May 30, 2024

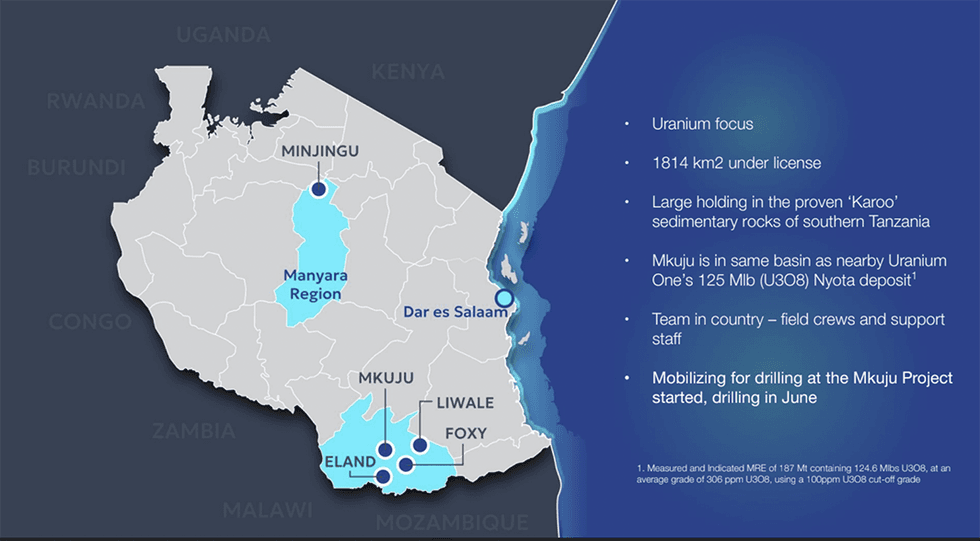

Gladiator Resources (ASX:GLA) focuses on uranium assets covering 1,811 square kilometres located in Tanzania. The company’s key projects include – Mkuju, Minjingu, Liwale, Foxy and Eland. The flagship Mkuju has the potential to host world-class uranium deposits given its proximity to the Nyota deposit, which contains 124.6 million pounds (Mlbs) U3O8. Nyota is regarded as one of the largest uranium deposits in the world.

The company is planning a 2024 drill program at Mkuju focusing on the South West Corner (SWC), Mtonya and Likuyu North targets. The 2024 drilling program will commence with initial core drilling at the SWC target, where 2023 trenching revealed up to 7,139 parts per million (ppm) U3O8. Drilling at Mtonya and Likuyu North aims to explore potential extensions and new zones of the existing uranium deposits.

The Mkuju project spans over 725 sq kms and is located 20 kms south of Uranium One’s Nyota deposit, regarded as one of the largest uranium deposits in the world. Nyota hosts a measured and indicated mineral resource estimate of 187 metric tons (MT) at 306 ppm U3O8, containing 124.6 Mlbs U3O8. The deposit is being developed by global uranium company Uranium One. The Nyota deposit and the Mkuju project are underlain by sediments of the lower Karoo, which are considered highly prospective for uranium.

Company Highlights

- Gladiator Resources is an ASX-listed exploration and mining company focused on uranium. The company operates eight exploration projects, mainly in Tanzania, covering a total area of 1,811 sq kms.

- The company’s key projects include – Mkuju, Minjingu, Liwale, Foxy and Eland.

- Gladiator’s primary short term focus is on advancing the Mkuju project, located only 20 kms south of Uranium One’s Nyota deposit, regarded as one of the largest uranium deposits in the world.

- The 2024 drill program at Mkuju will focus on the South West Corner (SWC) initially, where trench assay results received Dec/Jan 2023/24 confirmed high-grade uranium in sandstone, 1000’s ppm U3O8 in places.

- Further work is also planned at Mtonya and Likuyu North – also located within the promising Mkuju area.

- Tanzania is endowed with many uranium-bearing deposits and is known for its mining-friendly policies. The government offers attractive tax policies and quick permitting processes to encourage investment in the sector.

- The presence in relatively attractive uranium mining jurisdictions such as Tanzania positions the company to capitalize on opportunities in the uranium sector and deliver superior returns to its shareholders.

This Gladiator Resources profile is part of a paid investor education campaign.*

Click here to connect with Gladiator Resources (ASX:GLA) to receive an Investor Presentation

GLA:AU

The Conversation (0)

29 May 2024

Gladiator Resources

Capitalizing on the uranium momentum with prolific assets in Tanzania

Capitalizing on the uranium momentum with prolific assets in Tanzania Keep Reading...

13h

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00