October 02, 2024

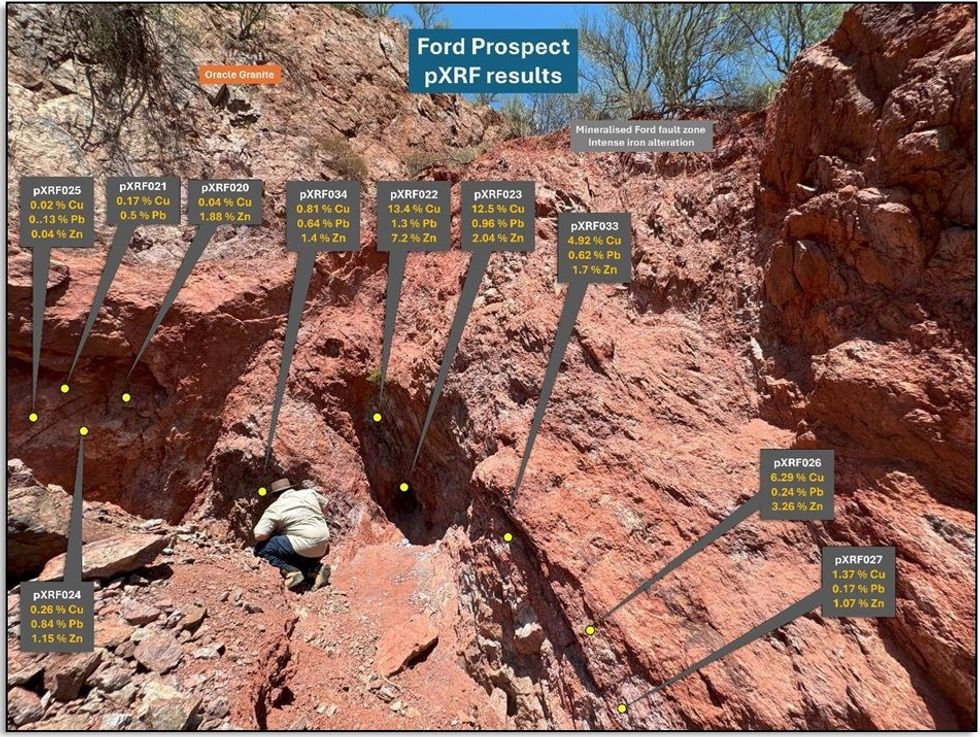

Golden Mile Resources Ltd (“Golden Mile”; “the Company”; ASX: “G88”) is pleased to announce the portable X-Ray Fluorescent (pXRF) results from the preliminary field mapping at the Ford Prospect, contained within the Pearl Copper Project (“the Project”). The polymetallic Ford Mine mineralisation is exposed at the surface within an eight-metre wide fault zone. Within this zone is visible copper mineralisation within a broader, intensely iron oxide alteration zone.

VISIBLE COPPER MINERALISATION AT FORD PROSPECT

- Mapping revealed an intensely altered eight-meter-wide fault zone with visible malachite (hydrated copper carbonate) mineralization.

- Significant pXRF Results highlight the polymetallic potential including:

- Copper values up to 13.4%

- Lead values up to 1.29%

- Zinc values up to 7.22%

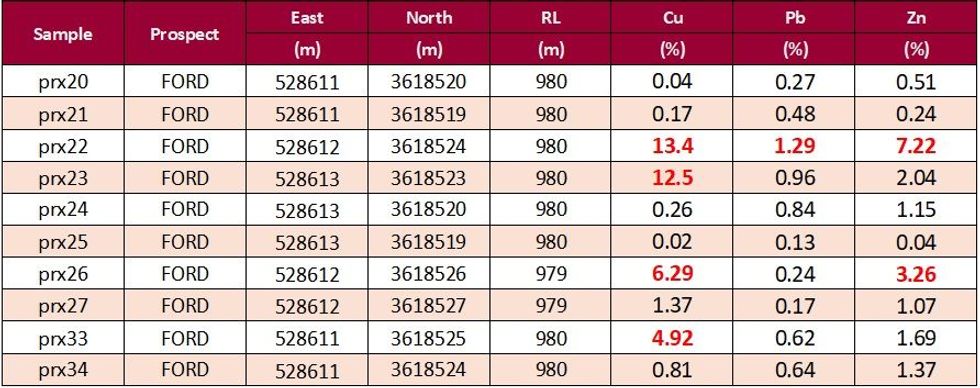

The alteration zone was mapped and supported by a total of ten pXRF readings (Figure 1). Copper (Cu) ranged from 0.02% up to 13.4%, lead (Pb) ranged from 0.08% to 1.3%, and zinc (Zn) ranged from 0.04% to 7.2%.

