TSXV:AUC) (OTCQB:AUCCF), (Frankfurt:9FY), (the "Company" or "Goldplay"), is pleased to announce new drill results from the Phase 1 drilling program completed at the Aparis Copper Mine ("Aparis") in Southern Portugal. The Aparis mine is part of the 73.2 km2 Barrancos exploration license, and two other projects, held by a private Portuguese company, Indice Crucial Lda ("Indice Crucial") on which Goldplay can earn up to 100% interest (see Company's news release dated June 23, 2021 for more details

HIGHLIGHTS

- Drill intercept: 1.18 % Copper ("Cu") over 12.2 meters ("m") from 207.0m, including 2.33% Cu over 5.50m and including 5.50% Cu over 2m.

- Discovery of a broad mineralized copper zone, immediately adjacent at depth to the old mining works

- Excellent exploration upside. Extensive copper mineralized vein system mapped over 2.5 km along strike, with potential to extend up to 5 km.

- Discovery of a gold-bearing structure, 140 m west of the copper zone, averaging 5.87 grams per tonne ("g/t") gold over 2 m

- Historic Mine located less than 160Km (over paved roads) to a large copper smelter located in Huelva

Catalin Kilofliski, President & CEO stated: "We are very excited with the results of our inaugural drilling program that confirm our belief that a copper mineralized system occurs at the Aparis mine that is much wider than the previous mining activities indicate. Furthermore, the discovery of a gold-bearing structure within 140 m of the copper zone further enhances the potential of the project. The Aparis copper mineralized system has been traced for 2.5 km through historical workings, surface exposures and historical geophysical surveys and early indications are this could be extended further providing us with an exciting advanced copper-gold project. Excellent infrastructure and an existing copper smelter nearby provide further benefits for project exploration and potential future development to feed Europe's urgent needs for copper metal."

Assay results have been received from all three diamond holes from the Phase 1 drilling campaign for a total of 824 m.

The objective of this initial Phase 1 drilling program was to better determine the overall width and expansion potential of the copper mineralized structures.

The Company's initial objectives were fully accomplished. The results confirm the presence of a wide (>10m) copper mineralized envelope as indicated by the most recent results which include a 12.2m interval grading 1.18% Copper in hole GBA2103 with several sections of high-grade including 5.5m averaging 2.33% and including 2.0 m of 5.5% Cu (as indicated in the table below). In addition, a new auriferous zone has been identified 140 m west of the main vein system which returned 5.87 g/t Au over 2m in hole GBA2101 (previously reported by the Company on February 28, 2022).

Table 1 - Significant Drill Results, Aparis Copper Mine

Drill Hole | From (m) | To (m) | Drilled Width (m)* | Cu (%) | Au (g/t) | Structure |

GBA2101** | 46.05 | 48.05 | 2.00 | --- | 5.87 | 140 west of Main vein |

and | 295.00 | 300.50 | 5.50 | 0.21 | --- | Main vein |

and | 318.50 | 321.50 | 3.00 | 0.31 | --- | Parallel vein |

| GBA2102 | No significant results - old mine stope intersected @ 104.4-106.8 m | |||||

GBA2103 | 212.40 | 219.20 | 12.20*** | 1.18 | --- | Main vein |

including | 213.70 | 219.20 | 5.50 | 2.33 | --- | Main Vein |

including | 213.70 | 215.70 | 2.00 | 5.50 | --- | Main Vein |

* True widths have not been determined as the mineralized body remains open. Further drilling is required to determine the mineralized body orientation and true widths.

**Analytical results from Hole GBA2101 were previously reported. Refer to press release dated February 28, 2022

***Adjacent to 2.4 m of historically mined stope (210 - 212.4 m)

The Aparis Mine was operated as a small scale mine from 1889 to 1927 and more recently between 1969 and 1975 when the mine closed due to low copper prices.

Aparis consists of a main vein zone (Saramago vein) that has been traced through surface exposures and mostly shallow underground workings for more than 2.5 km along a north-northeast strike and dipping steeply to the west. Historical mining focused on a narrow (

Goldplay drill tested the vein system from November 2021 to February 2022 with a total of 3 holes to investigate in detail the grades, nature, and potential for broader zones and depth extension of the mineralized system.

