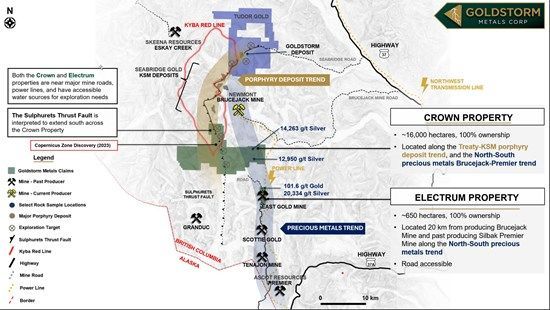

Goldstorm Metals Corp. (TSXV: GSTM,OTC:GSTMF) (FSE: B2U) ("Goldstorm" or the "Company") reports that the Induced Polarization (IP) survey has been completed, and the Magnetotelluric (MT) survey is now underway at its 100%-owned Crown Property. The property covers approximately 16,000 hectares and is located directly south of, and adjacent to, Seabridge Gold Inc.'s KSM gold-copper project and Newmont's Brucejack gold mine. See the map below for the Crown Property location. The IP and MT programs are designed to advance exploration at the Copernicus Zone and to further test promising geochemical anomalies along the Orion Spine. Results of these programs will be reported once the Company receives the final reports from the geophysical consultant.

Crown and Electrum Properties - Location Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9214/267922_071bd718d4baf850_002full.jpg

Ken Konkin, P. Geo., President and CEO, comments "As we await the results of the IP and MT surveys from our consultants that will help define and prioritize drill targets at the Crown Property, Goldstorm will continue to advance exploration efforts with a 1,200-meter diamond drill program at the Electrum Property. This program will follow up on previous near-surface high-grade gold and silver drill intercepts and represents another exciting step in our broader exploration strategy, which includes expanding the high-grade mineralization footprint at Electrum. The sheeted gold-silver vein complex at Electrum has many similarities to that of the Blueberry vein system found immediately to the south on the adjoining claims owned by Scottie Resources Corp. Our drill holes are designed to test areas that may contain some very high grades of multi-pulse gold and silver mineralization, based on results of nearby drill holes. A track-mounted drill will be utilized to

drill at least six HQ and NQ2 drill holes. Given that we have excellent road access throughout the entire Electrum Property, all holes can be collared from existing access roads.

We expect the completion of the geophysical surveys within days at the Orion Spine on the Crown Property, which is located just north of the Electrum Property. Once finalized, we will receive the geophysical interpretations from the IP and MT studies. In addition, our crews have recently made new discoveries from an intensive prospecting and rock sampling program, collecting 527 grab, chip and channel samples from the Crown Project, including the Orion Spine area where we concentrated our geophysical study. The majority of these samples have been submitted to the lab recently, so we expect to see the results within three weeks. With the geophysical and geochemical results in-hand, we will then select drill targets for the Orion Spine. Ideally, we hope to complete this compilation before the end of the season so we can construct several drill pads, which will be ready to receive drills for the 2026 exploration season. The goal at Orion is to discover the next set of large intrusive-related deposits that are on trend from the south-trending Treaty-KSM deposits that occur at a regular frequency of distribution at approximately three-kilometer intervals."

Results of the geophysical work at the Crown Property will refine the understanding of mineralized zones and structural controls and will assist in identifying potential large-scale targets along the 1.4-kilometer-long Copernicus Zone and the 6-kilometerlong Orion Spine. Results from the surveys are expected to provide valuable insight into the geology of the project area and guide future drilling campaigns.

