October 05, 2021

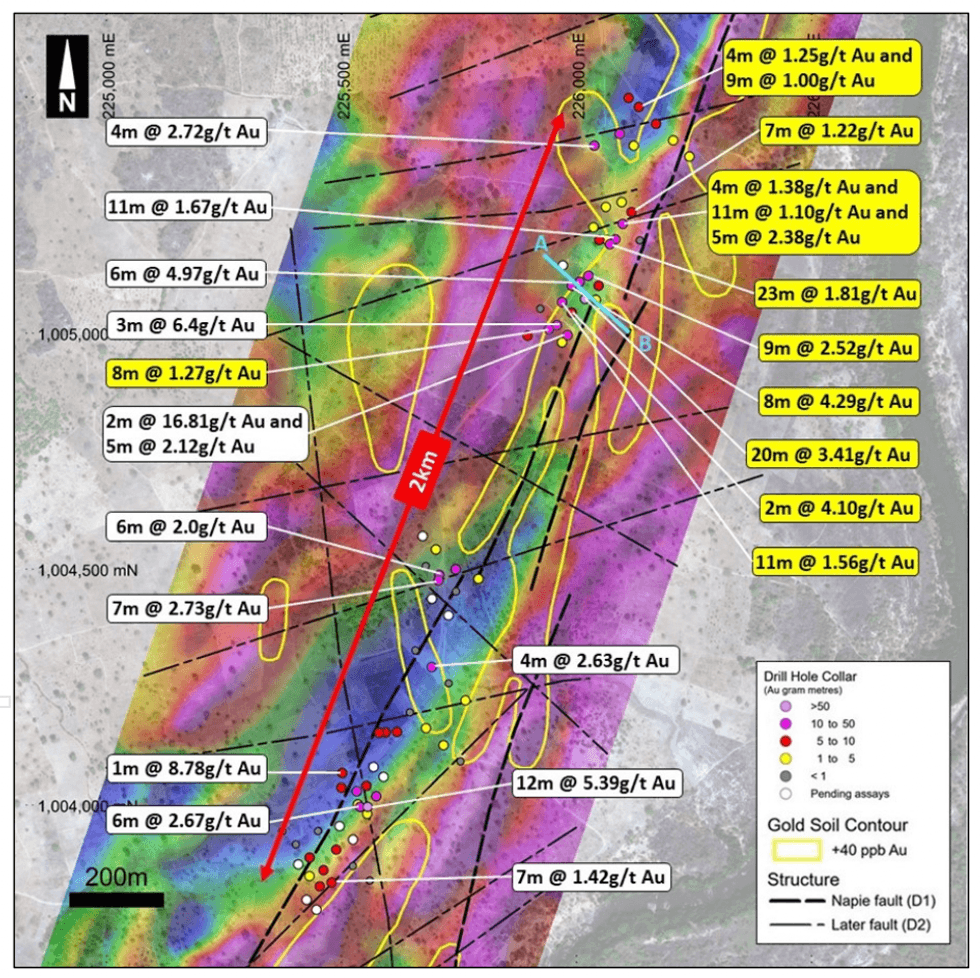

Mako Gold Limited ("Mako" or "the Company"; ASX:MKG) is pleased to advise that it has received assay results from 14 drill holes from the 10,000m drilling program at the Gogbala Prospect at the Company's flagship Napié Project in Côte d'Ivoire. Gogbala is located on a +23km soil anomaly and coincident 30km-long Napié Fault (Figure 3).

Highlights

- Best drill result returned to date from Gogbala Prospect with 20m at 3.41g/t Au

- Gogbala is located 5km to the south of the Tchaga Prospect (the core focus of exploration to date) and is one of several prospective zones located on the 30km-long Napié Fault. The shallow, wide and high- grade gold mineralisation demonstrated by exploration to date is similar to that identified at Tchaga

- 14 RC holes received from Gogbala with all holes intersecting significant mineralisation. Select results include:

- NARC531: 20m at 3.41g/t Au from 19m; including

- 1m at 6.70g/t Au from 22m and 2m at 14.12g/t Au from 37m

- NARC535: 23m at 1.81g/t Au from 19m; including

- 1m at 5.73g/t Au from 24m and 1m at 5.41 from 28m and 4m at 3.05g/t Au from 36m

- NARC532: 8m at 4.29g/t Au from 82m; including

- 3m at 8.45g/t Au from 86m

- NARC534: 9m at 2.52g/t Au from 55m; including

- 1m at 11.84g/t Au from 55m

- NARC530: 11m at 1.56g/t Au from 77m; including

- 1m at 4.27g/t Au from 77m and 1m at 8.60g/t Au from 87m

- NARC539: 4m at 1.38g/t Au from 71m and 11m at 1.10g/t Au from 79m and 5m at 2.38g/t Au from 125m; including

- 1m at 7.08g/t Au from 128m

- NARC528: 8m at 1.27g/t Au from 70m; including

- 1m at 5.02g/t Au from 77m

- NARC540: 4m at 1.25g/t Au from 9m and 9m at 1.00g/t from 17m

- NARC537: 7m at 1.22g/t Au from 9m

- NARC531: 20m at 3.41g/t Au from 19m; including

- 4,400m drilled of the planned 10,000m at Gogbala forming part of the larger 35,000m drill program on the Napié Project

- Further drill assay results are pending for the Gogbala and Tchaga prospects

Mako's Managing Director, Peter Ledwidge commented:

"After receipt of the best drill intercepts to date at Gogbala, we reiterate the similarities of mineralisation style between Gogbala and Tchaga. The wide and high-grade intercepts returned from Gogbala drilling is making Gogbala look more and more like "Tchaga 2.0". Both prospects have strong mineralisation outlined over a 2km strike length. This increases our optimism for delineating more deposits along the 30km-long Napié fault to target a multi-million-ounce resource. The next target will be the Tchaga North Prospect where we have a 10,000m drill program planned. We are growing the potential mineral inventory at Napié using our methodical approach to exploration and are funded to continue to do so. We look forward to providing more outstanding results from Tchaga and Gogbala as they come to hand."

Best Results To Date

At GogbalaResults are reported from 14 holes of the planned 10,000m drill program as announced to ASX on 12 August 2021 (Figure 1). All 14 holes intersected significant mineralisation including 20m at 3.41g/t Au from 19m in NARC531. This is the best drill intersect returned from Gogbala to date which is a 69 gram-metre intercept (grams/t Au X metre). The Company's strategy targeting high-grade areas identified from previous drilling and further expanding these zones is paying off as demonstrated by the positive drill results returned.

MKG:AU

The Conversation (0)

24 August 2021

Mako Gold

Exploring High-Grade Gold Deposits in Côte d'Ivoire

Exploring High-Grade Gold Deposits in Côte d'Ivoire Keep Reading...

8h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

9h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

9h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

14h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00