August 12, 2024

Dart Mining NL (ASX:DTM) (“Dart Mining” or “the Company”) has received more positive results from the Phase 2 diamond drilling within the company’s 100% owned Rushworth Gold tenement package.

Results continue to highlight the prospectivity of the Historic Rushworth Goldfield. The ongoing success of the drilling validates our mineral systems model and supports the company’s ongoing exploration strategy across a field showing very shallow historic development and very limited previous deeper drill testing.

Highlights include:

- SWDD005 - 1.2m @ 4.5g/t Au from 19.9m downhole, including

- 0.4m @ 8.4g/t Au, and

- 0.3m @ 6.6g/t Au.

- Drilling continues at the Phoenix Reef with 2 of a planned 6 holes (1100m) completed targeting repeating thrust faults at depth.

Chairman, James Chirnside commented:

“Dart’s drilling activities at Rushworth continue to be successful. By leveraging our advanced mineral systems model and in-depth structural analysis, we have effectively pinpointed highly prospective targets. Each drill hole has consistently returned positive gold grades, reinforcing the potential of these identified structures. We remain committed to further advancing our exploration efforts and are eager to further develop the project’s apparent opportunities”

Drilling Results Discussion

The first results from the Phase 2 program returned up to 0.24m @ 8.8g/t Au, from 56.2m downhole from hole SWDD004 (Shellback Reef) from within a broad zone of sulphide mineralisation returning 7.1m @ 0.75g/t Au from 50.8m - (DTM ASX 23rd July 2024) in the Star of the West area. Results from Phase 2 continue to show high grade results within the targeted Shellback Reef structures with hole SWDD005 showing up to 0.4m @ 8.4g/t Au from 19.9m downhole.

SWDD005 intersected a steep south dipping thrust fault structure surrounded by apparent sulphide mineralisation forming a halo of gold results (1.2m @ 4.5g/t Au from 19.9m). Mineralisation was observed in the drill core as weathered sulphide pitting with surrounding iron staining, surrounding a quartz reef structure in sandstone lithologies. In line with the results from hole SWDD004, SWDD005 also intersected at least two zones of gold mineralisation with the weak lower zone showing up to 0.5m @ 1.1g/t from 94.9m downhole (Figure 3). Lidar interpretation to the west of holes SWDD004 & SWDD005 illustrates a broad area of extensive surface pitting (Figure 2). SWDD006 results remain outstanding, however given the pleasing results from initial drilling into the Shellback Reef to date, further drill testing appears to be clearly warranted in the coming months

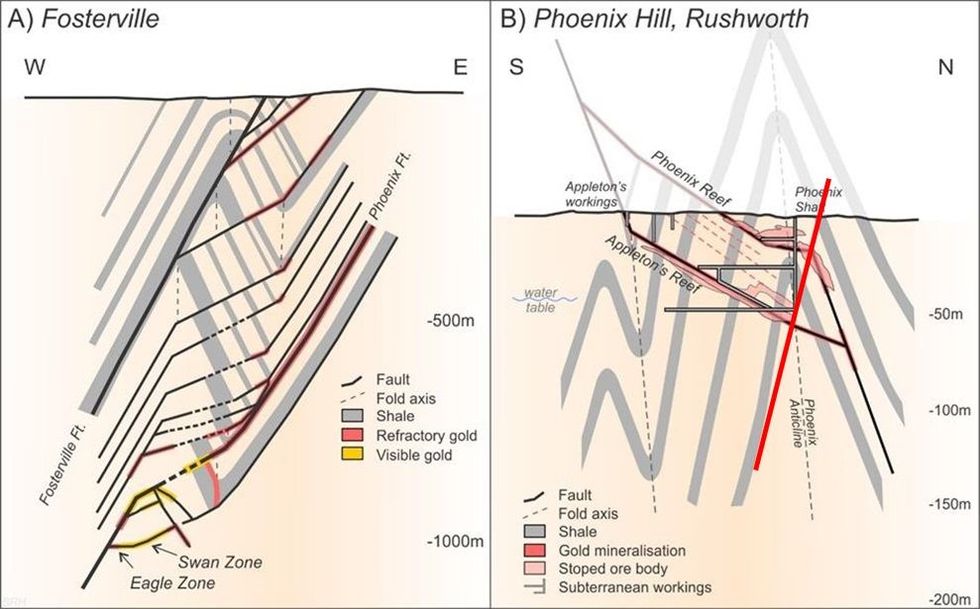

The presence of gold rich sulphide mineralisation surrounding thrust faulting is a consistent observation and supports the company’s interpretation that the mineralising fluid and deposition environment of the Rushworth region is similar, if not the same, as nearby Central Victorian gold regions of Fosterville and Costerfield.

Rushworth Phase 3 drilling

Drilling has commenced at the Phoenix Reef prospect with 385m of a planned 1100m drill program completed to the 7th of August 2024. The Phoenix group of historic workings is one of the more extensive for the field but still only shows historic workings to some 50m below surface. Drilling is targeting interpreted deeper repeating thrust faulting below the historic stacked Phoenix, Fletchers and Appleton’s Reefs exploited for over 1000m of strike from surface.

Rushworth Structural Architecture

The Rushworth goldfield is focused along a series of regional East-West orientated anticline folds which host shallow historic gold workings along a cumulative strike length of approximately 14km (Figure 2). The major limbs of the anticline also exhibit smaller scale parasitic folding and various changes in bedding strike and dip. Significant North-South orientated structures crosscut and offset East-West bedding and fold hinges along the length of the field.

The East-West orientation of the field is unusual for Victorian Goldfields, which usually trend North-South, due to the added structural complexity of the Rushworth Region being highly influenced by the Lachlan Orocline formation and induced North-South crustal shortening through subduction rollback.

Mineralisation historically exploited at Rushworth concentrated on alluvial mining before focus shifted to the hard rock source. Mineralisation is dominated by free gold located in quartz veins hosted within sandstone and shale lithologies.

Click here for the full ASX Release

This article includes content from Dart Mining NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00