- WORLD EDITIONAustraliaNorth AmericaWorld

October 05, 2021

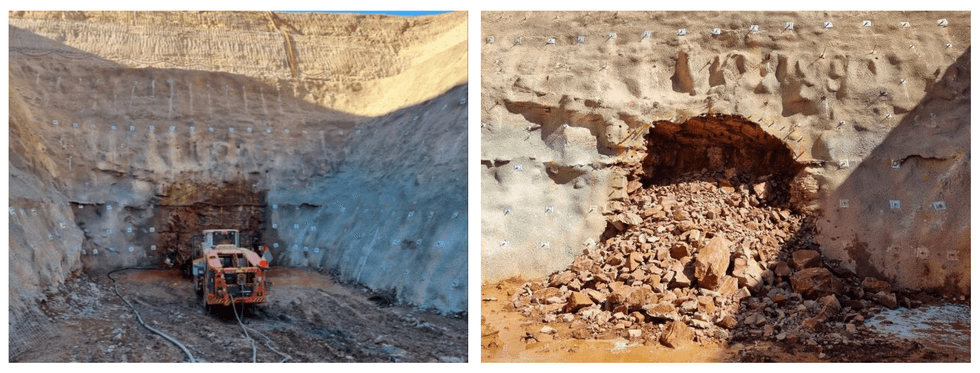

GALENA MINING LTD. ("Galena" or the "Company") (ASX: G1A) announces that mining of the underground decline has commenced at its Abra Base Metals Project ("Abra" or the "Project").

Managing Director, Tony James commented, "Taking the first cut in the portal to start the underground decline at Abra is very exciting. This keeps us on track for first commercial production of our high-value, high-grade lead-silver concentrate at the start of 2023. It is also the historical beginning of mining in the very prospective Edmund Sedimentary Basin. Special appreciation is given to Byrnecut and the Abra team on site for the extremely professional approach taken to achieve the official commencement of underground mining at Abra".

Byrnecut Australia Pty Ltd ("Byrnecut"), the mining contractor for Abra, commenced operations for the underground decline on Tuesday 5 October following the deployment of people and equipment to the mine site, and completion of final box-cut preparation works and services installation.

Primary decline works are expected to continue for approximately 14-months to gain access to the orebody and with their commencement on-time, the Abra Base Metals Project remains on-track for first commercial ore production at the start of 2023.

Read the full article here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as prices slide.Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively bullish on... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

02 February

When Will Silver Stocks Catch Up to the Silver Price?

The silver price remains historically high despite a recent pullback, and many silver stocks haven't kept pace. Silver's strong performance over the past year is the result of a perfect storm of factors, including an entrenched supply deficit, growing industrial demand, a weakening US dollar and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00