July 22, 2024

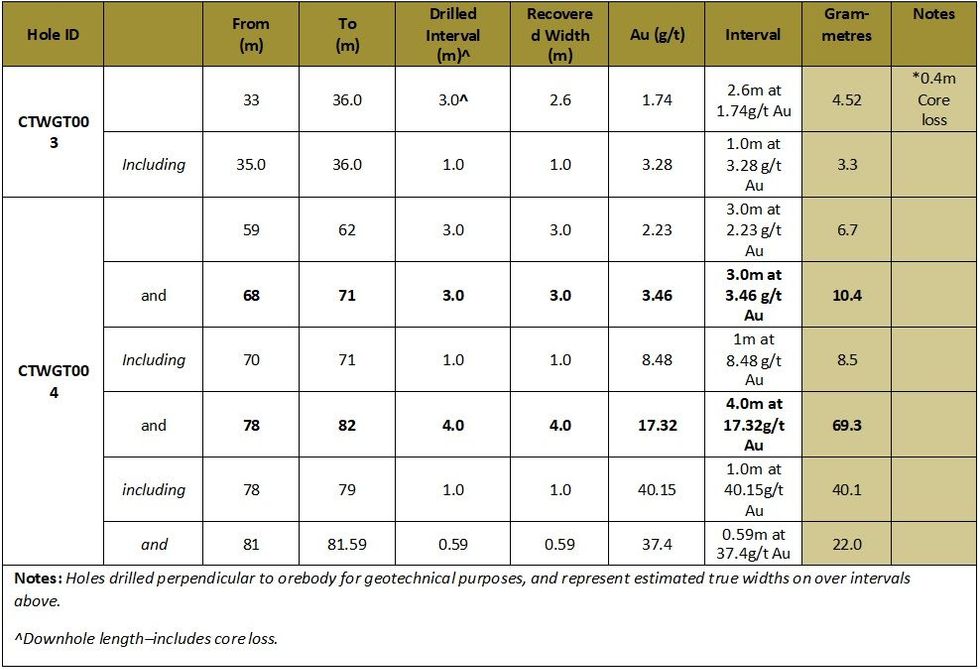

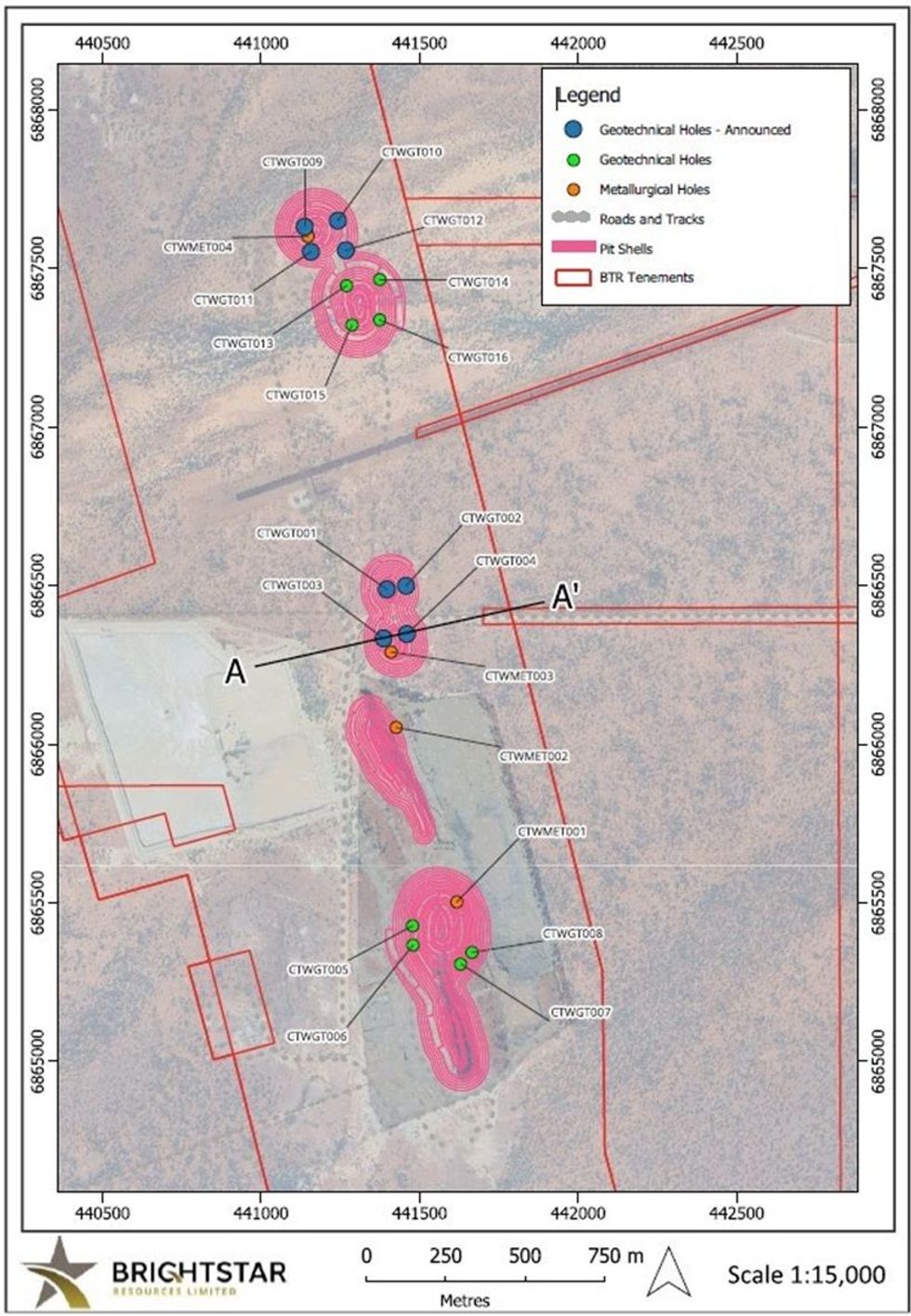

Brightstar Resources Limited (ASX: BTR) (Brightstar or the Company) is pleased to announce the second round of non- priority assay results from sixteen Geotechnical diamond drillholes at Cork Tree Well (CTW) within the Laverton Gold Project (LGP). These sixteen holes were part of a broader 20-hole diamond drilling program2 designed for metallurgical and geotechnical purposes.

HIGHLIGHTS

- Assays received from eight geotechnical diamond holes completed at Cork Tree Well with gold assays up to 40.15g/t Au, located near CTWMET003 which returned 27.6m at 17.77g/t Au from 51m1

- Intercepts returned include 4.0m @ 17.32g/t Au from 78.0m (CTWGT004), including:

- 1.0m at 40.15 g/t Au from 78.0m, and

- 0.59m at 37.4 g/t Au from 81.0m, and

- 0.41m at 11.62 g/t Au from 81.59m

- Additional lode within CTWGT004 returned 3.0m at 3.46 g/t Au from 68m including 1.0m at 8.48 g/t Au from 70m

- Shallow intercept returned from CTWGT003:

- 2.6m at 1.74g/t Au from 33.0m

- High-grade results at the base of current pit shell design provides confidence for continuous mineralisation extensions at depth with historically defined significant intercepts

- CTWGT003 and CTWGT004 were drilled into the unmined material north of the historically mined northern pit at Cork Tree Well, with the gold mineralisation entirely contained within a sheared mafic/ultramafic sequence