This will help us evaluate possible scenario scenarios of developing a modern mining operation by contrast with the artisanal methods used in the past, with historical production coming exclusively from

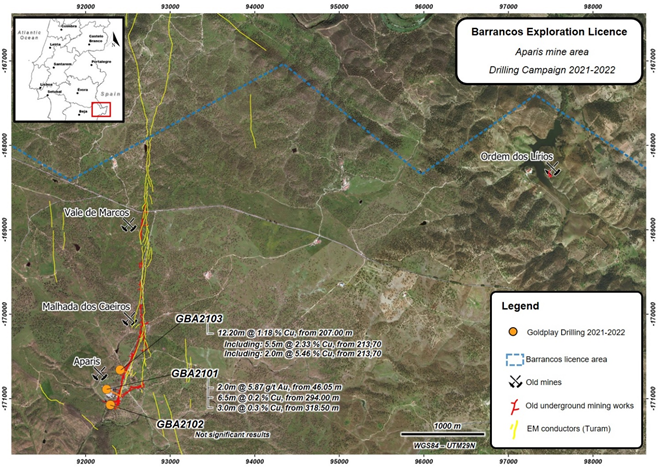

Figure 1 - Location of Drill Holes and Historic Workings at the Aparis Copper Mine

Drill Hole GBA2101 targeted the main vein zone at approximately 260 m depth and 90 meters below the historical workings. The hole intersected two parallel vein structures, grading 0.21% Cu over 5.5 m from 295m drilled depth and 0.31% Cu over 3m from 318.5m drilled depth. These results are encouraging in that they show the copper mineralized structures are wide and continuous at depth and that additional drilling is needed to vector in on potential higher-grade shoots within the structures. As previously reported, this same hole also intersected a previously unknown gold-bearing zone, approximately 140 m west of the main copper vein zone which grading 5.87 g/t Au over 2m, from 46.05m drilled depth.

Drill Hole GBA2102 was collared approximately 180 m south of GBA2101 and drilled through a series of historic mining works (that have not been previously identified). The hole was therefore stopped at a vertical depth of approximately 80 m. It is believed that significant copper grades may have been historically mined from these mined out stopes.

