly to the east of the Dibbwi deposit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5017/256603_fe8d3374a4b2aa74_005full.jpg

Further south, in an area known as Dibbwi South, a trenching programme will be undertaken over radon anomalies, which appear identical to the anomalies found in GoviEx's current Dibbwi deposit. These trenches will expose the underlying geology for mapping and sampling, with the goal of identifying new zones of near-surface mineralisation suitable for follow-up drilling later in the season.

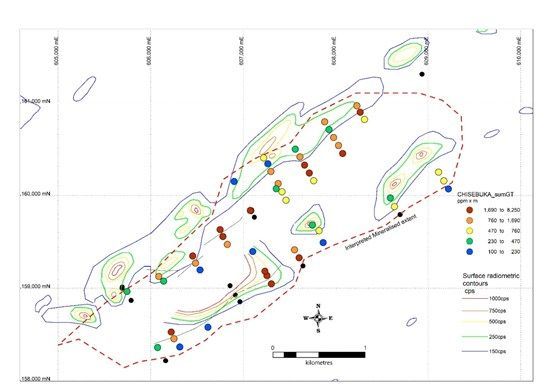

Within the Kariba Valley Mining License (38555-HQ-LML), our geologic field team sees high potential for economic mineralisation on the Chisebuka prospect. This permit, acquired from African Energy Resources in 2017, hosts the same Karoo sedimentary package as the Muntanga-Dibbwi deposits, yet has seen no follow up drilling since the initial reconnaissance work.

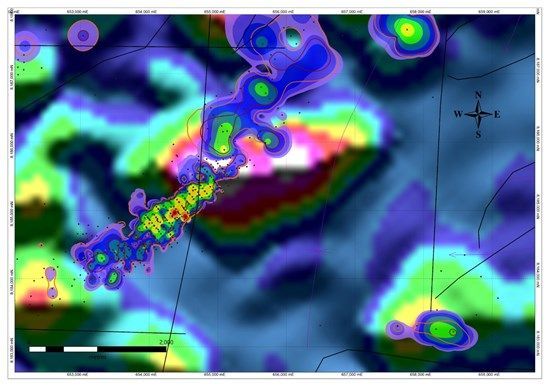

Figure 4: Map of Chisebuka prospect area showing existing drillhole locations and potential mineralised extents.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5017/256603_fe8d3374a4b2aa74_007full.jpg

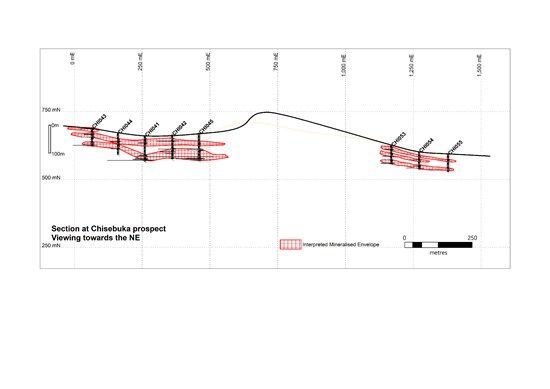

Figure 5: Sectional view across Chisebuka showing potential for extension between the two sets of drilling in the centre, as well as open extension at both ends

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5017/256603_fe8d3374a4b2aa74_008full.jpg

Review of the available drilling data as well as ground radiometric and mapping data confirms that the Chisebuka mineralisation remains open up-dip, down-dip at depth and potentially on strike. Geological modelling suggests a shallow, gently dipping mineralized body that can be traced for approximately 4 km along strike and up to 1 km across, with mineralised horizons cropping out from surface to roughly 110 m depth. On this basis, GoviEx has delineated a conceptual model to guide exploration with targets of 20-30 million lb U₃O₈, and grades estimated between 150-300 ppm, consistent with the grades already defined at Muntanga-Dibbwi.[3]

To get a sense of scale on GoviEx' mine permitted licence, the area targeted for exploration this Summer on Kariba Valley is only approximately 3% of the total license area and the rest of the license is also deemed highly prospective.

The above section highlights the presence of untested gaps between historical drill fences, where mineralisation may demonstrate continuity-suggesting alignment of mineralised sedimentary horizons across the undrilled segments. Interestingly, this prospect remains underexplored due to historical drilling being focused on easily accessible areas, rather than targeting most prospective full extent of the geological potential.

The Company plans to drill 20 proof-of-concept holes totalling roughly 2,000m with planned hole depths of 50-150, to determine the extensions to mineralisation.

Successful confirmation of mineralisation across the planned sections would allow Chisebuka to move rapidly into resource definition drilling, supporting our strategy to enhance the project's economic potential through scale and optionality.

Next steps

Drilling and trenching across all four priority targets is scheduled to commence next week. Initial results from each area will help determine the design of follow-up programmes later in the field season.

Across all targets, GoviEx's strategic objective remains clear: to materially improve overall project economics by expanding Muntanga's resource base, extending mine life, and identifying new deposits that could enhance the scale and long-term stakeholder value of the project.

Qualified Person Statement

The scientific and technical information in this release has been reviewed, verified, and approved by Mr. Jerome Randabel, MAIG, Chief Geologist of GoviEx, a Qualified Person as defined in Canadian National Instrument 43-101 "Standards of Disclosure for Mineral Projects".

About GoviEx Uranium Inc.

