FPX Nickel Corp. (TSXV: FPX) (OTCQB: FPOCF) (" FPX Nickel " or the " Company ") is pleased to provide an update on value engineering (" Value Engineering ") studies that have substantially improved the operating margin and reduced the risk profile for an awaruite concentrate refinery to produce battery-grade nickel sulphate. Building on this improved business case and incorporating results from the ongoing pilot-scale hydrometallurgical testwork program, FPX has commenced the development of a standalone refinery study which will be completed in the first quarter of 2025.

Highlights

- Value engineering studies highlight the strategic opportunity for FPX Nickel to develop North America's largest battery metals refinery, with the capacity to produce 32,000 tonnes of nickel in nickel sulphate per year, enough to build about 450,000 electric vehicles annually

- Building on previous engineering work outlined in the 2023 Baptiste Nickel Project (" Baptiste ") preliminary feasibility study, optimization of the purification flowsheet has substantially improved the refinery operating margin while reducing waste handling and disposal risk

- Pilot-scale testwork of the refinery flowsheet, with funding support from the Government of Canada , is well progressed and results will be reported in October 2024

- FPX has commenced a standalone scoping study for the battery metals refinery, which will include a detailed technical and economic analysis, for publication in the first quarter of 2025

"Our refinery Value Engineering studies have substantially improved the business case and reduced the risk profile for a standalone refinery to convert awaruite concentrate into battery-grade nickel sulphate," commented Andrew Osterloh , the Company's Senior Vice President, Projects & Operations. "Awaruite presents an unparalleled opportunity to significantly expand North America's battery material supply chain, all without the need to either displace or add smelting capacity. As we close-out our Value Engineering for Baptiste, we are excited at the new value basis for our large-scale, long-life, high margin, and low-carbon project."

Background

The Baptiste 2023 preliminary feasibility study (" PFS ") demonstrates the potential to develop a high-margin and low-carbon nickel mine producing an average of 59,100 tonnes per year of nickel over a 29-year mine life (see the Company's September 6, 2023 news release). Due to awaruite's properties, Baptiste has the unparalleled flexibility to produce a high-grade concentrate (60% nickel) for either direct feed into the stainless steel industry (the " Base Case ") or for further refining into battery-grade nickel and cobalt products for the electric vehicle battery supply chain (the " Refinery Option ").

While the PFS presents robust economics, including a Base Case after-tax NPV 8% of US$2.01 Billion and after-tax IRR of 18.6% at US$8.75 /lb. Ni, FPX continues to strive towards adding further value to Baptiste, focusing on a holistic blend of economics, constructability, operability, risk and ESG considerations.

The key Value Engineering studies pursued by FPX in 2024 are:

- Mineral processing (see the Company's July 10, 2024 news release)

- Mine planning and engineering (see the Company's July 30, 2024 )

- Refinery planning (described herein)

Refinery Engineering Studies

To demonstrate Baptiste's strategic flexibility to also produce nickel and cobalt for the battery material supply chain, the Refinery Option in the 2023 PFS envisioned the development of a standalone refinery to produce battery-grade nickel from awaruite concentrate. Located in an urban setting in central British Columbia , the refinery would benefit from the infrastructure, services, and labour which would be available at an integrated battery material processing hub, such as those being developed in eastern Canada and other locations worldwide.

Earlier this year, FPX commissioned a detailed technical review of the 2023 PFS Refinery Option, and executed refinery Value Engineering studies. No major risks were identified in the review of the PFS Refinery Option, and several tangible opportunities were highlighted for further evaluation during both the Value Engineering and subsequent study stages.

Most notable of the identified near-term opportunities was the refinery reagent scheme. The PFS Refinery Option assumed the use of caustic (a.k.a. sodium hydroxide, NaOH) as the neutralizing base, with caustic accounting for approximately 60% of the total operating cost. The use of caustic generates sodium sulphate (Na 2 SO 4 ) as a byproduct, which is a low value commodity, has limited industrial uses, and is projected to be in significant over-supply as the battery material supply chain further develops.