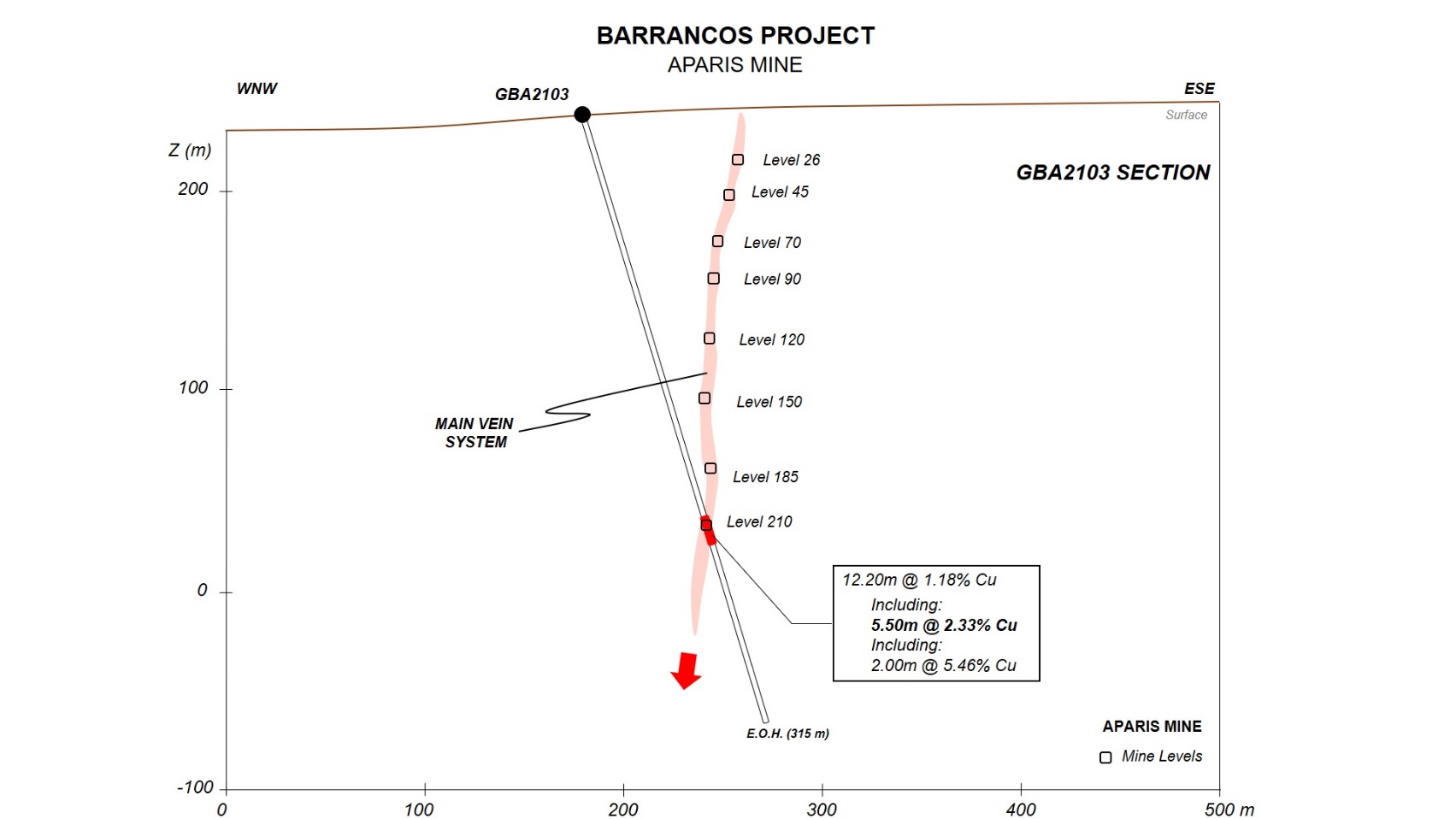

Drill Hole GBA2103 was collared approximately 230 m north of GBA2101 and was the furthest north hole drilled by the Company. The hole intersected a 12.2m interval averaging 1.18% Cu, including several higher-grade sections, as shown in Table 1. The interval includes a 2.4 m drilled length through an historical mine stope where no core was recovered, and a 0.00% Cu grade assigned to the interval. Immediately east of the stope the drill hole returned the highest copper grades, including 9.69% Cu over 1m 5.50% Cu over 2m and 2.33% Cu over 5.50 m. This intercept is suggesting that significant copper mineralization still remains unmined. The old workings were focused on thin high-grade sections (>3% Cu typically) leaving behind a large of the mineralized material. As shown in the Figure 2 the drill hole crossed the mineralized structure at the deepest part of the historical mine at a vertical depth of approximately 200 m, indicating good potential for the mineralization to continue at depth and towards the north.

Figure 2 - Cross Section (looking North) Showing Drill Hole GBA2103 and Historical Mine Workings

Exploration focus will be put on drilling continuation on the depth and strike extensions of the known mineralization and evaluation of wider zones than those historically mined, better tailored to the present technologies and higher metal prices.

Table 2: Drill Hole Summary

Drill Hole | Easting (UTM) | Northing (UTM) | Elevation (m) | Azimuth (degrees) | Dip (degrees) | Length (m) |