Brightstar’s Managing Director, Alex Rovira, commented “It is pleasing to see further high-grade assays continuing from geotechnical holes from the diamond drilling program that was completed at Cork Tree Well earlier this year. CTWGT004 returned a significant high-grade intersection of 4.0m @ 17.32g/t Au from 78.0m, which complements the previously announced1 intersection of 27.6m @ 17.77g/t Au (CTWMET003) drilled 200m to the north.

The sixteen Geotechnical drillholes (CTWGT001 – CTWGT016) were drilled into the current optimized $2,750/oz pit- shells generated in the 2023 Scoping Study3 with these holes designed by Brightstar’s independent geotechnical consultants targeting structural and rock mass data for the definitive feasibility study. Both CTWGT003 and CTWGT004 were drilled perpendicular to the orebody and thus reported intersections represent estimated true widths of significant mineralised intercepts.

Given the quality of the assays received from the drilling to date, Brightstar is excited to build on the existing 303koz @ 1.4g/t Au Mineral Resource4, which is open both at depth with high-grade plunging shoots and along strike targeting the structurally-controlled mineralised trends. The high-grade results returned to date are significantly higher than the current 1.4g/t Au head grade of the Mineral Resource (and 1.85g/t mine grade from the 2023 Scoping Study), representing significant upside to both metrics.”

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

20h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

20h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

21h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

21h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

05 March

Oreterra Metals

Get access to more exclusive Gold Investing Stock profiles here Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00