Golden Mile’s Managing Director Damon Dormer commented: “These exceptional preliminary results underscore the high-grade potential and polymetallic nature of the Ford Prospect. The pXRF readings are consistent with historical data, further strengthening our confidence in the project’s exploration potential. We look forward to advancing Ford as a key drill target alongside the Odyssey Prospect”

These pXRF results were attained by Golden Mile personnel utilising an Olympus Vanta Instrument pXRF, Model VMR-CCC-G3-A. All readings were 30 second, three beam spot readings directly on outcropping, in situ material. A total of 10 readings were taken in close proximity to each other across the mineralised zone.

Cautionary Statement on pXRF. pXRF (Portable X-Ray Fluorescence) results that are announced in this report are from uncrushed rock-chip samples that are preliminary only. The use of pXRF is an indication only, of the order of magnitude of further rock chip assay results. This first pass assessment was for due diligence purposes only, during the exclusivity period of the Binding Term Sheet. It should be noted that these values are not formal assays and are effectively estimates of grade only and are thus used only as a guide for follow-up, detailed and systematic mapping and sampling programs.

These results are highly encouraging and indicate the presence of significant grades of copper, lead, and zinc. This area will undergo detailed lithological and structural mapping, followed by systematic rock-chip and channel sampling. These steps will precede an upcoming drilling program aimed at unlocking the full potential of the Ford Prospect.

Click here for the full ASX Release

This article includes content from Golden Mile Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G88:AU

The Conversation (0)

18 February 2025

Golden Mile Resources

Multiple exploration opportunities across base and precious metals in Australia and the US

Multiple exploration opportunities across base and precious metals in Australia and the US Keep Reading...

22 August 2025

Private Placement to Raise $510.8K

Golden Mile Resources (G88:AU) has announced Private Placement to Raise $510.8KDownload the PDF here. Keep Reading...

20 August 2025

Trading Halt

Golden Mile Resources (G88:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 July 2025

June 2025 Quarterly Activities and Cashflow Reports

Golden Mile Resources (G88:AU) has announced June 2025 Quarterly Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

07 July 2025

Aurora Prospect Delivers High-Grade Gold Assays

Golden Mile Resources (G88:AU) has announced Aurora Prospect Delivers High-Grade Gold AssaysDownload the PDF here. Keep Reading...

02 July 2025

Maiden Drilling Campaign Intersects Copper and Lead

Golden Mile Resources (G88:AU) has announced Maiden Drilling Campaign Intersects Copper and LeadDownload the PDF here. Keep Reading...

2h

Metallurgical Testwork Commences at Oaky Creek High Grade Antimony Prospect

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”), a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce the commencement of metallurgical testing work for the... Keep Reading...

5h

Boundiali extends strike and depth at BDT3 and BST1

Aurum Resources (AUE:AU) has announced Boundiali extends strike and depth at BDT3 and BST1Download the PDF here. Keep Reading...

13 February

Editor's Picks: Gold, Silver Prices Dip and Bounce Back, Plus Top Takeover Candidate

Gold and silver were having a fairly quiet week until Thursday (February 12), when both precious metals experienced steep drops early in the day.The gold price, which had been steady above US$5,000 per ounce, and even briefly breached US$5,100, tumbled by over US$100, bottoming out around... Keep Reading...

13 February

Filing of Initial Prospectus

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce that it has filed a preliminary non-offering prospectus (the "Prospectus") with the Ontario Securities Commission (the "Commission") and has applied to the Canadian Securities... Keep Reading...

12 February

Keith Weiner: Silver Being Remonetized "With a Vengeance" as Gold Rises

Keith Weiner, founder and CEO of Monetary Metals, shares his outlook for gold and silver in 2026, saying that while he expects higher prices there will be volatility. He also outlines his thoughts on the role of precious metals in the monetary system. Don’t forget to follow us @INN_Resource for... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00