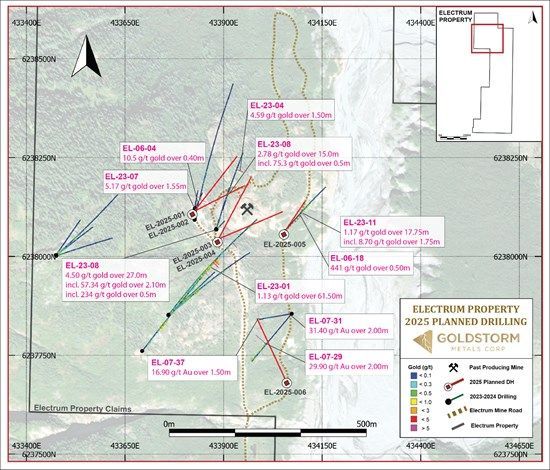

2025 Electrum Drill Program

Drilling at Electrum this fall will total approximately 1,200 meters (m) in six holes targeting high-grade gold and silver intervals reported from previous drill programs in 2023 and 2024 operated by Goldstorm Metals, and from historical discoveries (please refer to press releases dated November 14, 2023, January 24, 2024 and November 6, 2024). In prior programs operated by Goldstorm Metals and other operators, the targeted drill area returned several higher-grade gold and silver results, including:

- EL-06-18 intercepting 440.8 g/t gold and 400.0 g/t silver over 0.52 m

- EL-07-31 intercepting 31.40 g/t gold and 19.0 g/t silver over 2.0 m

- EL-23-08 intercepting 57.34 g/t gold and 214.27 g/t silver over 2.1 m

The drill targets will include the area of the historical East Gold Mine area, where intermittent small-scale, underground production between 1939 and 1965 produced 3,816 ounces of gold and 2,442 ounces of silver from 45 tons of hand selected ore. Sampling and mapping by Tudor Gold Corp. in 2020 further support this prospective target, as a verification chip sample taken within this area returned values of 101.60 g/t gold and 20,334.0 g/t silver. Another prospective drill target, 300 m to the south of this area, includes high-grade gold intercepts drilled in 2007, which have never received follow-up work. See below to view the map of the Electrum 2025 drill plan.

2025 Electrum Drill Plan Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9214/267922_071bd718d4baf850_003full.jpg

Qualified Person

The Qualified Person for this news release for the purposes of National Instrument 43-101 is the Company's President and CEO, Ken Konkin, P.Geo. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

QA/QC

All samples were prepared at MSA Labs' Preparation Laboratory in Terrace, BC and assayed at MSA Labs' Geochemical Laboratory in Langley, BC. Gold was assayed using a fire assay with atomic absorption (AA) spectrometry finish. Samples over 10 ppm gold were fire assayed with gravimetric finish. All samples were analyzed by four acid digestion with multi-element ICP-MS, with silver and base metal over-limits being reanalyzed by emission spectrometry. MSA Laboratories quality system complies with the requirements for the International Standards ISO 17025 and ISO 9001. MSA Labs is independent of the Company.

About Goldstorm Metals

Goldstorm Metals Corp. is a precious and base metals exploration company with a large strategic land position in the Golden Triangle of British Columbia, an area that hosts some of the largest and highest-grade gold deposits in the world. Goldstorm's flagship projects, Crown and Electrum, cover an area that totals 16,469 hectares over 6 concessions, of which 5 are contiguous. The Crown Project is situated directly south of Seabridge Gold's KSM gold-copper deposits and Newmont Corporation's Brucejack/Valley of the Kings gold mine. Electrum, also located in the Golden Triangle of BC, is situated directly between Newmont Corporation's Brucejack Mine, approximately 20 kilometers to the north, and the past producing Silbak Premier mine, 20 kilometers to the south.

ON BEHALF OF THE BOARD OF DIRECTORS OF

Goldstorm Metals Corp.

"Ken Konkin"

Ken Konkin

President and Chief Executive Officer

For further information, please visit the Company's website at https://goldstormmetals.com/or contact:

Chris Curran

VP Investor Relations and Corporate Communications

Phone: (604) 559-8092

E-Mail: chris.curran@goldstormmetals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance, including without limitation, the statement regarding the expectation that geologists are expected to complete a compilation study this winter once all assay results are received. Such a statement is a forward-looking statement and contains forward-looking information.

Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". Forward-looking statements are based on certain material assumptions and analysis made by Goldstorm and the opinions and estimates of management as of the date of this press release, including that geologists will complete a compilation study this winter once all assay results are received.

These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Goldstorm to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important factors that may cause actual results to vary, include, without limitation that geologists will not complete a compilation study this winter or at all.

Although management of Goldstorm has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Goldstorm does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267922