GoviEx (TSXV: GXU) (OTCQB: GVXXF), is a mineral resource company focused on the exploration and development of uranium properties in Africa. GoviEx's principal objective is to become a significant uranium producer through the continued exploration and development of its mine-permitted Muntanga Project in Zambia.

Contact Information

Isabel Vilela, Head of Corporate Communications

Daniel Major, Chief Executive Officer

Tel: +1-604-681-5529 Email: info@goviex.com Web: www.goviex.com

Cautionary Statement Regarding Forward-Looking Information

This news release may contain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities laws. All information and statements other than statements of current or historical facts contained in this news release are forward-looking information. Forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in GoviEx's periodic filings with Canadian securities regulators. When used in this news release, words such as "will", "could", "plan", "estimate", "expect", "intend", "may", "potential", "should," and similar expressions, are forward-looking statements. Information provided in this document is necessarily summarized and may not contain all available material information. Forward-looking statements include those in relation to: (i) the proposed exploration program improving the project's overall economics by increasing resource size, extending mine life, and identifying new deposits that could enhance the scale and long-term stakeholder value of the project; (ii) the method and timing of any exploration, development or mining operations at Muntanga; and (iii) the potential resource expansion for Muntanga. Although GoviEx believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, it can give no assurances that its expectations will be achieved. Such assumptions, which may prove incorrect, include the following: (i) that GoviEx will successfully file the final ESIA as and when anticipated; that GoviEx will successfully raise required financing for Muntanga; (ii) that the current uranium upcycle will continue and expand; (iii) that the integration of nuclear power into power grids worldwide will continue as a clean energy alternative; and (iv) that the price of uranium will remain sufficiently high and the costs of advancing GoviEx's mining projects will remain sufficiently low so as to permit GoviEx to implement its business plans in a profitable manner. Factors that could cause actual results to differ materially from expectations include: (i) the inability of the Company to conduct its planned exploration program for any reason; (ii) the inability of the Company to raise financing for Muntanga for any reason; (iii) a regression in the uranium market price; (iv) an inability or unwillingness to include or increase nuclear power generation by major markets; (v) potential delays due to new or ongoing health or environmental restrictions; (vi) the failure of GoviEx's projects, for technical, logistical, labour-relations, political, or other reasons; (vii) a decrease in the price of uranium below what is necessary to sustain GoviEx's operations; (viii) an increase in GoviEx's operating costs above what is necessary to sustain its operations; (ix) accidents, labour disputes, or the materialization of similar risks; (x) a deterioration in capital market conditions that prevents GoviEx from raising the funds it requires on a timely basis; (xi) political instability in the jurisdictions where GoviEx operates; and (xii) generally, GoviEx's inability to develop and implement a successful business plan for any reason. In addition, the factors described or referred to in the section entitled "Risk Factors" in the MD&A for the year ended December 31, 2024, as well as the Annual Information Form for the year ended December 31, 2024, of GoviEx, which are available on the SEDAR+ website at www.sedarplus.ca, should be reviewed in conjunction with the information found in this news release. Although GoviEx has attempted to identify important factors that could cause actual results, performance, or achievements to differ materially from those contained in the forward-looking statements, there can be other factors that cause results, performance, or achievements not to be as anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate or that management's expectations or estimates of future developments, circumstances, or results will materialize. As a result of these risks and uncertainties, no assurance can be given that any events anticipated by the forward-looking information in this news release will transpire or occur, or, if any of them do so, what benefits GoviEx will derive therefrom. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this news release are made as of the date of this news release, and GoviEx disclaims any intention or obligation to update or revise such information, except as required by applicable law.

Cautionary Note to United States Persons:

The disclosure contained herein does not constitute an offer to sell or the solicitation of an offer to buy securities of GoviEx.

Safe Harbor Statement under the United States Private Securities Litigation Reform Act of 1995: Except for the statements of historical fact contained herein, the information presented constitutes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements including but not limited to those referenced above collectively as "forward-looking statements" under the "Cautionary Statement Regarding Forward-Looking Information" involve known and unknown risks, uncertainties and other factors which may cause the actual results, the performance or achievements of GoviEx to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. There can be no assurance that such statements will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

[1]At US$ 90 per pound U3O8. See the Feasibility Study technical report titled, "NI 43-101 Technical Report: Muntanga Uranium Project in the Southern Province of Zambia", dated March 7, 2025, which has been filed under GoviEx's profile on SEDAR+ (www.sedarplus.ca) and is also available on the Company's website www.goviex.com.

[2]The potential quantity and grade referenced for the Muntanga East target is conceptual in nature. There has been insufficient exploration to define a mineral resource, and it is uncertain whether further exploration will result in the delineation of a mineral resource. The stated range of two to four million pounds of U₃O₈ at grades between 150 and 350 ppm was derived by GoviEx's technical team from geological interpretation of existing data, consisting of 39 drill holes. The parameters were applied volumetrically to generate the conceptual tonnage and grade range.

[3] The potential quantity and grade referenced for the Kariba Valley (Chisebuka) target is conceptual in nature. There has been insufficient exploration to define a mineral resource, and it is uncertain whether further exploration will result in the delineation of a mineral resource. The stated range of 20 - 30 million lb U₃O₈ at 150 - 300 ppm was derived by GoviEx's technical team from interpretation of geological mapping, surface radiometric, and 51 drill holes. The parameters were applied volumetrically to generate the conceptual tonnage and grade range.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/256603