GBA2101 | 668200 | 4221334 | 233 | 115 | -60 | 359.30 |

GBA2102 | 668246 | 4221150 | 225 | 110 | -45 | 150.00 |

GBA2103 | 668357 | 4221566 | 235 | 110 | -70 | 315.00 |

TOTAL | 834.3 |

Future Exploration Plans

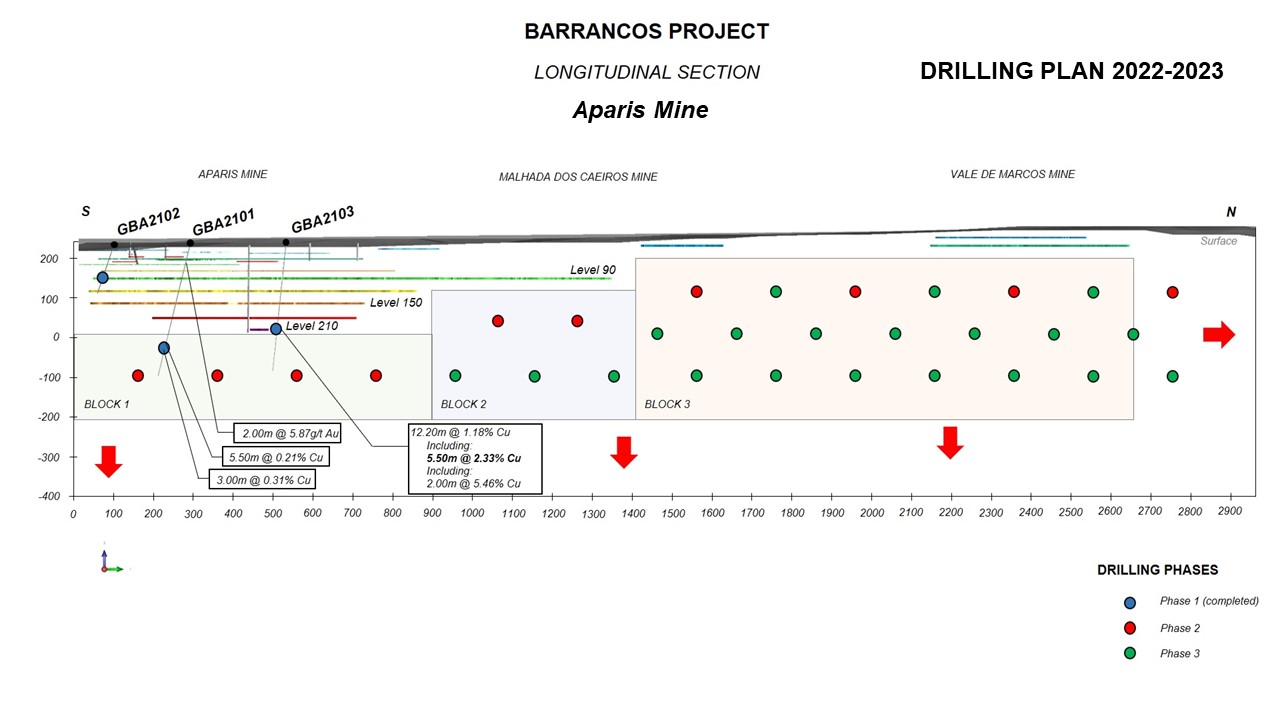

The Company's review of historical exploration and mining records indicate that historical miners have focused on narrow (

The potential quantity and grade of the Company's exploration target is conceptual in nature. There has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

With Phase 1 complete, the Company is planning to complete two additional follow-up drill programs with the following goals and objectives:

Phase 2 (2,500m in drilling, 10 holes):

- Drill confirmation of reported high grade zones from old reports and expand the "mining widths" to a more substantial target size.

- Check depth extensions to the mineralized system below reported known ore shoots

Phase 3 (6,500m in drilling, 20 holes):

- Infill drilling on a ca. 200 x 200m grid to come out with a preliminary resource estimation (Inferred category);

- Mineralogical and metallurgic tests of composite core samples on an independent laboratory.

- Based on results undertaking of a PFS considering at this stage several possible mining scenarios.

- Preparation of a preliminary Environmental Impact Study (EIS) is also considered along with a decision to proceed with the application for a mining license will be taken during this period.

Figure 3 - Longitudinal Section (looking West) Along the 2.5km Length of the Main Vein System Showing Phase 1 and Proposed Phases 2 and 3 Drilling

The potential quantity and grade of the Company's exploration target is conceptual in nature, there has been insufficient exploration to define a mineral resource and t it is uncertain if further exploration will result in the target being delineated as a mineral resource.

QA/QC

All samples were sent to ALS Global Laboratories in Spain for sample preparation and analysis. At the laboratory, rock sample preparation involved drying, fine crushing to better than 70% passing minus 2 mm (CRY-31), then split the sample using a Boyd Rotary Splitter (SPL-22Y) and pulverizing a 1000g split to 85% passing the

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Mr. Jose Mario Castelo Branco, Euro Geo, Golplay's Exploration Manager, a Qualified Person within the context of Canadian Securities Administrators' National Instrument 43-101; Standards of Disclosure for Mineral Projects. The readers should not rely on any historical estimates. The Company and the QP have not done sufficient work to verify any historical estimates. Additional work including drilling will be required to verify and upgrade historical estimates.

About Goldplay Mining

Goldplay Mining is a Canadian public company listed on TSXV and in US on OTCQB. Goldplay holds large district scale gold, and copper-gold projects located in BC's Golden Triangle and southwestern BC with potential for world class mineral discoveries. The Company also holds several brownfield gold, and copper-gold projects located in Portugal with near term mining potential.

On behalf of the Board of Directors

"Catalin Kilofliski"

President, CEO & Director

For further information please contact:

Goldplay Mining Inc.

Mr. Catalin Kilofliski, President & CEO

Suite 650 - 1021 West Hastings Street

Vancouver, BC V6E 0C3

T: (604) 655-1420

E: catalin@goldplaymining.ca

www.goldplaymining.ca

Forward Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws relating to the exploration potential of Aparis. Generally forward-looking statements can be identified by the use of terminology such as "anticipate", "will", "expect", "may", "continue", "could", "estimate", "forecast", "plan", "potential" and similar expressions. These forward-looking statements involve risks and uncertainties relating to, among other things, results of future exploration and development activities, uninsured risks, regulatory changes, defects in title, availability of materials and equipment, timeliness of government approvals, changes in commodity prices and unanticipated environmental impacts on operations. Although the Company believes current conditions and expected future developments and other factors that have been considered are appropriate and that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct or enduring. Readers are cautioned to not place undue reliance on forward-looking information. The statements in this press release are made as of the date of this release. Except as required by law, the Company does not undertake any obligation to update publicly or to revise any forward-looking statements that are contained or incorporated in this press release. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Goldplay Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/699903/Goldplay-Drills-122m-of-118-Copper-Including-55m-of-233-Copper-at-Aparis-Mine-In-Southern-Portugal