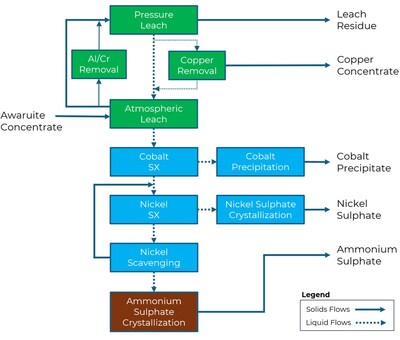

Following a review of all potential reagent schemes, an ammonia-based flowsheet was selected as the best value for further evaluation. The ammonia-based flowsheet is similar to the sodium hydroxide flowsheet, except ammonia gas (or ammonium hydroxide when dissolved in water) is the reagent used in the process plant in solvent extraction operations. A similar flowsheet is used in Terrafame's nickel sulphate refinery in Finland . See Figure 1 for a block flow diagram of the new refinery flowsheet.

Modifying the refinery flowsheet to an ammonia-based reagent scheme results in an immaterial increase to capital costs, but a material decrease in operating costs (given the significantly lower consumption rate for ammonia versus caustic). Additionally, the waste product of sodium sulphate, for which zero value was ascribed in the PFS Refinery Option, is now replaced by ammonium sulphate, a valuable fertilizer product. In addition to generating a significant new value source with a more stable future market outlook, the production of ammonium sulphate eliminates the previous waste handling/disposal risk associated with sodium sulphate production. Overall, this change results in a significant improvement to the operating margin and reduction in the project risk profile.

Refinery Testwork with Funding Support from Natural Resources Canada

The previously announced pilot-scale testwork of the refinery flowsheet (see the Company's April 30, 2024 news release) is progressing well, with results forecast for release to the market in October 2024 . In addition to pilot-scale testwork of the leaching circuit, batch-scale testwork will be completed of the purification flowsheet up to production of nickel sulphate.

The pilot testing campaign was funded in part by a $725,000 grant from Natural Resources Canada (" NRCan ") under the Government of Canada's Critical Minerals Research, Development and Demonstration (" CMRDD ") program, which is advancing the commercial readiness of processing technologies that will support the development Canada's EV battery material supply chain.

Refinery Scoping Study

Incorporating results of the refinery Value Engineering and testwork programs, FPX has commenced the preparation of a standalone awaruite refinery scoping study. Considering current off-take rights that have been granted to strategic investors, the refinery will have a capacity of 32,000 tonnes per year of contained nickel in battery-grade nickel sulphate. For the purposes of this study, the refinery location will continue to consider an urban location within central British Columbia .

Along with the improved business case and reduced risk profile, the standalone study will better present the strategic opportunity to meaningfully increase North America's battery material supply chain capacity without the need to construct new smelting or complex primary refining capacity. The scoping study, which will contain a detailed evaluation of capital, operating costs and the overall economics of the awaruite refinery, will be published in the first quarter of 2025.

Andrew Osterloh , P.Eng., FPX Nickel's Qualified Person under NI 43-101, has reviewed and approved the technical content of this news release.

About the Decar Nickel District

The Company's Baptiste Nickel Project represents a large-scale greenfield discovery of nickel mineralization in the form of a sulphur-free, nickel-iron mineral called awaruite (Ni 3 Fe) hosted in an ultramafic/ophiolite complex. The Baptiste mineral claims cover an area of 408 km 2 , west of Middle River and north of Trembleur Lake, in central British Columbia . In addition to the Baptiste Deposit itself, awaruite mineralization has been confirmed through drilling at several target areas within the same claims package, most notably at the Van Target which is located 6 km to the north of the Baptiste Deposit. Since 2010, approximately US $30 million has been spent on the exploration and development of Baptiste.

The Baptiste deposit is located within the territories, keyohs, and consultative boundaries of the Tl'azt'en Nation, Binche Whut'enne, Yekooche First Nation, and Takla Nation .

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia , and other occurrences of the same distinctive style of awaruite nickel-iron mineralization.

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne , President, CEO and Director

Email: ceo@fpxnickel.com

Phone: 604-681-8600

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c6952.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/16/c6952.html